- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:RR.

Rolls-Royce Holdings plc's (LON:RR.) Shareholders Might Be Looking For Exit

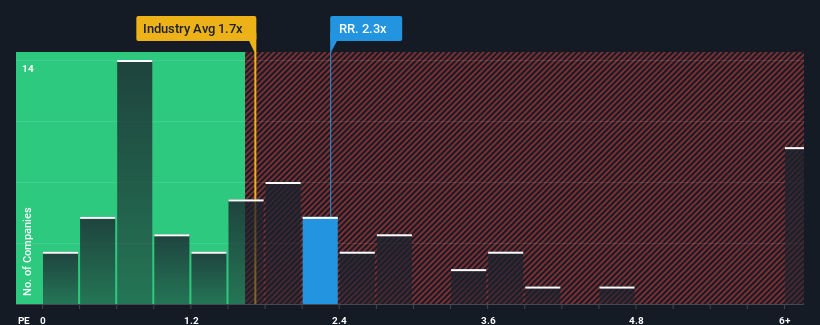

When close to half the companies in the Aerospace & Defense industry in the United Kingdom have price-to-sales ratios (or "P/S") below 1.6x, you may consider Rolls-Royce Holdings plc (LON:RR.) as a stock to potentially avoid with its 2.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Rolls-Royce Holdings

What Does Rolls-Royce Holdings' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Rolls-Royce Holdings has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Rolls-Royce Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Rolls-Royce Holdings?

In order to justify its P/S ratio, Rolls-Royce Holdings would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. Pleasingly, revenue has also lifted 43% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 5.8% per annum over the next three years. That's shaping up to be materially lower than the 11% each year growth forecast for the broader industry.

With this information, we find it concerning that Rolls-Royce Holdings is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Rolls-Royce Holdings' P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It comes as a surprise to see Rolls-Royce Holdings trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 4 warning signs we've spotted with Rolls-Royce Holdings (including 2 which are significant).

If you're unsure about the strength of Rolls-Royce Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RR.

Rolls-Royce Holdings

Develops and delivers complex power and propulsion solutions for air, sea, and land in the United Kingdom and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives