- United Kingdom

- /

- Banks

- /

- LSE:BARC

Barclays (LSE:BARC) Valuation: Is Further Upside Possible After 70% Share Price Surge?

Reviewed by Kshitija Bhandaru

Barclays (LSE:BARC) shares have delivered strong gains over the past year, climbing roughly 70% as the bank posted solid annual growth in both revenue and net income. Investors are watching to see if this momentum can continue.

See our latest analysis for Barclays.

After a year marked by robust revenue growth, Barclays’ share price has reflected investor optimism, with a strong lift in total shareholder returns. Up more than 70% over twelve months, this performance comfortably outpaces many peers and suggests that market momentum is in its favor for now. Short-term gains have reinforced that positive trend, with share price returns accelerating alongside improved fundamentals.

If you’re watching how momentum stories unfold, now’s an ideal moment to broaden your opportunities and discover fast growing stocks with high insider ownership

But with shares already surging and only a modest discount to analyst price targets, is there still value on the table for new investors? Or has the market fully accounted for Barclays’ future growth prospects?

Most Popular Narrative: 7.4% Undervalued

Barclays' widely followed narrative suggests the fair value is notably above the latest share price, with room for upside if growth drivers play out as projected. Investors are closely watching whether assumptions around digital innovation and strategic cost management will justify this unpriced potential.

Ongoing investments in digital banking and technology platforms, including integration of fintech partnerships and sustained client onboarding in corporate banking, are set to drive operational efficiency and expand Barclays' digital revenue streams. This supports stronger net margins and long-term earnings growth.

Curious about what ambitious growth targets and transformational tech investments underpin this bold valuation call? The narrative's outlook rests on a future earnings leap, margin trends, and a valuation multiple usually reserved for sector leaders. Discover which forecast figures the market is missing, as key assumptions and potential upside await inside the full story.

Result: Fair Value of £4.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if heightened competition in investment banking or further UK economic uncertainty emerges, these factors could present challenges to Barclays' bullish growth narrative.

Find out about the key risks to this Barclays narrative.

Another View: What Do Market Multiples Indicate?

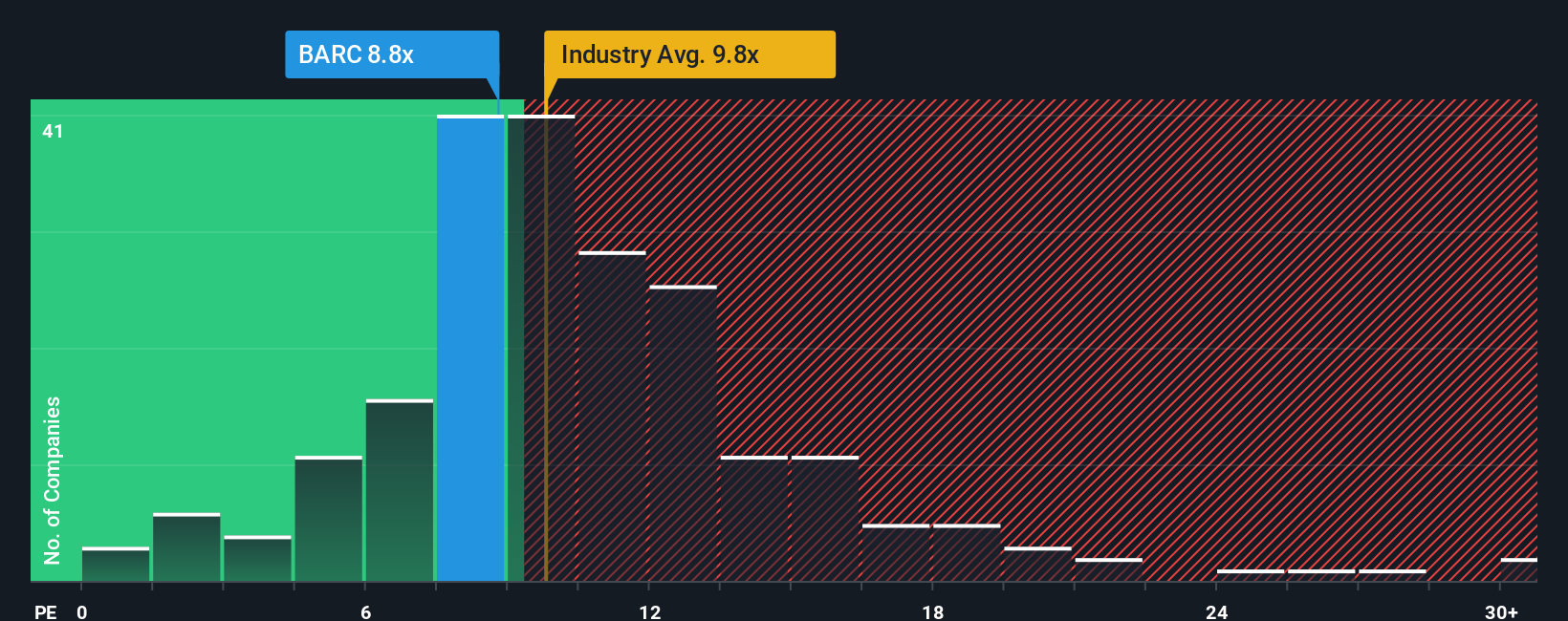

Looking at how Barclays is valued by its price-to-earnings ratio, it trades at 8.8x. This is lower than the peer average of 11.2x and below the European banks’ average of 9.8x. However, this figure sits just above the fair ratio of 8.6x, which suggests less room for mispricing.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Barclays Narrative

If you see things differently or want to dive into the numbers for yourself, crafting a personalized assessment takes just a few minutes. Why not Do it your way

A great starting point for your Barclays research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Act now to uncover smart opportunities before others spot them. Let Simply Wall Street's powerful screener guide your search for stocks with unique potential in today's market.

- Tap into major breakthroughs in healthcare technology by following these 32 healthcare AI stocks to see which companies are transforming patient care and diagnostics with artificial intelligence.

- Chase exciting gains from fast-moving companies using these 3574 penny stocks with strong financials to find stocks that are catching momentum before they hit the mainstream radar.

- Fuel your portfolio with income by seeking out these 19 dividend stocks with yields > 3% to explore investments offering strong yields and potential for compounding returns over the long haul.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barclays might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BARC

Barclays

Provides various financial services in the United Kingdom, Europe, the Americas, Africa, the Middle East, and Asia.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives