- United Kingdom

- /

- Banks

- /

- LSE:HSBA

Has HSBC’s 260% Five Year Surge Still Got Room To Run In 2025?

Reviewed by Bailey Pemberton

- If you are wondering whether HSBC Holdings is still a smart buy after its big run, or if the easy money has already been made, this is the right place to unpack what the current share price really implies.

- The stock has climbed 50.9% over the last year and an impressive 260.0% over five years. However, the last month was basically flat at around 0.1% lower, signaling that expectations have shifted a lot over time.

- Recent headlines have focused on HSBC sharpening its strategic focus, including continued exits from non core markets and further investment in its Asia franchise. Investors often read these moves as catalysts for a simpler, more profitable bank. At the same time, ongoing commentary about global interest rate paths and regulatory capital requirements has kept risk perceptions in play for big lenders like HSBC.

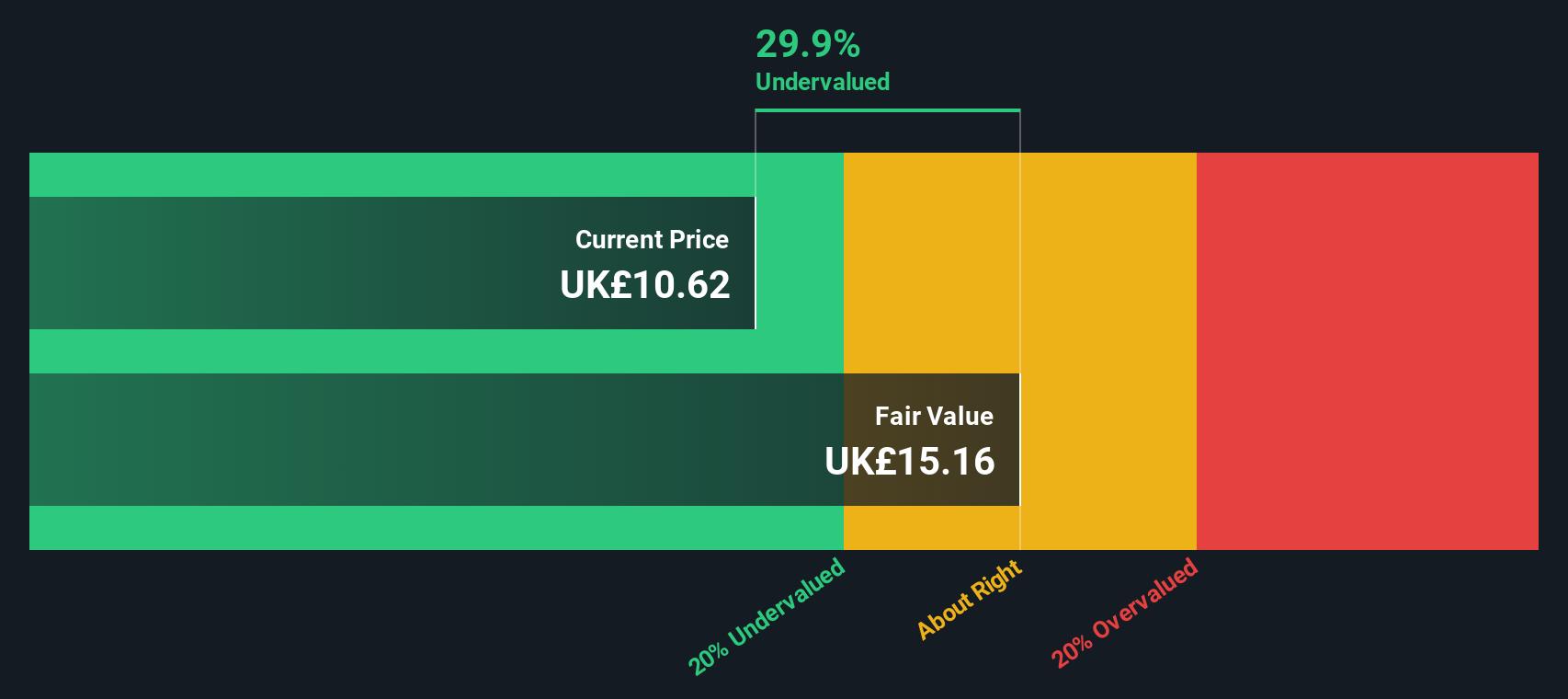

- On our framework, HSBC earns a 2/6 valuation score, suggesting pockets of undervaluation but also areas where the market might be ahead of fundamentals. Below, we walk through the main valuation lenses investors use today and then finish with a more holistic way to think about what the shares are really worth.

HSBC Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: HSBC Holdings Excess Returns Analysis

The Excess Returns model looks at how much profit HSBC can generate above the return that investors reasonably demand on its equity, then capitalizes those surplus profits into an intrinsic value per share.

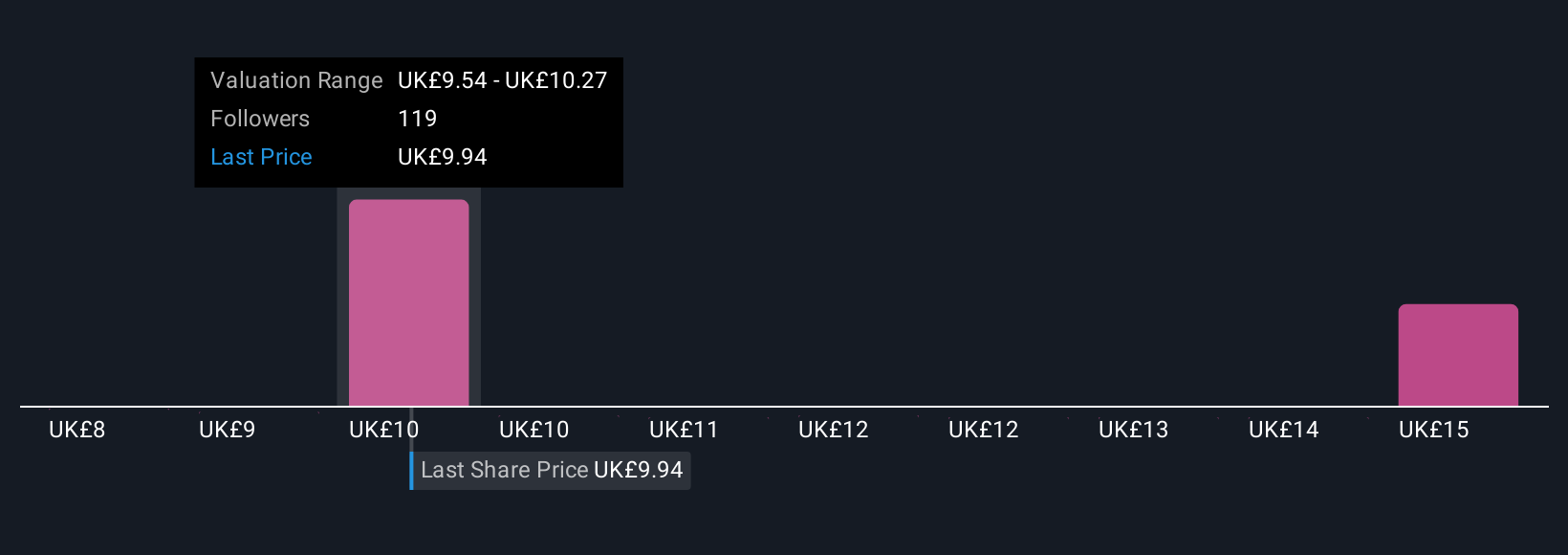

On this view, HSBC starts with a Book Value of £9.94 per share and a Stable EPS estimate of £1.54 per share, based on weighted future Return on Equity forecasts from 17 analysts. That implies an Average Return on Equity of 14.17%, which is comfortably above the implied Cost of Equity of £0.92 per share.

The difference between what shareholders require and what the bank is expected to earn, the Excess Return, is £0.62 per share. With Stable Book Value projected to rise to £10.89 per share, using estimates from 8 analysts, the model effectively assumes HSBC can keep compounding value at attractive spreads over its cost of capital.

Putting these inputs together, the Excess Returns valuation points to an intrinsic value around £16.70 per share, indicating the stock is roughly 35.7% undervalued versus the current market price.

Result: UNDERVALUED

Our Excess Returns analysis suggests HSBC Holdings is undervalued by 35.7%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: HSBC Holdings Price vs Earnings

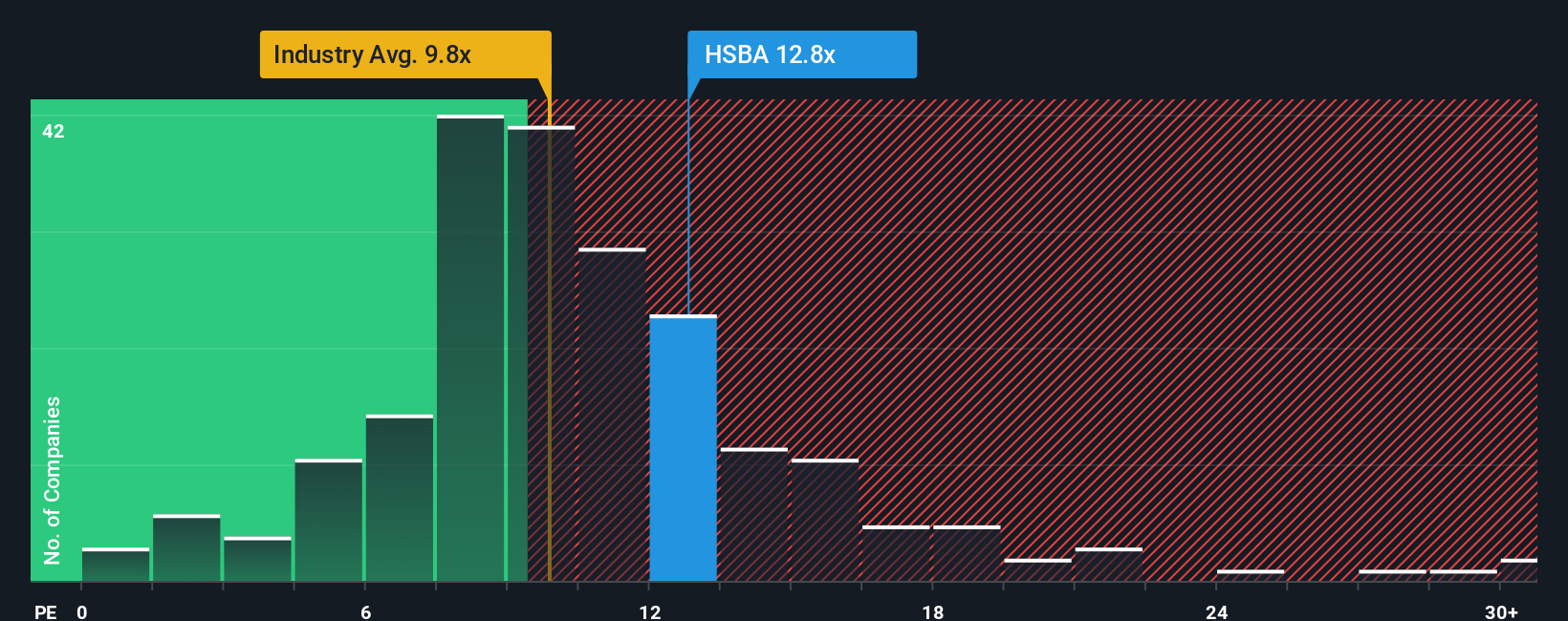

For a consistently profitable bank like HSBC, the price to earnings ratio is a practical way to gauge what investors are willing to pay for each pound of current earnings. It naturally blends expectations for future growth and the perceived risks around delivering those earnings, so faster growing or safer banks usually command higher PE ratios, while slower or riskier ones trade on lower multiples.

HSBC currently trades on a PE of 14.84x, which is notably above the broader Banks industry average of 10.56x and also higher than the 11.80x average of its peer group. On the surface, that suggests the market is already assigning HSBC a premium for its earnings profile. Simply Wall St’s Fair Ratio framework refines this by estimating the PE you would expect for HSBC, given its specific mix of earnings growth, profit margins, risk profile, industry and market cap. On this basis, HSBC’s Fair Ratio is 10.20x, implying the shares trade at a meaningful premium to what those fundamentals justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your HSBC Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you connect your story about HSBC Holdings to hard numbers like future revenue, earnings, margins and a fair value. You can then compare that fair value with today’s share price to consider whether the stock fits your strategy, while the platform keeps your view dynamically updated as new news or earnings arrive. For example, one investor might build a bullish HSBC narrative that assumes Asian wealth and trade flows drive revenue growth above 8% a year, margins rise into the high 30s and arrive at a fair value closer to the £11.29 end of analyst targets. A more cautious investor might emphasize Hong Kong property risks, rate volatility and execution costs, assume slower growth and tighter margins, and arrive at a narrative that supports a fair value nearer the £7.93 bear case. Both narratives are grounded in a clear, traceable link from story, to forecast, to valuation.

Do you think there's more to the story for HSBC Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HSBC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSBA

HSBC Holdings

Engages in the provision of banking and financial products and services worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026