- France

- /

- Telecom Services and Carriers

- /

- ENXTPA:ALMEX

Mexedia (ENXTPA:ALMEX) Discounted vs Peers, But 5-Year Losses Challenge Value Narrative

Reviewed by Simply Wall St

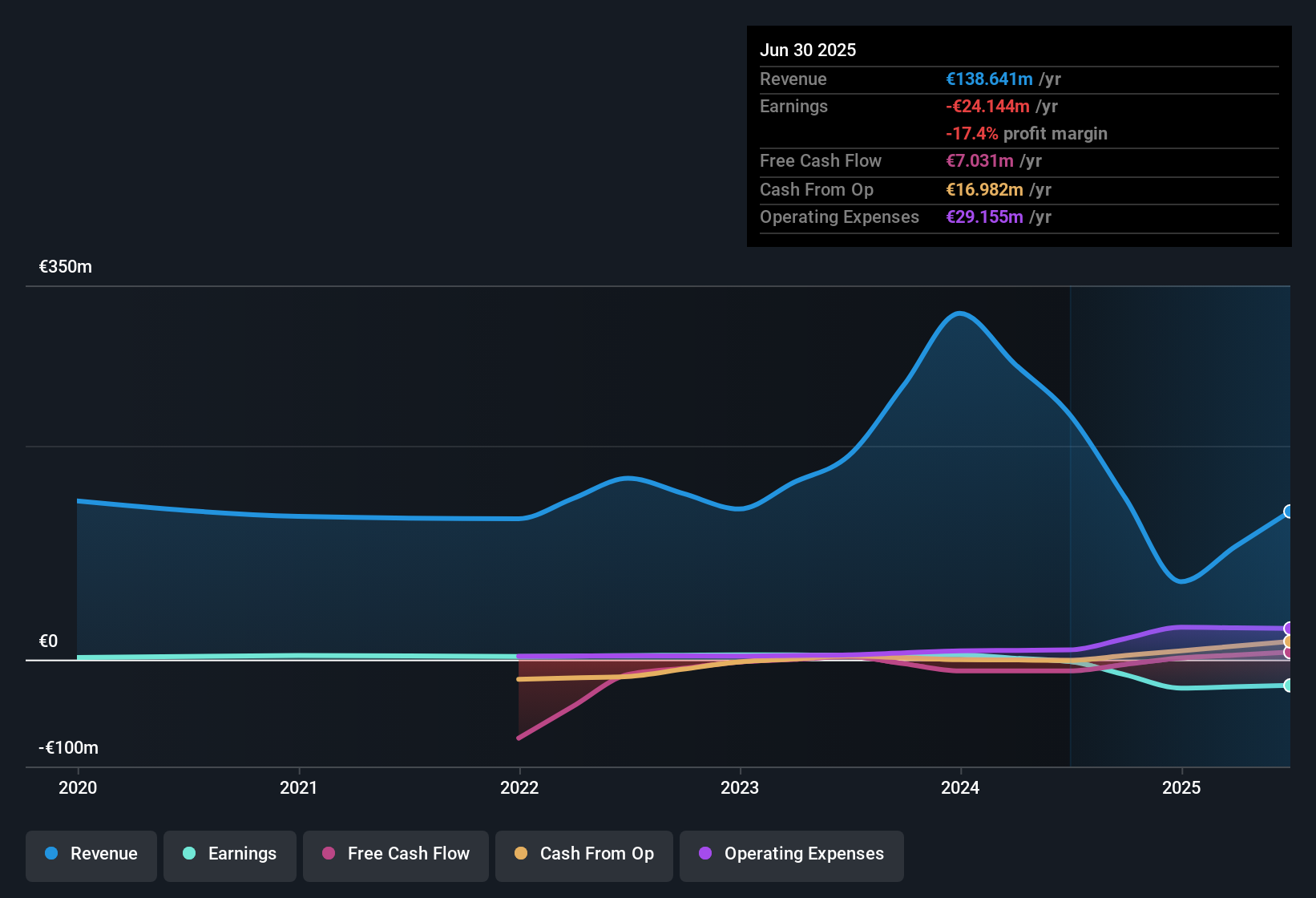

Mexedia Società Per Azioni S.B (ENXTPA:ALMEX) is trading at a Price-To-Sales Ratio of 1.2x, which is below its peer average of 2.1x and aligns with the broader European Telecom industry. Despite this apparent value, the company remains unprofitable, with losses widening at an average annual rate of 84.1% over the past five years. Margins have not improved, and ongoing instability in the share price means profitability remains elusive for investors looking for a sustained turnaround.

See our full analysis for Mexedia Società Per Azioni S.B.Now, let’s see how this earnings performance compares with the most closely watched narratives on Simply Wall St. Some will align, while others may be reconsidered.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Accelerate Despite Valuation Discount

- ALMEX's losses have grown at an average annual rate of 84.1% over the past five years, significantly outpacing any gains suggested by its Price-To-Sales Ratio of 1.2x.

- Rather than aligning with hopes for a turnaround, the narrative that recent strategic initiatives or sector momentum might reverse the trend faces challenges, as net profit margin has not improved and the company has not generated high-quality earnings.

- This rapid widening of losses points to ongoing business pressures that weigh against the idea of immediate recovery.

- Investors looking for value based solely on the price discount may overlook persistent underlying challenges to profitability.

Profit Margin Stagnation Raises Red Flags

- The company’s net profit margin remains unchanged, offering no improvement despite expanding initiatives and continued investment.

- Bears argue this lack of margin progress serves as a caution for would-be value investors, since unstable margins often reflect unresolved structural or operational issues.

- Persistent negative profitability means ALMEX is yet to deliver on any turnaround hopes.

- Share price instability in the last three months further emphasizes market skepticism about an imminent recovery.

Discounted Valuation: Opportunity or Trap?

- With its Price-To-Sales Ratio at 1.2x, noticeably below the peer average of 2.1x and near the broader industry, ALMEX screens as undervalued on relative multiples.

- However, the prevailing market view is that while these discounted multiples might attract bargain hunters, ongoing and accelerating losses create a gap that the valuation alone does not bridge.

- Lack of evidence for revenue or earnings growth leaves the discount potentially justified in the absence of a path to profitability.

- Stability concerns and absence of financial improvement mean the market may continue to demand a discount until operational issues are addressed.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Mexedia Società Per Azioni S.B's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Mexedia’s widening losses, stagnant profit margins, and ongoing instability highlight structural challenges that make a turnaround difficult and profits elusive.

If you want to focus on companies with consistent earnings and more predictable financial outcomes, set your sights on stable growth stocks screener (2090 results) to find businesses delivering reliable growth through cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALMEX

Mexedia Società Per Azioni S.B

Engages in the provision of technologies for the telecommunications and business services sector in Italy.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives