- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:RR.

How the Recent Price Surge Shapes the Outlook for Rolls-Royce in 2025

Reviewed by Simply Wall St

Trying to figure out whether to buy, hold, or pass on Rolls-Royce Holdings? You are not alone. After another impressive run-up in its share price, many investors are scanning the horizon for what's next. Over just the past week, Rolls-Royce’s stock gained 5.1%. Zoom out to the last month and that is a 4.5% lift. But the big story is in the longer term. Over the past year, shares exploded by 128.3%, and if you had the nerve to hold on since mid-2019, your investment would be up a jaw-dropping 1750.8%.

What is driving this remarkable climb? Broadly, improvement in the company’s balance sheet and renewed interest in the aerospace sector after recent market shifts have both played a part. Investors seem to be weighing the company as lower risk than in the past, pushing the valuation higher despite some market volatility. This mix of optimism and momentum gives the stock a unique profile. Some see huge growth potential while others worry about how much ongoing good news is already baked into the price.

On the numbers front, Rolls-Royce holds a value score of 3 out of 6, meaning it appears undervalued in 3 of the main checks analysts use. That is a decent score, but not a screaming bargain just based on the typical methods. So, how does it stack up through the lens of these different valuation tools? Is there an even smarter way to size up its real worth? Let’s break down the big valuation approaches first, then circle back to a perspective that can cut through the noise.

Rolls-Royce Holdings delivered 128.3% returns over the last year. See how this stacks up to the rest of the Aerospace & Defense industry.Approach 1: Rolls-Royce Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today's terms. In simple terms, it helps investors determine what the business is worth by adding up all the expected future cash earnings, adjusted for the time value of money.

For Rolls-Royce Holdings, the current Free Cash Flow stands at £3.27 billion. Analysts forecast that by 2029, Free Cash Flow could rise to £4.48 billion, with projections extending to 2035 using extrapolations. Notably, cash flow estimates from analysts generally cover up to 2029, and further numbers are based on extended assumptions.

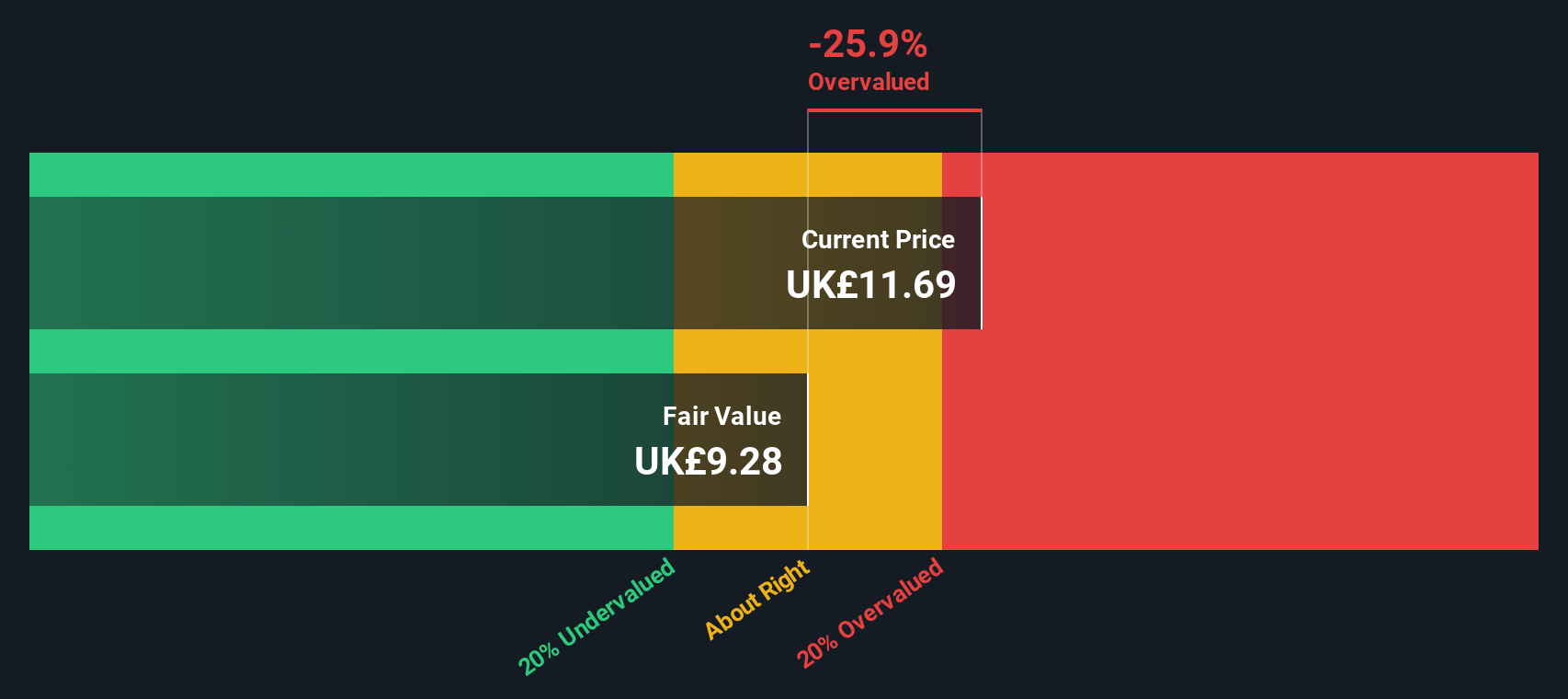

Based on this projection and the 2 Stage Free Cash Flow to Equity model, the DCF fair value estimate for Rolls-Royce is £9.35 per share. However, the current stock price implies a 20.8% premium to this intrinsic value, suggesting that the market is pricing in more growth or optimism than these cash flow estimates support.

In summary, the DCF model indicates Rolls-Royce stock is trading above its calculated fair value. On this basis, it appears overvalued right now.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Rolls-Royce Holdings.

Approach 2: Rolls-Royce Holdings Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is one of the most common ways to value profitable companies, as it compares the current share price to earnings per share. For established businesses generating consistent profits, PE can reveal whether the market is pricing growth ambitions or potential risks too aggressively.

Growth expectations and perceived risk both shape what investors consider a “normal” or “fair” PE ratio. When a company is expected to grow earnings rapidly, its PE ratio should logically be higher since investors are willing to pay more for its stock relative to present profits. Conversely, companies with uncertain prospects or higher risks usually see lower PE multiples.

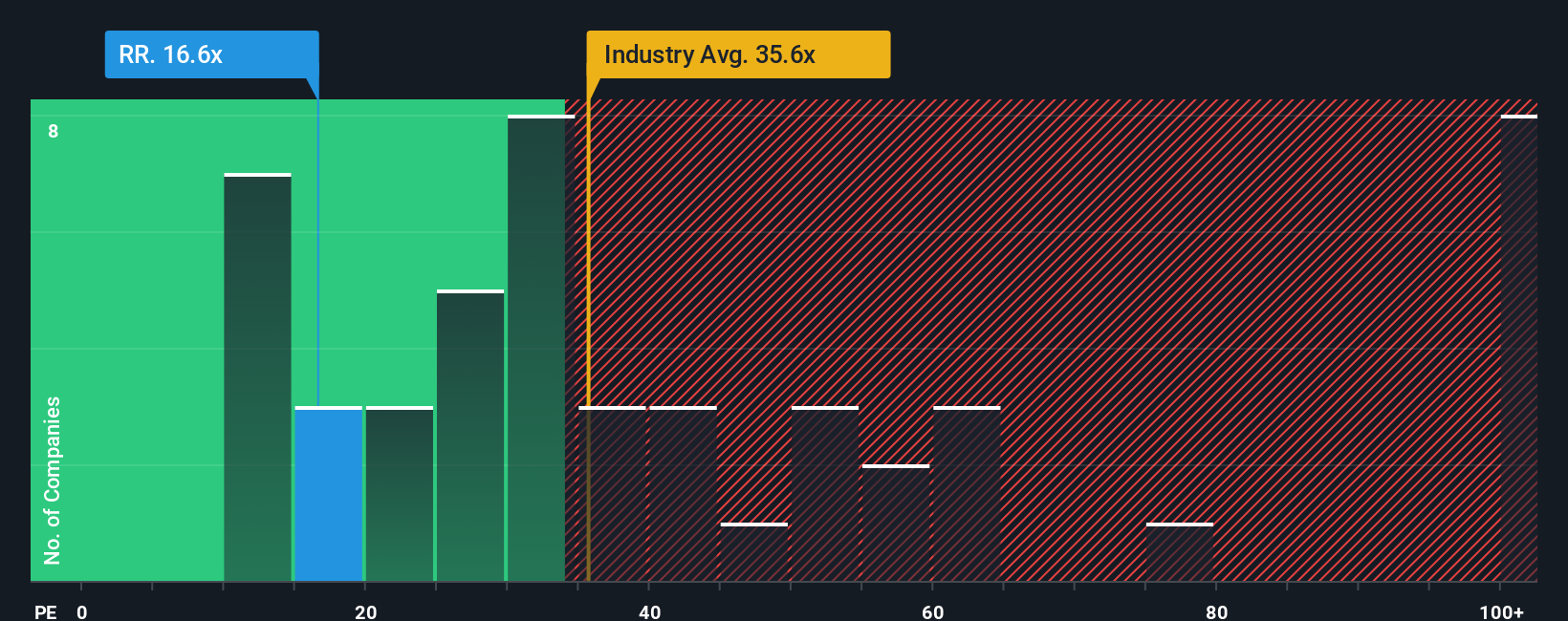

Currently, Rolls-Royce Holdings trades at a PE ratio of 16.4x. Industry peers in Aerospace and Defense average 26.8x, while the broader industry PE sits even higher at 44.6x. This might suggest the stock is cheap at first glance, but these broad comparisons can miss vital context.

That is where the Simply Wall St “Fair Ratio” comes in. This proprietary metric calculates what an appropriate PE should be for Rolls-Royce given its specific earnings growth, profit margins, market cap, and risks, as well as how it fits within its industry. Unlike simple peer or industry averages, the Fair Ratio tailors the multiple to the company’s individual profile, offering a much more nuanced view.

For Rolls-Royce, the Fair Ratio is 18.2x, very close to the company’s actual PE. This suggests that, based on all the relevant factors, the current price is well aligned with expectations.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Rolls-Royce Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story about a company: it is how you connect the business’s bigger picture, including its opportunities, risks, and competitive strengths, to a set of expectations for future revenue, profit margins, and fair value. Unlike static models, Narratives let you spell out your key assumptions, see how those translate into forecasts, and check whether the current price matches your vision or not.

Narratives are an easy, interactive tool available to everyone inside the Simply Wall St Community page. Trusted by millions of investors, Narratives help bring numbers to life. By building or choosing a Narrative, you can instantly compare your view and your fair value with the latest market price, helping you time your buy, hold, or sell decisions in a way that reflects your own perspective rather than just consensus estimates.

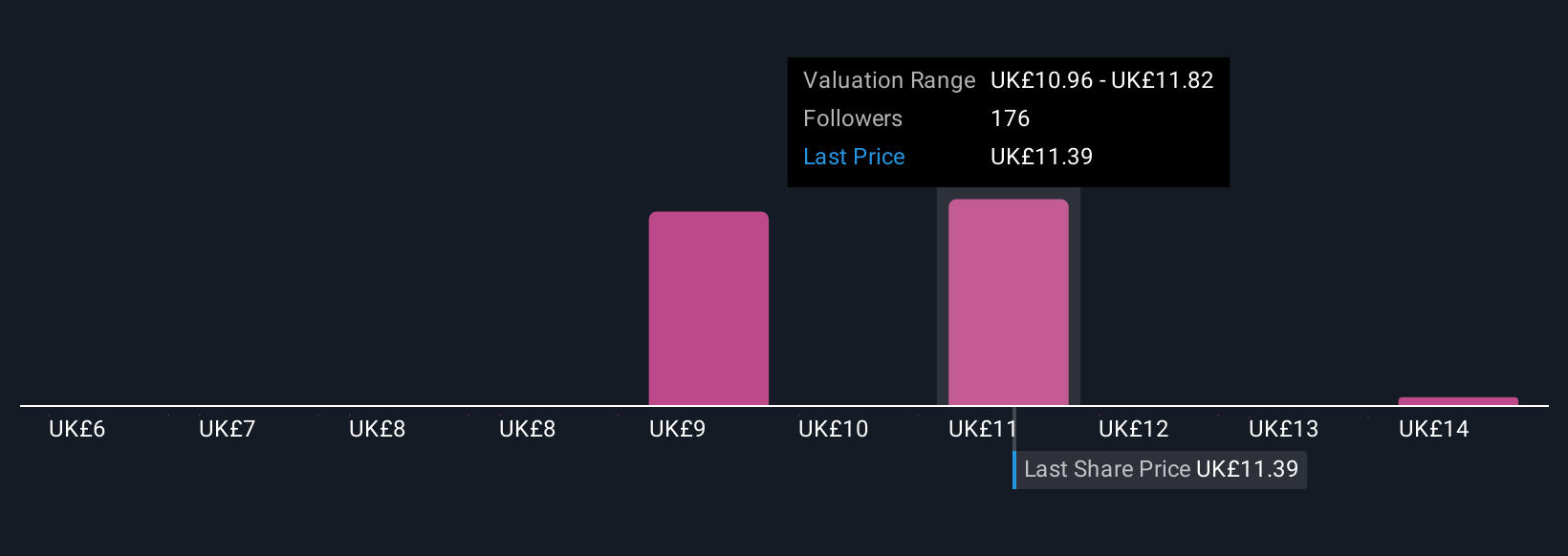

What makes Narratives especially powerful is that they update automatically as news, results, or industry changes unfold. This way, your reasoning stays connected to real-world events. For Rolls-Royce Holdings, for example, optimistic investors might build a Narrative expecting margins and aerospace demand to stay at peak levels, assigning a fair value above £14 per share. In contrast, cautious investors forecasting slower growth and rising risks might conclude the stock is worth closer to £2.40, all based on differences in outlook, not just the numbers alone.

In short, Narratives give you a fast, accessible way to turn your beliefs about Rolls-Royce into actionable decisions, keeping you one step ahead of the crowd.

Do you think there's more to the story for Rolls-Royce Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RR.

Rolls-Royce Holdings

Develops and delivers mission-critical power systems in the United Kingdom and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives