- United Kingdom

- /

- Life Sciences

- /

- AIM:DXRX

UK Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The UK market has recently faced downward pressure, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting challenges in global economic recovery. Despite these broader market concerns, investors may still find opportunities in penny stocks—an investment area that remains relevant despite its somewhat outdated name. These stocks often represent smaller or newer companies and can offer growth potential at lower price points when backed by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.56 | £520.84M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.40 | £193.89M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.935 | £14.12M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.075 | £14.79M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.52 | £31.98M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £2.69 | £96.73M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Braemar (LSE:BMS) | £2.35 | £71.6M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.884 | £711.63M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 294 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Avingtrans (AIM:AVG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Avingtrans plc, with a market cap of £160.26 million, operates through its subsidiaries to deliver engineered components, systems, and services to the energy, medical, and infrastructure sectors globally.

Operations: The company's revenue is primarily generated from its Energy Advanced Engineering Systems segment, which accounts for £151.46 million, and its Medical and Industrial Imaging segment, contributing £4.95 million.

Market Cap: £160.26M

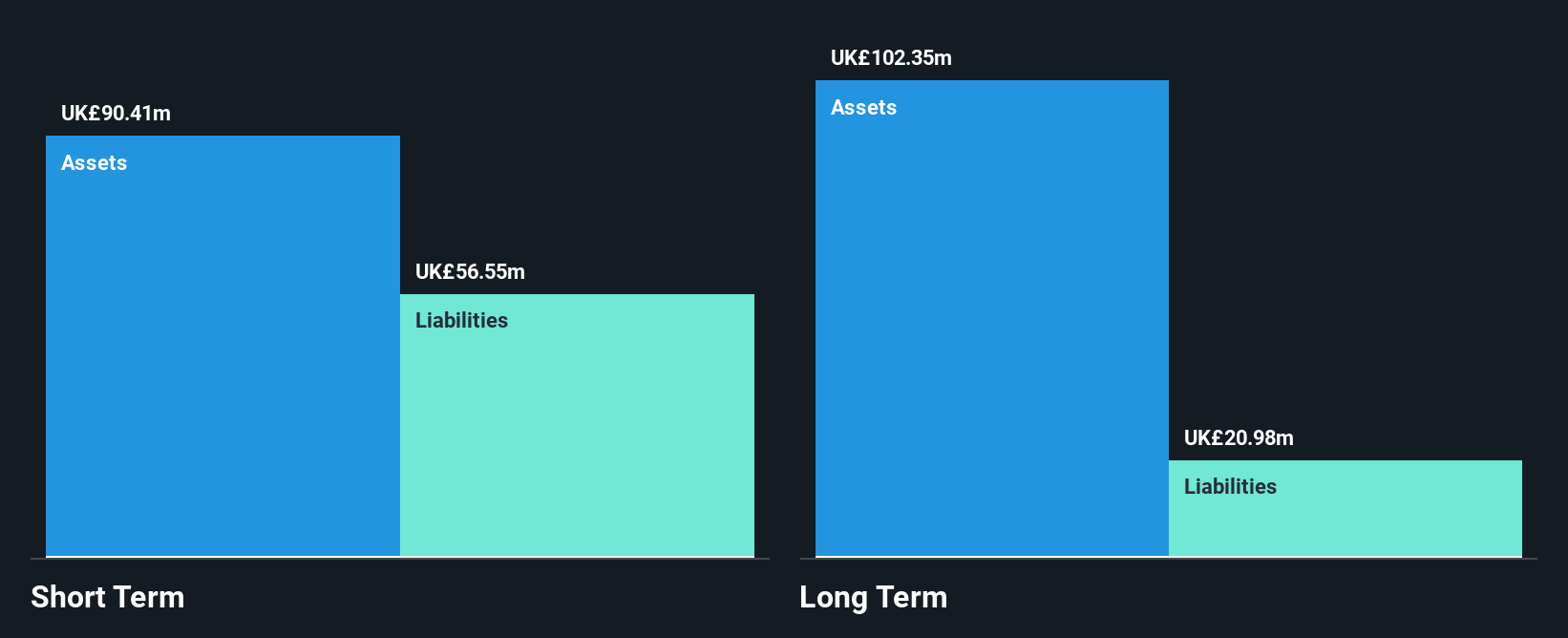

Avingtrans plc, with a market cap of £160.26 million, has demonstrated strong earnings growth of 79.1% over the past year, surpassing its five-year average and outperforming the Machinery industry. The company's financial stability is supported by a satisfactory net debt to equity ratio of 7.4%, and its short-term assets cover both short-term and long-term liabilities comfortably. Despite a low return on equity at 5.4%, Avingtrans offers high-quality earnings and well-covered interest payments by EBIT (6.9x). Recent developments include an executive appointment in its medical imaging division and an increased dividend proposal for shareholders.

- Dive into the specifics of Avingtrans here with our thorough balance sheet health report.

- Understand Avingtrans' earnings outlook by examining our growth report.

Diaceutics (AIM:DXRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Diaceutics PLC is a diagnostic commercialization company that offers data, data analytics, and implementation services to pharma and biotech companies, with a market cap of £142.18 million.

Operations: The company generates revenue of £34.40 million from its Medical Labs & Research segment.

Market Cap: £142.18M

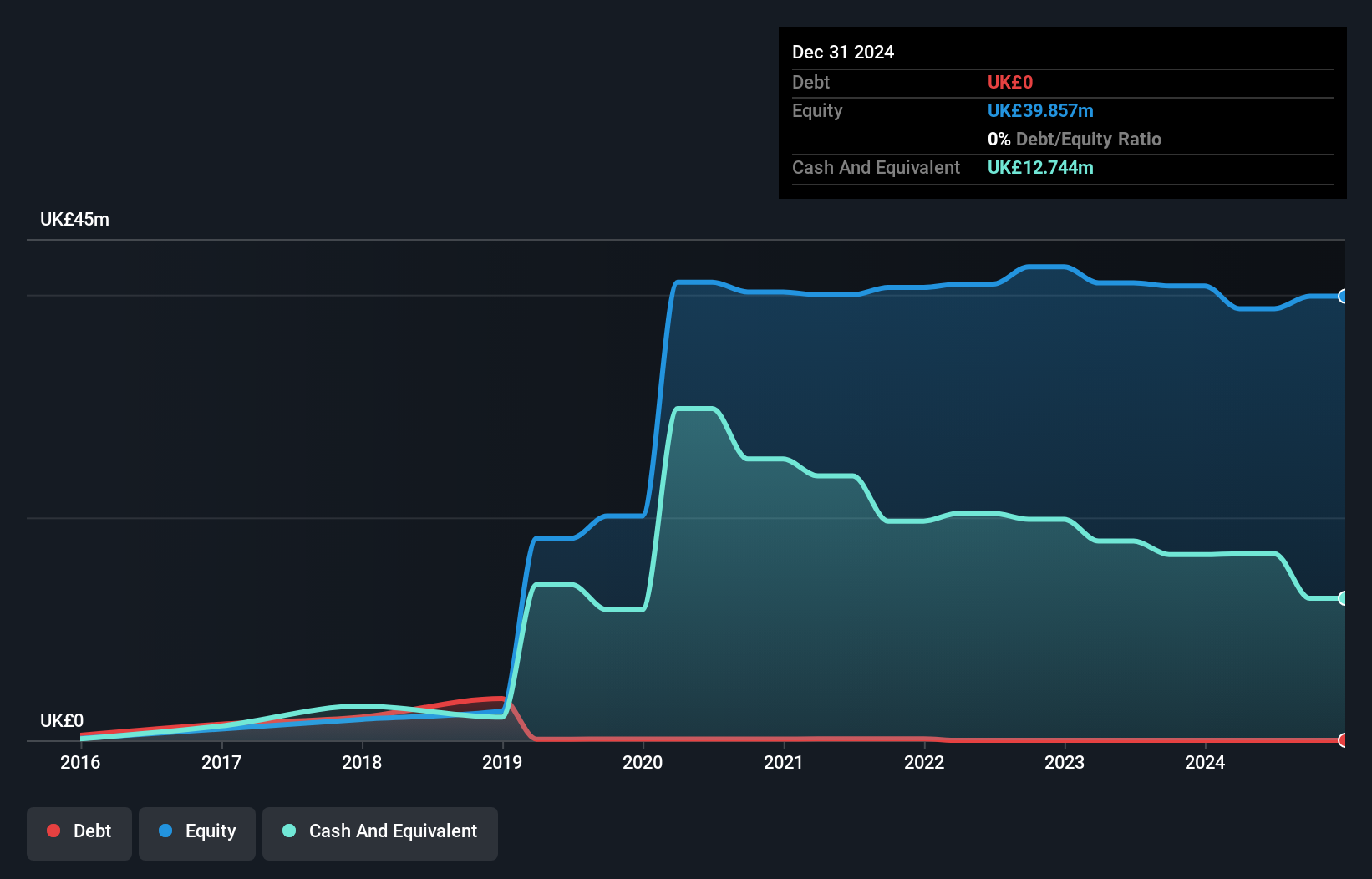

Diaceutics PLC, with a market cap of £142.18 million, is currently unprofitable but shows potential as it trades at 25.8% below estimated fair value. The company's short-term assets (£24.5M) comfortably cover both short-term (£6.2M) and long-term liabilities (£998K), and it remains debt-free, enhancing financial flexibility. Despite losses increasing by 62% annually over five years, earnings are forecast to grow significantly at 75.84% per year. Recent half-year results show revenue growth to £14.56 million from £12.32 million year-on-year, with a slight reduction in net loss from GBP 2.58 million to GBP 2.4 million.

- Take a closer look at Diaceutics' potential here in our financial health report.

- Evaluate Diaceutics' prospects by accessing our earnings growth report.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gulf Keystone Petroleum Limited focuses on the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £393.03 million.

Operations: The company generates revenue of $163.17 million from its oil and gas exploration and production activities.

Market Cap: £393.03M

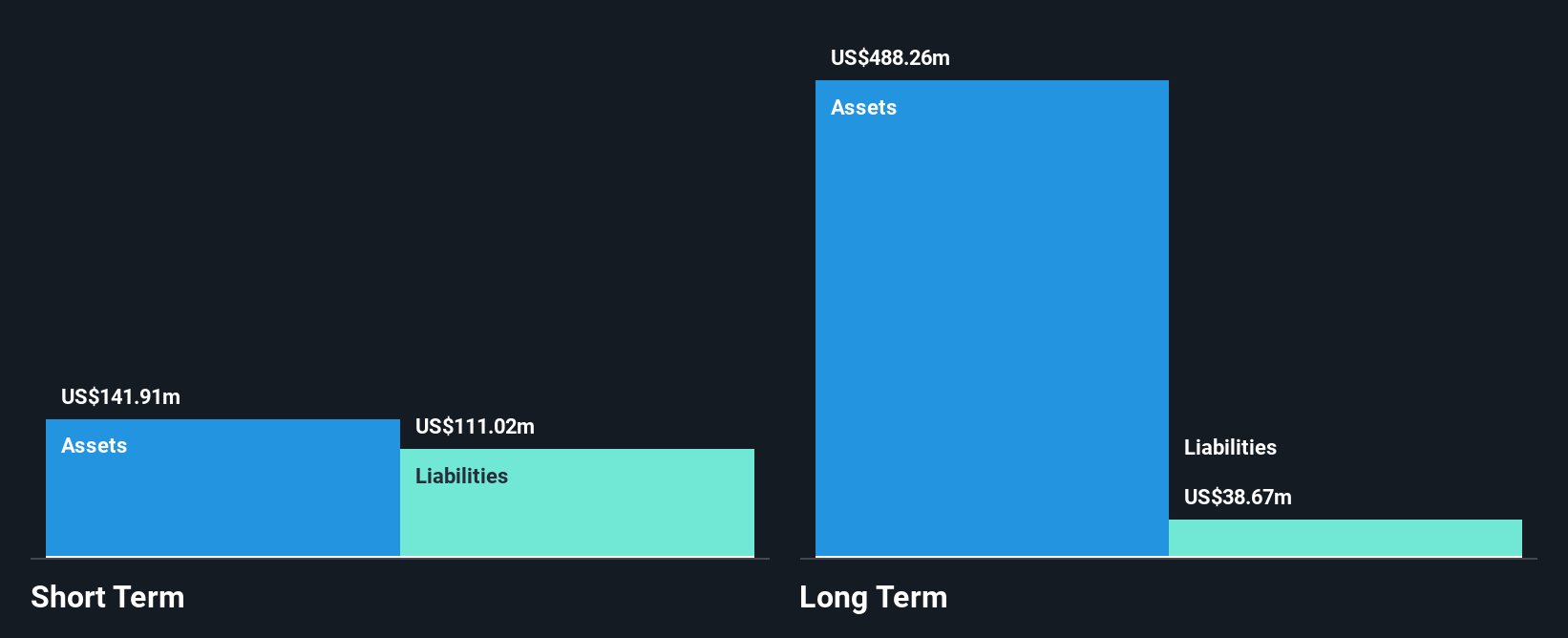

Gulf Keystone Petroleum, with a market cap of £393.03 million, operates in the Kurdistan Region and has recently signed agreements to restart crude exports, potentially improving its realised prices above $30/bbl. Despite being debt-free and having short-term assets exceeding liabilities, the company is currently unprofitable with a net loss of US$7.21 million for H1 2025 compared to a small profit last year. The management team is experienced; however, the board lacks seasoned members. While earnings are forecasted to grow significantly at 87.8% annually, recent disruptions have affected production guidance for 2025.

- Click here and access our complete financial health analysis report to understand the dynamics of Gulf Keystone Petroleum.

- Assess Gulf Keystone Petroleum's future earnings estimates with our detailed growth reports.

Where To Now?

- Unlock more gems! Our UK Penny Stocks screener has unearthed 291 more companies for you to explore.Click here to unveil our expertly curated list of 294 UK Penny Stocks.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:DXRX

Diaceutics

A diagnostic commercialization company, provides data, data analytics, and implementation services for pharma and biotech companies.

Excellent balance sheet and good value.

Market Insights

Community Narratives