- United Kingdom

- /

- Specialty Stores

- /

- LSE:PETS

3 Top UK Dividend Stocks With Yields Up To 5.8%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faced downward pressure, closing 0.4 percent lower at 7,527.42 amid weak trade data from China and global economic uncertainties. Despite these challenges, dividend stocks continue to attract investors seeking steady income streams and potential resilience in volatile markets.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.73% | ★★★★★★ |

| Shoe Zone (AIM:SHOE) | 9.80% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.16% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.31% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.85% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.59% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.51% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.66% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.98% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.44% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

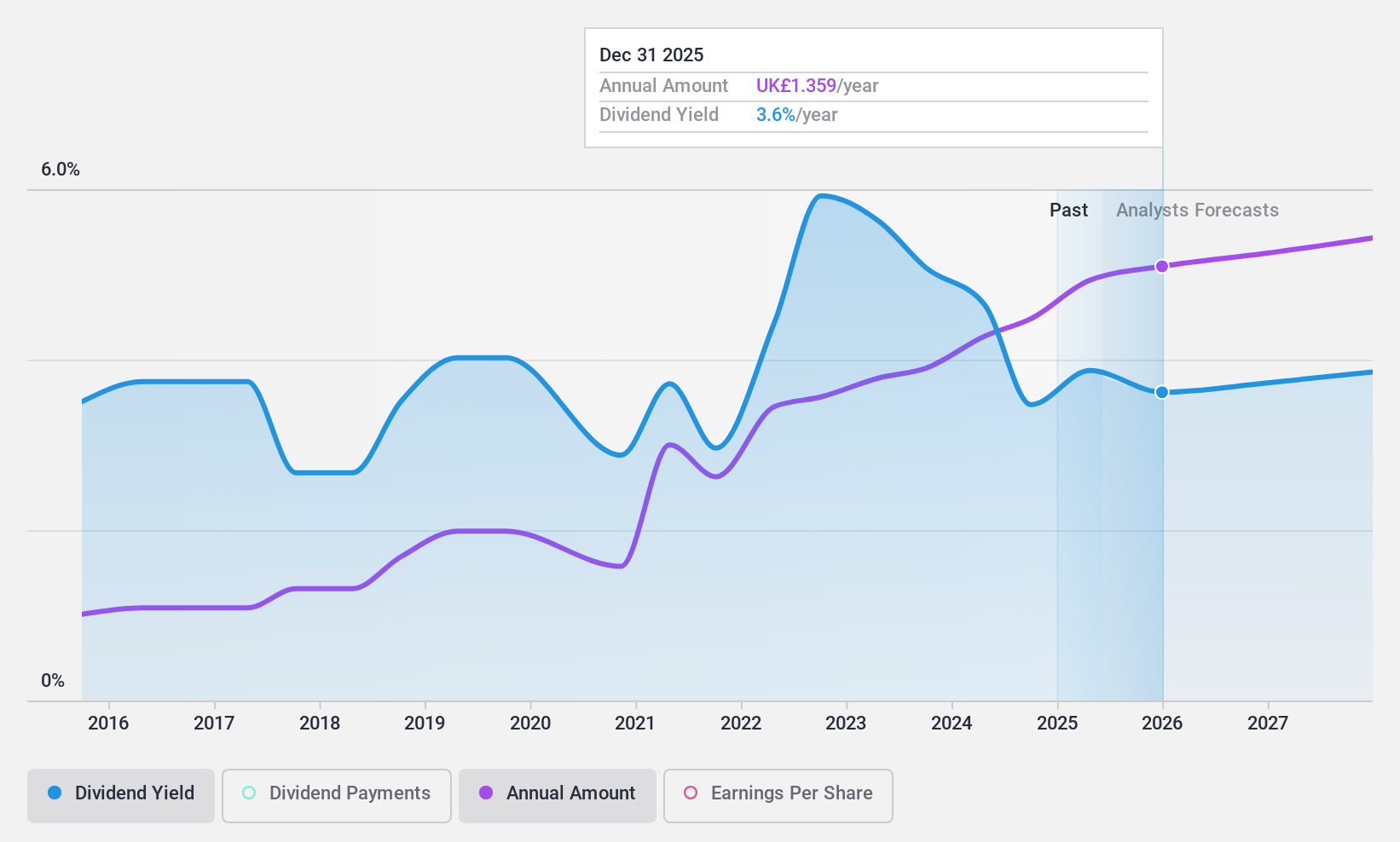

Morgan Sindall Group (LSE:MGNS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Morgan Sindall Group plc operates as a construction and regeneration company in the United Kingdom with a market cap of £1.45 billion.

Operations: Morgan Sindall Group plc generates revenue from several segments, including Fit Out (£1.24 billion), Construction (£1.02 billion), Infrastructure (£989.20 million), Property Services (£191.80 million), Urban Regeneration (£148.40 million), and Partnership Housing (£845.20 million).

Dividend Yield: 3.9%

Morgan Sindall Group has demonstrated a volatile dividend track record over the past decade, with payments experiencing significant fluctuations. Despite this, the company's dividends are well-covered by both earnings (44.7% payout ratio) and free cash flows (33.4% cash payout ratio). Recent earnings growth of 93.1% and a 15% increase in the interim dividend to 41.5 pence per share suggest positive momentum. However, its current yield of 3.88% remains below the UK's top quartile payers at 5.48%.

- Click to explore a detailed breakdown of our findings in Morgan Sindall Group's dividend report.

- Our valuation report here indicates Morgan Sindall Group may be undervalued.

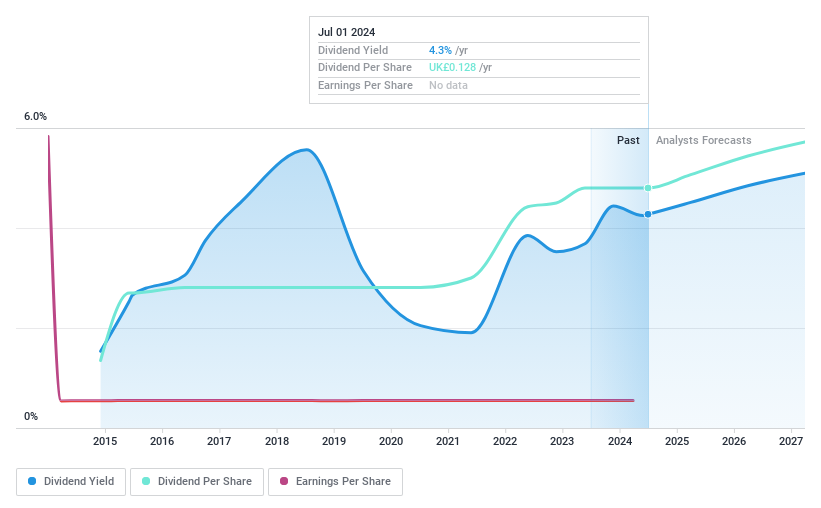

Pets at Home Group (LSE:PETS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Pets at Home Group Plc operates as a specialist omnichannel retailer of pet food, related products, and accessories in the United Kingdom with a market cap of £1.42 billion.

Operations: The company's revenue segments include Retail at £1.33 billion and the Vet Group at £146.50 million.

Dividend Yield: 4.1%

Pets at Home Group offers a stable dividend yield of 4.14%, though it falls short of the UK's top quartile payers at 5.48%. Over the past decade, its dividends have been reliable and growing, supported by a sustainable payout ratio of 77.2% from earnings and a low cash payout ratio of 36.2%. Recent revenue growth was modest at £441.1 million, with like-for-like revenue up just 0.5%, but the company affirmed an annual dividend of 8.3 pence per share in July's AGM.

- Take a closer look at Pets at Home Group's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Pets at Home Group shares in the market.

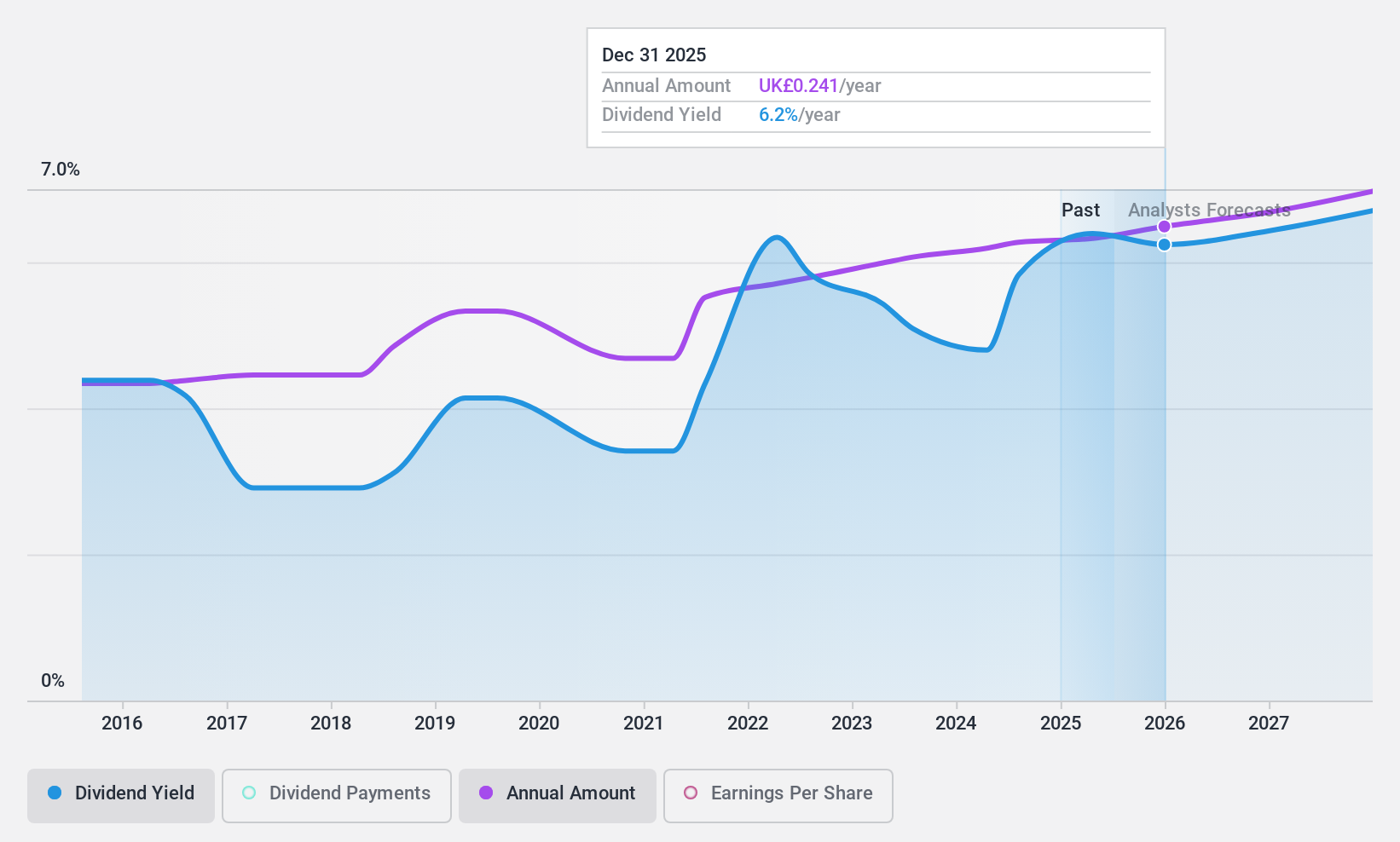

Vesuvius (LSE:VSVS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Vesuvius plc provides molten metal flow engineering and technology services to steel and foundry casting industries worldwide, with a market cap of £1.06 billion.

Operations: Vesuvius plc generates revenue from several segments: £496.80 million from Foundry, £784.90 million from Steel - Flow Control, £40.70 million from Steel - Sensors & Probes, and £548.60 million from Steel - Advanced Refractories.

Dividend Yield: 5.8%

Vesuvius has increased its interim dividend by 4.4% to 7.1 pence per share, payable on September 13, 2024. The company completed a £30.2 million buyback of 6.3 million shares, enhancing shareholder value. Despite a volatile dividend history over the past decade, current dividends are well-covered by earnings and cash flows with payout ratios around 59%. Trading at a significant discount to estimated fair value and offering a competitive yield of 5.85%, Vesuvius remains attractive for income-focused investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Vesuvius.

- The analysis detailed in our Vesuvius valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Reveal the 60 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PETS

Pets at Home Group

Engages in the specialist omnichannel retailing of pet food, pet related products, and pet accessories in the United Kingdom.

Very undervalued 6 star dividend payer.