- United Kingdom

- /

- Trade Distributors

- /

- LSE:AVAP

Would Shareholders Who Purchased Avation's (LON:AVAP) Stock Year Be Happy With The Share price Today?

This week we saw the Avation PLC (LON:AVAP) share price climb by 12%. But that doesn't change the fact that the returns over the last year have been disappointing. Like a receding glacier in a warming world, the share price has melted 60% in that period. It's not that amazing to see a bounce after a drop like that. You could argue that the sell-off was too severe.

Check out our latest analysis for Avation

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

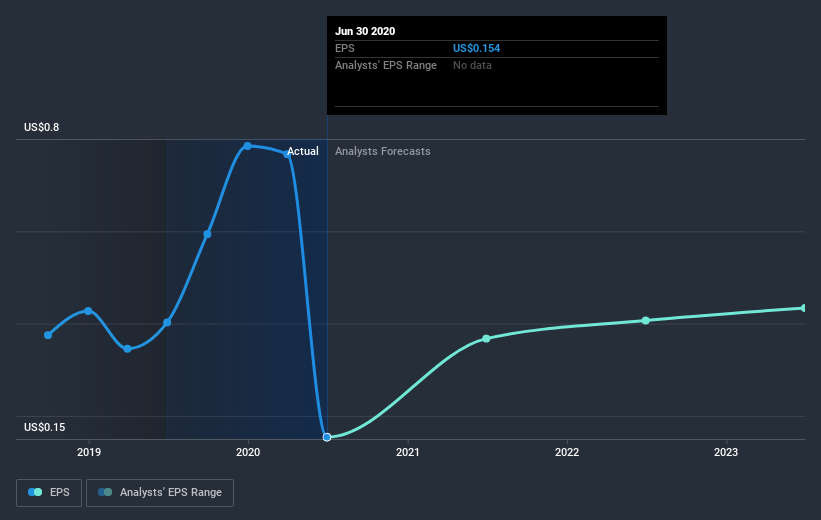

Unfortunately Avation reported an EPS drop of 62% for the last year. This change in EPS is remarkably close to the 60% decrease in the share price. Therefore one could posit that the market has not become more concerned about the company, despite the lower EPS. Instead, the change in the share price seems to reduction in earnings per share, alone.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Avation's key metrics by checking this interactive graph of Avation's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Avation shareholders are down 60% for the year. Unfortunately, that's worse than the broader market decline of 3.1%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.9% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Avation (1 is potentially serious!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade Avation, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:AVAP

Avation

Avation PLC, together with its subsidiaries, leases commercial passenger aircraft to airlines in Europe and the Asia-Pacific.

Fair value with imperfect balance sheet.

Market Insights

Community Narratives