- United Kingdom

- /

- Food

- /

- AIM:MPE

Undiscovered Gems In The United Kingdom To Explore January 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index grapples with external pressures such as weak trade data from China, investors are increasingly looking beyond blue-chip stocks to uncover opportunities in smaller, lesser-known companies. In this environment, identifying undiscovered gems requires a keen eye for businesses that demonstrate resilience and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

We'll examine a selection from our screener results.

Andrews Sykes Group (AIM:ASY)

Simply Wall St Value Rating: ★★★★★★

Overview: Andrews Sykes Group plc is an investment holding company that specializes in the hire, sale, and installation of environmental control equipment across the United Kingdom, Europe, the Middle East, Africa, and internationally with a market capitalization of £223.94 million.

Operations: The company generates revenue primarily through hiring, selling, and installing environmental control equipment across various regions. It has a market capitalization of £223.94 million.

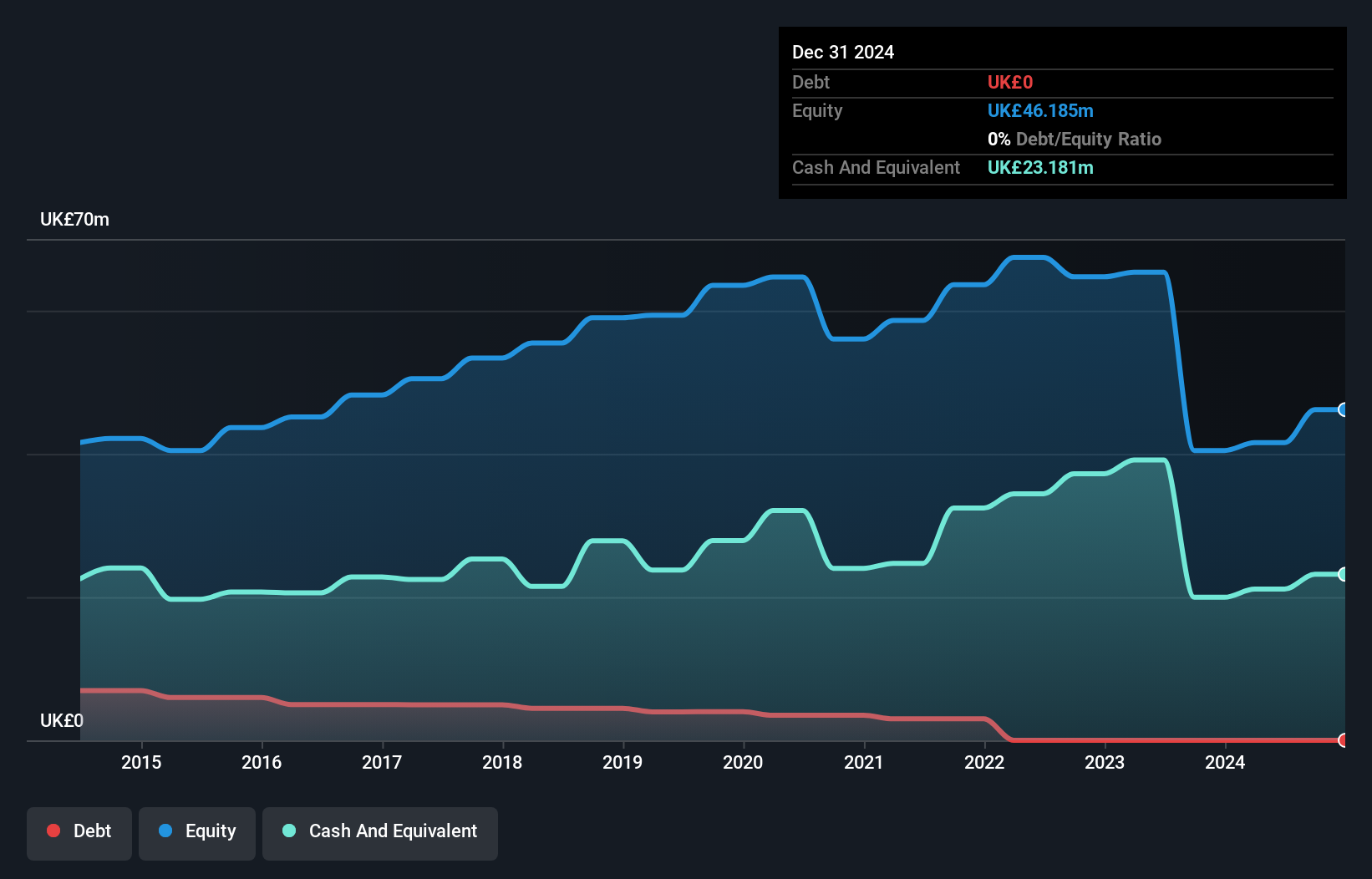

Andrews Sykes Group, a niche player in the UK market, stands out with its debt-free status and high-quality earnings. Trading at 39% below its estimated fair value, it offers a compelling valuation proposition. Despite a recent negative earnings growth of 4.3%, which contrasts with the Trade Distributors industry average of 8.4%, the company remains profitable with positive free cash flow recorded at £19.44 million as of June 2024. The absence of debt since reducing from a debt-to-equity ratio of 6.7% five years ago highlights prudent financial management, suggesting resilience amidst industry challenges.

- Click to explore a detailed breakdown of our findings in Andrews Sykes Group's health report.

Gain insights into Andrews Sykes Group's past trends and performance with our Past report.

London Security (AIM:LSC)

Simply Wall St Value Rating: ★★★★★★

Overview: London Security plc is an investment holding company that manufactures, sells, and rents fire protection equipment across several European countries including the United Kingdom, Belgium, and Germany, with a market cap of £416.84 million.

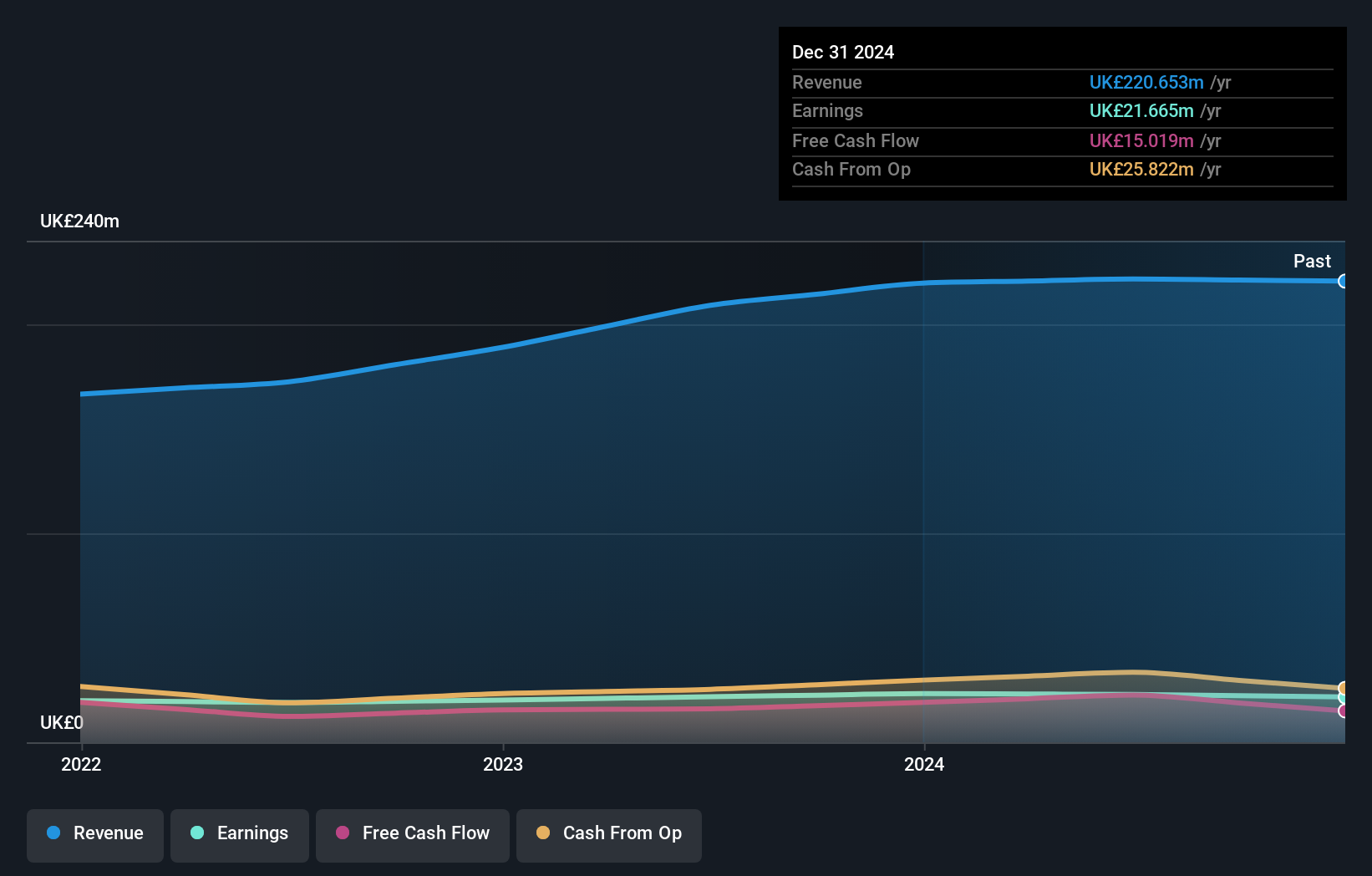

Operations: Revenue from the provision and maintenance of fire protection and security equipment stands at £221.72 million.

London Security, a smaller player in its field, is trading significantly below its estimated fair value by 54.7%, suggesting potential undervaluation. Over the past year, earnings grew by 5.2%, outpacing the broader machinery industry's -8.8% performance, indicating resilience and growth potential. The company's debt to equity ratio has impressively decreased from 7.3% to just 0.2% over five years, reflecting strong financial management and reduced leverage risk. Despite a recent dividend decrease to £0.80 per share, London Security's solid cash position and high-quality earnings underscore its stability in uncertain markets while offering room for future growth opportunities.

- Get an in-depth perspective on London Security's performance by reading our health report here.

Evaluate London Security's historical performance by accessing our past performance report.

M.P. Evans Group (AIM:MPE)

Simply Wall St Value Rating: ★★★★★★

Overview: M.P. Evans Group PLC focuses on the ownership and development of oil palm plantations in Indonesia and Malaysia, with a market capitalization of £504.53 million.

Operations: M.P. Evans Group generates revenue primarily from its plantation operations in Indonesia, amounting to $336.59 million.

