- United Kingdom

- /

- Food

- /

- AIM:MPE

Top UK Dividend Stocks To Consider In May 2025

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience downward pressure amid disappointing trade data from China, investors are closely monitoring global economic cues that could impact their portfolios. In such uncertain times, dividend stocks often attract attention due to their potential for providing a steady income stream and resilience against market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 6.48% | ★★★★★★ |

| Man Group (LSE:EMG) | 7.34% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.04% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.15% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.60% | ★★★★★☆ |

| Treatt (LSE:TET) | 3.27% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 5.08% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.14% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.94% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.58% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

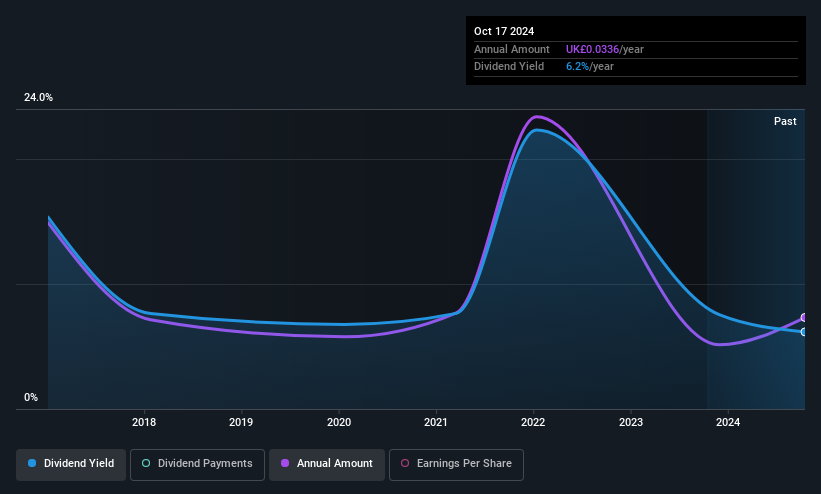

Livermore Investments Group (AIM:LIV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Livermore Investments Group Limited is a publicly owned investment manager with a market cap of £91.36 million.

Operations: Livermore Investments Group Limited generates revenue from its equity and debt instruments investment activities, amounting to $23.75 million.

Dividend Yield: 5.7%

Livermore Investments Group's Price-To-Earnings ratio of 6.2x suggests good value compared to the UK market average of 16.5x. Its dividend yield of 5.72% ranks in the top quartile among UK dividend payers, supported by a low payout ratio of 25.3%. However, its dividends have been volatile and unreliable over the past decade, with insufficient data on cash flow coverage and outdated financial reports impacting sustainability assessments.

- Click to explore a detailed breakdown of our findings in Livermore Investments Group's dividend report.

- Our valuation report here indicates Livermore Investments Group may be overvalued.

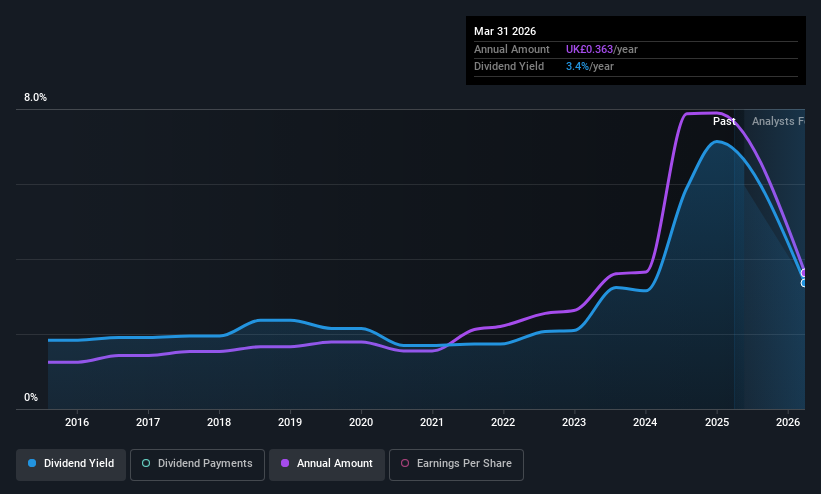

James Latham (AIM:LTHM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: James Latham plc, with a market cap of £220.60 million, imports and distributes timbers, panels, and decorative surfaces across the United Kingdom, the Republic of Ireland, Europe, and internationally.

Operations: James Latham plc generates its revenue primarily through its Timber Importing and Distribution segment, which accounts for £362.22 million.

Dividend Yield: 7.1%

James Latham's dividend yield of 7.14% ranks in the top quartile among UK dividend payers, supported by a stable and growing dividend history over the past decade. However, its high cash payout ratio of 107% indicates dividends are not well covered by free cash flows, raising sustainability concerns despite a low earnings payout ratio of 33.4%. Recent guidance confirms stable revenue expectations amidst competitive market conditions for timber and panel products.

- Dive into the specifics of James Latham here with our thorough dividend report.

- According our valuation report, there's an indication that James Latham's share price might be on the cheaper side.

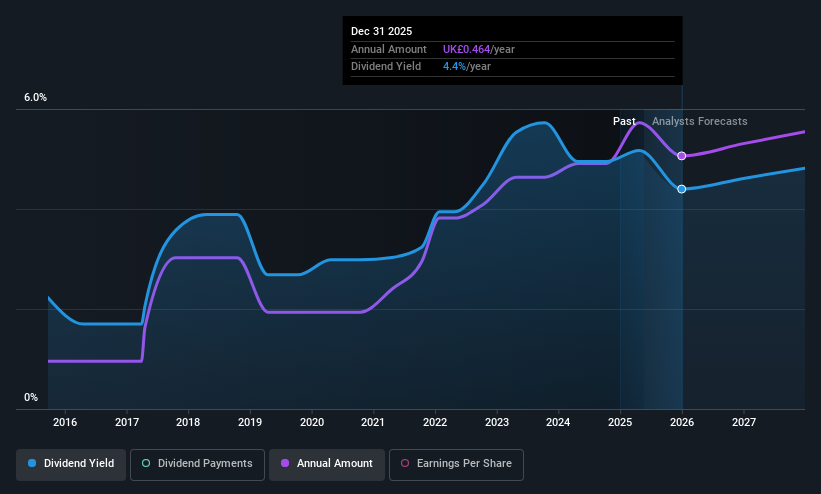

M.P. Evans Group (AIM:MPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M.P. Evans Group PLC, with a market cap of £539.06 million, owns and develops oil palm plantations in Indonesia and Malaysia through its subsidiaries.

Operations: M.P. Evans Group PLC generates revenue of $352.84 million from its plantation operations in Indonesia.

Dividend Yield: 4.8%

M.P. Evans Group's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 39.6% and 30.3%, respectively, supporting sustainability despite a volatile dividend history over the past decade. The company recently increased its annual dividend to 52.5 pence per share for 2024, reflecting a progressive policy but still yielding below top UK payers at 4.79%. Earnings grew significantly last year, although future declines are forecasted.

- Click here to discover the nuances of M.P. Evans Group with our detailed analytical dividend report.

- Our valuation report here indicates M.P. Evans Group may be undervalued.

Seize The Opportunity

- Delve into our full catalog of 59 Top UK Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MPE

M.P. Evans Group

Through its subsidiaries, owns and develops oil palm plantations in Indonesia and Malaysia.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives