- United Kingdom

- /

- Specialty Stores

- /

- AIM:SCHO

November 2024's Top Penny Stocks On UK Exchange

Reviewed by Simply Wall St

The United Kingdom market remained flat over the last week, but it has risen by 6.1% over the past year, with earnings forecast to grow by 15% annually. Penny stocks, though a somewhat outdated term, continue to capture interest as they often represent smaller or newer companies with potential for growth at lower price points. In light of current market conditions, identifying penny stocks with strong balance sheets and solid fundamentals can offer investors an appealing mix of affordability and potential upside.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Solid State (AIM:SOLI) | £1.202751 | £69.6M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.8975 | £67.4M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.635825 | £190.08M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.225 | £104.12M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.278 | £197.1M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.39 | $226.72M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £3.20 | £409.48M | ★★★★★★ |

Click here to see the full list of 463 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ocean Harvest Technology Group (AIM:OHT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ocean Harvest Technology Group plc focuses on the research, development, production, and sale of seaweed blend ingredients for the animal feed market across the United Kingdom, North America, and Asia with a market cap of £11.20 million.

Operations: The company generates its revenue of €2.57 million through the provision of seaweed products.

Market Cap: £11.2M

Ocean Harvest Technology Group, with a market cap of £11.20 million, is currently navigating financial challenges typical of penny stocks. Despite generating €0.95 million in revenue for the first half of 2024, the company remains unprofitable and has seen declining sales compared to the previous year. It recently raised £1.5 million through secured loan notes to bolster its short-term cash runway, which was previously estimated at four months based on free cash flow as of June 2024. The leadership team is undergoing changes with a new Executive Chairman appointed and plans to strengthen its board and executive team soon.

- Take a closer look at Ocean Harvest Technology Group's potential here in our financial health report.

- Explore historical data to track Ocean Harvest Technology Group's performance over time in our past results report.

M&C Saatchi (AIM:SAA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: M&C Saatchi plc is a global advertising and marketing communications company operating across the United Kingdom, Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of £234.73 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: £234.73M

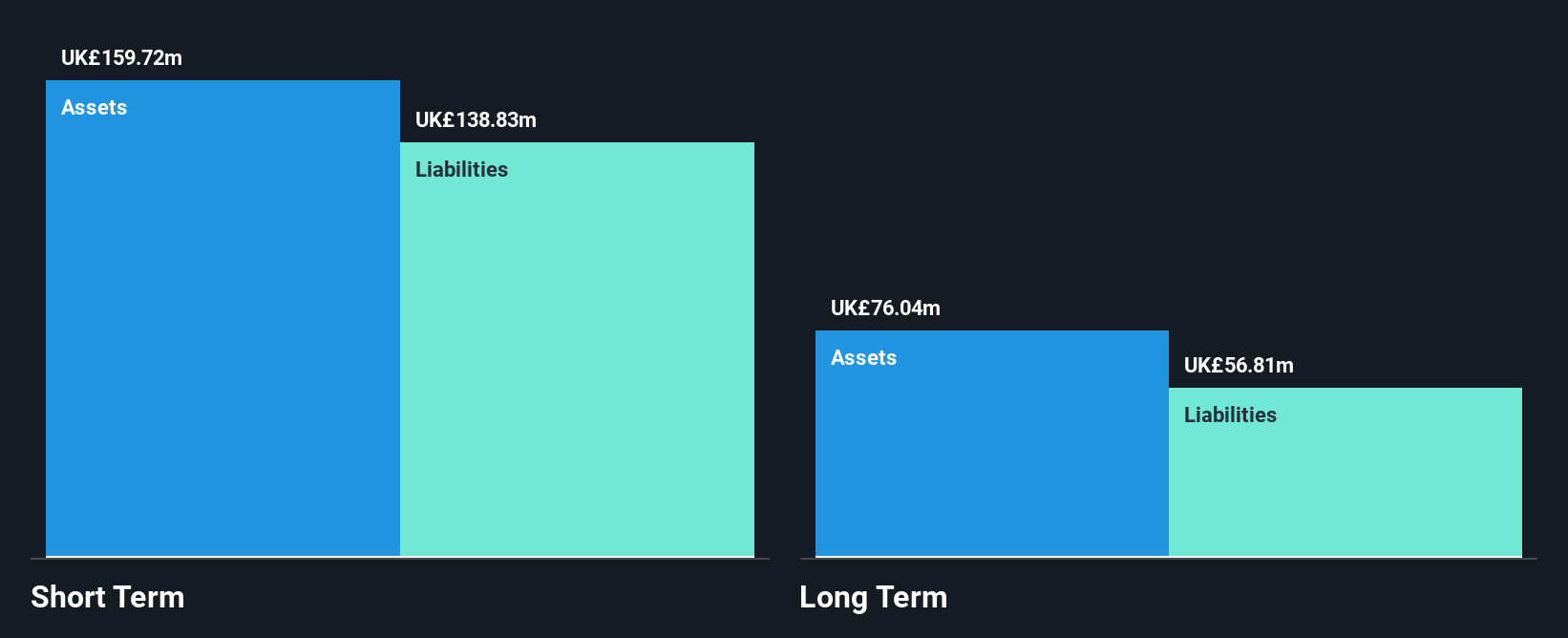

M&C Saatchi plc, with a market cap of £234.73 million, has recently transitioned to profitability, reporting net income of £8.11 million for the first half of 2024 compared to a loss last year. The company declared a dividend increase and is trading significantly below its fair value estimate. Its debt levels are well-managed with cash exceeding total debt, and short-term assets comfortably cover liabilities. However, the board's inexperience could be a concern despite having an experienced management team. Recent executive changes include Georgina Harvey joining as Non-Executive Director, potentially strengthening governance structures further.

- Jump into the full analysis health report here for a deeper understanding of M&C Saatchi.

- Examine M&C Saatchi's earnings growth report to understand how analysts expect it to perform.

Scholium Group (AIM:SCHO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Scholium Group Plc, with a market cap of £5.39 million, operates in the United Kingdom by trading, retailing, and selling rare books and fine arts through its subsidiaries.

Operations: The company's revenue is primarily derived from its Collectibles segment, which generated £9.27 million.

Market Cap: £5.39M

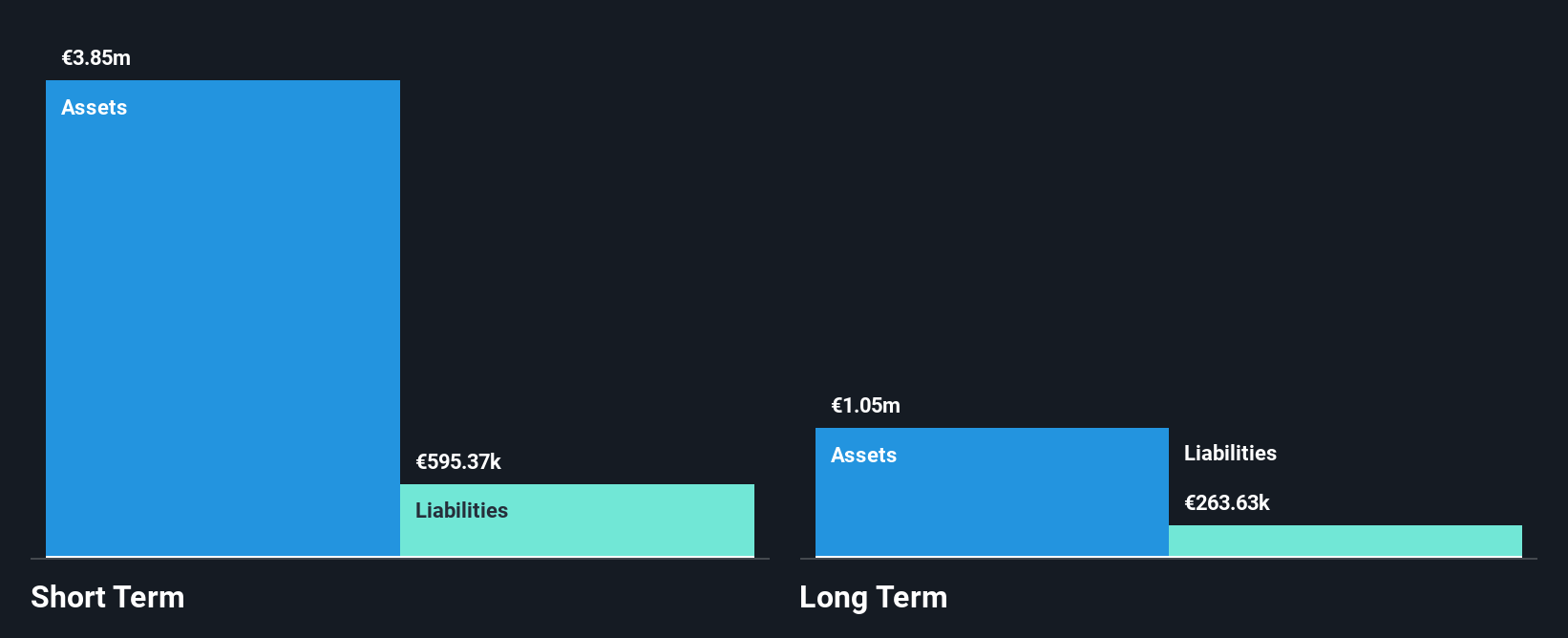

Scholium Group Plc, with a market cap of £5.39 million, demonstrates financial stability as its short-term assets (£13.6M) exceed both short-term (£3.5M) and long-term liabilities (£821K). The company has shown consistent earnings growth, achieving 29.9% over the past year despite a low Return on Equity (3%). Its debt levels are satisfactory with a net debt to equity ratio of 7.9%, although operating cash flow is negative, indicating potential liquidity challenges. The board's experience (10.8 years average tenure) adds governance strength while profit margins have improved from 2.5% to 3.2%.

- Navigate through the intricacies of Scholium Group with our comprehensive balance sheet health report here.

- Examine Scholium Group's past performance report to understand how it has performed in prior years.

Taking Advantage

- Unlock more gems! Our UK Penny Stocks screener has unearthed 460 more companies for you to explore.Click here to unveil our expertly curated list of 463 UK Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SCHO

Scholium Group

Engages in trading, retailing, and selling of rare books and fine arts in the United Kingdom.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives