- United Kingdom

- /

- Capital Markets

- /

- LSE:FSG

3 UK Stocks Estimated To Be Up To 40.4% Below Intrinsic Value

Reviewed by Simply Wall St

The UK stock market has recently experienced some turbulence, with the FTSE 100 index closing lower amid concerns over weak trade data from China and its impact on global demand. As investors navigate these challenging conditions, identifying stocks that are trading below their intrinsic value can offer potential opportunities for long-term growth.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gooch & Housego (AIM:GHH) | £3.73 | £7.16 | 47.9% |

| NIOX Group (AIM:NIOX) | £0.614 | £1.10 | 44.3% |

| Aptitude Software Group (LSE:APTD) | £2.90 | £5.18 | 44.1% |

| On the Beach Group (LSE:OTB) | £2.64 | £4.80 | 45% |

| Trainline (LSE:TRN) | £2.88 | £5.19 | 44.5% |

| Franchise Brands (AIM:FRAN) | £1.37 | £2.46 | 44.4% |

| Deliveroo (LSE:ROO) | £1.40 | £2.68 | 47.7% |

| Kromek Group (AIM:KMK) | £0.051 | £0.10 | 49.8% |

| Ibstock (LSE:IBST) | £1.758 | £3.26 | 46.1% |

| CVS Group (AIM:CVSG) | £10.16 | £18.64 | 45.5% |

Underneath we present a selection of stocks filtered out by our screen.

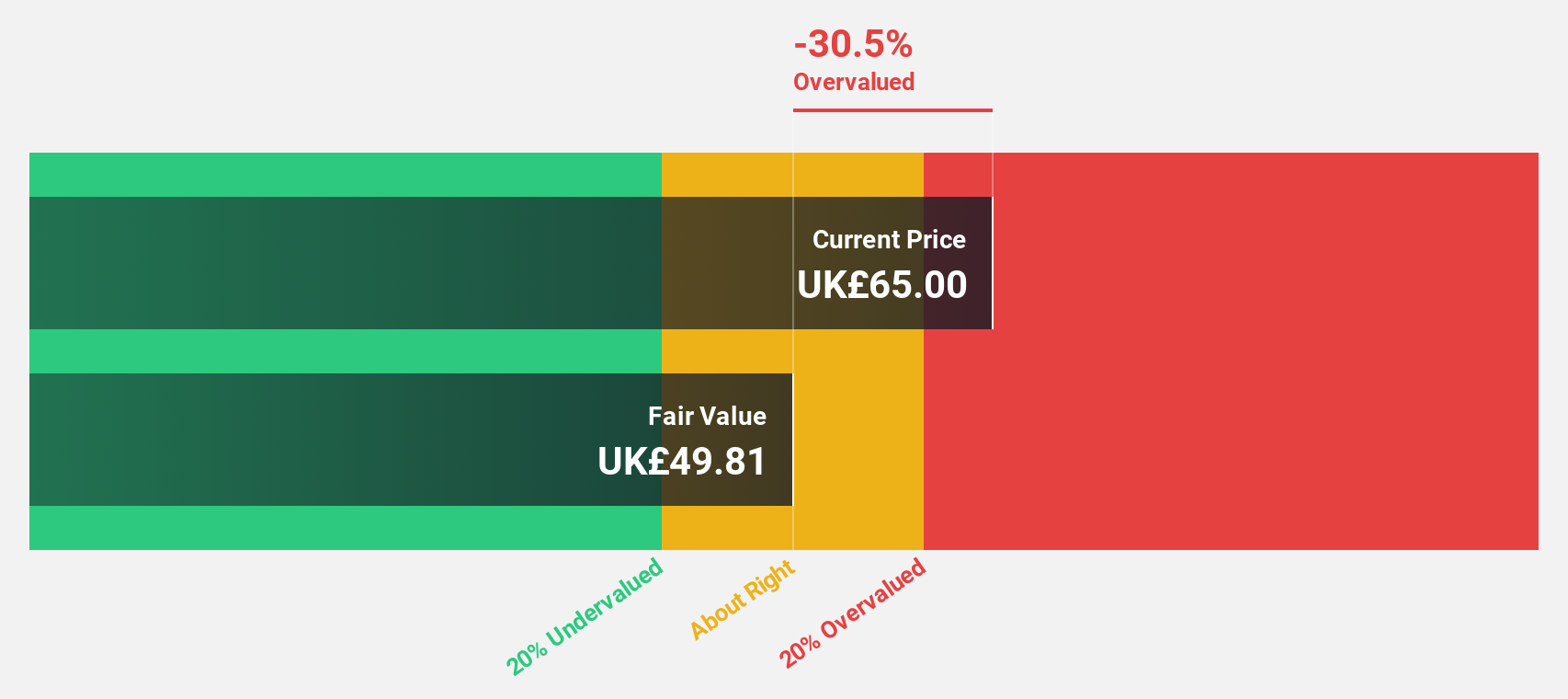

Judges Scientific (AIM:JDG)

Overview: Judges Scientific plc designs, manufactures, and sells scientific instruments and services with a market cap of £398.67 million.

Operations: The company's revenue is derived from its Vacuum segment, contributing £69 million, and Materials Sciences segment, adding £64.60 million.

Estimated Discount To Fair Value: 14.4%

Judges Scientific is trading 14.4% below its estimated fair value of £70.11, with earnings expected to grow significantly at 24.4% annually, outpacing the UK market's 13.8%. Despite a slight decline in sales to £133.6 million for 2024, net income rose to £10.4 million from £9.5 million previously, demonstrating robust cash flow management and profitability improvements, further supported by a proposed dividend increase of 10%, pending shareholder approval in May 2025.

- Our expertly prepared growth report on Judges Scientific implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Judges Scientific here with our thorough financial health report.

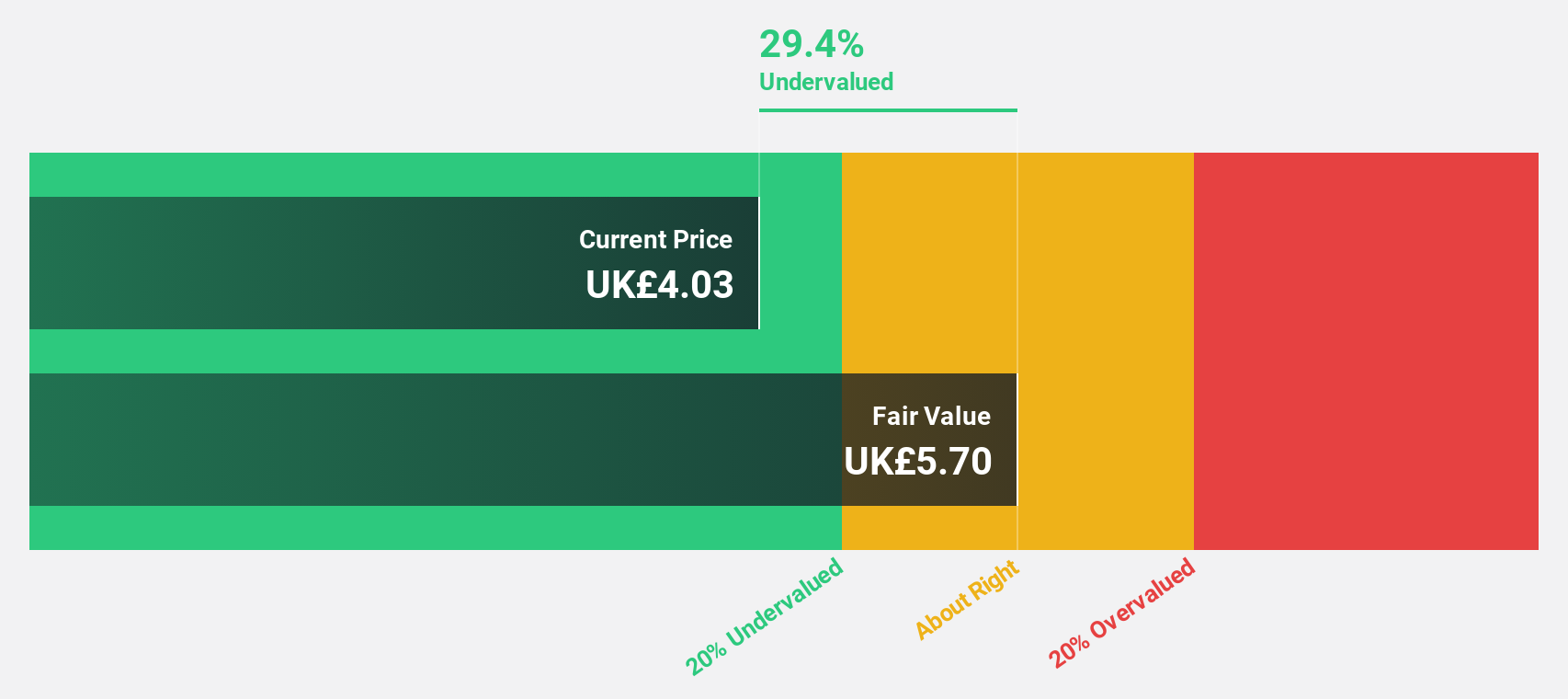

Foresight Group Holdings (LSE:FSG)

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £417.56 million.

Operations: The company's revenue is derived from three main segments: Infrastructure (£87.79 million), Private Equity (£50.78 million), and Foresight Capital Management (£8.10 million).

Estimated Discount To Fair Value: 40.4%

Foresight Group Holdings is trading at £3.7, significantly below its estimated fair value of £6.2, suggesting it is undervalued based on cash flows. The company has announced a £50 million share repurchase program, enhancing shareholder value through strategic use of cash resources. With earnings forecast to grow 26.32% annually and a very high return on equity projected in three years, Foresight's financial outlook appears robust despite slower revenue growth compared to earnings expansion.

