Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in RS Group (LON:RS1). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for RS Group

How Fast Is RS Group Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Like a wedge-tailed eagle on the wind, RS Group's EPS soared from UK£0.29 to UK£0.39, in just one year. That's a impressive gain of 35%.

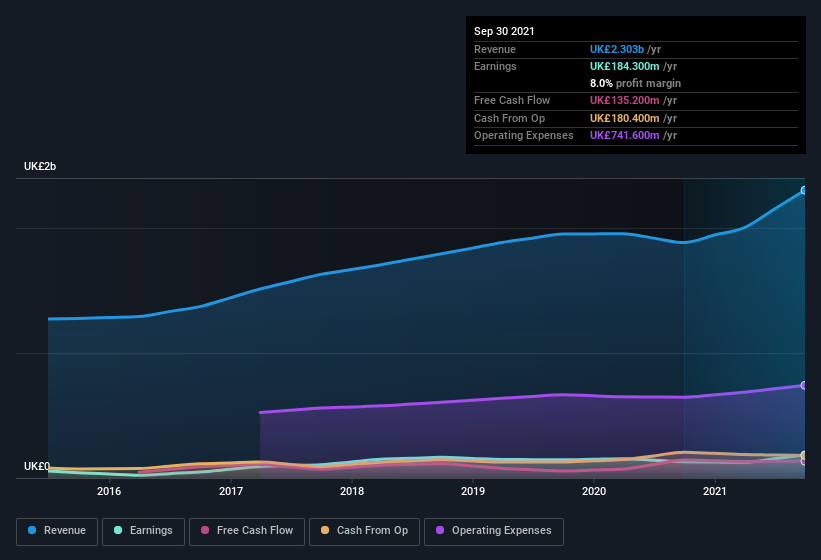

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that RS Group is growing revenues, and EBIT margins improved by 2.4 percentage points to 11%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of RS Group's forecast profits?

Are RS Group Insiders Aligned With All Shareholders?

Since RS Group has a market capitalization of UK£4.3b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. Indeed, they hold UK£13m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 0.3% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add RS Group To Your Watchlist?

For growth investors like me, RS Group's raw rate of earnings growth is a beacon in the night. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. Of course, just because RS Group is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RS1

RS Group

Engages in the distribution of maintenance, repair, and operations products and service solutions in the United Kingdom, the United States, France, Germany, Italy, Mexico, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives