- United Kingdom

- /

- Software

- /

- LSE:ALFA

Undiscovered Gems in United Kingdom for September 2024

Reviewed by Simply Wall St

Over the last 7 days, the market in the United Kingdom has dropped 1.3%, but it has risen by 8.3% over the past year, with earnings expected to grow by 14% per annum over the next few years. In this context, identifying stocks with strong growth potential and solid fundamentals can be particularly rewarding for investors looking to capitalize on these trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| FW Thorpe | 3.34% | 11.37% | 9.41% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

Overview: Warpaint London PLC, together with its subsidiaries, produces and sells cosmetics and has a market cap of £445.61 million.

Operations: Warpaint London PLC generates revenue primarily from its Own Brand segment (£87.07 million) and a smaller portion from Close-Out sales (£2.52 million).

Warpaint London, a small-cap player in the Personal Products industry, has shown impressive earnings growth of 122.4% over the past year, far outpacing the industry's 13.7%. The company is debt-free, a significant improvement from five years ago when its debt to equity ratio was 5.2%. Additionally, Warpaint recently declared a final dividend of £0.06 per share, reflecting its strong financial health and commitment to shareholder returns. Earnings are forecasted to grow at 14.71% annually.

Alfa Financial Software Holdings (LSE:ALFA)

Simply Wall St Value Rating: ★★★★★★

Overview: Alfa Financial Software Holdings PLC, with a market cap of £652.21 million, provides software and consultancy services to the auto and equipment finance industry across the UK, US, Europe, Middle East, Africa, and internationally through its subsidiaries.

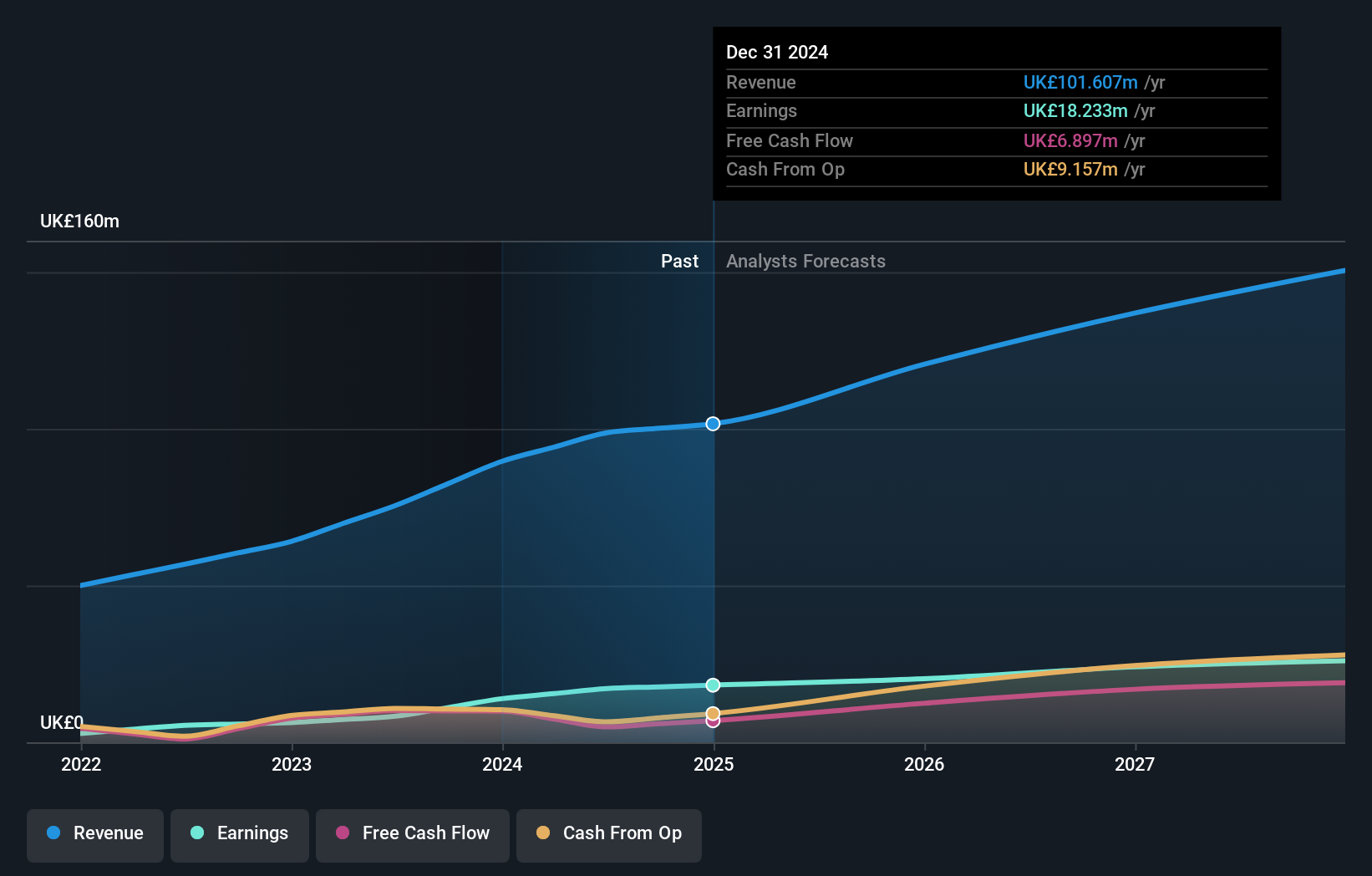

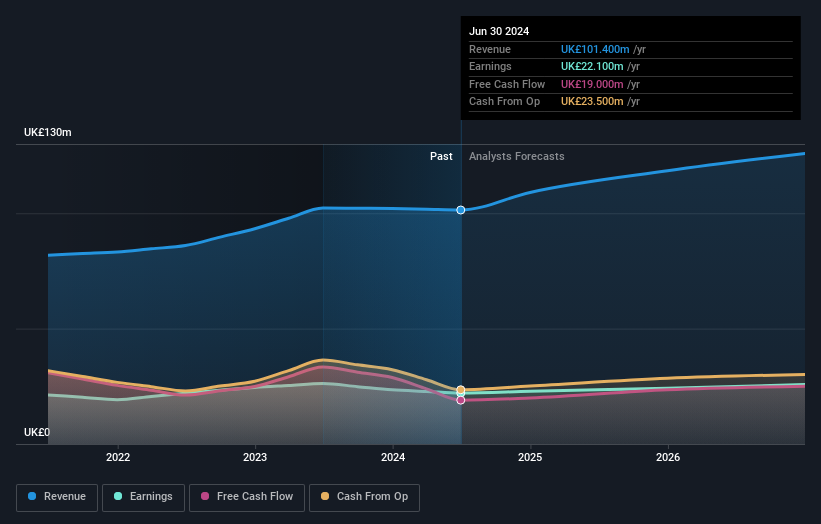

Operations: Alfa Financial Software Holdings PLC generates revenue primarily from the sale of software and related services, amounting to £101.40 million.

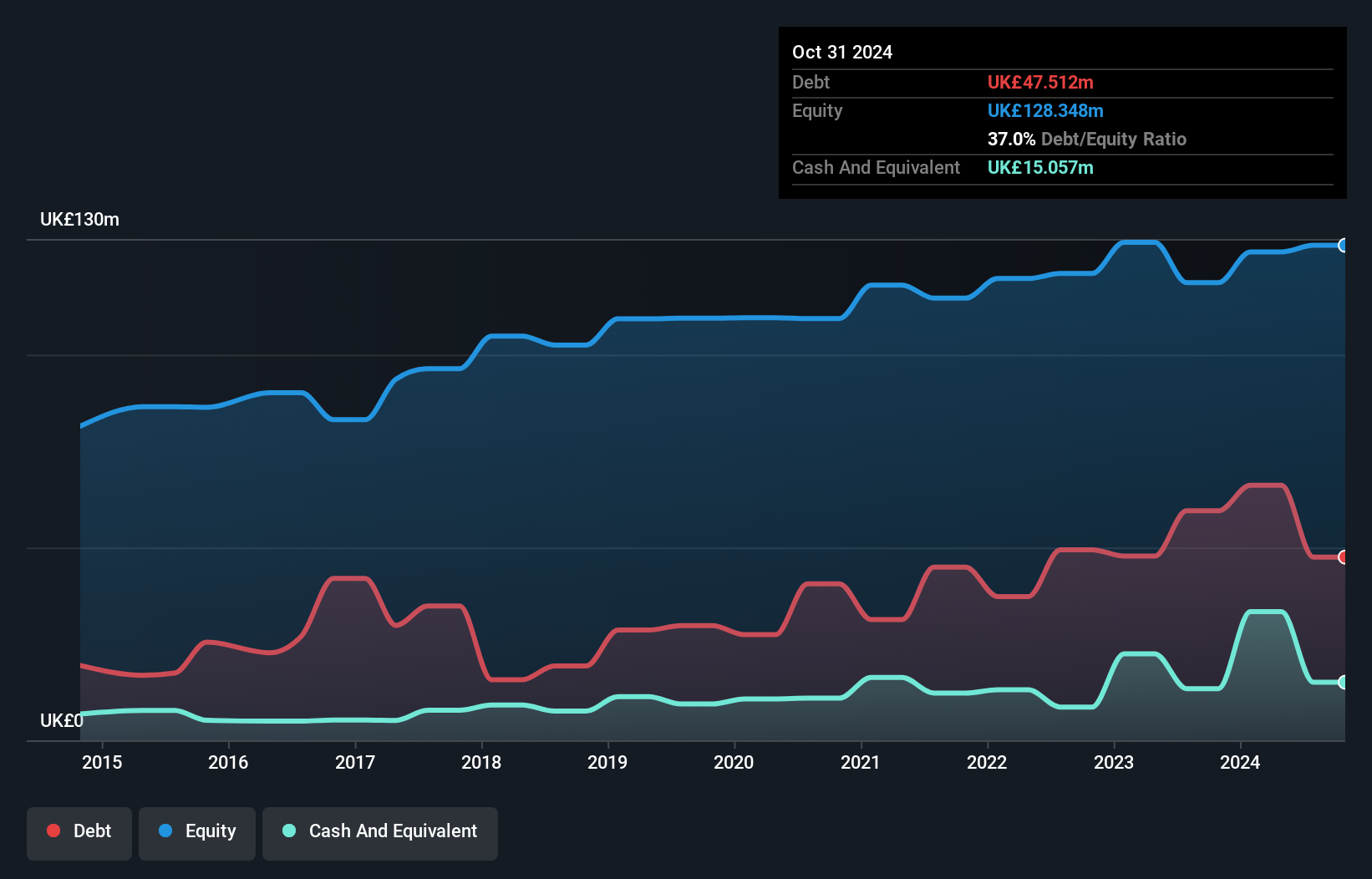

Alfa Financial Software Holdings, a debt-free entity with high-quality earnings, trades at a P/E ratio of 29.5x, below the industry average of 36.8x. Despite negative earnings growth of -15.6% over the past year, it is forecasted to grow at 6.1% annually. For H1 2024, Alfa reported sales of £52.3 million and net income of £11.9 million compared to £52.9 million and £13.3 million respectively in H1 2023; basic EPS was £0.0405 from continuing operations.

- Get an in-depth perspective on Alfa Financial Software Holdings' performance by reading our health report here.

Understand Alfa Financial Software Holdings' track record by examining our Past report.

Goodwin (LSE:GDWN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Goodwin PLC, with a market cap of £557.21 million, provides mechanical and refractory engineering solutions primarily in the United Kingdom, Europe, the United States, the Pacific Basin, and internationally.

Operations: Goodwin PLC generates revenue through two primary segments: Mechanical Engineering (£156.94 million) and Refractory Engineering (£75.86 million).

Goodwin, a niche player in the UK, has shown solid performance with earnings growth of 6.3% over the past year, outpacing the Machinery industry's -4.7%. The company's EBIT covers interest payments 9.8 times over, indicating robust financial health. Despite a volatile share price recently, Goodwin's debt to equity ratio has increased from 26.2% to 52.2% over five years but remains satisfactory at a net debt to equity ratio of 25.9%.

- Click here to discover the nuances of Goodwin with our detailed analytical health report.

Explore historical data to track Goodwin's performance over time in our Past section.

Taking Advantage

- Gain an insight into the universe of 82 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ALFA

Alfa Financial Software Holdings

Through its subsidiaries, provides software and consultancy services to the auto and equipment finance industry in the United Kingdom, the United States, rest of Europe, the Middle East, Africa, and internationally.

Flawless balance sheet and fair value.