- United Kingdom

- /

- Transportation

- /

- LSE:ZIG

Exploring 3 Promising Undervalued Small Caps With Insider Activity In UK

Reviewed by Simply Wall St

The United Kingdom's market has been experiencing turbulence, with the FTSE 100 and FTSE 250 indices recently closing lower due to weak trade data from China, highlighting ongoing global economic challenges. Amidst this backdrop, identifying promising small-cap stocks can be crucial for investors seeking opportunities in sectors less impacted by international headwinds.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 20.7x | 5.3x | 17.69% | ★★★★★☆ |

| 4imprint Group | 17.8x | 1.5x | 28.99% | ★★★★★☆ |

| Stelrad Group | 11.7x | 0.6x | 18.27% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 24.81% | ★★★★★☆ |

| NCC Group | NA | 1.3x | 21.02% | ★★★★★☆ |

| Telecom Plus | 17.9x | 0.7x | 26.15% | ★★★★☆☆ |

| Gamma Communications | 22.9x | 2.4x | 33.35% | ★★★★☆☆ |

| CVS Group | 29.8x | 1.2x | 36.03% | ★★★★☆☆ |

| Franchise Brands | 40.6x | 2.1x | 22.04% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 47.04% | ★★★★☆☆ |

We'll examine a selection from our screener results.

SThree (LSE:STEM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: SThree is a global staffing company specializing in the recruitment of professionals in science, technology, engineering, and mathematics sectors, with a market cap of £1.15 billion.

Operations: SThree's revenue streams are primarily derived from its operations in DACH, the Netherlands (including Spain), and the USA. The company's net profit margin has shown fluctuations, peaking at 3.73% in May 2024 before declining to 3.33% by February 2025. Operating expenses have consistently been a significant component of their cost structure, with general and administrative expenses being a major part of these costs.

PE: 6.8x

SThree, a staffing firm in the UK, reported a decline in sales to £1.49 billion for FY24, down from £1.66 billion the previous year, with net income also slipping to £49.69 million. Despite this challenging environment and an anticipated earnings contraction of 18% annually over the next three years, insider confidence is evident through strategic share repurchase plans worth £20 million initiated in December 2024. The company’s stable dividend strategy remains attractive despite a proposed decrease for FY25.

- Get an in-depth perspective on SThree's performance by reading our valuation report here.

Gain insights into SThree's historical performance by reviewing our past performance report.

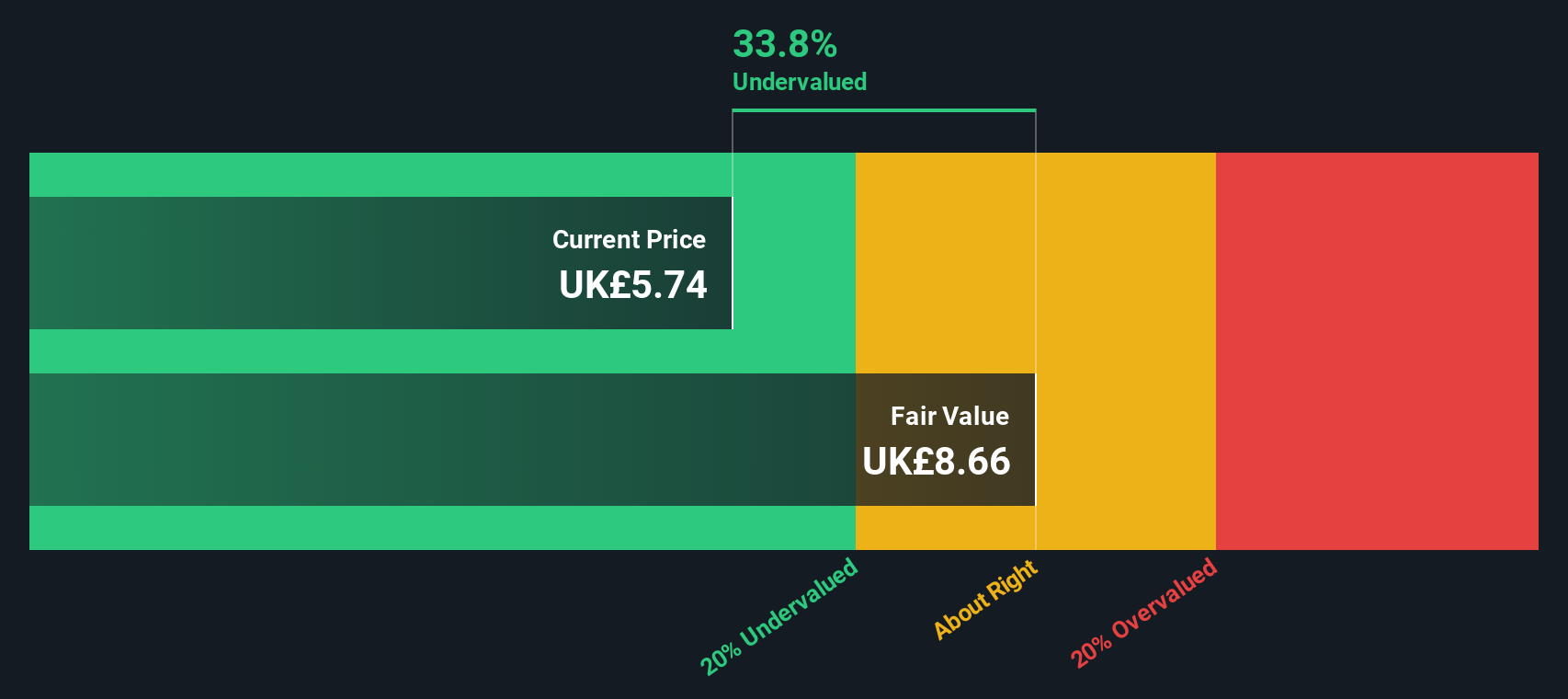

Vp (LSE:VP.)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vp is a specialist rental business providing equipment and services to a diverse range of sectors, with a market cap of approximately £0.25 billion.

Operations: Vp generates revenue primarily from the UK at £339.21 million, with an additional contribution of £43.35 million internationally. The company's cost of goods sold (COGS) was £247.77 million in the latest reported period, impacting its gross profit of £122.46 million and resulting in a gross profit margin of 33.08%. Operating expenses were noted at £54.17 million, alongside significant non-operating expenses amounting to £73.69 million, affecting net income figures which showed a loss in recent periods.

PE: -42.7x

Vp's recent activities highlight its potential as an undervalued investment. The company reported half-year sales of £192.46 million, slightly up from the previous year, while net income saw a slight dip to £14.27 million. Insider confidence is evident with Jeremy F. Pilkington acquiring 113,532 shares for approximately £638,583 between late 2024 and early 2025, signaling belief in future prospects despite high debt levels. Vp Rail's launch aims to streamline operations and enhance customer experience in the rail sector, aligning with its growth-focused strategy amidst a challenging financial landscape.

- Unlock comprehensive insights into our analysis of Vp stock in this valuation report.

Explore historical data to track Vp's performance over time in our Past section.

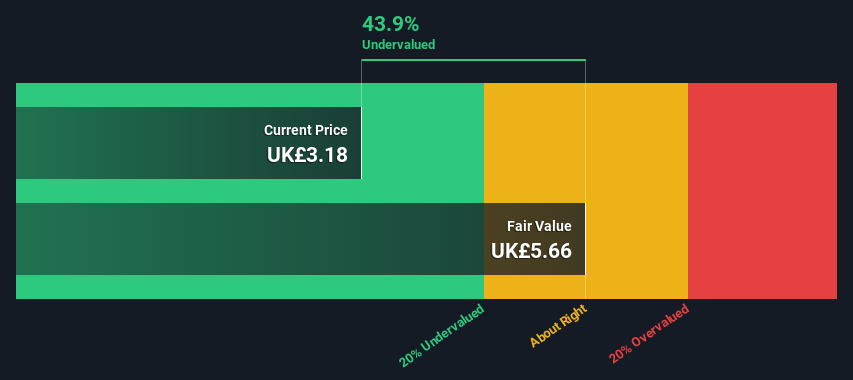

Zigup (LSE:ZIG)

Simply Wall St Value Rating: ★★★★★★

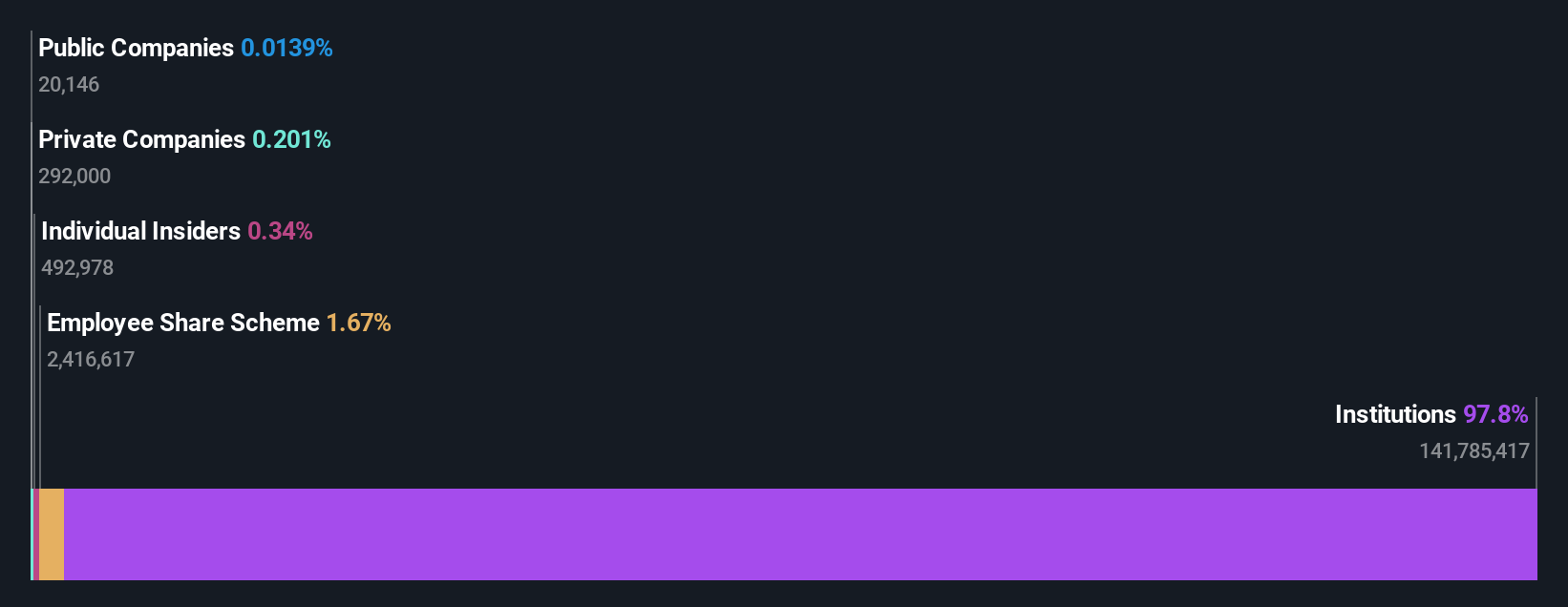

Overview: Zigup operates in the rental and claims services sectors, with a focus on the UK, Ireland, and Spain, and has a market capitalization of £2.75 billion.

Operations: Zigup generates revenue primarily from UK&I Rental (£575.33 million), Spain Rental (£360.69 million), and Claims & Services (£953.98 million). The company has experienced fluctuations in its gross profit margin, with a recent figure of 21.99% as of October 2024, down from a peak of 29.54% in October 2022. Operating expenses have shown an upward trend, reaching £244.24 million by October 2024, impacting overall profitability despite increasing revenues over time.

PE: 7.6x

Zigup, a UK-based company, is navigating financial challenges with profit margins dipping from 7.7% to 5.1% and earnings projected to grow at 5.38% annually. The company's reliance on external borrowing poses higher risk, yet recent executive changes bring optimism; Rachel Coulson joins as CFO by August 2025, promising digital transformation expertise from her tenure at Pearson and Vodafone. Despite revenue slipping slightly year-on-year to £903 million, Zigup declared an increased interim dividend of £0.088 per share for January 2025 payout, reflecting potential shareholder value appreciation amidst evolving leadership dynamics.

- Take a closer look at Zigup's potential here in our valuation report.

Gain insights into Zigup's past trends and performance with our Past report.

Summing It All Up

- Embark on your investment journey to our 35 Undervalued UK Small Caps With Insider Buying selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zigup might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ZIG

Zigup

Engages in the provision of mobility solutions and automotive services to business and personal customers in the United Kingdom, Spain, and Ireland.

Very undervalued average dividend payer.

Market Insights

Community Narratives