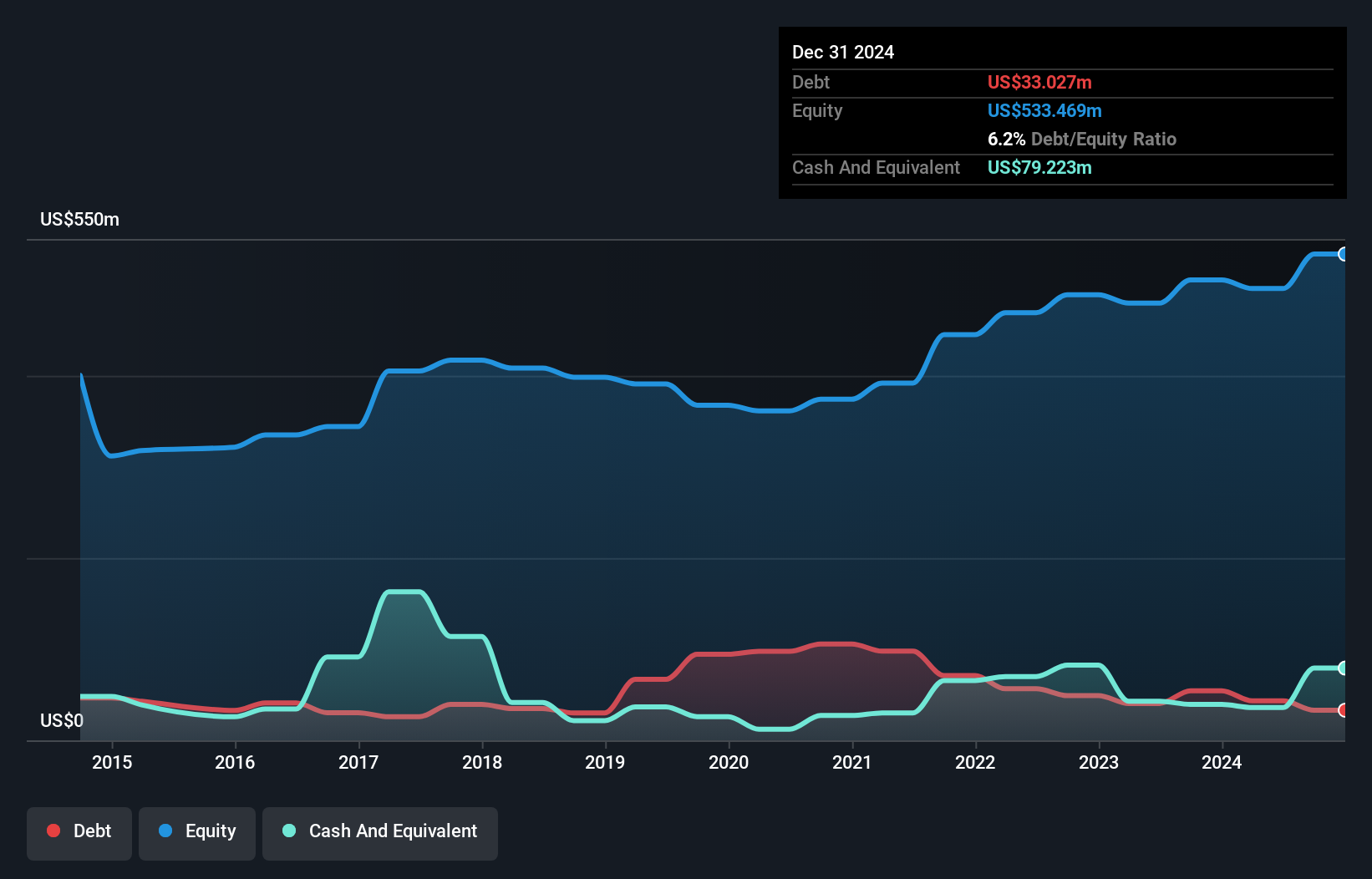

M.P. Evans, a small player in the agricultural sector, is trading at 70.6% below its estimated fair value, suggesting potential undervaluation. Its earnings growth of 47.8% over the past year outpaced the food industry average of 25.3%, highlighting robust performance. The company demonstrates financial prudence with an interest coverage ratio of 35.1x and a net debt to equity ratio at a satisfactory 1.5%. Over five years, M.P. Evans has reduced its debt to equity from 17.1% to 8.7%, indicating improved financial health despite recent significant insider selling activity that could raise some concerns among investors.

Turning Ideas Into Actions

- Dive into all 63 of the UK Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MPE

M.P. Evans Group

Through its subsidiaries, engages in the ownership and development of oil palm plantations in Indonesia and Malaysia.

Very undervalued with flawless balance sheet and pays a dividend.