- United Kingdom

- /

- Auto Components

- /

- AIM:TRT

Here's Why We Think Transense Technologies (LON:TRT) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Transense Technologies (LON:TRT). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Transense Technologies

How Fast Is Transense Technologies Growing Its Earnings Per Share?

In the last three years Transense Technologies' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Impressively, Transense Technologies' EPS catapulted from UK£0.054 to UK£0.09, over the last year. It's not often a company can achieve year-on-year growth of 68%. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

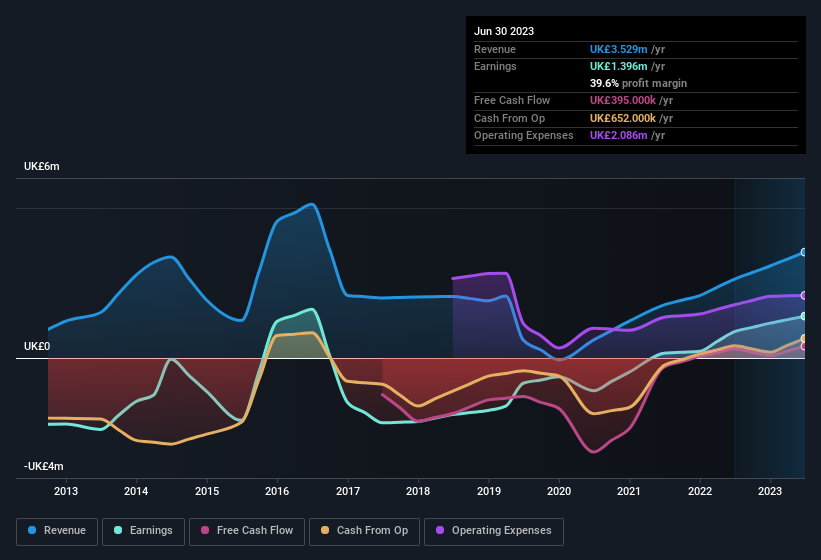

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Transense Technologies shareholders can take confidence from the fact that EBIT margins are up from 8.1% to 27%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Transense Technologies isn't a huge company, given its market capitalisation of UK£18m. That makes it extra important to check on its balance sheet strength.

Are Transense Technologies Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Transense Technologies insiders both bought and sold shares over the last twelve months, but they did end up spending UK£22k more on stock than they received from selling it. When you weigh that up, it is a mild positive, indicating increased alignment between shareholders and management. Zooming in, we can see that the biggest insider purchase was by Executive Chairman Nigel Rogers for UK£8.9k worth of shares, at about UK£0.89 per share.

Does Transense Technologies Deserve A Spot On Your Watchlist?

Transense Technologies' earnings per share growth have been climbing higher at an appreciable rate. Growth-minded people will be intrigued by the incredible movement in EPS growth. And may very well signal a significant inflection point for the business. If this these factors intrigue you, then an addition of Transense Technologies to your watchlist won't go amiss. Before you take the next step you should know about the 3 warning signs for Transense Technologies (1 is a bit concerning!) that we have uncovered.

The good news is that Transense Technologies is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Transense Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TRT

Transense Technologies

Engages in the provision of specialist sensor systems in the United Kingdom, North America, South America, Australia, Europe, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion