- United Kingdom

- /

- Electrical

- /

- AIM:CKT

UK Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. In such a climate, investors often turn their attention to smaller companies that may offer unique opportunities for growth and value. Penny stocks, though an older term, still signify these smaller or newer entities that can provide significant potential when backed by strong financials. We've identified three penny stocks that stand out for their financial resilience and potential for growth in today's market landscape.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.87 | £295.98M | ✅ 4 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.17 | £157.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £4.68 | £378.08M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.815 | £429.87M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.205 | £405.35M | ✅ 2 ⚠️ 2 View Analysis > |

| FRP Advisory Group (AIM:FRP) | £1.24 | £306.06M | ✅ 4 ⚠️ 0 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.98 | £156.34M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.40 | £43.28M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 400 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Checkit (AIM:CKT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Checkit plc, with a market cap of £16.74 million, provides predictive operations solutions for large facilities and multi-site locations in the United Kingdom and the Americas.

Operations: The company's revenue is primarily generated from its Electronic Components & Parts segment, which accounts for £14.1 million.

Market Cap: £16.74M

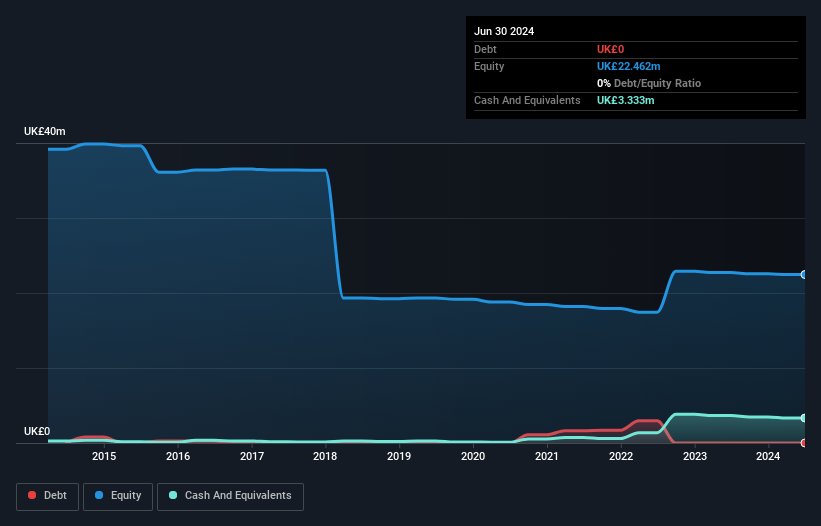

Checkit plc, with a market cap of £16.74 million, has shown revenue growth from £12 million to £14.1 million in the past year, though it remains unprofitable with a net loss of £3.6 million. The company is debt-free and possesses sufficient cash runway for over a year based on current free cash flow levels, although this may shorten if historical reduction rates continue. Despite its unprofitability, Checkit forecasts annual revenue growth of 10.14%. The management team is experienced; however, the board's average tenure suggests limited experience which could impact strategic guidance amidst high share price volatility and negative return on equity (-32.43%).

- Jump into the full analysis health report here for a deeper understanding of Checkit.

- Gain insights into Checkit's future direction by reviewing our growth report.

Tanfield Group (AIM:TAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tanfield Group PLC is an investment company with a market cap of £7.33 million, primarily focused on its 49% interest in Snorkel International Holdings LLC, which manufactures various types of aerial lifts such as scissor lifts and boom lifts.

Operations: Tanfield Group does not report specific revenue segments.

Market Cap: £7.33M

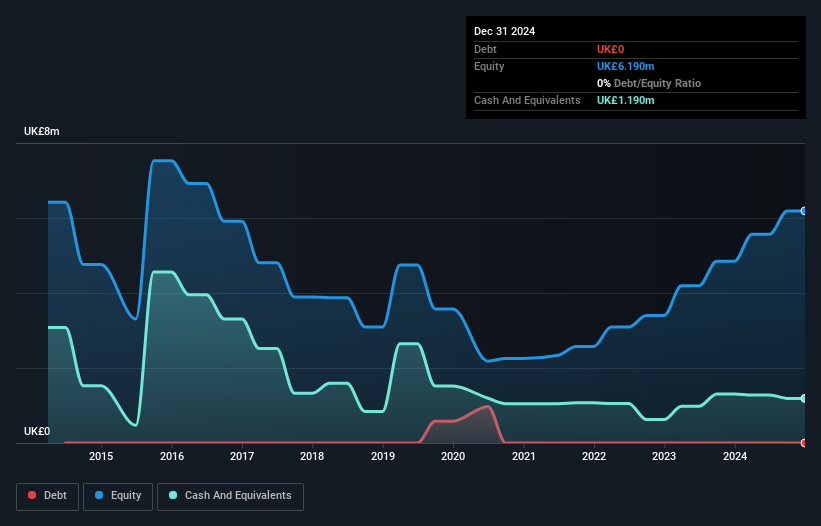

Tanfield Group PLC, with a market cap of £7.33 million, is primarily focused on its 49% stake in Snorkel International Holdings LLC. The company is pre-revenue and debt-free, with sufficient cash runway for over three years based on current free cash flow levels. Recent legal proceedings have favored Tanfield; a court ruling confirmed that its interest in Snorkel cannot be acquired for nothing, countering claims by Xtreme. Despite ongoing litigation set to continue into October 2025, the board remains optimistic about future outcomes. The company's share price has been highly volatile recently and it remains unprofitable with reduced losses reported over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Tanfield Group.

- Assess Tanfield Group's previous results with our detailed historical performance reports.

Transense Technologies (AIM:TRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Transense Technologies plc develops and supplies specialist sensor systems across various regions including the United Kingdom, North America, South America, Australia, Europe, and internationally, with a market cap of £21.69 million.

Operations: The company's revenue is derived from three segments: SAWsense (£0.75 million), Translogik (£1.15 million), and Itrack Royalties (£2.93 million).

Market Cap: £21.69M

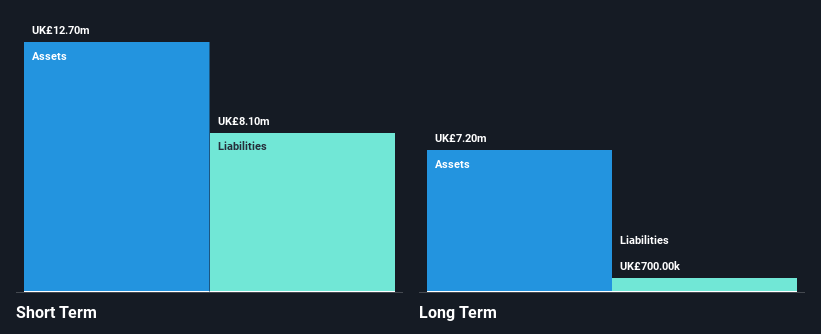

Transense Technologies plc, with a market cap of £21.69 million, has recently strengthened its position in the US defence and aerospace sectors through a new licensing agreement with ISI Interconnect Systems. This deal is expected to generate substantial revenue by creating a domestic supply chain for its SAW ASIC technology. Despite negative earnings growth last year, Transense remains debt-free and boasts high return on equity at 23.3%. Its short-term assets comfortably cover liabilities, though profit margins have decreased from 45.1% to 29.9%. The company trades significantly below estimated fair value, offering potential upside for investors seeking undervalued opportunities in penny stocks.

- Click to explore a detailed breakdown of our findings in Transense Technologies' financial health report.

- Understand Transense Technologies' earnings outlook by examining our growth report.

Next Steps

- Discover the full array of 400 UK Penny Stocks right here.

- Seeking Other Investments? Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CKT

Checkit

Operates as a provider of predictive operations for large facilities and multi-site locations in the United Kingdom and the Americas.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives