- United Kingdom

- /

- Machinery

- /

- AIM:SOM

How Should Investors Feel About Somero Enterprises' (LON:SOM) CEO Remuneration?

This article will reflect on the compensation paid to Jack Cooney who has served as CEO of Somero Enterprises, Inc. (LON:SOM) since 1997. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Somero Enterprises

Comparing Somero Enterprises, Inc.'s CEO Compensation With the industry

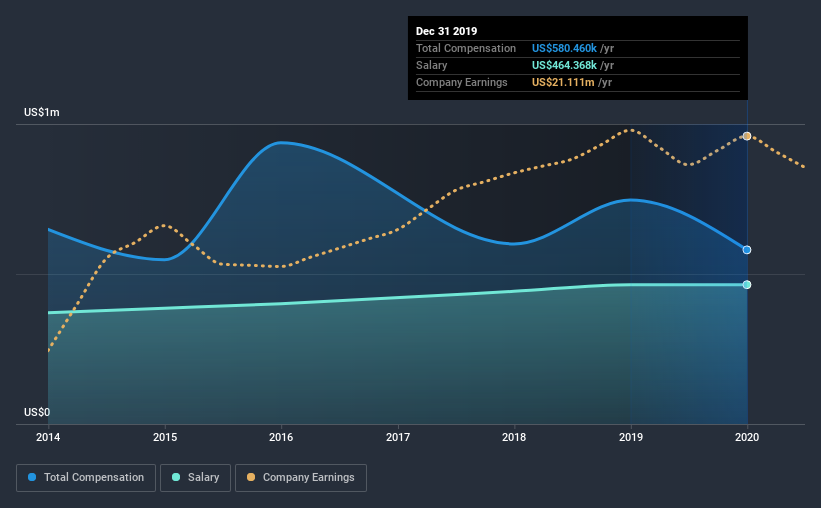

Our data indicates that Somero Enterprises, Inc. has a market capitalization of UK£161m, and total annual CEO compensation was reported as US$580k for the year to December 2019. Notably, that's a decrease of 22% over the year before. In particular, the salary of US$464.4k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from UK£75m to UK£300m, we found that the median CEO total compensation was US$507k. So it looks like Somero Enterprises compensates Jack Cooney in line with the median for the industry. Furthermore, Jack Cooney directly owns UK£1.8m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$464k | US$464k | 80% |

| Other | US$116k | US$282k | 20% |

| Total Compensation | US$580k | US$746k | 100% |

On an industry level, around 48% of total compensation represents salary and 52% is other remuneration. According to our research, Somero Enterprises has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Somero Enterprises, Inc.'s Growth

Somero Enterprises, Inc. has seen its earnings per share (EPS) increase by 3.1% a year over the past three years. Its revenue is down 2.8% over the previous year.

We would prefer it if there was revenue growth, but it is good to see a modest EPS growth at least. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Somero Enterprises, Inc. Been A Good Investment?

With a total shareholder return of 29% over three years, Somero Enterprises, Inc. shareholders would, in general, be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

As we touched on above, Somero Enterprises, Inc. is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. On the other hand, EPS and shareholder returns have been stable over the last three years, but have not grown substantially. Considering the steady performance, it's tough to call out CEO compensation as too high, but shareholders might want to see more robust growth metrics before agreeing to a future raise.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Somero Enterprises that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Somero Enterprises, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:SOM

Somero Enterprises

Designs, assembles, remanufactures, sells, and distributes concrete leveling, contouring, and placing equipment in the United States and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives