- France

- /

- Electric Utilities

- /

- ENXTPA:ELEC

Uncovering 3 Undiscovered European Gems with Promising Potential

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index rises on easing trade tensions and optimism over potential U.S. interest rate cuts, investors are increasingly looking towards small-cap stocks for opportunities amidst a backdrop of mixed economic signals across the continent. In this environment, identifying promising companies often involves assessing their resilience to macroeconomic fluctuations and their ability to capitalize on emerging market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme provides electricity and natural gas services to individuals, businesses, and local authorities in France, with a market cap of approximately €1.18 billion.

Operations: Revenue primarily stems from the production and marketing of electricity and gas, amounting to €1.12 billion, followed by consumption activities at €311.39 million. The net profit margin reflects the company's profitability trends over time.

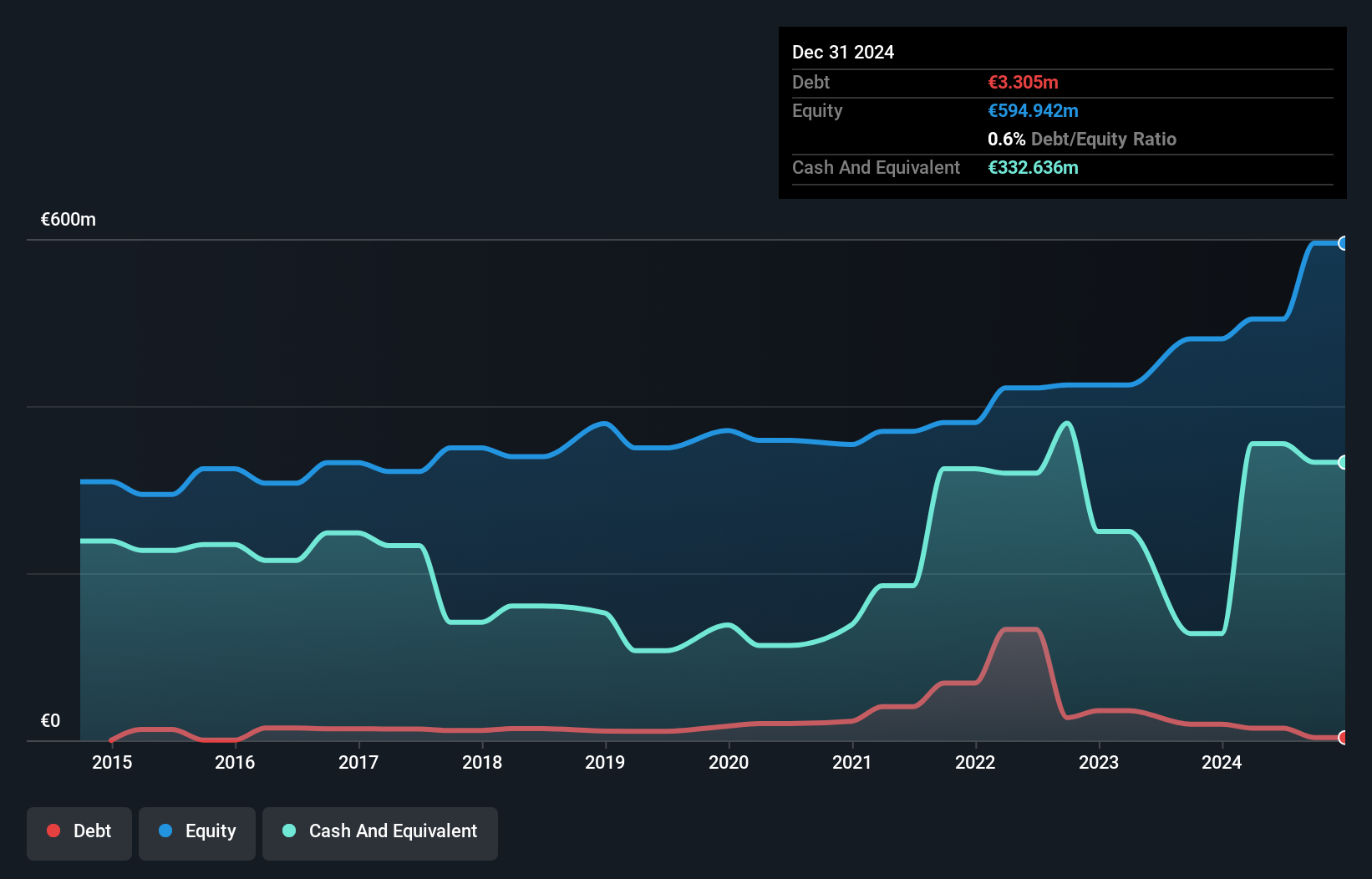

With earnings growth of 61% over the past year, Électricite de Strasbourg Société Anonyme outpaced the Electric Utilities industry average of 1.3%, highlighting its robust performance. The company's debt to equity ratio has impressively decreased from 4.6 to 0.6 over five years, indicating a strong balance sheet position with cash exceeding total debt levels. Trading at approximately 76% below estimated fair value suggests potential undervaluation in the market, while high-quality earnings and solid interest coverage further underscore its financial health and operational efficiency within the sector.

Harvia Oyj (HLSE:HARVIA)

Simply Wall St Value Rating: ★★★★★☆

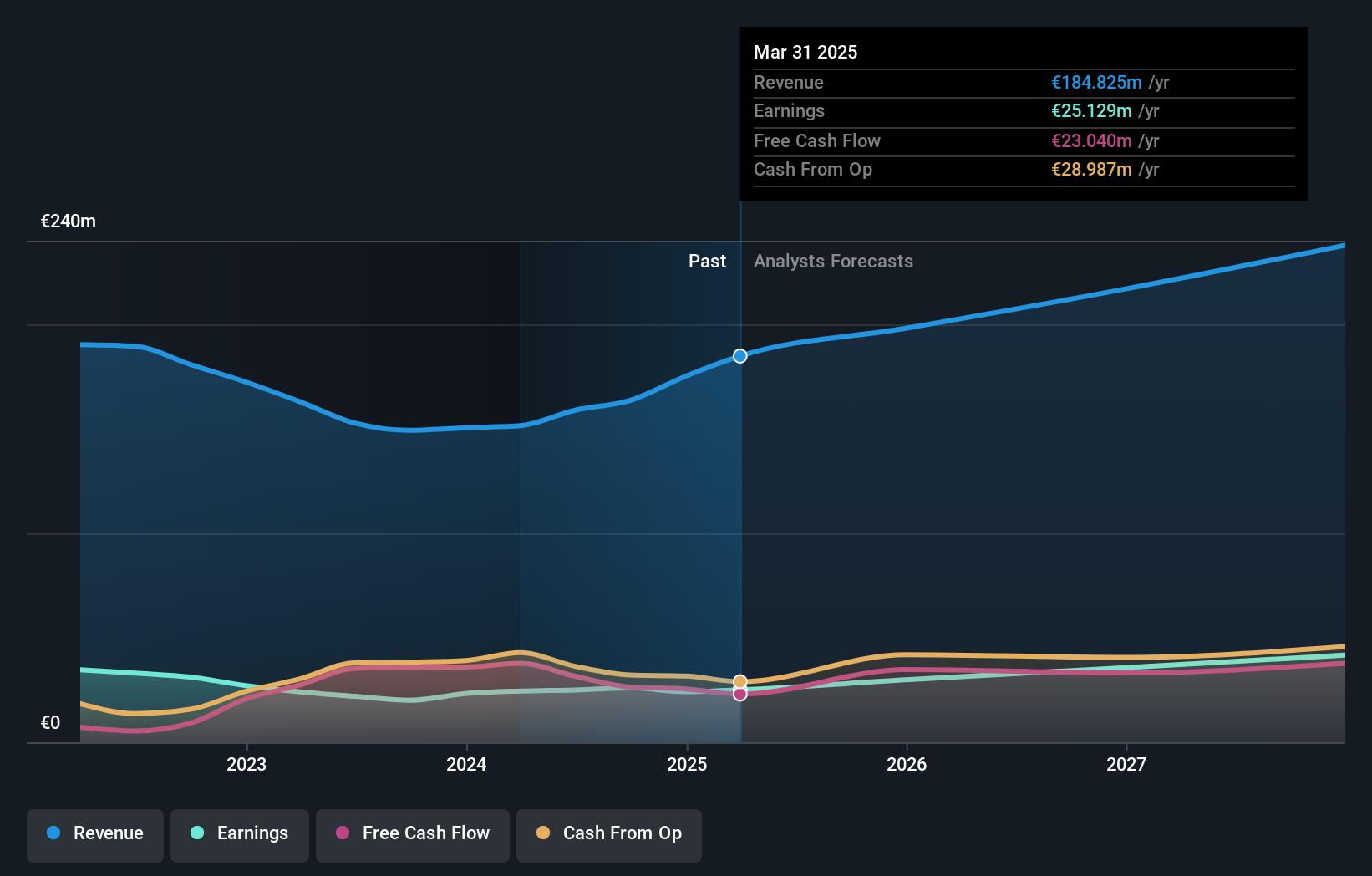

Overview: Harvia Oyj is a company focused on the sauna industry, with a market capitalization of €743.88 million.

Operations: Harvia Oyj generates revenue primarily from its Building Materials - HVAC Equipment segment, totaling €188.89 million.

Harvia Oyj, a niche player in the sauna and spa industry, is strategically expanding into emerging markets to capture global wellness demand. Recent collaborations, like the one with Toyota for hydrogen-powered saunas, highlight its commitment to innovation and sustainability. Despite challenges such as high debt levels (net debt to equity ratio at 43.3%) and negative earnings growth of 5.5% last year, Harvia's EBIT covers interest payments 6.6 times over, indicating strong financial health. The company trades at 36.9% below estimated fair value, suggesting potential upside if it can navigate competitive pressures and operational costs effectively.

Rainbow Tours (WSE:RBW)

Simply Wall St Value Rating: ★★★★★★

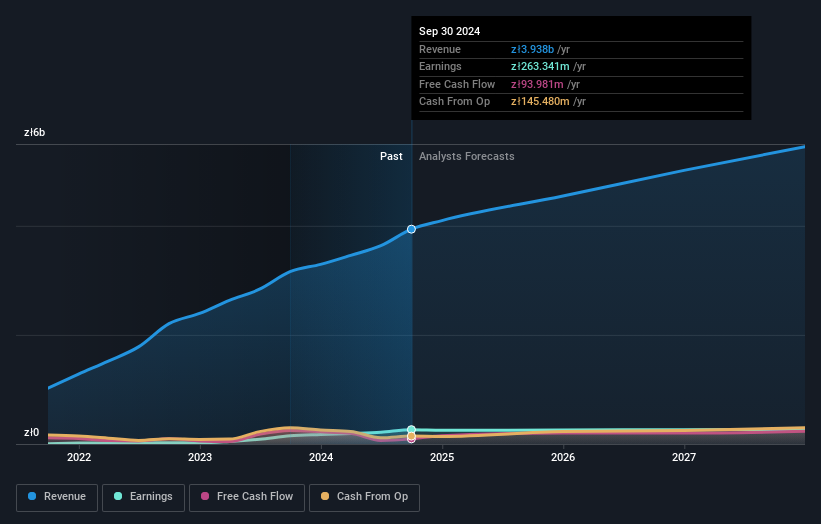

Overview: Rainbow Tours S.A. is a tour operator providing travel services in Poland and several international markets, with a market capitalization of PLN 2.11 billion.

Operations: Rainbow Tours generates revenue primarily from its tour operator activities in Poland, amounting to PLN 4.14 billion, and foreign operations contributing PLN 161.84 million. The company's financial performance is influenced by various segment adjustments totaling PLN -93.58 million.

Rainbow Tours, a dynamic player in the travel sector, has shown impressive financial strides. Over the past year, their earnings surged by 58%, outpacing the hospitality industry’s 10% growth. The company's debt-to-equity ratio significantly improved from 102% to just under 10% over five years, reflecting sound financial management. Trading at a discount of around 40% below its estimated fair value, Rainbow Tours offers attractive valuation prospects. Recent earnings reports highlighted strong performance with net income rising to PLN 59 million from PLN 39 million year-on-year for Q1. However, an anticipated earnings decline averaging nearly 9% annually over three years suggests cautious optimism is warranted moving forward.

Next Steps

- Reveal the 333 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Électricite de Strasbourg Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELEC

Électricite de Strasbourg Société Anonyme

Engages in the supply of electricity and natural gas to individuals, businesses, and local authorities in France.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)