- United Kingdom

- /

- Auto Components

- /

- AIM:JNEO

Frontier Developments Leads The Way Among 3 UK Penny Stocks

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower following weak trade data from China, highlighting the interconnectedness of global economies. Amid these broader market fluctuations, investors may find opportunities in penny stocks—an investment area that remains relevant despite its somewhat outdated name. These stocks often represent smaller or newer companies and can offer growth potential at lower price points when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £3.98 | £447.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.55 | £367.58M | ✅ 5 ⚠️ 3 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.44 | £183.39M | ✅ 5 ⚠️ 2 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.769 | £64.71M | ✅ 4 ⚠️ 3 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.43 | £427.11M | ✅ 2 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.95 | £304.69M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.07 | £170.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.32 | £72.49M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 406 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Frontier Developments (AIM:FDEV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frontier Developments plc is a company that develops and publishes video games for the interactive entertainment sector, with a market cap of £113.53 million.

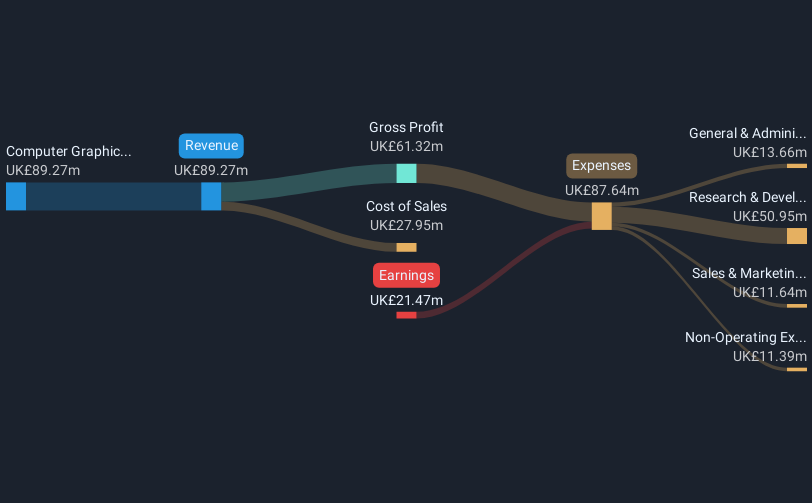

Operations: The company generates revenue primarily from its Computer Graphics segment, which accounted for £88.88 million.

Market Cap: £113.53M

Frontier Developments plc, with a market cap of £113.53 million, has shown signs of financial stability and growth potential despite recent challenges. The company became profitable in the past year, although its earnings have declined by 47% annually over the last five years. Its price-to-earnings ratio of 7.1x is below the UK market average, indicating potentially good value for investors seeking undervalued opportunities. Recent strategic moves include establishing an Executive Board to enhance operational efficiency and announcing Jurassic World Evolution 3's release, which could drive future revenue growth alongside its robust short-term asset position (£53.1M).

- Click here and access our complete financial health analysis report to understand the dynamics of Frontier Developments.

- Gain insights into Frontier Developments' outlook and expected performance with our report on the company's earnings estimates.

Journeo (AIM:JNEO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Journeo plc offers solutions for the transport sector by capturing, processing, and displaying critical information to improve travel experiences in the UK and globally, with a market cap of £58.38 million.

Operations: The company's revenue is primarily derived from its Fleet Systems segment at £23.69 million, followed by Infotec at £12.42 million, Passenger Systems contributing £9.50 million, and Journeo A/S generating £4.03 million.

Market Cap: £58.38M

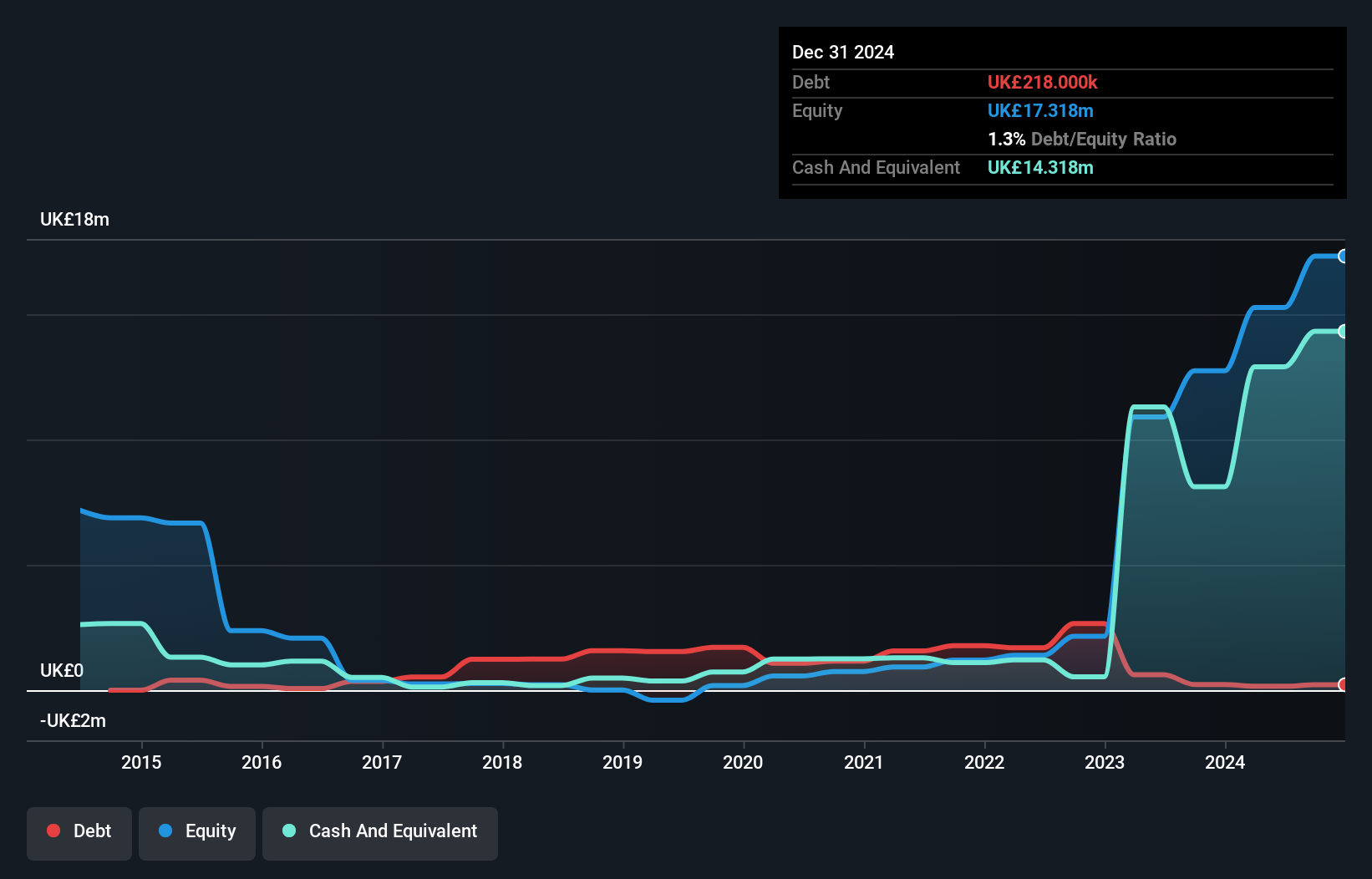

Journeo plc, with a market cap of £58.38 million, displays financial resilience and growth potential within the transport sector. The company's recent EUR 4.2 million order from Alstom SA for CCTV and APC systems highlights its strategic partnerships and revenue prospects, expected to be recognized mainly in FY26 and FY27. With strong short-term assets (£33.7M) covering liabilities (£17.1M), high Return on Equity (26.1%), and significant debt reduction over five years, Journeo's financial health is robust. Its price-to-earnings ratio of 12.9x suggests good value compared to the UK market average of 16.5x, appealing to value-focused investors.

- Take a closer look at Journeo's potential here in our financial health report.

- Gain insights into Journeo's historical outcomes by reviewing our past performance report.

Litigation Capital Management (AIM:LIT)

Simply Wall St Financial Health Rating: ★★★★☆☆

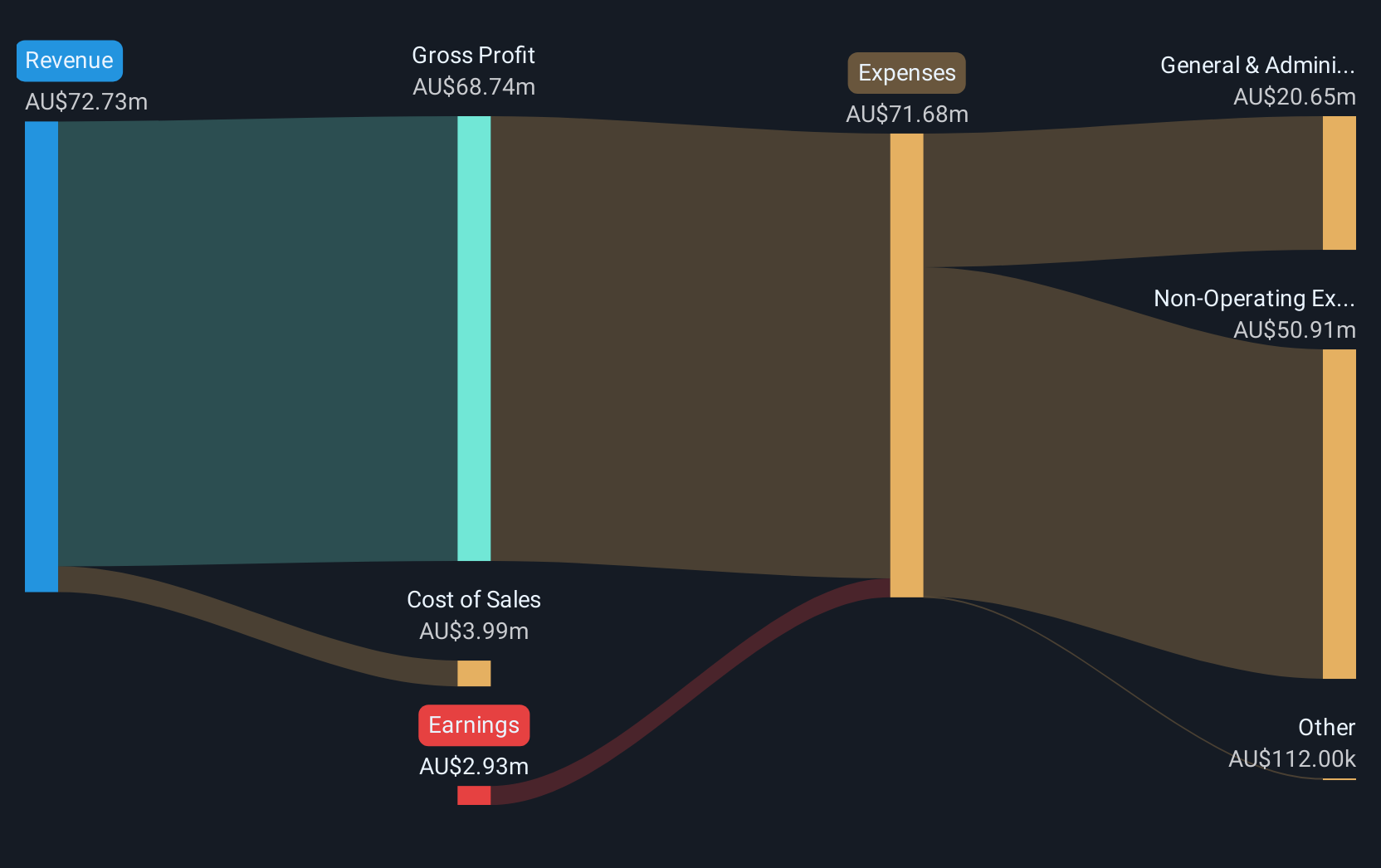

Overview: Litigation Capital Management Limited offers dispute finance and risk management services in Australia and the United Kingdom, with a market cap of £50.14 million.

Operations: There are no specific revenue segments reported for this company.

Market Cap: £50.14M

Litigation Capital Management Limited, with a market cap of £50.14 million, is trading at a significant discount to its estimated fair value. Despite being unprofitable, the company has reduced losses by 20.8% annually over five years and forecasts earnings growth of 95.3% per year. Recent earnings reports show revenue of A$7.41 million for Q2 2024, down from A$21.88 million the previous year, alongside an A$8.35 million net loss. Short-term assets (A$557.8M) comfortably cover both short-term (A$17.6M) and long-term liabilities (A$407.3M), indicating solid liquidity despite negative operating cash flow impacting debt coverage.

- Unlock comprehensive insights into our analysis of Litigation Capital Management stock in this financial health report.

- Assess Litigation Capital Management's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Embark on your investment journey to our 406 UK Penny Stocks selection here.

- Contemplating Other Strategies? These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JNEO

Journeo

Provides solutions to the transport community that captures, processes, and displays essential information to enhance journeys in the United Kingdom and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives