- United Kingdom

- /

- Banks

- /

- LSE:TBCG

TBC Bank Group's (LON:TBCG) Stock Price Has Reduced 25% In The Past Three Years

It is a pleasure to report that the TBC Bank Group PLC (LON:TBCG) is up 35% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 25% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

View our latest analysis for TBC Bank Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, TBC Bank Group actually managed to grow EPS by 1.7% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed.

It's pretty reasonable to suspect the market was previously to bullish on the stock, and has since moderated expectations. But it's possible a look at other metrics will be enlightening.

Revenue is actually up 6.1% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating TBC Bank Group further; while we may be missing something on this analysis, there might also be an opportunity.

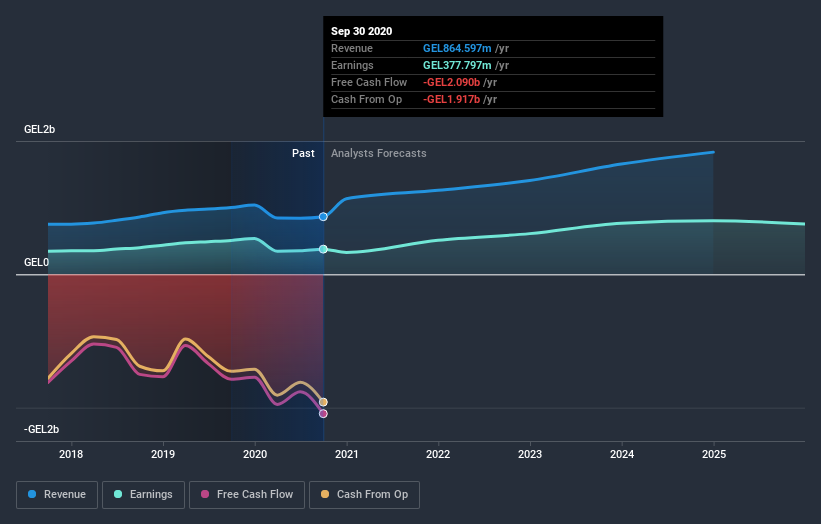

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on TBC Bank Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between TBC Bank Group's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for TBC Bank Group shareholders, and that cash payout explains why its total shareholder loss of 20%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

Pleasingly, TBC Bank Group's total shareholder return last year was 4.2%. This recent result is much better than the 6% drop suffered by shareholders each year (on average) over the last three. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for TBC Bank Group you should be aware of, and 1 of them makes us a bit uncomfortable.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade TBC Bank Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TBC Bank Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:TBCG

TBC Bank Group

Through its subsidiaries, provides banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives