- United Kingdom

- /

- Metals and Mining

- /

- AIM:GFM

Emerging Undiscovered Gems in the United Kingdom for September 2024

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience turbulence due to weak trade data from China, investors are increasingly looking for resilient opportunities within the United Kingdom's small-cap sector. Amid this backdrop, identifying promising yet overlooked stocks becomes crucial for those seeking to navigate these uncertain times effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| FW Thorpe | 3.34% | 11.37% | 9.41% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Griffin Mining (AIM:GFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration and development of mineral properties, with a market cap of £271.30 million.

Operations: Griffin Mining generates its revenue primarily from the Caijiaying Zinc Gold Mine, which contributed $146.02 million. The company's market cap stands at £271.30 million.

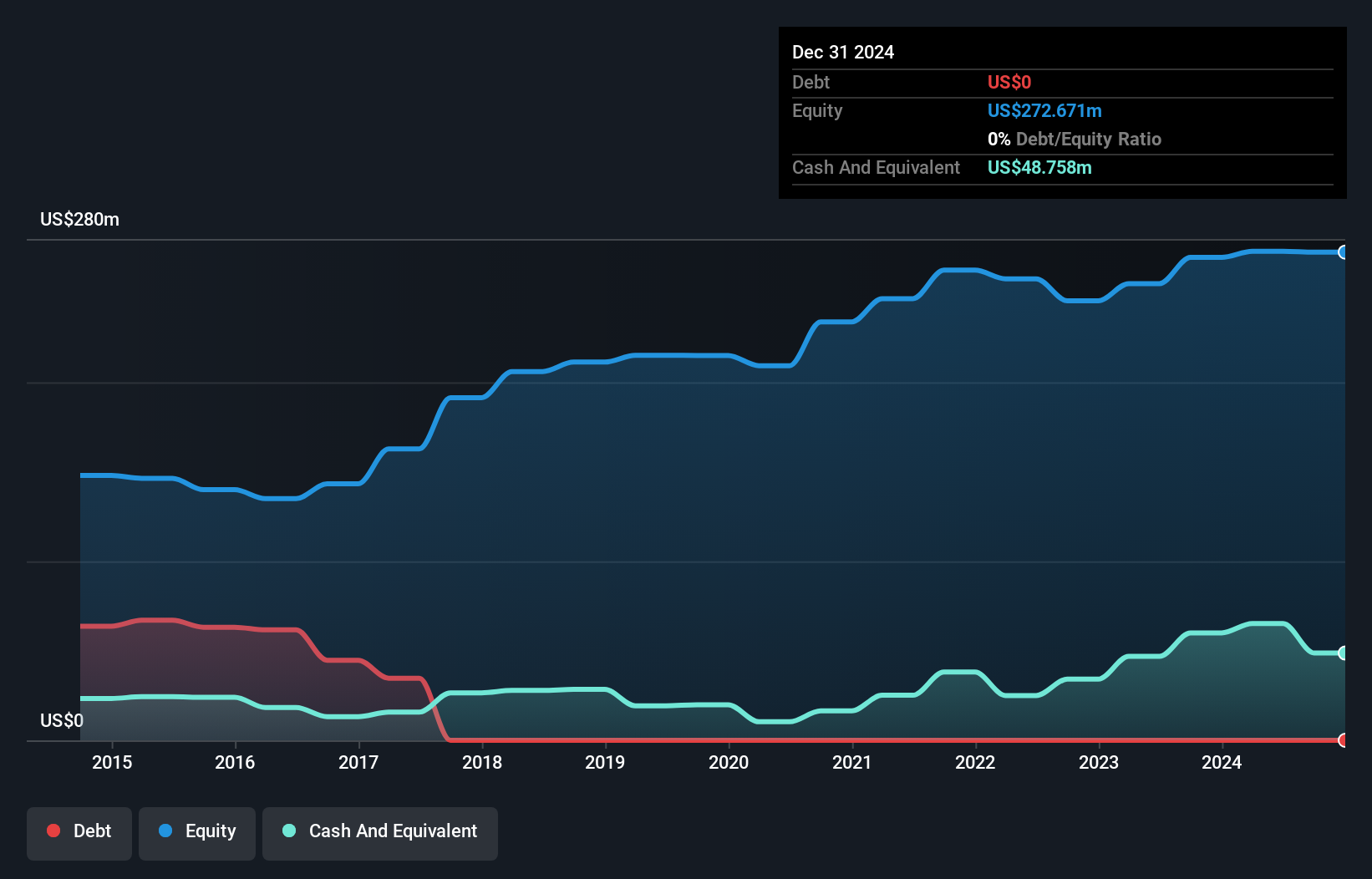

Griffin Mining, a small-cap company in the UK, has shown impressive earnings growth of 97.8% over the past year, significantly outpacing the Metals and Mining industry’s 7.6%. The company reported ore mined at 429,448 tonnes for Q2 2024 compared to 366,762 tonnes a year ago. Zinc production hit 14,779 tonnes while gold reached 6,037 ounces. Trading at nearly two-thirds below its estimated fair value and being debt-free adds to its appeal as an investment prospect.

- Delve into the full analysis health report here for a deeper understanding of Griffin Mining.

Gain insights into Griffin Mining's past trends and performance with our Past report.

Alfa Financial Software Holdings (LSE:ALFA)

Simply Wall St Value Rating: ★★★★★★

Overview: Alfa Financial Software Holdings PLC, with a market cap of £630.24 million, provides software and consultancy services to the auto and equipment finance industry across the UK, US, Europe, Middle East, Africa, and internationally.

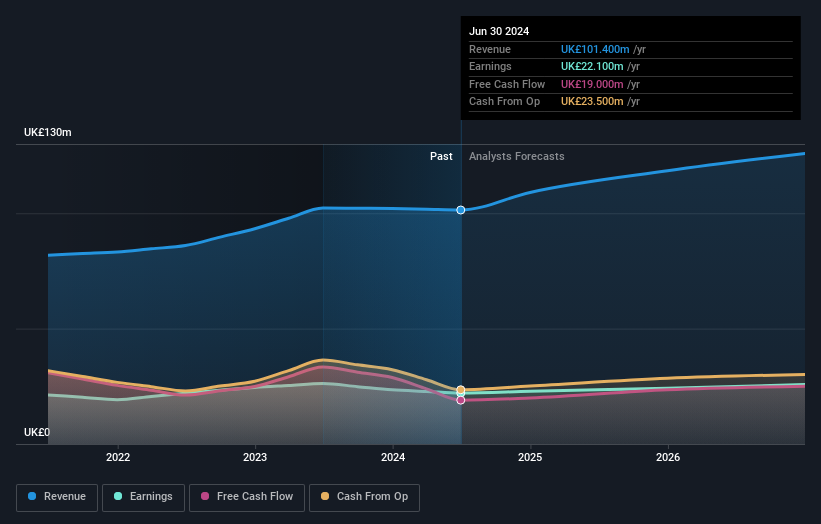

Operations: Alfa Financial Software Holdings PLC generated £102 million in revenue from the sale of software and related services. The company has a market cap of £630.24 million.

Alfa Financial Software Holdings has demonstrated resilience despite recent challenges. For the half year ended June 30, 2024, sales were GBP 52.3 million, slightly down from GBP 52.9 million a year ago, and net income was GBP 11.9 million compared to GBP 13.3 million previously. The company is debt-free and boasts high-quality earnings with a price-to-earnings ratio of 26.8x, lower than the software industry average of 37.7x. However, it faced negative earnings growth (-4.1%) last year against an industry average growth of 16%.

Costain Group (LSE:COST)

Simply Wall St Value Rating: ★★★★★★

Overview: Costain Group PLC offers smart infrastructure solutions across the transportation, energy, water, and defense sectors in the UK and has a market cap of £295.93 million.

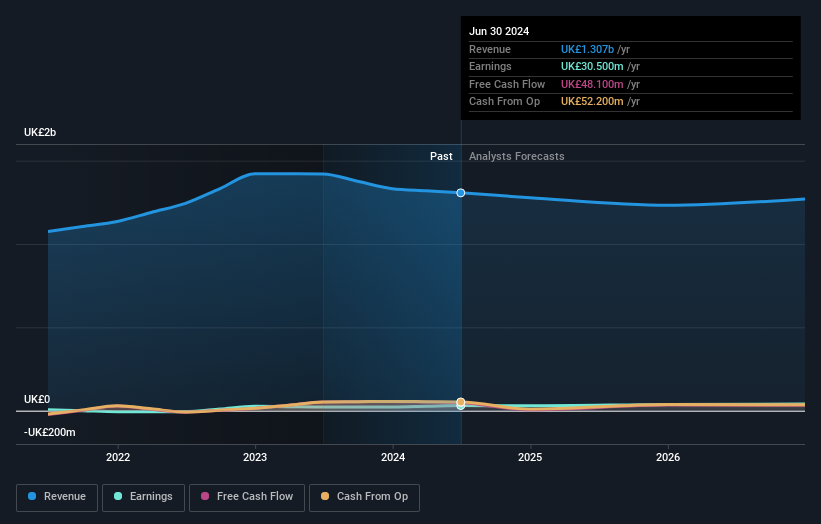

Operations: Costain Group PLC generates revenue primarily from the transportation and natural resources sectors, with £900.30 million and £406.60 million respectively.

Costain Group, a construction and engineering company, has seen its earnings grow 39.3% over the past year, outpacing the industry average of 10.3%. The firm is trading at nearly half of its estimated fair value and has no debt compared to five years ago when its debt-to-equity ratio was 50.3%. Recently, Costain announced a £10 million share repurchase program and declared an interim dividend of £0.004 per share for H1 2024.

Turning Ideas Into Actions

- Investigate our full lineup of 82 UK Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GFM

Griffin Mining

A mining and investment company, engages in the mining, exploration, and development of mineral properties.

Flawless balance sheet with solid track record.