- United Kingdom

- /

- Auto Components

- /

- AIM:TRT

Avingtrans Leads The Charge Among 3 UK Penny Stocks

Reviewed by Simply Wall St

The UK's FTSE 100 index has recently faced downward pressure, influenced by weak trade data from China that highlighted ongoing struggles in the global economy. Amid such market fluctuations, identifying stocks with strong fundamentals becomes crucial for investors seeking potential opportunities. Penny stocks, often representing smaller or emerging companies, can offer a blend of affordability and growth potential when backed by solid financials. In this article, we explore three UK penny stocks that stand out for their financial strength and potential value.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.875 | £545.79M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.05 | £165.61M | ✅ 3 ⚠️ 2 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.26 | £161.68M | ✅ 4 ⚠️ 3 View Analysis > |

| Ingenta (AIM:ING) | £0.775 | £11.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.545 | $316.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £184.68M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.73 | £10.05M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.40 | £73.12M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.852 | £699.54M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 301 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Avingtrans (AIM:AVG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Avingtrans plc, with a market cap of £163.33 million, operates through its subsidiaries to deliver engineered components, systems, and services across the energy, medical, and infrastructure sectors.

Operations: The company generates revenue from two primary segments: Energy Advanced Engineering Systems, contributing £151.46 million, and Medical and Industrial Imaging, which accounts for £4.95 million.

Market Cap: £163.33M

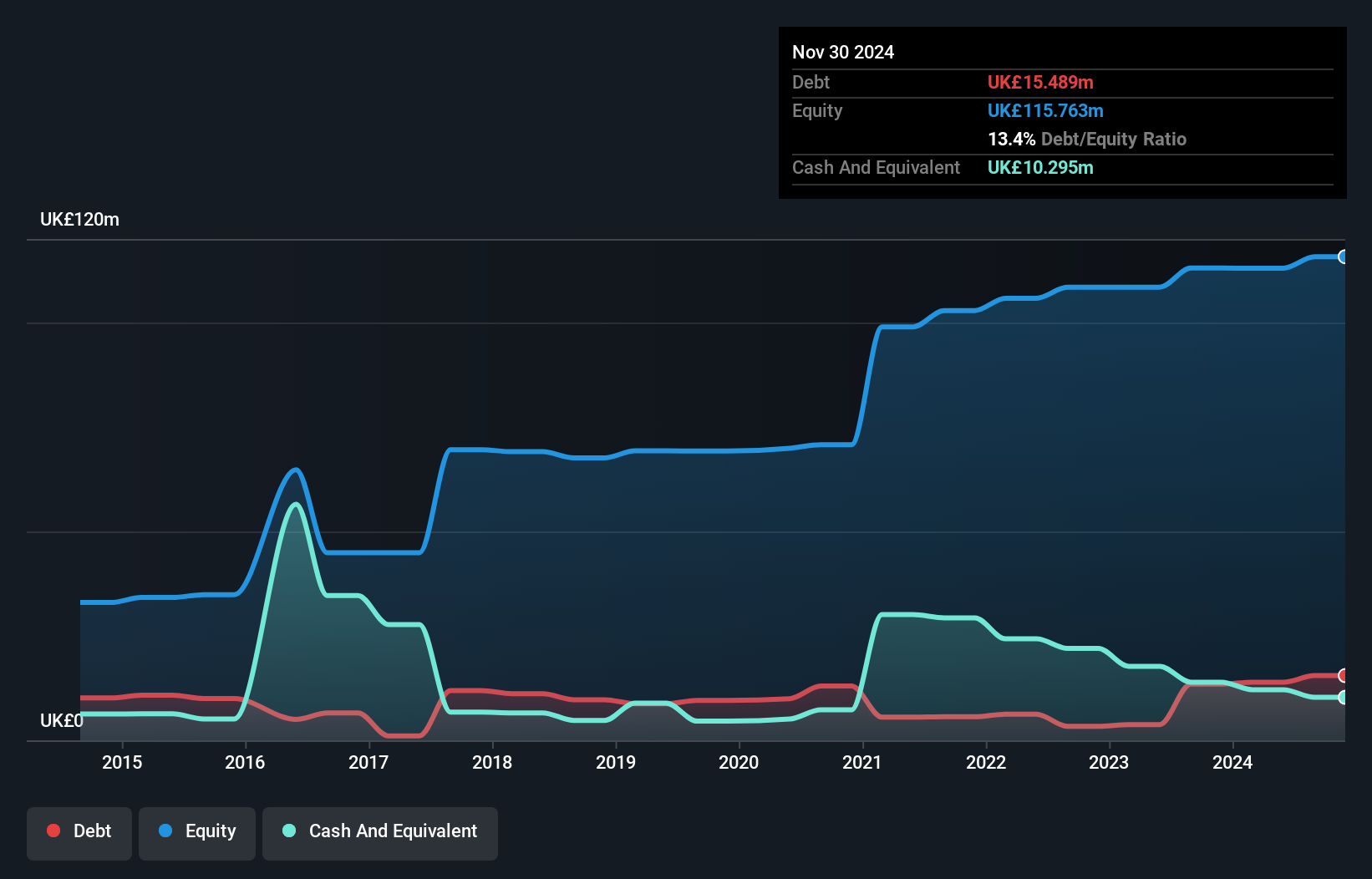

Avingtrans plc has demonstrated robust financial health with its net debt to equity ratio at 7.4%, indicating satisfactory leverage. The company's operating cash flow effectively covers its debt, and interest payments are well-covered by EBIT. Avingtrans has shown strong earnings growth, with a remarkable 79.1% increase over the past year, surpassing industry trends and accelerating beyond its five-year average growth rate of 12.3%. Recent results highlight improved profitability, with net income rising to £6.56 million from £3.66 million last year, alongside a slight dividend increase to 4.9 pence per share for the year ending May 31, 2025.

- Navigate through the intricacies of Avingtrans with our comprehensive balance sheet health report here.

- Evaluate Avingtrans' prospects by accessing our earnings growth report.

CML Microsystems (AIM:CML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CML Microsystems plc, with a market cap of £43.34 million, designs and manufactures semiconductor products for industrial, professional, and commercial applications across the Americas, Europe, the Far East, and internationally.

Operations: The company's revenue is primarily derived from its Semiconductor Components for The Communications Industry segment, which generated £22.90 million.

Market Cap: £43.34M

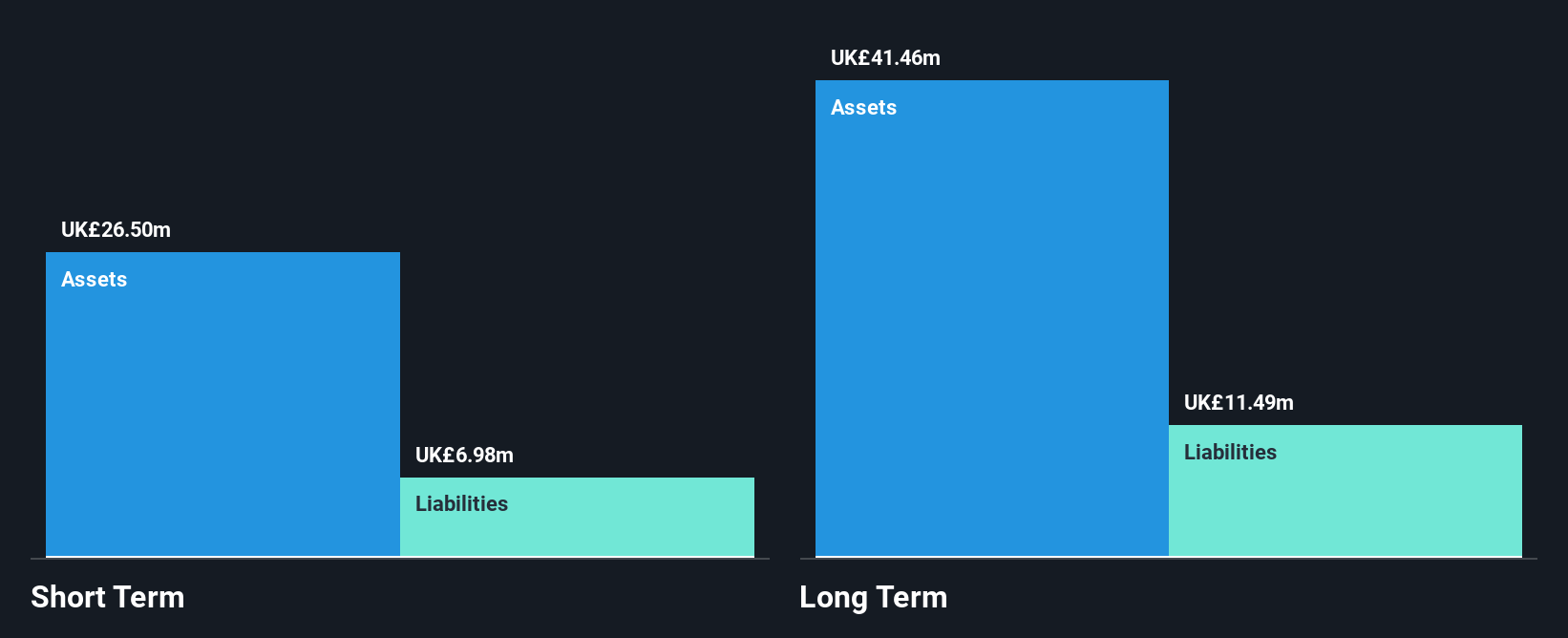

CML Microsystems, with a market cap of £43.34 million, is currently unprofitable but has been reducing its losses by 10.8% annually over the past five years. The company maintains financial stability with short-term assets (£21.5M) exceeding both short-term (£5.5M) and long-term liabilities (£8.7M), and it operates debt-free, which eliminates concerns about interest coverage or cash flow constraints from debt servicing. Despite its lack of profitability, CML's strategic positioning is reinforced by a significant $30 million agreement to supply GNSS equipment over 12 years, reflecting strong customer trust and potential for future revenue growth in the semiconductor sector.

- Unlock comprehensive insights into our analysis of CML Microsystems stock in this financial health report.

- Understand CML Microsystems' track record by examining our performance history report.

Transense Technologies (AIM:TRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Transense Technologies plc develops and supplies specialist sensor systems globally, with a market cap of £19.02 million.

Operations: The company generates revenue through three primary segments: SAWsense (£1.11 million), Translogik (£1.32 million), and Itrack Royalties (£3.11 million).

Market Cap: £19.02M

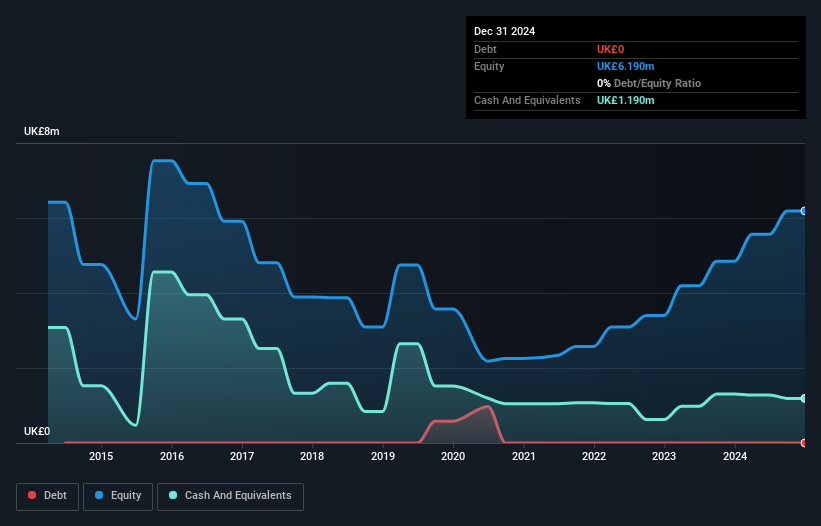

Transense Technologies, with a market cap of £19.02 million, reported revenue growth to £5.55 million for the fiscal year ended June 2025. The company is debt-free, enhancing its financial stability and eliminating concerns about interest payments or cash flow constraints from debt servicing. Short-term assets (£3.2M) comfortably cover both short-term (£923K) and long-term liabilities (£252K). Despite a decline in net profit margin from 37.4% to 25.4%, Transense has demonstrated profitability over the past five years with earnings growing by an impressive rate annually, although recent earnings growth was negative at -10%.

- Click to explore a detailed breakdown of our findings in Transense Technologies' financial health report.

- Learn about Transense Technologies' future growth trajectory here.

Summing It All Up

- Get an in-depth perspective on all 301 UK Penny Stocks by using our screener here.

- Looking For Alternative Opportunities? Uncover 12 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Transense Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TRT

Transense Technologies

Develops and supplies specialist sensor systems in the United Kingdom, North America, South America, Australia, Europe, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives