- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:RR.

Is Rolls-Royce Still Attractive After Talks on Small Nuclear Reactor Funding?

Reviewed by Bailey Pemberton

If you’ve been eyeing Rolls-Royce Holdings stock, you’re not alone. With a jaw-dropping 121.4% surge in the past year and a five-year gain north of 1700%, even the most seasoned investors are pausing to ask: did I miss the boat, or is there more fuel in the tank? The story here goes beyond the impressive headline numbers. After a robust 7.3% uptick over the past month, there was a short-term dip of 3.1% in the last week, revealing just how quickly sentiment can shift on this high-flying stock.

A big part of this momentum connects back to news swirling around Rolls-Royce’s efforts in next-generation technology, including its search for funding for small nuclear reactor units. These behind-the-scenes moves suggest the company is thinking far beyond engines and jetliners, stoking investor optimism about growth potential and risk. With the dust still settling from the latest updates and a world hungry for innovation, the company’s stock remains firmly on the radar.

Of course, rapid growth can invite questions about whether the price truly matches the company’s value. That’s where things get interesting. By our count, Rolls-Royce is undervalued in 3 out of 6 key valuation checks, putting its numerical value score at 3. Over the next sections, we’ll break down what each valuation metric really says about Rolls-Royce today. And before we wrap up, I’ll show you a smarter, more holistic way to think about value that goes beyond any single checklist.

Approach 1: Rolls-Royce Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model takes the company's expected future cash flows and estimates what they are worth in today’s money. It is a way of projecting how much cash Rolls-Royce might generate over the coming years and then discounting those numbers back to a present value to see what the company could actually be worth now.

Currently, Rolls-Royce Holdings reports a trailing twelve months Free Cash Flow of £3.27 billion. Analysts have provided detailed estimates for the next five years, and based on their projections and further extrapolations, Free Cash Flow is expected to reach about £5.17 billion in 2035. These ambitious forecasts factor in both reinvestment in the business and likely organic growth. They are expressed in billions of pounds (£) to reflect Rolls-Royce’s scale.

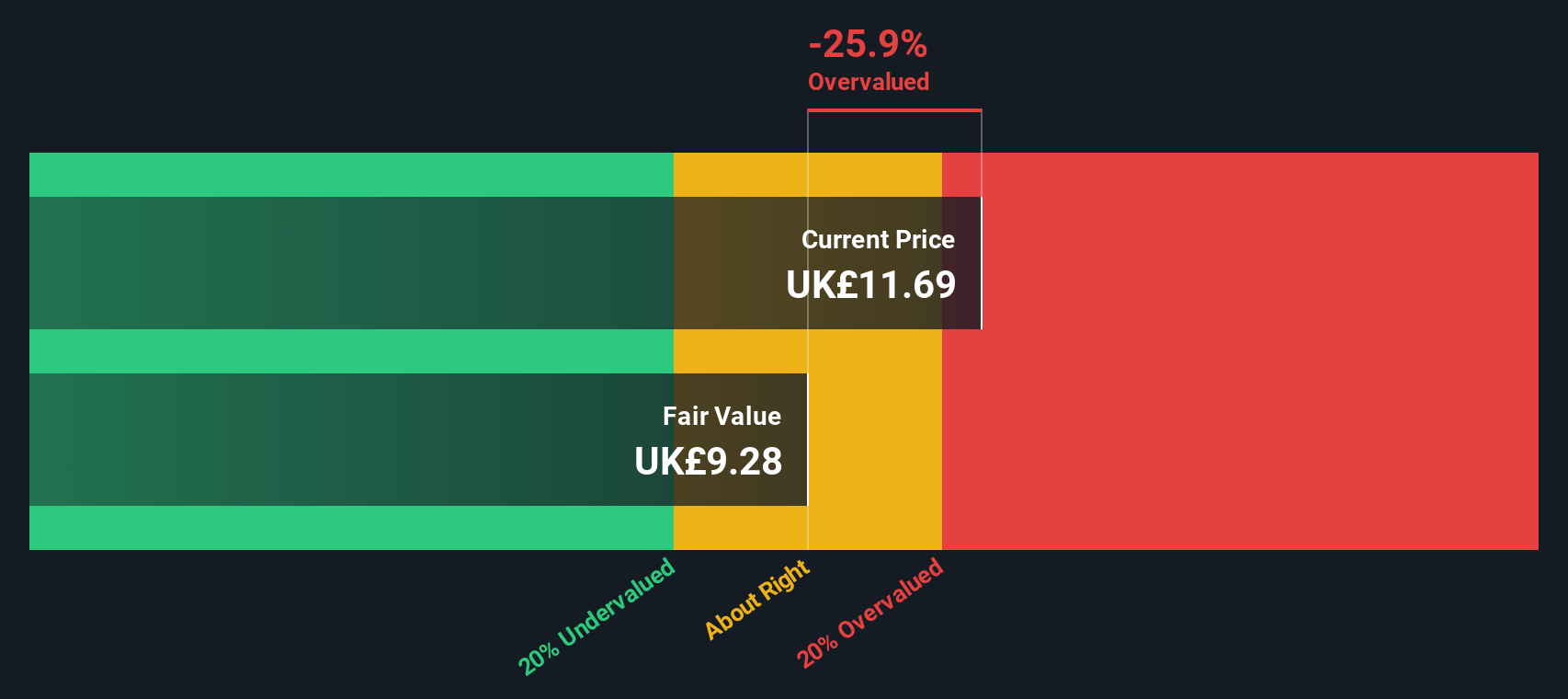

After applying the DCF model with these cash flows, the estimated intrinsic value per share is £9.26. Comparing that to the recent share price, the stock appears roughly 24.5% overvalued based on this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rolls-Royce Holdings may be overvalued by 24.5%. Find undervalued stocks or create your own screener to find better value opportunities.

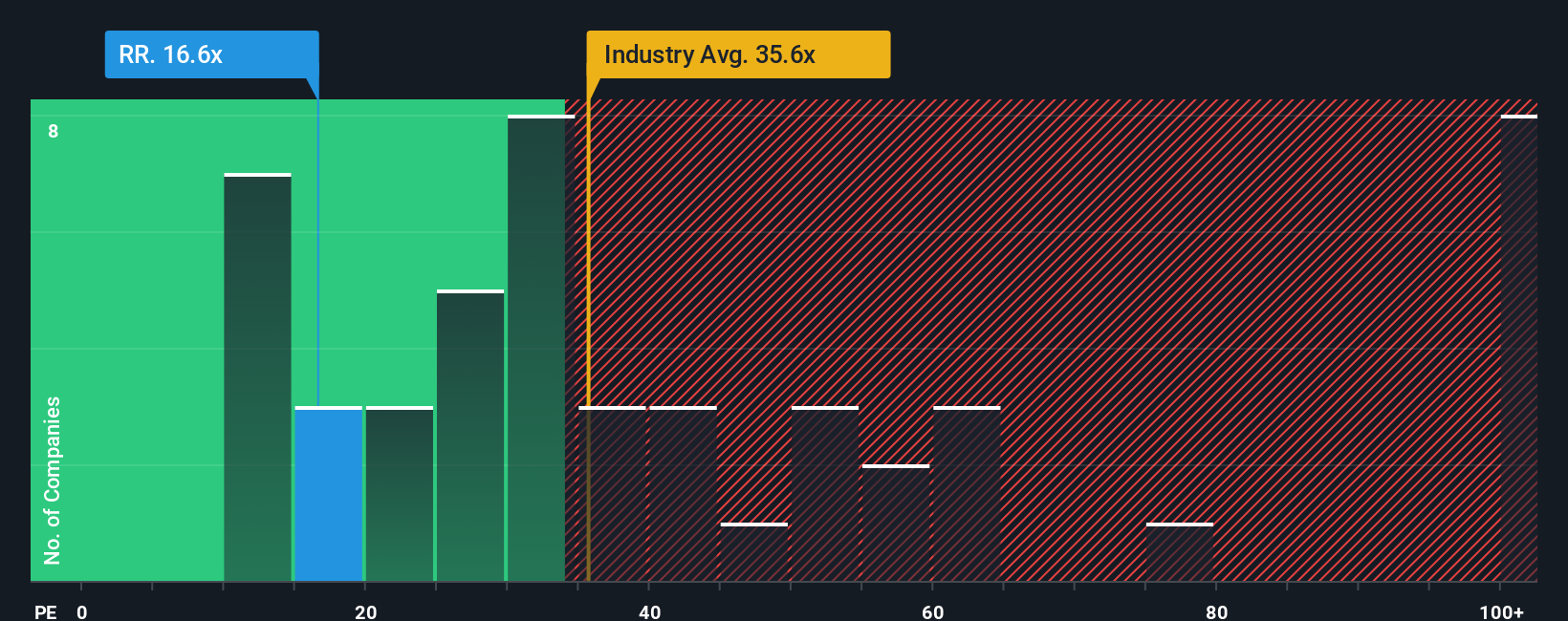

Approach 2: Rolls-Royce Holdings Price vs Earnings (PE)

For established, profitable companies like Rolls-Royce Holdings, the Price-to-Earnings (PE) ratio is often the go-to tool for stock valuation. It measures how much investors are paying for each pound of earnings and helps gauge market expectations for a company’s growth and risk profile compared to its industry peers.

Growth expectations and risk both heavily influence what counts as a “normal” or “fair” PE ratio. Companies with strong earnings growth or lower risk tend to command higher PE multiples. By contrast, if risks are elevated or growth is uncertain, the market often applies a discount.

Rolls-Royce currently trades at a PE ratio of 16.7x, notably below the Aerospace & Defense industry average of 47.6x and the peer average of 27.9x. At first glance, this might suggest the stock is undervalued, but simple comparisons can miss key pieces of context.

This is where the Simply Wall St “Fair Ratio” comes in. The Fair Ratio for Rolls-Royce is 19.5x. This proprietary benchmark reflects not just the company’s growth outlook, but also its profit margins, market cap, industry factors, and unique risks. Unlike generic peer or industry averages, the Fair Ratio provides a more tailored benchmark for value, making it a more reliable reference point for this stock.

With Rolls-Royce’s actual PE ratio (16.7x) just slightly below its Fair Ratio (19.5x), the stock looks about right on this measure, neither notably cheap nor expensive.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rolls-Royce Holdings Narrative

Earlier we mentioned that there's an even better way to understand value, so let's introduce you to Narratives: a smarter, more intuitive approach where you combine your view of a company's story with a financial forecast, connecting what the business does to what it's worth.

A Narrative lets you explain, in simple terms, your assumptions about Rolls-Royce Holdings’s future, such as projecting revenue growth, estimating profit margins, or weighing transformative new technologies, and then translates those beliefs into a fair value estimate. This takes you beyond just plugging numbers into ratios and empowers you to make active decisions based on your own perspective, not just copying others.

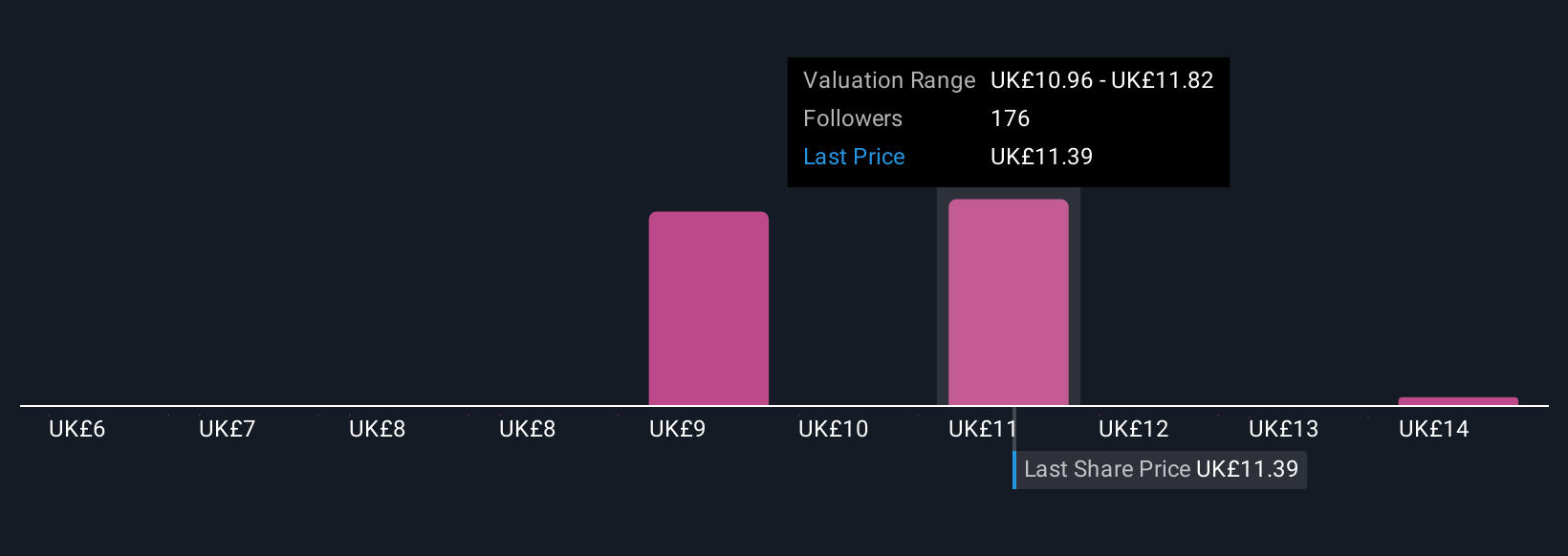

On Simply Wall St’s Community page, millions of investors are already using Narratives to map their outlook on each company and see how their fair value compares to the current share price. Narratives automatically update as new news and earnings emerge, helping them decide whether to buy, sell, or hold.

For Rolls-Royce Holdings, one investor’s Narrative might see enormous long-term upside and assign a fair value at £14.4, based on booming clean energy markets and successful new tech. Another may focus on execution risks and margin pressure, arguing for a much lower fair value of just £2.4. Narratives make it simple to express, compare, and refine these viewpoints in real time.

Do you think there's more to the story for Rolls-Royce Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RR.

Rolls-Royce Holdings

Develops and delivers mission-critical power systems in the United Kingdom and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives