- France

- /

- Renewable Energy

- /

- ENXTPA:NEOEN

Did Business Growth Power Neoen's (EPA:NEOEN) Share Price Gain of 118%?

Unfortunately, investing is risky - companies can and do go bankrupt. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Neoen S.A. (EPA:NEOEN) share price has soared 118% return in just a single year. On top of that, the share price is up 51% in about a quarter. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

View our latest analysis for Neoen

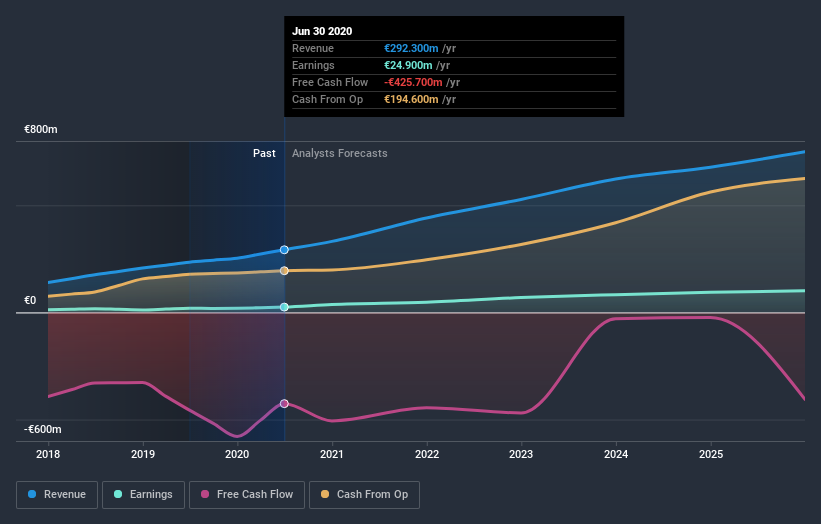

Given that Neoen only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Neoen grew its revenue by 25% last year. We respect that sort of growth, no doubt. While that revenue growth is pretty good the share price performance outshone it, with a lift of 118% as mentioned above. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. Of course, we are always cautious about succumbing to 'fear of missing out' when a stock has shot up strongly.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Neoen will earn in the future (free profit forecasts).

A Different Perspective

Neoen boasts a total shareholder return of 118% for the last year. And the share price momentum remains respectable, with a gain of 51% in the last three months. This suggests the company is continuing to win over new investors. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Neoen (1 makes us a bit uncomfortable) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you’re looking to trade Neoen, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Neoen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:NEOEN

Neoen

An independent renewable energy production company, engages in the development and operation of renewable energy power plants.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives