- United Kingdom

- /

- Food and Staples Retail

- /

- AIM:VINO

Spotlight On 3 UK Penny Stocks With Market Caps Over £2M

Reviewed by Simply Wall St

The United Kingdom market remained flat over the last week, with a 6.1% rise in the past 12 months and earnings forecasted to grow by 15% annually. In such a climate, identifying stocks that offer both value and growth potential is crucial for investors seeking opportunities beyond larger firms. Penny stocks, though an outdated term, still signify smaller or less-established companies that can provide significant returns when backed by strong financials; this article highlights three such stocks with promising prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Solid State (AIM:SOLI) | £1.202751 | £69.6M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.8975 | £67.4M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.635825 | £190.08M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.225 | £104.12M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.278 | £197.1M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.39 | $226.72M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £3.20 | £409.48M | ★★★★★★ |

Click here to see the full list of 463 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Mineral & Financial Investments (AIM:MAFL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mineral & Financial Investments Limited is an investment company that focuses on natural resources, minerals, metals, and oil and gas projects in the Cayman Islands with a market cap of £3.90 million.

Operations: No specific revenue segments have been reported.

Market Cap: £3.9M

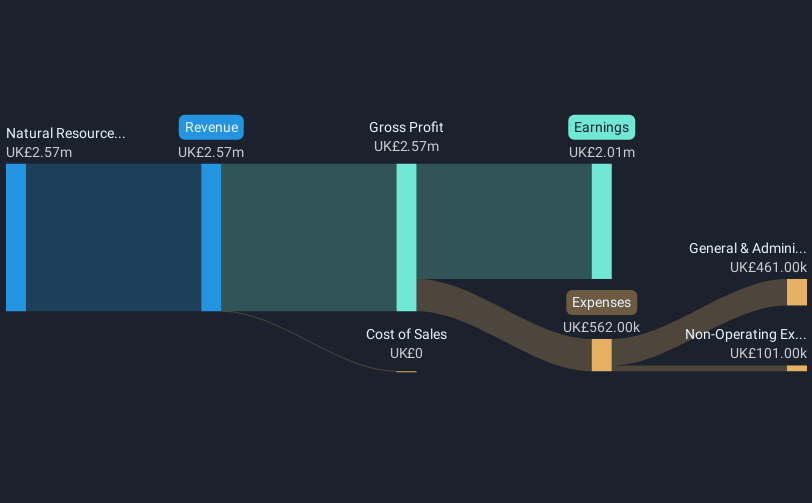

Mineral & Financial Investments Limited, with a market cap of £3.90 million, has demonstrated significant earnings growth of 29.4% over the past year, surpassing its five-year average and the broader Capital Markets industry. The company reported revenues of £2.57 million for the year ending June 2024, indicating it is not pre-revenue despite limited revenue streams. Its strong net profit margin improved to 78.1%, and it maintains a solid financial position with more cash than total debt and short-term assets significantly exceeding liabilities. However, negative operating cash flow suggests challenges in covering debt through operations alone.

- Dive into the specifics of Mineral & Financial Investments here with our thorough balance sheet health report.

- Assess Mineral & Financial Investments' previous results with our detailed historical performance reports.

Enteq Technologies (AIM:NTQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Enteq Technologies Plc, along with its subsidiaries, offers reach and recovery products and technologies for the oil and gas services market across the United States, China, Europe, Central Asia, Australasia, and other international regions; it has a market cap of £2.92 million.

Operations: Enteq Technologies does not report specific revenue segments.

Market Cap: £2.92M

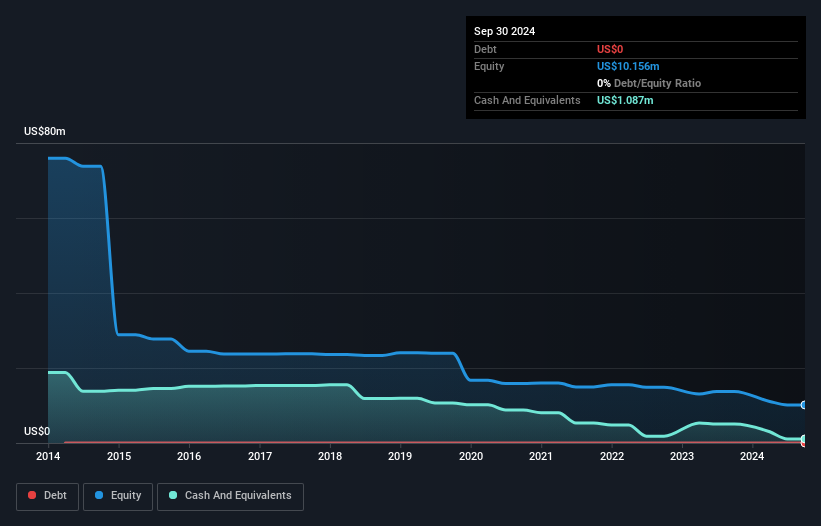

Enteq Technologies, with a market cap of £2.92 million, is currently pre-revenue and unprofitable but has managed to reduce its losses over the past five years by 14.7% annually. The company maintains a strong financial position with short-term assets of $3.8 million exceeding both its short and long-term liabilities, while remaining debt-free for the past five years. Despite having a negative return on equity at -28.06%, Enteq recently raised £1.60302 million through follow-on equity offerings, potentially extending its cash runway beyond the current estimate of six months based on free cash flow forecasts.

- Jump into the full analysis health report here for a deeper understanding of Enteq Technologies.

- Gain insights into Enteq Technologies' future direction by reviewing our growth report.

Virgin Wines UK (AIM:VINO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Virgin Wines UK PLC is a direct-to-consumer online wine retailer in the United Kingdom with a market cap of £19.54 million.

Operations: The company's revenue is primarily derived from the sale of alcohol, totaling £59.01 million.

Market Cap: £19.54M

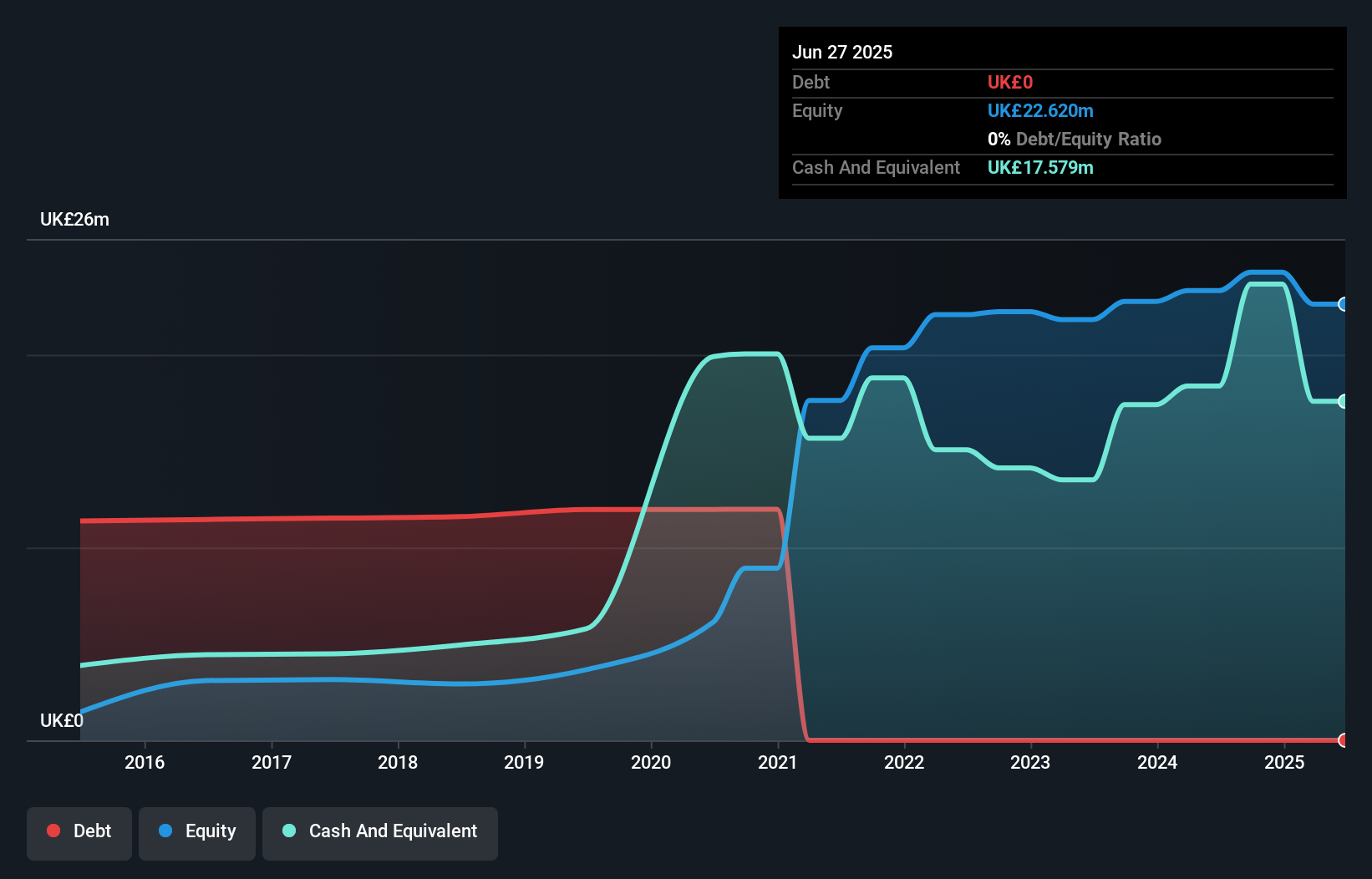

Virgin Wines UK PLC, with a market cap of £19.54 million, has recently turned profitable, reporting a net income of £1.38 million for the year ending June 28, 2024. The company operates debt-free and maintains strong liquidity with short-term assets (£26.9M) comfortably exceeding both short-term (£15M) and long-term liabilities (£2.6M). Despite past earnings declines averaging 23.8% annually over five years, recent profitability marks a positive shift in performance. The board is experienced with an average tenure of 3.8 years, and the company trades at a significant discount to its estimated fair value while reiterating strong future profitability guidance.

- Click here and access our complete financial health analysis report to understand the dynamics of Virgin Wines UK.

- Evaluate Virgin Wines UK's prospects by accessing our earnings growth report.

Taking Advantage

- Click through to start exploring the rest of the 460 UK Penny Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Virgin Wines UK, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VINO

Virgin Wines UK

Operates as a direct-to-consumer online wine retailer in the United Kingdom.

Flawless balance sheet with questionable track record.