- Our comprehensive growth report raises the possibility that Foresight Group Holdings is poised for substantial financial growth.

- Navigate through the intricacies of Foresight Group Holdings with our comprehensive financial health report here.

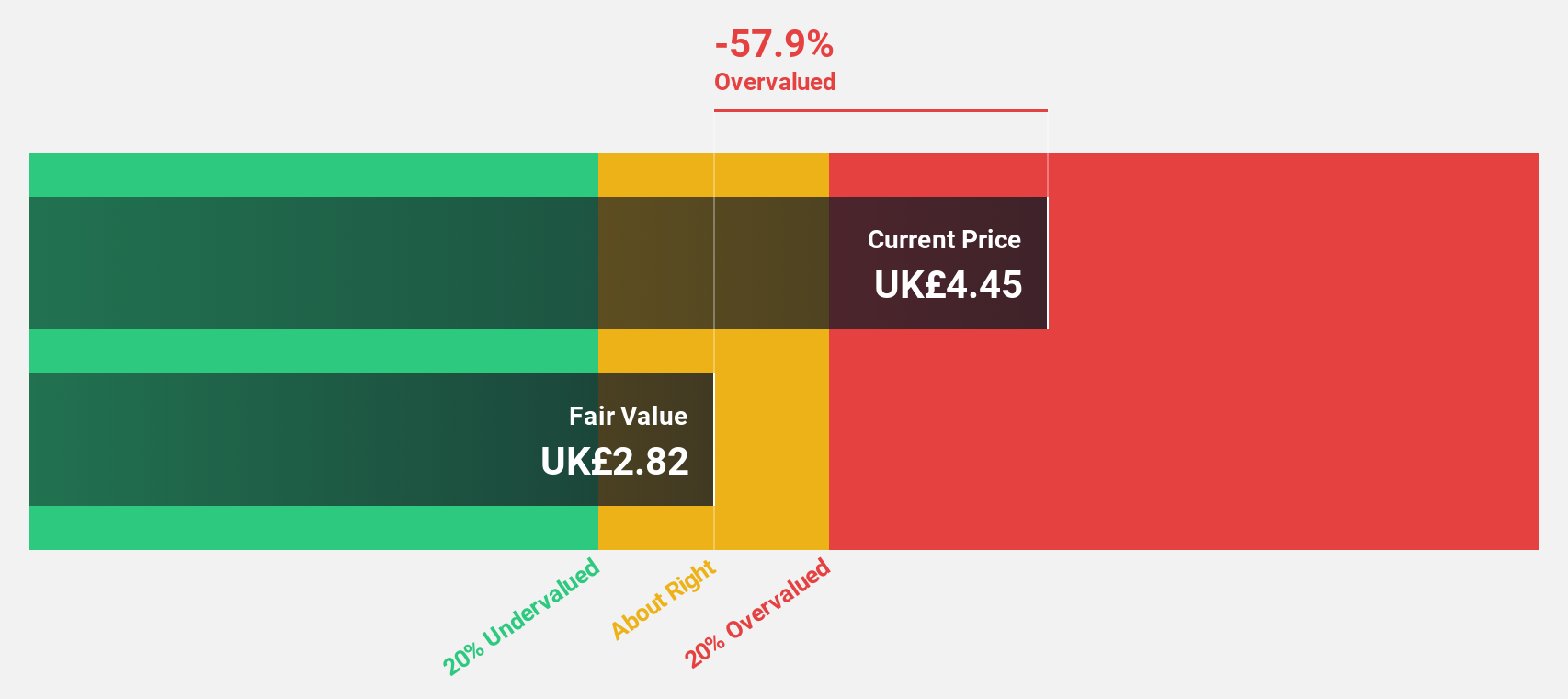

Pinewood Technologies Group (LSE:PINE)

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider serving the automotive industry across multiple regions, including the UK, Europe, Africa, Asia, the Middle East, and North America, with a market cap of £313.17 million.

Operations: The company's revenue segments include software solutions for the automotive industry across the United Kingdom, Europe, Africa, Asia, the Middle East, and North America.

Estimated Discount To Fair Value: 26.1%

Pinewood Technologies Group, trading at £3.12, is undervalued with an estimated fair value of £4.21. Revenue and earnings are projected to grow significantly faster than the UK market at 24.5% and 41.5% annually, respectively. Despite recent shareholder dilution from equity offerings totaling over £42 million, a major contract with Global Auto Holdings promises substantial future earnings potential across multiple regions, enhancing its cash flow prospects despite large one-off items affecting current results.

- The growth report we've compiled suggests that Pinewood Technologies Group's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Pinewood Technologies Group stock in this financial health report.

Next Steps

- Take a closer look at our Undervalued UK Stocks Based On Cash Flows list of 49 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FSG

Foresight Group Holdings

Operates as an infrastructure and private equity manager in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives