- United Kingdom

- /

- Banks

- /

- LSE:HSBA

HSBC (LSE:HSBA): Has the Recent Share Price Surge Left the Bank Overvalued?

Reviewed by Simply Wall St

Why HSBC Holdings (LSE:HSBA) Is Back on Investors’ Radar

HSBC Holdings (LSE:HSBA) has quietly delivered a solid mix of income and growth, with shares up about 7% over the past 3 months and roughly 50% over the past year.

See our latest analysis for HSBC Holdings.

Recent moves in HSBC’s share price have been relatively muted in the short term. However, that follows a powerful run, with a roughly 36% year to date share price return and a 50% one year total shareholder return suggesting momentum is still firmly on the side of long term holders.

If HSBC’s run has you thinking about where capital could compound next, it is worth scanning fast growing stocks with high insider ownership for other fast growing businesses where management has meaningful skin in the game.

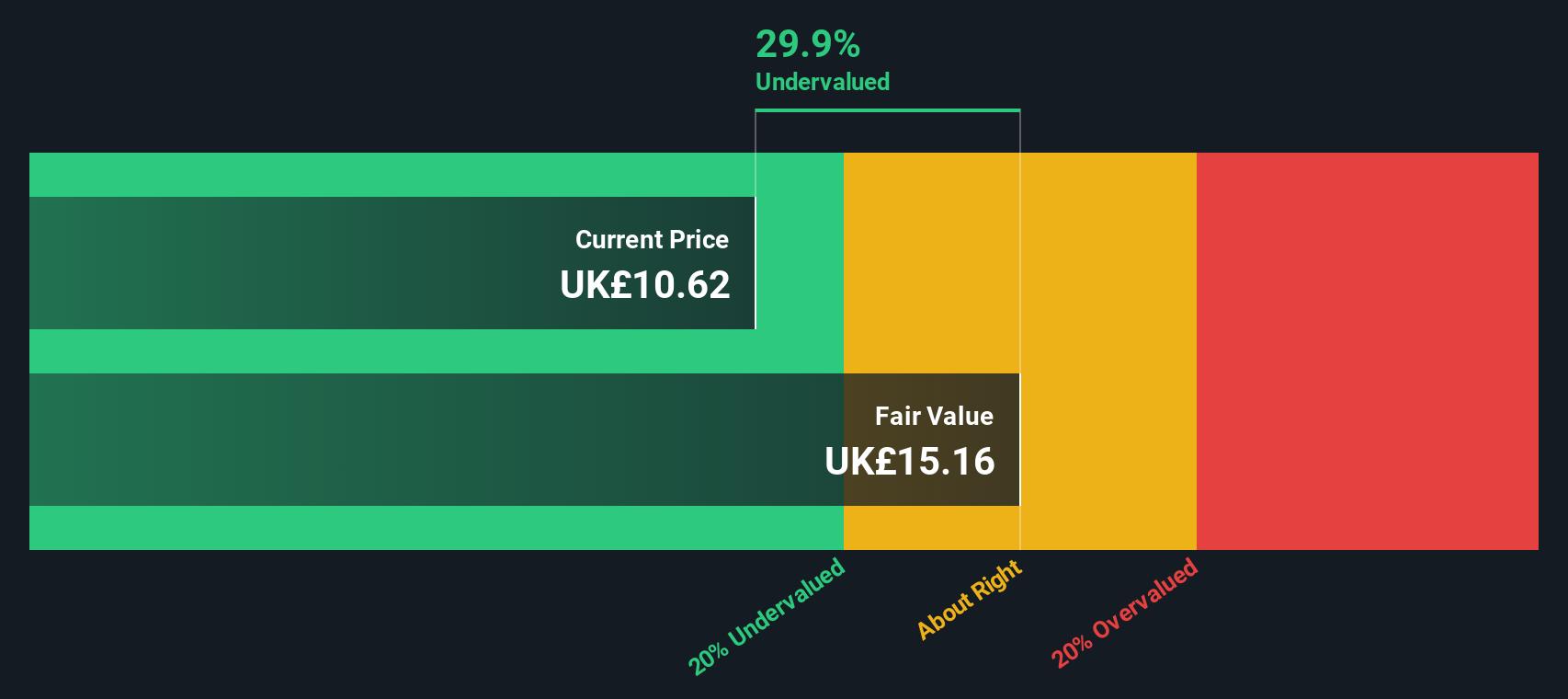

But after such a strong run and only a small discount to analyst targets, is HSBC still trading below its intrinsic value, or are investors now fully pricing in its future growth potential?

Most Popular Narrative: 0.6% Overvalued

With the current share price slightly above the narrative fair value of £10.62, the story hinges on how earnings, margins, and capital allocation evolve.

The strategic shift away from underperforming and non-core businesses in Europe and the Americas, and redeployment of capital into high-return businesses in Asia and the Middle East, is expected to improve overall net interest margins and boost group return on equity through better allocation of resources. Disproportionate investment in digital transformation, including AI-driven efficiency gains and digital onboarding, is described as a driver of structural cost reductions (organizational simplification savings), which would directly improve the cost-to-income ratio and support long-term operating leverage and net margins.

Curious how modest revenue growth, rising margins and a lower future earnings multiple can still justify today’s price premium? The full narrative unpacks the math behind that tight valuation gap.

Result: Fair Value of £10.62 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that tight valuation could quickly unravel if Hong Kong commercial real estate weakens further or if Asian growth and rate dynamics turn less supportive.

Find out about the key risks to this HSBC Holdings narrative.

Another Lens on Value

Our DCF model tells a very different story, suggesting HSBC’s shares are trading about 36% below an estimated fair value of £16.77. If cash flows really deserve that price, is the tight analyst target too cautious, or is the model overestimating resilience?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HSBC Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 893 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HSBC Holdings Narrative

If you see the numbers differently or just prefer hands on research, you can build a personalised HSBC story in minutes: Do it your way.

A great starting point for your HSBC Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next investment moves?

Do not stop your research with HSBC. Use the Simply Wall St Screener to uncover fresh, data driven ideas that could quietly reshape your portfolio.

- Capture potential mispricings by running these 893 undervalued stocks based on cash flows that could offer stronger upside based purely on future cash flows.

- Ride structural shifts in healthcare by assessing these 30 healthcare AI stocks using artificial intelligence to transform diagnostics, treatment, and operational efficiency.

- Tap into early stage innovation and rapid growth potential with these 3591 penny stocks with strong financials that still fly under most investors’ radars.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HSBC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSBA

HSBC Holdings

Engages in the provision of banking and financial products and services worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026