- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:ULE

The CFO & Director of Ultra Electronics Holdings plc (LON:ULE), Jos Sclater, Just Bought 3,221% More Shares

Whilst it may not be a huge deal, we thought it was good to see that the Ultra Electronics Holdings plc (LON:ULE) CFO & Director, Jos Sclater, recently bought UK£69k worth of stock, for UK£20.74 per share. While that isn't the hugest buy, it actually boosted their shareholding by 3,221%, which is good to see.

View our latest analysis for Ultra Electronics Holdings

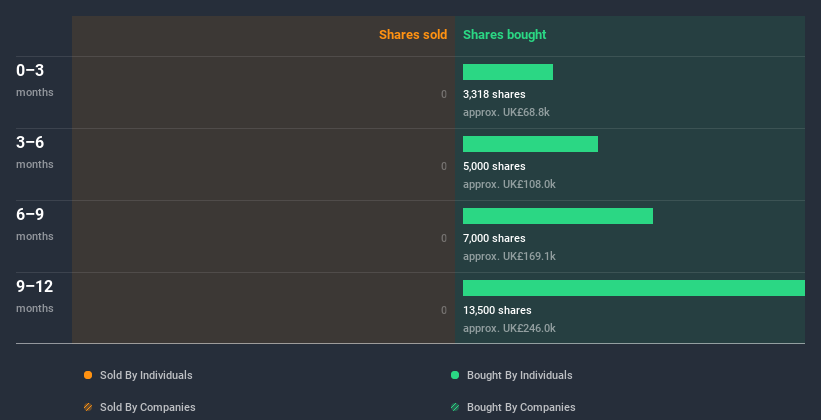

The Last 12 Months Of Insider Transactions At Ultra Electronics Holdings

Over the last year, we can see that the biggest insider purchase was by Chairman of the Board William Rice for UK£119k worth of shares, at about UK£23.75 per share. That means that even when the share price was higher than UK£20.54 (the recent price), an insider wanted to purchase shares. It's very possible they regret the purchase, but it's more likely they are bullish about the company. In our view, the price an insider pays for shares is very important. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

Ultra Electronics Holdings insiders may have bought shares in the last year, but they didn't sell any. The average buy price was around UK£21.26. I'd consider this a positive as it suggests insiders see value at around the current price. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Ultra Electronics Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Does Ultra Electronics Holdings Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. We usually like to see fairly high levels of insider ownership. Based on our data, Ultra Electronics Holdings insiders have about 0.1% of the stock, worth approximately UK£1.5m. We consider this fairly low insider ownership.

So What Do The Ultra Electronics Holdings Insider Transactions Indicate?

It is good to see the recent insider purchase. We also take confidence from the longer term picture of insider transactions. We would certainly prefer see higher levels of insider ownership but analysis of the insider transactions suggests that Ultra Electronics Holdings insiders are expecting a bright future. Therefore, you should definitely take a look at this FREE report showing analyst forecasts for Ultra Electronics Holdings.

But note: Ultra Electronics Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Ultra Electronics Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:ULE

Ultra Electronics Holdings

Ultra Electronics Holdings plc provides application-engineered bespoke solutions in the defense, security, critical detection, and control markets.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives