- United Kingdom

- /

- Tech Hardware

- /

- AIM:CNC

Uncovering Andrews Sykes Group And 2 Other Promising Small Cap Stocks In The UK

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 and FTSE 250 indices experience pressure from weak trade data out of China, investors are increasingly seeking opportunities in smaller, potentially less exposed segments of the market. In this environment, identifying promising small-cap stocks like Andrews Sykes Group can offer a strategic advantage by focusing on companies with robust fundamentals and growth potential that may not be directly impacted by global economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| Bioventix | NA | 7.39% | 5.15% | ★★★★★★ |

| Georgia Capital | NA | 6.53% | 10.96% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Andrews Sykes Group (AIM:ASY)

Simply Wall St Value Rating: ★★★★★★

Overview: Andrews Sykes Group plc is an investment holding company involved in the hire, sale, and installation of environmental control equipment across the UK, Europe, the Middle East, Africa, and globally, with a market capitalization of £231.27 million.

Operations: The group's primary revenue streams are derived from the hire and sale of environmental control equipment, with significant contributions from the UK (£43.13 million) and Europe excluding the UK (£24.09 million). The Middle East segment generates £7.68 million in revenue, while installation and maintenance services contribute £1.57 million.

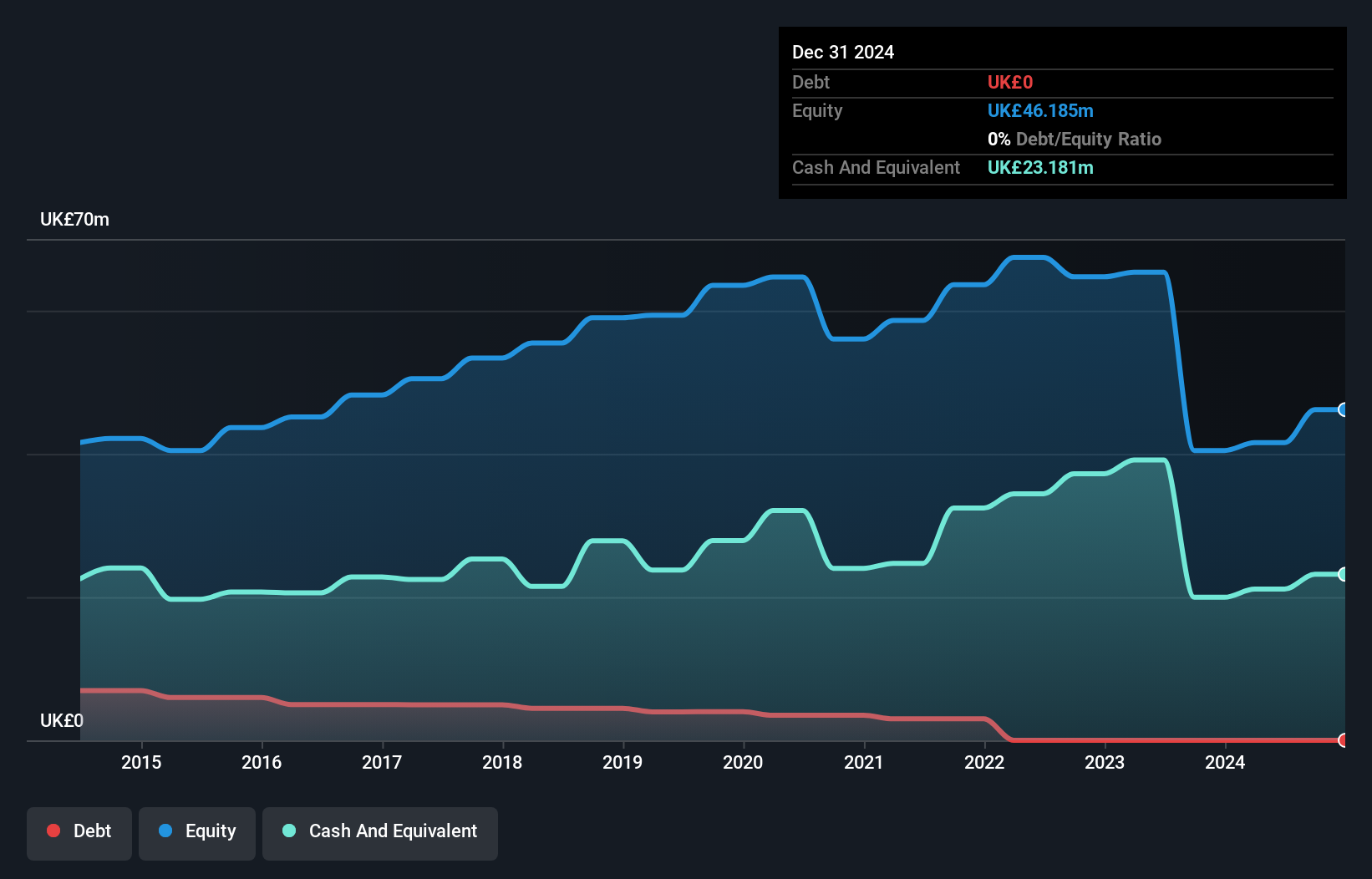

Andrews Sykes, a nimble player in the UK market, stands out with its debt-free status, having reduced its debt to equity ratio from 6.3% five years ago to zero. Its price-to-earnings ratio of 13.8x is attractive compared to the broader UK market's 16.6x, suggesting potential value for investors. Despite facing a challenging year with earnings growth at -5.4%, below the industry average of -2.5%, it continues to generate positive free cash flow and boasts high-quality earnings. Recently, shareholders approved a final dividend of £0.14 per ordinary share, indicating confidence in future prospects.

- Navigate through the intricacies of Andrews Sykes Group with our comprehensive health report here.

Understand Andrews Sykes Group's track record by examining our Past report.

Concurrent Technologies (AIM:CNC)

Simply Wall St Value Rating: ★★★★★★

Overview: Concurrent Technologies Plc, with a market cap of £189.28 million, specializes in designing, developing, manufacturing, and marketing single board computers for system integrators and original equipment manufacturers.

Operations: Concurrent Technologies generates revenue primarily from the design, manufacture, and supply of high-end embedded computer products, totaling £44.57 million.

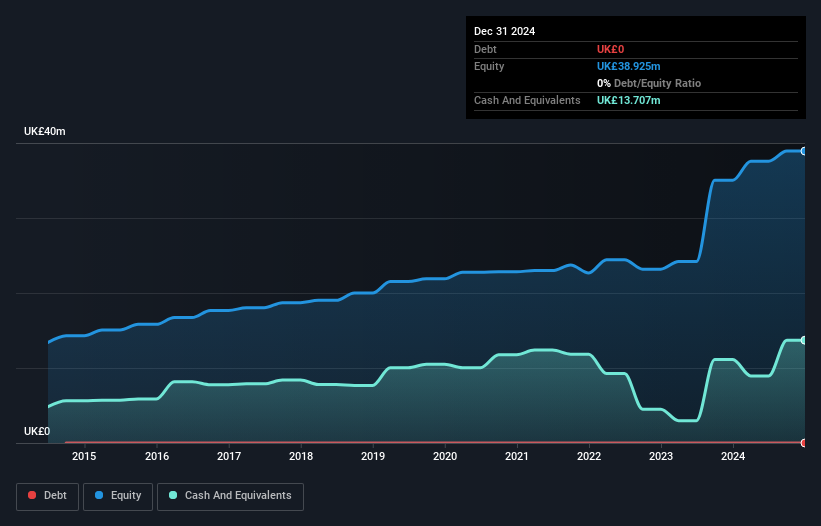

Concurrent Technologies, a UK-based tech innovator, has been making waves with its impressive earnings growth of 10.9% over the past year, outpacing the broader tech industry's -7.9%. The company recently reported half-year sales of £21.06 million and net income of £2.4 million, reflecting steady progress from last year's figures. Concurrent's strategic moves include securing a significant €4 million contract with a UK defence contractor and launching cutting-edge products like the Bragi NVIDIA graphics card and Apollo computer system. Trading at 4.7% below its estimated fair value, this debt-free firm seems poised for continued success in niche markets.

James Halstead (AIM:JHD)

Simply Wall St Value Rating: ★★★★★★

Overview: James Halstead plc is a company that manufactures and supplies flooring products for both commercial and domestic markets across the United Kingdom, Europe, Scandinavia, Australasia, Asia, and other international regions with a market cap of approximately £598.09 million.

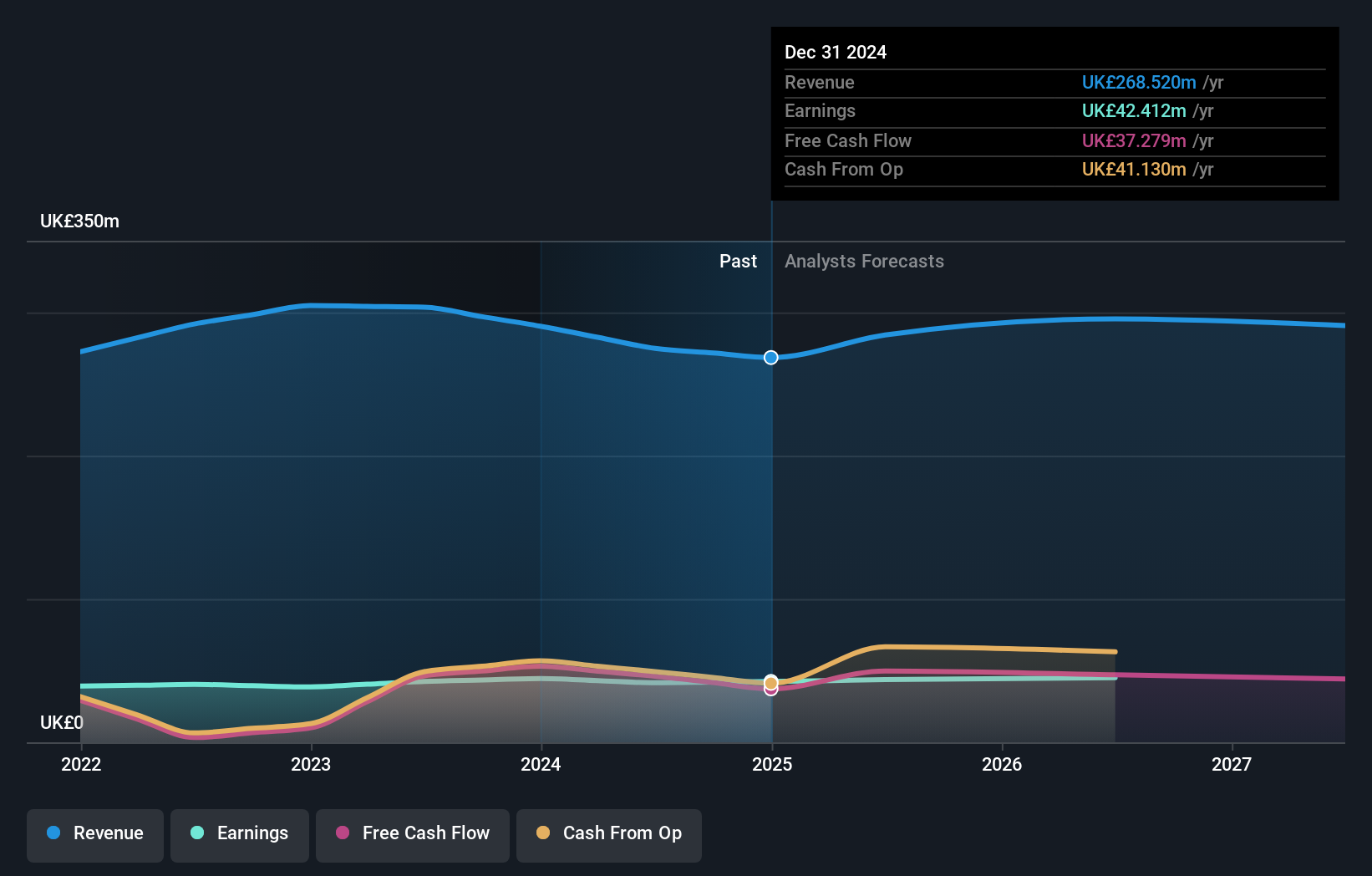

Operations: The primary revenue stream for James Halstead comes from the manufacture and distribution of flooring products, generating £268.52 million.

James Halstead, a notable player in its sector, has shown resilience despite facing a 4.6% drop in earnings over the past year compared to the building industry average of 1.1%. The company trades at 17.9% below its estimated fair value, offering potential for value seekers. Its debt-to-equity ratio improved from 0.2 to 0.1 over five years, reflecting prudent financial management with more cash than total debt on hand. With high-quality past earnings and positive free cash flow generation, James Halstead's solid balance sheet supports future stability even as sales and profit projections are slightly lower than last year's record levels.

- Dive into the specifics of James Halstead here with our thorough health report.

Evaluate James Halstead's historical performance by accessing our past performance report.

Next Steps

- Click through to start exploring the rest of the 61 UK Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CNC

Concurrent Technologies

Designs, develops, manufactures, and markets single board computers for system integrators and original equipment manufacturers.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives