- United Kingdom

- /

- Auto Components

- /

- AIM:ABDP

AB Dynamics plc Just Missed Earnings - But Analysts Have Updated Their Models

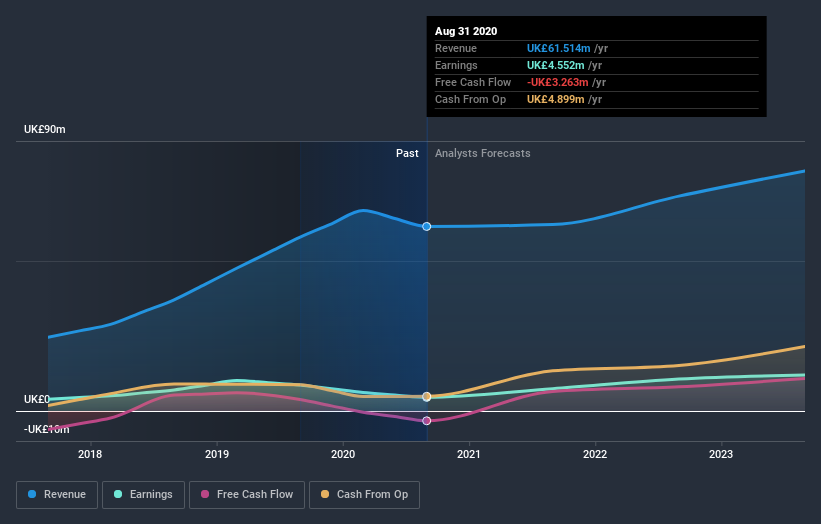

There's been a notable change in appetite for AB Dynamics plc (LON:ABDP) shares in the week since its yearly report, with the stock down 15% to UK£18.10. It looks like a pretty bad result, all things considered. Although revenues of UK£62m were in line with analyst predictions, statutory earnings fell badly short, missing estimates by 28% to hit UK£0.20 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for AB Dynamics

Following last week's earnings report, AB Dynamics' seven analysts are forecasting 2021 revenues to be UK£62.2m, approximately in line with the last 12 months. Per-share earnings are expected to jump 63% to UK£0.33. In the lead-up to this report, the analysts had been modelling revenues of UK£67.2m and earnings per share (EPS) of UK£0.40 in 2021. From this we can that sentiment has definitely become more bearish after the latest results, leading to lower revenue forecasts and a real cut to earnings per share estimates.

Despite the cuts to forecast earnings, there was no real change to the UK£21.67 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on AB Dynamics, with the most bullish analyst valuing it at UK£23.00 and the most bearish at UK£20.00 per share. This is a very narrow spread of estimates, implying either that AB Dynamics is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that AB Dynamics' revenue growth is expected to slow, with forecast 1.0% increase next year well below the historical 30%p.a. growth over the last five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 10% next year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than AB Dynamics.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for AB Dynamics. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple AB Dynamics analysts - going out to 2023, and you can see them free on our platform here.

We don't want to rain on the parade too much, but we did also find 1 warning sign for AB Dynamics that you need to be mindful of.

If you’re looking to trade AB Dynamics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:ABDP

AB Dynamics

Provides vehicle test development and verification products and services for driver assistance systems.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)