- United Kingdom

- /

- Auto Components

- /

- AIM:TRT

Are There Issues For Transense Technologies (LON:TRT) Beyond Its Promising Earnings?

The stock price didn't jump after Transense Technologies plc ( LON:TRT ) posted decent earnings last week. We did some digging and believe investors may be worried about some underlying factors in the report.

See our latest analysis for Transense Technologies

Examining Cashflow Against Transense Technologies' Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

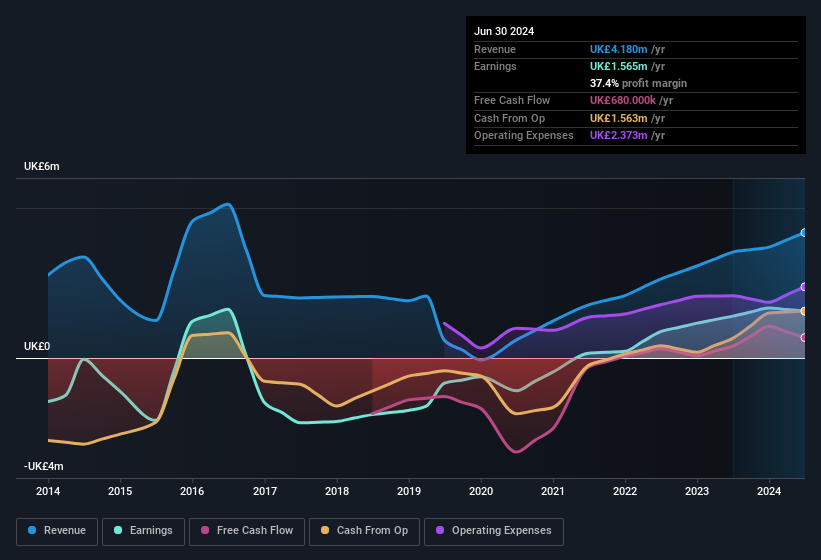

Transense Technologies has an accrual ratio of 0.24 for the year to June 2024. We can therefore deduce that its free cash flow fell short of covering its statutory profit. To wit, it produced free cash flow of UK£680k during the period, falling well short of its reported profit of UK£1.57m. At this point we should mention that Transense Technologies did manage to increase its free cash flow in the last twelve months Importantly, we note an unusual tax situation, which we discuss below, has impacted the accruals ratio. We should note that the accrual ratio of 0.24 was driven by the company utilising Net Cash Flow Generated by Operation (NCFO) to invest in the business, with Capex of UK£0.88m exceeding Deprecation and Amortisation of £0.29m. It was this Capex investment that that reduced the NCFO of £1.56m to a FCF of £0.68m.

While we mentioned before that a positive accrual ratio generally isn't as favourable, shareholders should always be appreciative when cash is being invested back into the business.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that Transense Technologies received a tax benefit of UK£300k. This arose due to the availability approximately UK£20m of Corporation Tax losses which could be brought forward from prior years, which are available for offset against future earnings. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man.

Of course, prima facie it's great to receive a tax benefit and shareholders would undoubtedly agree. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On Transense Technologies' Profit Performance

Transense Technologies' accrual ratio indicates weak cashflow relative to earnings, which perhaps arises in part from the tax benefit it received this year. If the tax benefit is not repeated, then profit would drop next year, all else being equal. Considering all this we'd argue Transense Technologies' profits probably give an overly generous impression of its sustainable level of profitability. If you want to do dive deeper into Transense Technologies, you'd also look into what risks it is currently facing. Be aware that Transense Technologies is showing 3 warning signs in our investment analysis and 1 of those makes us a bit uncomfortable...

Our examination of Transense Technologies has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity , or this list of stocks with high insider ownership .

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Transense Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TRT

Transense Technologies

Engages in the provision of specialist sensor systems in the United Kingdom, North America, South America, Australia, Europe, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)