It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like IMI (LON:IMI). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for IMI

How Fast Is IMI Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, IMI has grown EPS by 13% per year. That's a pretty good rate, if the company can sustain it.

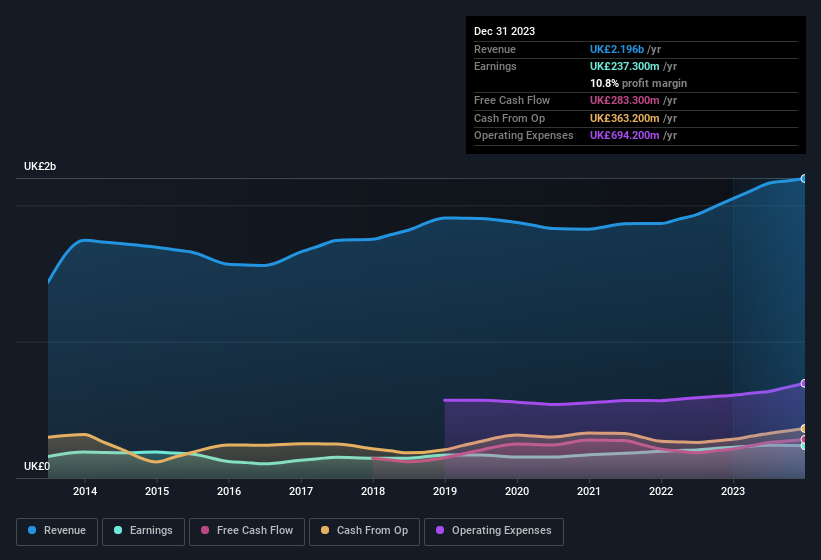

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note IMI achieved similar EBIT margins to last year, revenue grew by a solid 7.2% to UK£2.2b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of IMI's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are IMI Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling IMI shares, in the last year. So it's definitely nice that Senior Independent Non-Executive Director Thomas Andersen bought UK£6.4k worth of shares at an average price of around UK£16.00. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in IMI.

Is IMI Worth Keeping An Eye On?

As previously touched on, IMI is a growing business, which is encouraging. Not every business can grow its EPS, but IMI certainly can. The cherry on top is that we have an insider buying shares. A further encouragement to keep an eye on this stock. You should always think about risks though. Case in point, we've spotted 1 warning sign for IMI you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of IMI, you'll probably love this curated collection of companies in GB that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:IMI

IMI

An engineering company, engages in the design, manufacturing, and servicing of engineering products in the United Kingdom, Germany, rest of Europe, the United States, rest of the Americas, China, rest of the Asia Pacific, the Middle East, and Africa.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives