- United Kingdom

- /

- Machinery

- /

- LSE:MGAM

Top UK Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

In the last week, the United Kingdom market has been flat, but over the past 12 months, it has risen by 7.8%, with earnings expected to grow by 15% per annum in the coming years. In this environment, identifying dividend stocks that offer consistent payouts and potential for growth can be a prudent strategy for investors seeking steady income and capital appreciation.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Keller Group (LSE:KLR) | 3.12% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.23% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.64% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.40% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.07% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.83% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.60% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.79% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.89% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.50% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Associated British Foods (LSE:ABF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Associated British Foods plc is a diversified company engaged in food, ingredients, and retail operations globally, with a market cap of £16.37 billion.

Operations: Associated British Foods plc generates revenue from its various segments, including Retail (£9.45 billion), Grocery (£4.24 billion), Sugar (£2.53 billion), Ingredients (£2.13 billion), and Agriculture (£1.65 billion).

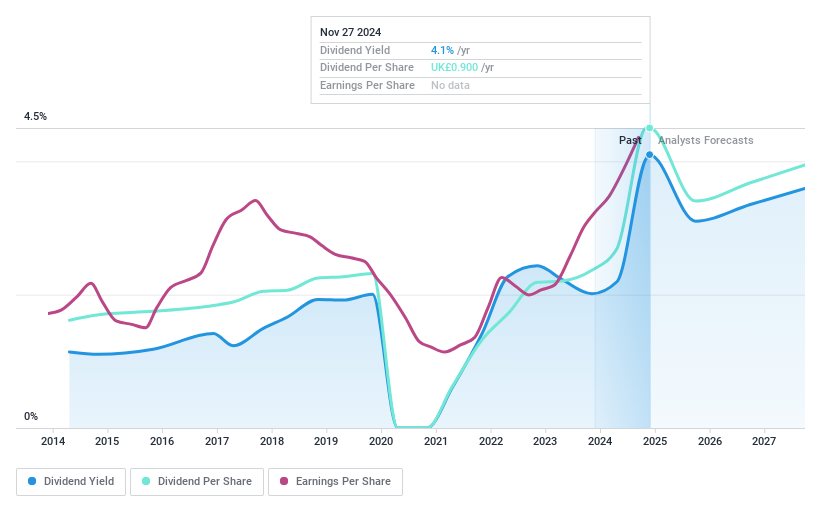

Dividend Yield: 4%

Associated British Foods has announced a special dividend of 27 pence per share alongside a final dividend of 42.3 pence, both payable on January 10, 2025. Despite recent profit growth and a low payout ratio suggesting dividends are covered by earnings and cash flows, its historical dividend reliability is questionable due to volatility. The company also initiated a £500 million share buyback program, reflecting confidence in financial stability despite insider selling concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Associated British Foods.

- In light of our recent valuation report, it seems possible that Associated British Foods is trading behind its estimated value.

Inchcape (LSE:INCH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inchcape plc is an automotive distributor and retailer with a market capitalization of £3.09 billion.

Operations: Inchcape plc generates revenue through its automotive distribution segments, with £3.07 billion from APAC, £3.44 billion from the Americas, and £2.75 billion from Europe & Africa.

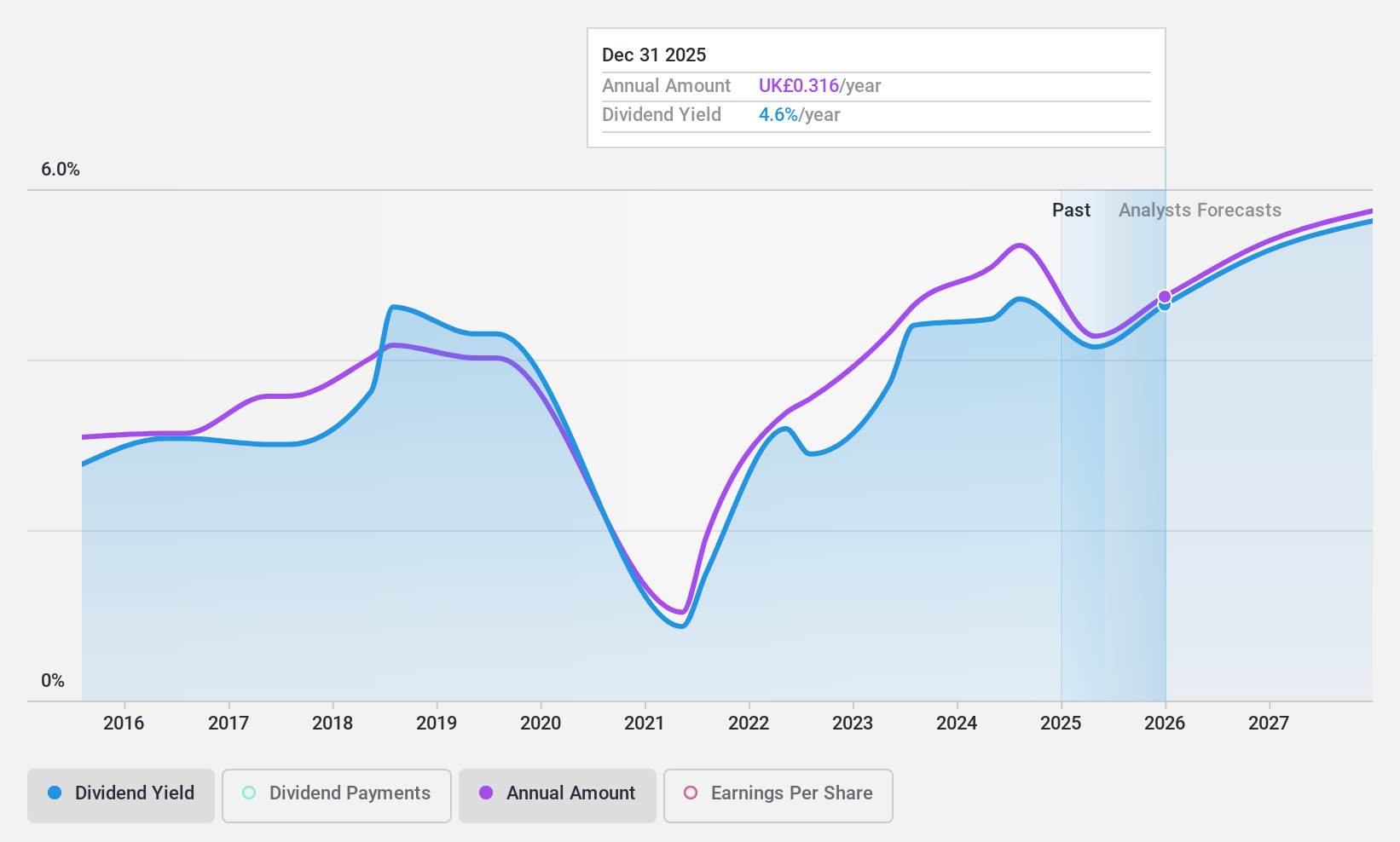

Dividend Yield: 4.6%

Inchcape's dividend payments are well-covered by earnings and cash flows, with payout ratios of 52.5% and 27.4%, respectively. However, the dividends have been unreliable over the past decade due to volatility. The company reported £2.2 billion in Q3 revenue but faces high debt levels. Despite this, Inchcape is pursuing bolt-on acquisitions to bolster growth as it trades at a significant discount to its estimated fair value, offering potential upside for investors seeking value plays in dividend stocks.

- Unlock comprehensive insights into our analysis of Inchcape stock in this dividend report.

- The analysis detailed in our Inchcape valuation report hints at an deflated share price compared to its estimated value.

Morgan Advanced Materials (LSE:MGAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Morgan Advanced Materials plc is a materials science and application engineering company based in the United Kingdom with a market capitalization of approximately £754.28 million.

Operations: Morgan Advanced Materials plc generates revenue from its Carbon & Technical Ceramics Division, specifically through its Technical Ceramics segment, which accounts for £320.90 million.

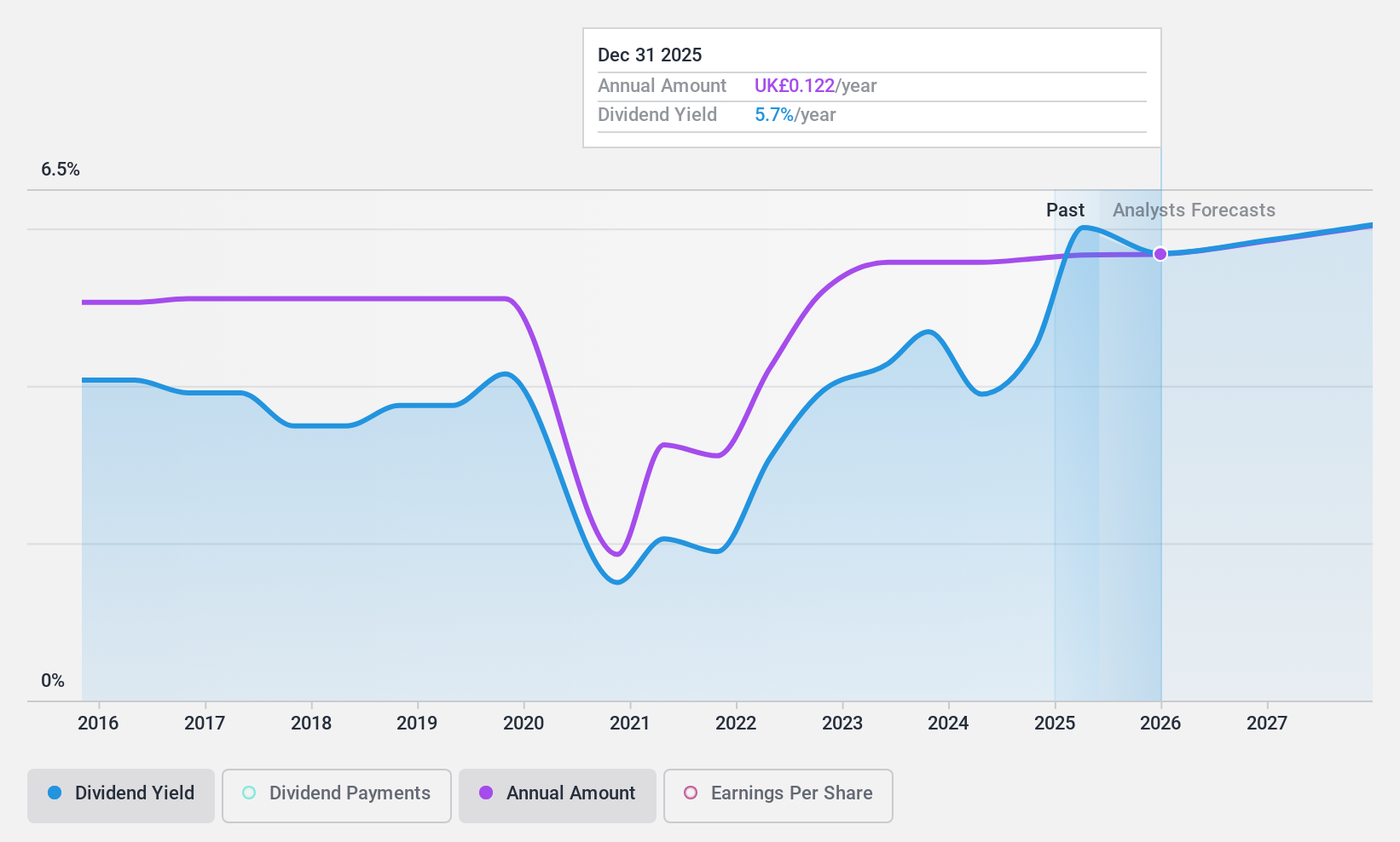

Dividend Yield: 4.5%

Morgan Advanced Materials trades at a favorable valuation with a price-to-earnings ratio of 10.9x, below the UK market average. Its dividend yield of 4.55% is lower than the top UK payers but remains well-covered by earnings and cash flows, despite past volatility. Recent share buyback announcements could enhance shareholder value, although high debt levels persist as a concern. The company anticipates modest revenue growth in 2024, reflecting stable operational performance amidst strategic financial maneuvers.

- Navigate through the intricacies of Morgan Advanced Materials with our comprehensive dividend report here.

- Our expertly prepared valuation report Morgan Advanced Materials implies its share price may be lower than expected.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 58 Top UK Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MGAM

Morgan Advanced Materials

Manufactures and sells various carbon and ceramic products.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives