- United Kingdom

- /

- Professional Services

- /

- AIM:FNTL

3 UK Stocks That May Be Undervalued In October 2024

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced challenges, closing lower amid weak trade data from China, which has impacted companies closely tied to the Chinese economy. As the global economic landscape remains uncertain, identifying potentially undervalued stocks can be appealing for investors looking to capitalize on market inefficiencies and long-term growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| GlobalData (AIM:DATA) | £2.005 | £3.72 | 46.1% |

| Tracsis (AIM:TRCS) | £5.35 | £9.97 | 46.3% |

| Franchise Brands (AIM:FRAN) | £1.45 | £2.63 | 44.9% |

| Redcentric (AIM:RCN) | £1.2925 | £2.42 | 46.6% |

| Videndum (LSE:VID) | £2.535 | £4.60 | 44.9% |

| Foxtons Group (LSE:FOXT) | £0.632 | £1.20 | 47.2% |

| SysGroup (AIM:SYS) | £0.325 | £0.65 | 49.9% |

| Hochschild Mining (LSE:HOC) | £1.858 | £3.56 | 47.8% |

| BATM Advanced Communications (LSE:BVC) | £0.1975 | £0.37 | 46.5% |

| Genel Energy (LSE:GENL) | £0.79 | £1.51 | 47.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Fintel (AIM:FNTL)

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £278.17 million.

Operations: The company's revenue segments include Research & Fintech (£24.20 million), Distribution Channels (£21.40 million), and Intermediary Services (£23.30 million).

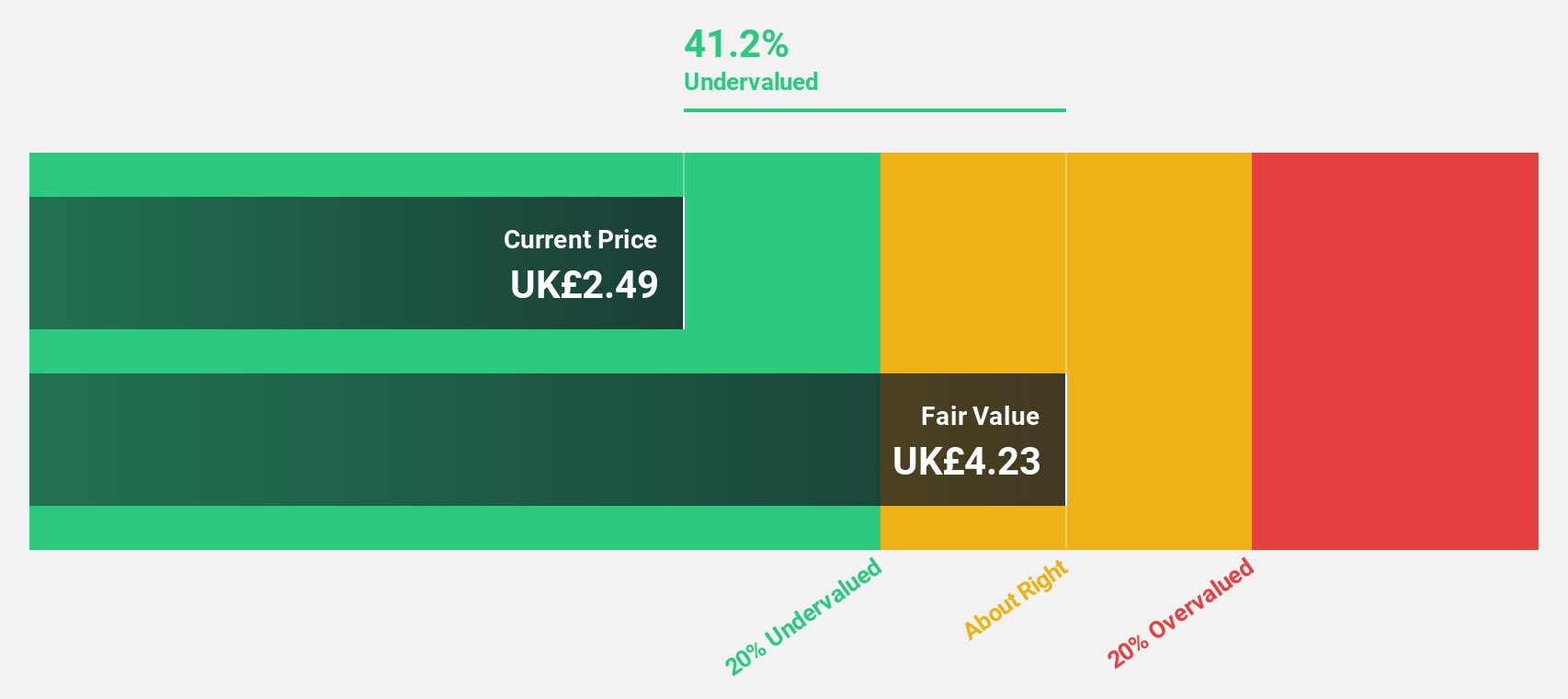

Estimated Discount To Fair Value: 40.3%

Fintel Plc's recent earnings report shows a sales increase to £35.7 million, though net income decreased to £2.1 million. Despite lower profit margins, the company is trading at 40.3% below its estimated fair value of £4.47 per share, indicating significant undervaluation based on discounted cash flow analysis. Revenue growth is expected at 10% annually, surpassing the UK market average of 3.6%, with earnings projected to grow significantly by over 20% annually in the coming years.

- Our earnings growth report unveils the potential for significant increases in Fintel's future results.

- Click to explore a detailed breakdown of our findings in Fintel's balance sheet health report.

Young's Brewery (AIM:YNGA)

Overview: Young & Co.'s Brewery, P.L.C. operates and manages pubs and hotels in the United Kingdom with a market cap of £498.70 million.

Operations: The company generates revenue primarily from its Managed Houses segment, amounting to £388.20 million.

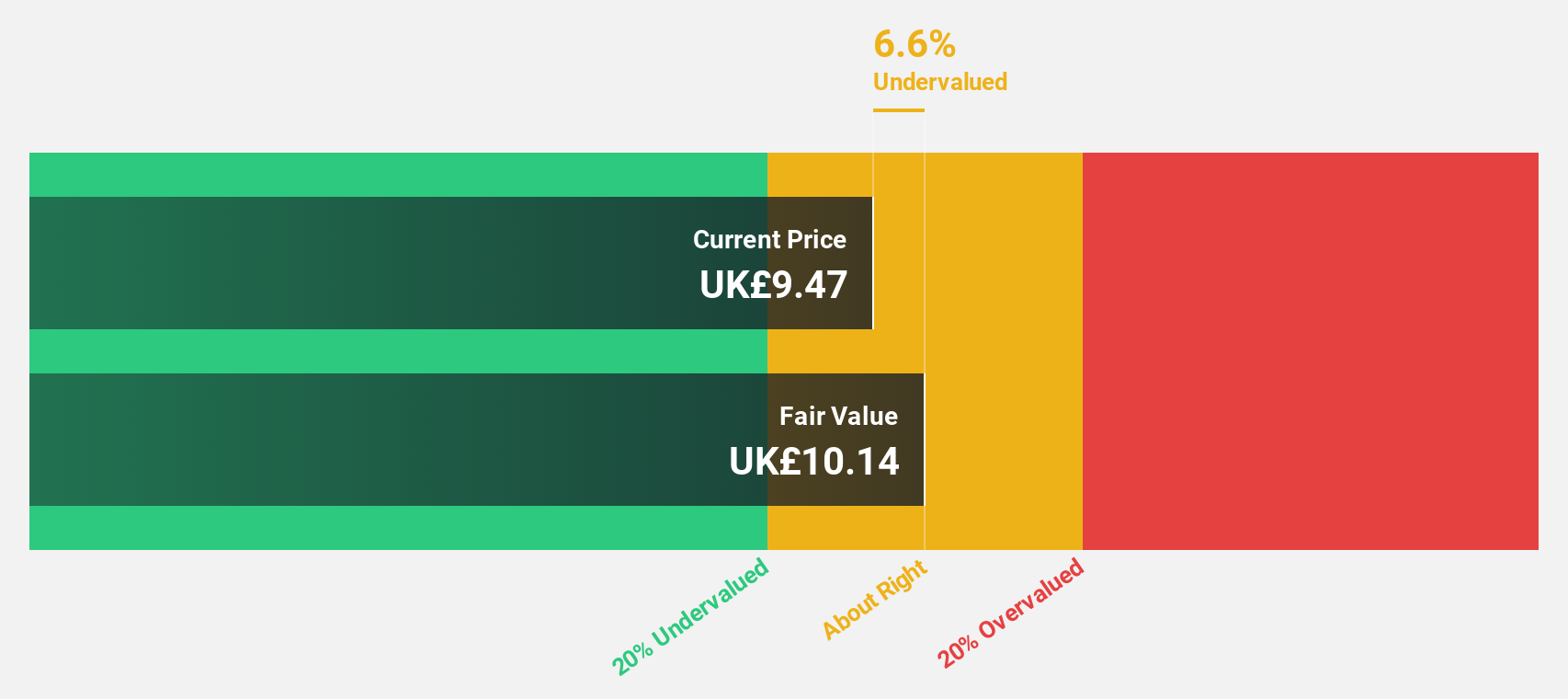

Estimated Discount To Fair Value: 15%

Young & Co.'s Brewery is trading at £9.18, below its estimated fair value of £10.8, suggesting undervaluation based on cash flow analysis. Despite a forecasted earnings growth of 35% per year, profit margins have declined from 8.1% to 2.9%. The dividend yield of 2.37% is not well-covered by earnings, and shareholders experienced dilution last year. Recent board changes include the departure of Mark Loughborough as Retail Director and Ian Dyson's appointment as Non-Executive Director.

- Our expertly prepared growth report on Young's Brewery implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Young's Brewery here with our thorough financial health report.

Avon Technologies (LSE:AVON)

Overview: Avon Technologies Plc specializes in providing respiratory and head protection solutions for military and first responder agencies across the UK, Europe, and the US, with a market cap of £374.36 million.

Operations: Revenue segments for the company include $113.60 million from Team Wendy and a segment adjustment of $155.70 million.

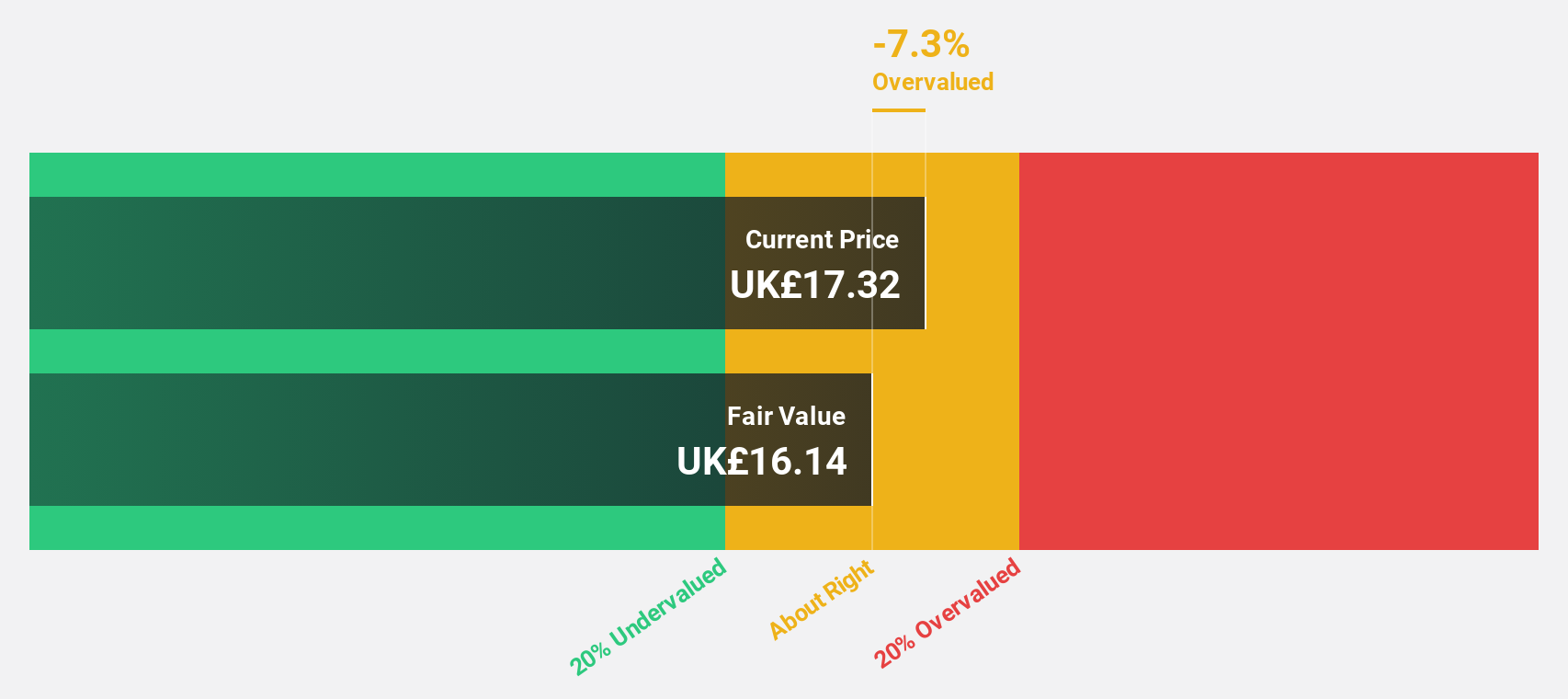

Estimated Discount To Fair Value: 39.6%

Avon Technologies, trading at £12.48, is significantly undervalued based on cash flow analysis with a fair value estimate of £20.65. Despite its low forecasted return on equity of 10.2% in three years and interest payments not well-covered by earnings, the company expects strong earnings growth of 118.7% annually over the next three years and revenue growth above market rates at 6.4%. Recent strategic advancements include a $19.5 million order from the U.S. Defense Logistics Agency and revised FY24 guidance indicating an 11% revenue increase, reflecting operational efficiency improvements.

- The growth report we've compiled suggests that Avon Technologies' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Avon Technologies.

Make It Happen

- Reveal the 58 hidden gems among our Undervalued UK Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNTL

Fintel

Engages in the provision of intermediary services and distribution channels to the retail financial services sector in the United Kingdom.

Reasonable growth potential with adequate balance sheet.