- United Kingdom

- /

- Building

- /

- AIM:EPWN

3 Dividend Stocks In UK With Up To 5% Yield To Enhance Your Portfolio

Reviewed by Simply Wall St

Amidst the recent turbulence in the UK market, highlighted by the FTSE 100's decline due to weak trade data from China, investors are increasingly seeking stability through dividend stocks. In such uncertain times, selecting dividend stocks with attractive yields can offer a reliable income stream and potentially enhance portfolio resilience.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.23% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.30% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.40% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.03% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.95% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.71% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.89% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.35% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.80% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.90% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Epwin Group (AIM:EPWN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Epwin Group Plc manufactures and sells building products in the United Kingdom, Europe, and internationally with a market cap of £133.29 million.

Operations: Epwin Group Plc generates its revenue through two main segments: Extrusion and Moulding (£233.30 million) and Fabrication and Distribution (£130.40 million).

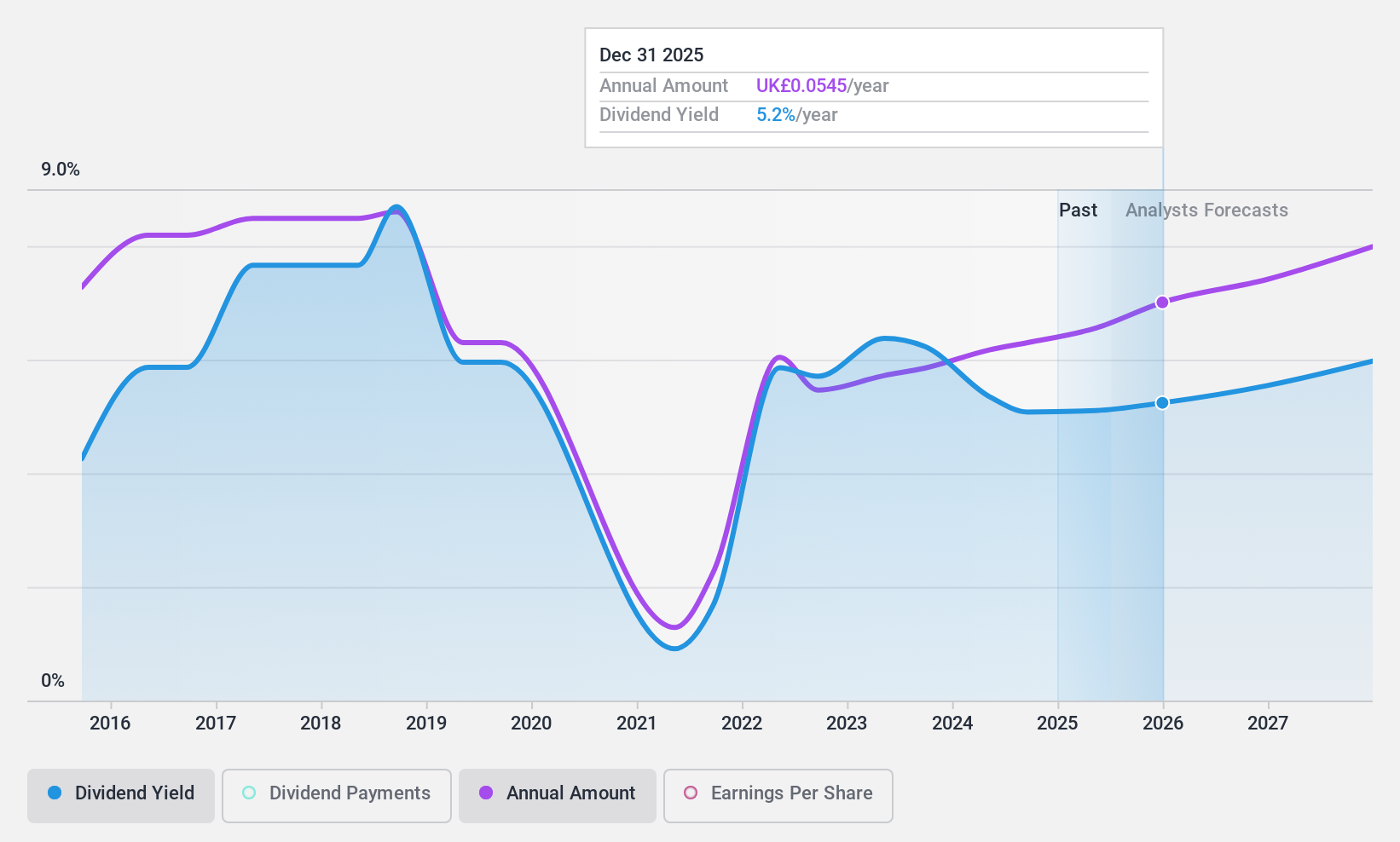

Dividend Yield: 5.1%

Epwin Group's dividend payments, while covered by earnings with a payout ratio of 77.5% and well supported by a cash payout ratio of 27.2%, have been historically volatile over the past decade, experiencing annual drops exceeding 20%. Although the dividend yield of 5.08% is lower than the top UK payers, its price-to-earnings ratio of 14.6x suggests good value relative to the market average of 15.9x. Recent earnings growth supports potential future stability in dividends.

- Navigate through the intricacies of Epwin Group with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Epwin Group is priced higher than what may be justified by its financials.

London Security (AIM:LSC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: London Security plc is an investment holding company that manufactures, sells, and rents fire protection equipment across several European countries including the UK, with a market cap of £416.84 million.

Operations: The company's revenue from the provision and maintenance of fire protection and security equipment amounts to £221.72 million.

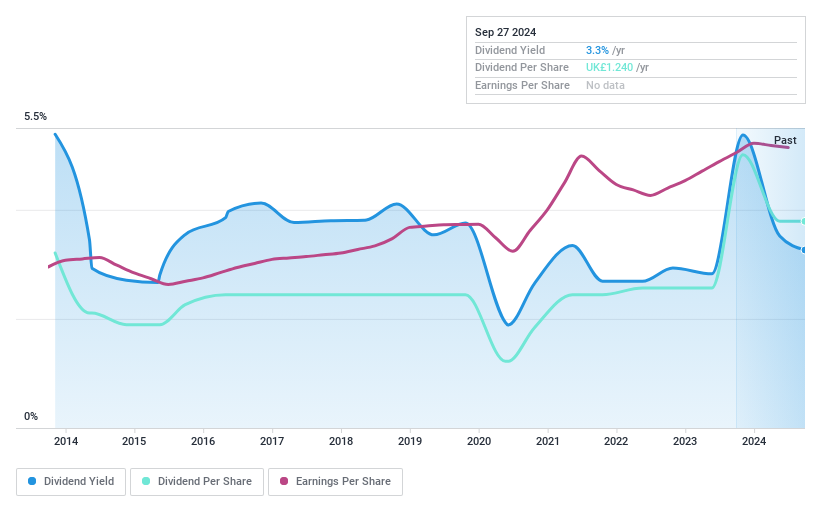

Dividend Yield: 3.6%

London Security's dividend payments, covered by earnings and cash flows with payout ratios of 65.3% and 66.2% respectively, have been historically volatile over the past decade despite a recent increase. The interim dividend was decreased to £0.80 per share, reflecting an unstable track record. Trading at 55.3% below estimated fair value, it offers potential value but yields only 3.59%, lower than top UK dividend payers' average of 5.82%.

- Click to explore a detailed breakdown of our findings in London Security's dividend report.

- The valuation report we've compiled suggests that London Security's current price could be quite moderate.

Mears Group (LSE:MER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mears Group plc, with a market cap of £330.19 million, provides outsourced services to both the public and private sectors in the United Kingdom.

Operations: Mears Group plc generates revenue through its Management segment, contributing £591.63 million, and its Maintenance segment, adding £551.73 million.

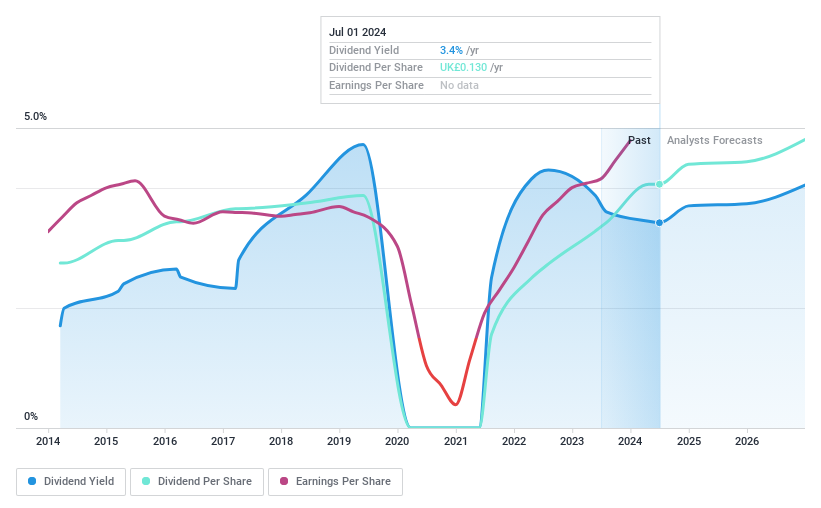

Dividend Yield: 3.9%

Mears Group's dividend yield of 3.88% is below the top UK payers, and its dividends have been volatile over the past decade despite some growth. The company's payout ratios—33.4% from earnings and 10.7% from cash flows—indicate strong coverage, suggesting sustainability despite an unstable track record. Mears trades at a favorable valuation with a P/E ratio of 7.9x against the UK's 15.9x average, while recent guidance anticipates revenues reaching £1.13 billion for 2024, exceeding expectations.

- Dive into the specifics of Mears Group here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Mears Group is trading behind its estimated value.

Turning Ideas Into Actions

- Access the full spectrum of 62 Top UK Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Epwin Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Epwin Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EPWN

Epwin Group

Manufactures and sells building products in the United Kingdom, rest of Europe, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives