FW Thorpe Plc (LON:TFW) has announced that it will be increasing its periodic dividend on the 24th of November to £0.0484, which will be 5.0% higher than last year's comparable payment amount of £0.0461. This takes the annual payment to 1.7% of the current stock price, which unfortunately is below what the industry is paying.

See our latest analysis for FW Thorpe

FW Thorpe's Earnings Easily Cover The Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. However, prior to this announcement, FW Thorpe's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

If the trend of the last few years continues, EPS will grow by 6.1% over the next 12 months. If the dividend continues on this path, the payout ratio could be 35% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

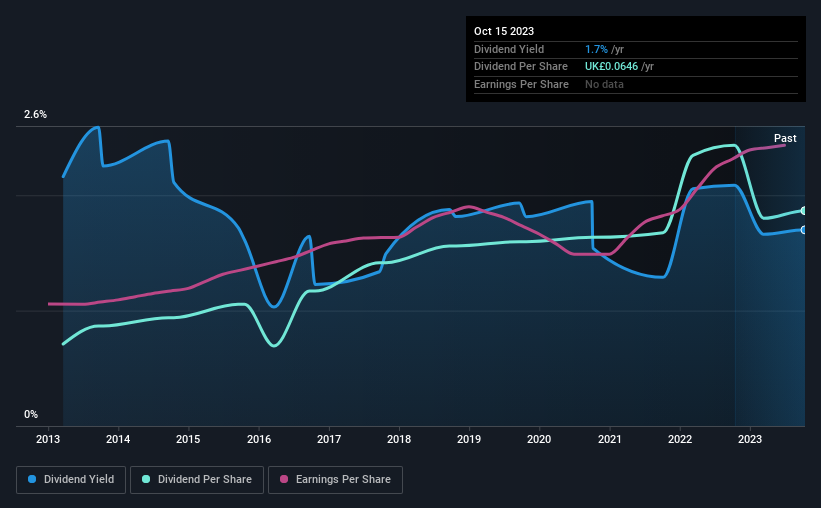

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2013, the dividend has gone from £0.0246 total annually to £0.0646. This implies that the company grew its distributions at a yearly rate of about 10% over that duration. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Dividend Has Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. FW Thorpe has impressed us by growing EPS at 6.1% per year over the past five years. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

Our Thoughts On FW Thorpe's Dividend

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in FW Thorpe stock. Is FW Thorpe not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TFW

FW Thorpe

Designs, manufactures, and supplies professional lighting equipment in the United Kingdom, the Netherlands, Germany, rest of Europe, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026