- United Kingdom

- /

- Hospitality

- /

- LSE:RNK

Discovering Undiscovered Gems in the United Kingdom October 2025

Reviewed by Simply Wall St

Amidst the recent turbulence in the UK market, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, investors are increasingly seeking opportunities beyond the blue-chip stocks that dominate headlines. In this environment, identifying undiscovered gems—stocks that demonstrate resilience and potential amidst broader economic challenges—can be key for those looking to navigate these uncertain times successfully.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| Anglo-Eastern Plantations | NA | 5.55% | 5.38% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Bioventix | NA | 7.39% | 5.15% | ★★★★★★ |

| Georgia Capital | NA | 6.53% | 10.96% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

We'll examine a selection from our screener results.

Andrews Sykes Group (AIM:ASY)

Simply Wall St Value Rating: ★★★★★★

Overview: Andrews Sykes Group plc is an investment holding company that specializes in the hire, sale, and installation of environmental control equipment across the United Kingdom, Europe, the Middle East, Africa, and other international markets with a market capitalization of £216.62 million.

Operations: The company generates revenue primarily through the hire, sale, and installation of environmental control equipment across various regions. Its financial performance is influenced by its ability to manage costs effectively, impacting the net profit margin. With a market capitalization of £216.62 million, Andrews Sykes Group operates in diverse international markets, contributing to its revenue streams.

Andrews Sykes Group, a nimble player in the UK market, stands out with its debt-free status and high-quality earnings. Despite a slight dip in earnings growth by 0.8% compared to the industry average of 1.7%, it trades at an attractive 17.6% below estimated fair value. Recent half-year results show sales of £37.94 million and net income rising to £7.44 million from last year's £7.08 million, reflecting resilience amid challenges. The board's decision to maintain an interim dividend of 11.9 pence per share underscores confidence in its financial health and future prospects for steady returns.

- Get an in-depth perspective on Andrews Sykes Group's performance by reading our health report here.

Assess Andrews Sykes Group's past performance with our detailed historical performance reports.

James Halstead (AIM:JHD)

Simply Wall St Value Rating: ★★★★★★

Overview: James Halstead plc is a company that manufactures and supplies flooring products for both commercial and domestic applications across the United Kingdom, Europe, Scandinavia, Australasia, Asia, and other international markets with a market cap of £591.84 million.

Operations: The company's revenue is primarily derived from the manufacture and distribution of flooring products, totaling £261.97 million.

James Halstead, a prominent player in the flooring industry, reported sales of £261.97 million for the year ending June 2025, slightly down from £274.88 million previously. Net income stood at £40.61 million compared to £41.52 million last year, reflecting a modest dip in performance with basic earnings per share at £0.097 from continuing operations versus £0.1 previously. Despite this, the company boasts high-quality past earnings and maintains an ungeared balance sheet with more cash than total debt, suggesting financial resilience even as it trades 3% below estimated fair value and forecasts annual earnings growth of 4%.

- Dive into the specifics of James Halstead here with our thorough health report.

Evaluate James Halstead's historical performance by accessing our past performance report.

Rank Group (LSE:RNK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Rank Group Plc, along with its subsidiaries, provides gaming services in the United Kingdom, Europe, and internationally, with a market capitalization of £599.59 million.

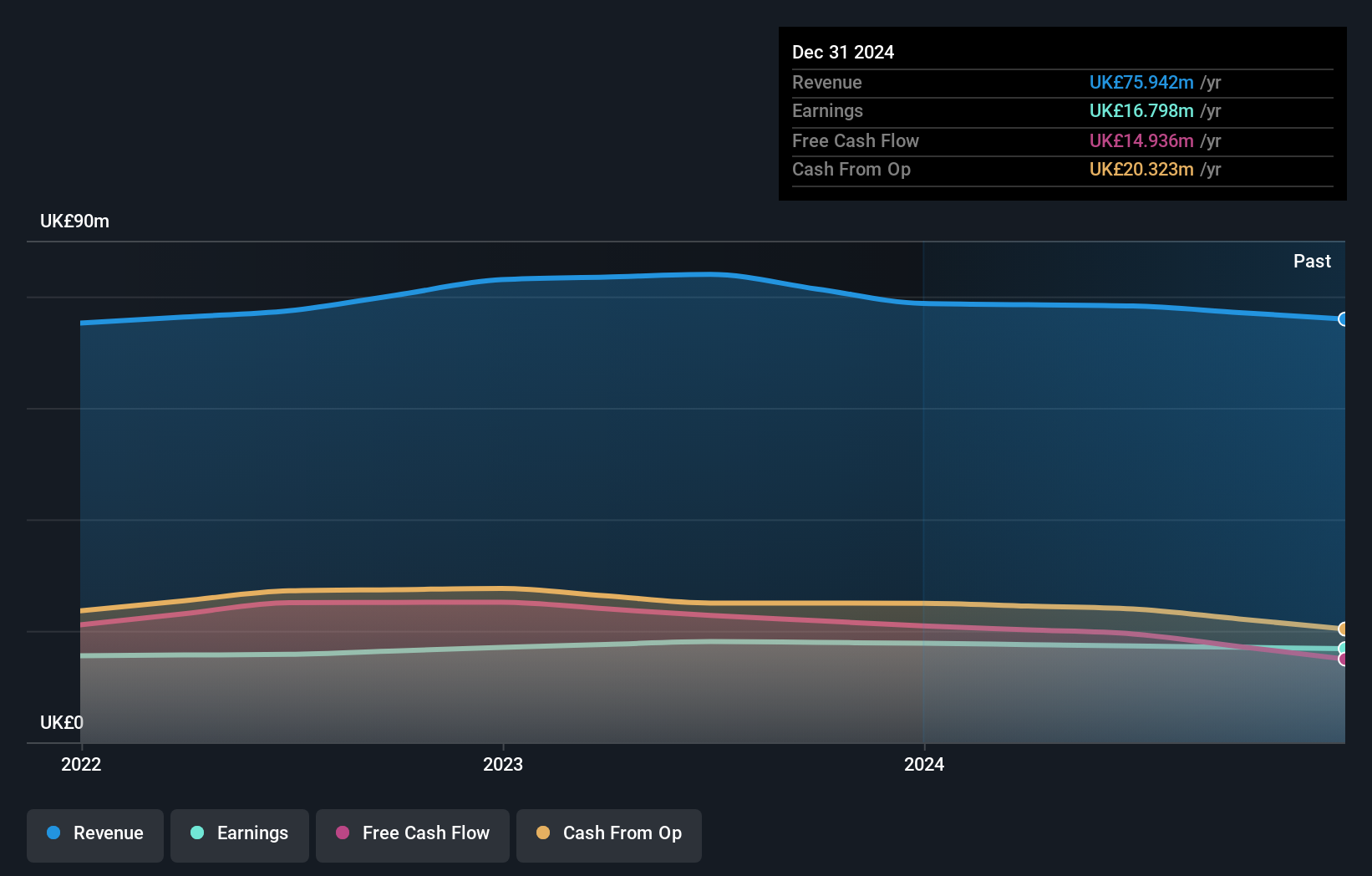

Operations: Rank Group generates revenue primarily from its Grosvenor Venues (£378.40 million), Digital operations (£235.70 million), and Mecca Venues (£140.40 million). Enracha Venues contribute £40.90 million to the total revenue stream.

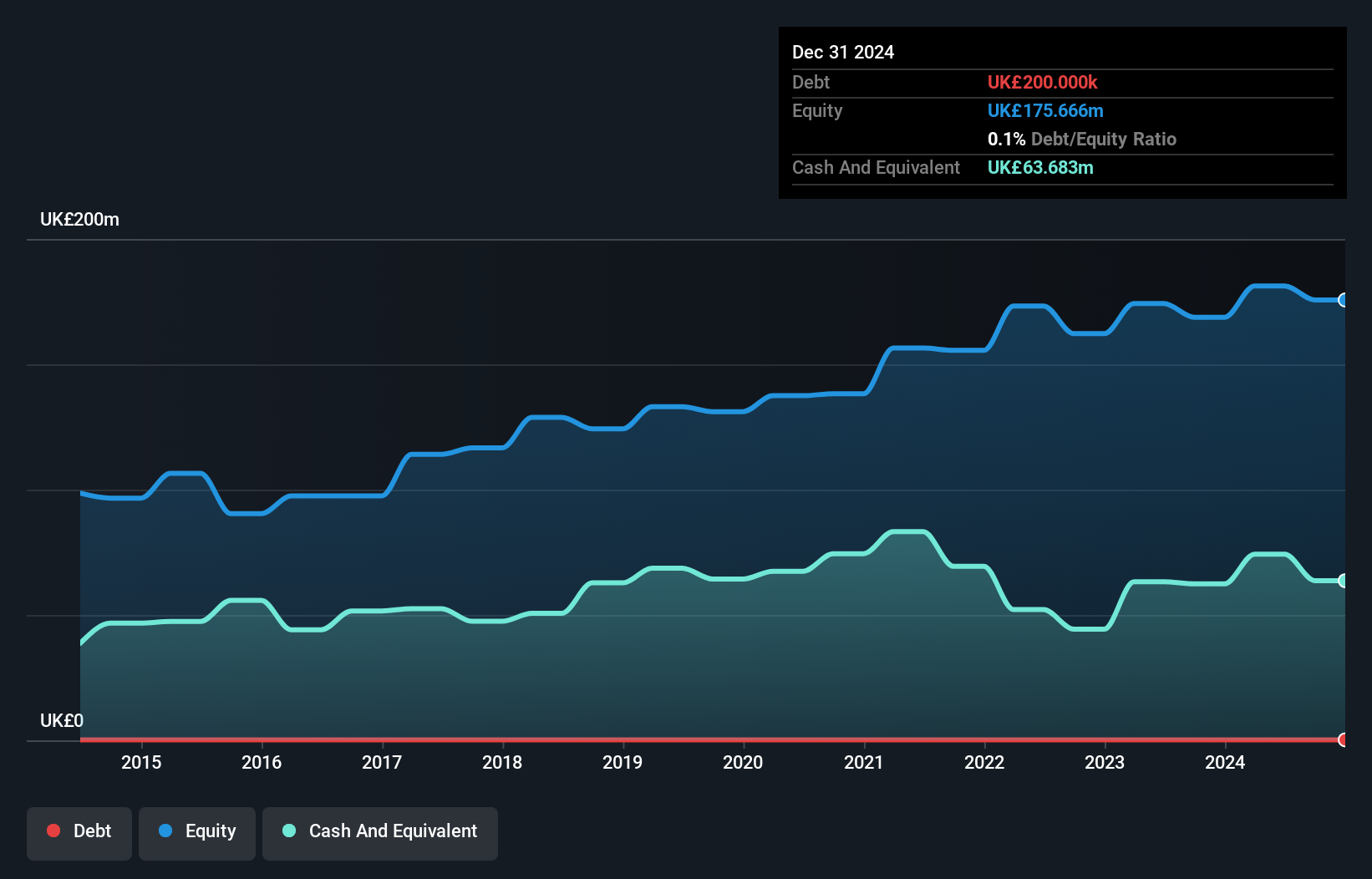

Rank Group, a smaller player in the UK market, has been making waves with its impressive financial turnaround. Over the past year, earnings surged by 262.6%, outpacing the broader hospitality sector's 4.1% growth. This robust performance is underpinned by high-quality earnings and a commendable reduction in debt-to-equity ratio from 35 to just 8 over five years. The company enjoys good value compared to peers, trading at a notable discount of 62% below estimated fair value. Recent additions to the S&P Global BMI Index further underscore its potential as it embarks on strategic expansions and digital innovations.

Turning Ideas Into Actions

- Take a closer look at our UK Undiscovered Gems With Strong Fundamentals list of 64 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RNK

Rank Group

Engages in provision of gaming services in the United Kingdom, Europe, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives