- United Kingdom

- /

- Insurance

- /

- AIM:PGH

James Halstead And 2 Additional UK Penny Stocks For Consideration

Reviewed by Simply Wall St

The United Kingdom's market has been experiencing some turbulence, with the FTSE 100 index faltering due to weak trade data from China, highlighting the interconnectedness of global economies. For investors interested in exploring beyond well-known companies, penny stocks can present intriguing opportunities. Despite being somewhat outdated as a term, these smaller or newer companies can offer surprising value when backed by strong financials and may provide a combination of growth and stability that larger firms sometimes miss.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.63 | £519.47M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.96 | £319.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.385 | £41.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Vertu Motors (AIM:VTU) | £0.623 | £196.23M | ✅ 3 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.855 | £316.16M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.01 | £309.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.22 | £193.87M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.40 | £74.15M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £2.185 | £825.19M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 300 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

James Halstead (AIM:JHD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: James Halstead plc is a manufacturer and supplier of flooring products for both commercial and domestic uses across the UK, Europe, Scandinavia, Australasia, Asia, and other international markets with a market cap of £650.19 million.

Operations: The company generates £268.52 million in revenue from the manufacture and distribution of flooring products.

Market Cap: £650.19M

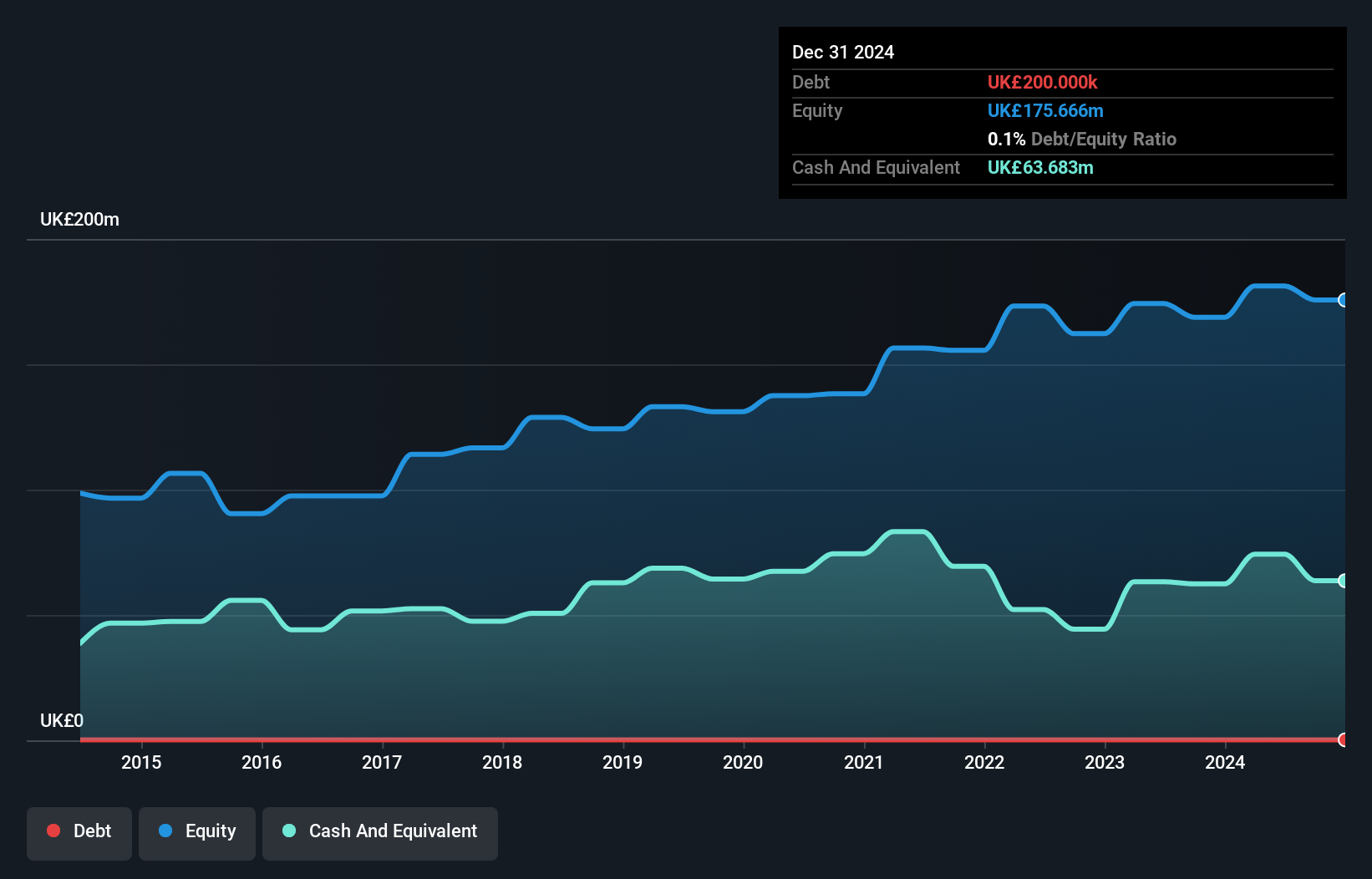

James Halstead plc, with a market cap of £650.19 million and revenue of £268.52 million, exhibits high-quality earnings and a strong Return on Equity at 24.1%. Despite negative earnings growth over the past year, its five-year profit growth averages 4% annually. The company maintains financial stability with short-term assets exceeding liabilities and more cash than total debt, while operating cash flow significantly covers its debt obligations. However, the dividend yield of 5.45% is not well covered by free cash flows, indicating potential sustainability concerns despite stable weekly volatility and no significant shareholder dilution recently.

- Click to explore a detailed breakdown of our findings in James Halstead's financial health report.

- Gain insights into James Halstead's future direction by reviewing our growth report.

Personal Group Holdings (AIM:PGH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Personal Group Holdings Plc provides employee services and salary sacrifice technology products in the United Kingdom with a market cap of £103.27 million.

Operations: The company generates revenue primarily through its Affordable Insurance segment, which accounts for £32.17 million, and its Benefits Platform segment, contributing £13.02 million.

Market Cap: £103.27M

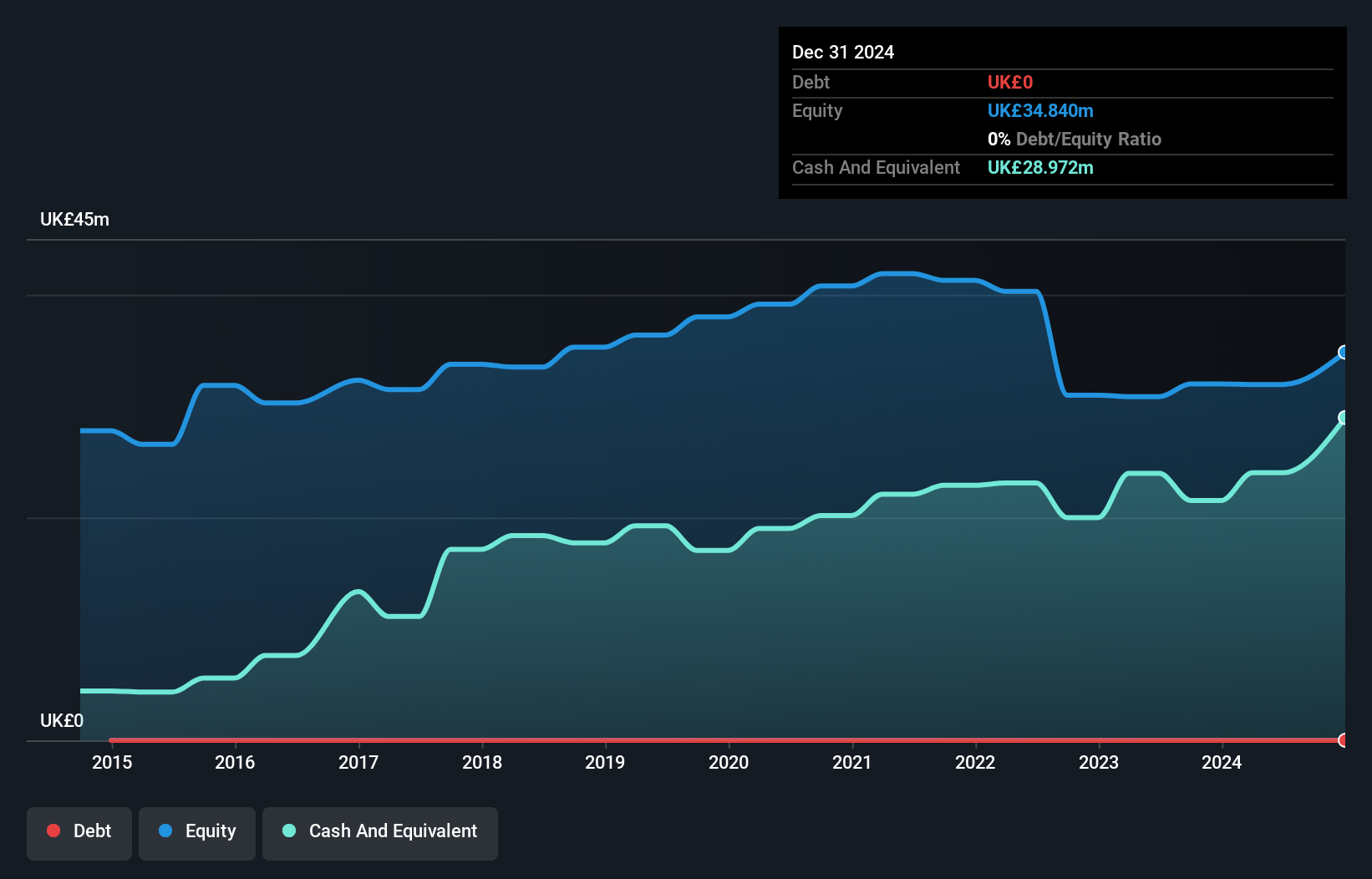

Personal Group Holdings Plc, with a market cap of £103.27 million, shows promising financial health despite some challenges. The company has experienced significant earnings growth of 32.3% over the past year, surpassing industry averages and improving its net profit margins to 12.6%. It operates debt-free, with short-term assets (£39.3M) comfortably covering both short-term (£14.9M) and long-term liabilities (£1.5M). However, the dividend yield of 6.04% is not well covered by earnings, posing sustainability concerns. While the board is seasoned with an average tenure of 4.5 years, the management team remains relatively new at 1.2 years on average.

- Get an in-depth perspective on Personal Group Holdings' performance by reading our balance sheet health report here.

- Examine Personal Group Holdings' earnings growth report to understand how analysts expect it to perform.

Irish Continental Group (LSE:ICGC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Irish Continental Group plc is a maritime transport company serving Ireland, the United Kingdom, and Continental Europe with a market cap of £786.44 million.

Operations: The company's revenue is derived from two main segments: Ferries, which generated €433.5 million, and Container and Terminal operations, contributing €203.5 million.

Market Cap: £786.44M

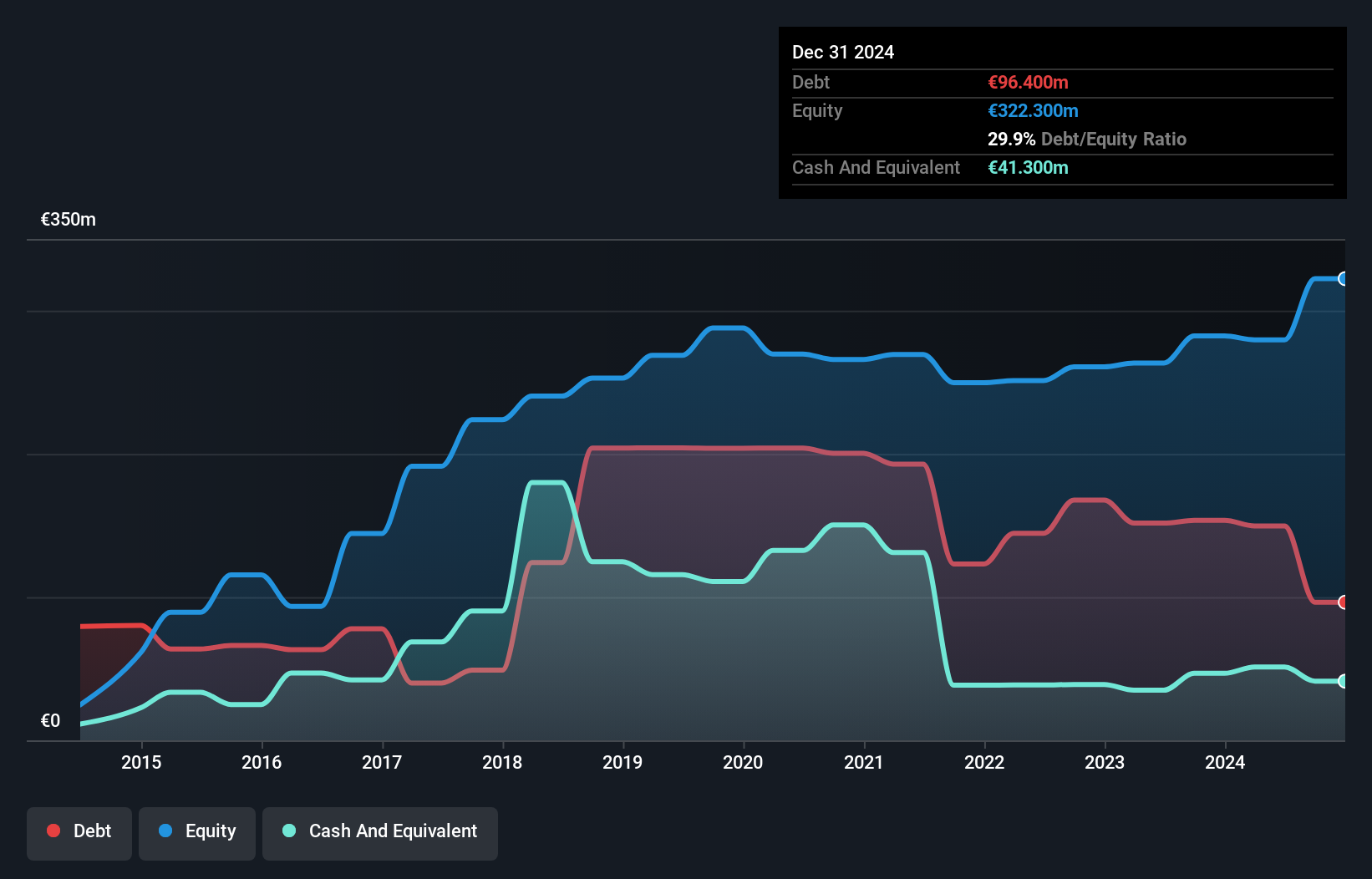

Irish Continental Group plc, with a market cap of £786.44 million, presents a mixed picture for investors. Its revenue is robust, driven by €433.5 million from Ferries and €203.5 million from Container and Terminal operations. Despite high-quality past earnings and satisfactory net debt to equity ratio (17.1%), the company faces challenges such as negative earnings growth over the past year and lower current net profit margins (9.9%) compared to last year (10.8%). While operating cash flow covers debt well at 136.7%, share price volatility remains high, impacting investor confidence in its stability as an investment option.

- Navigate through the intricacies of Irish Continental Group with our comprehensive balance sheet health report here.

- Gain insights into Irish Continental Group's outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Take a closer look at our UK Penny Stocks list of 300 companies by clicking here.

- Want To Explore Some Alternatives? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PGH

Personal Group Holdings

Engages in the provision of employee services and salary sacrifice technology products in the United Kingdom.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives