- Italy

- /

- Commercial Services

- /

- BIT:DOV

3 European Stocks Estimated To Be Up To 45.3% Below Intrinsic Value

Reviewed by Simply Wall St

As European markets navigate mixed performances amid global growth concerns and a stronger euro, investors are increasingly focused on identifying stocks that may be undervalued relative to their intrinsic value. In such an environment, assessing stocks with strong fundamentals and potential for growth can be particularly appealing for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK44.12 | SEK86.24 | 48.8% |

| Trifork Group (CPSE:TRIFOR) | DKK88.70 | DKK172.07 | 48.5% |

| STMicroelectronics (ENXTPA:STMPA) | €22.26 | €43.44 | 48.8% |

| SIT (BIT:SIT) | €1.695 | €3.37 | 49.7% |

| Norconsult (OB:NORCO) | NOK46.50 | NOK92.12 | 49.5% |

| Lingotes Especiales (BME:LGT) | €5.80 | €11.31 | 48.7% |

| Camurus (OM:CAMX) | SEK733.50 | SEK1416.78 | 48.2% |

| Atea (OB:ATEA) | NOK143.80 | NOK280.43 | 48.7% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.93 | €3.80 | 49.2% |

| adidas (XTRA:ADS) | €178.10 | €351.81 | 49.4% |

We're going to check out a few of the best picks from our screener tool.

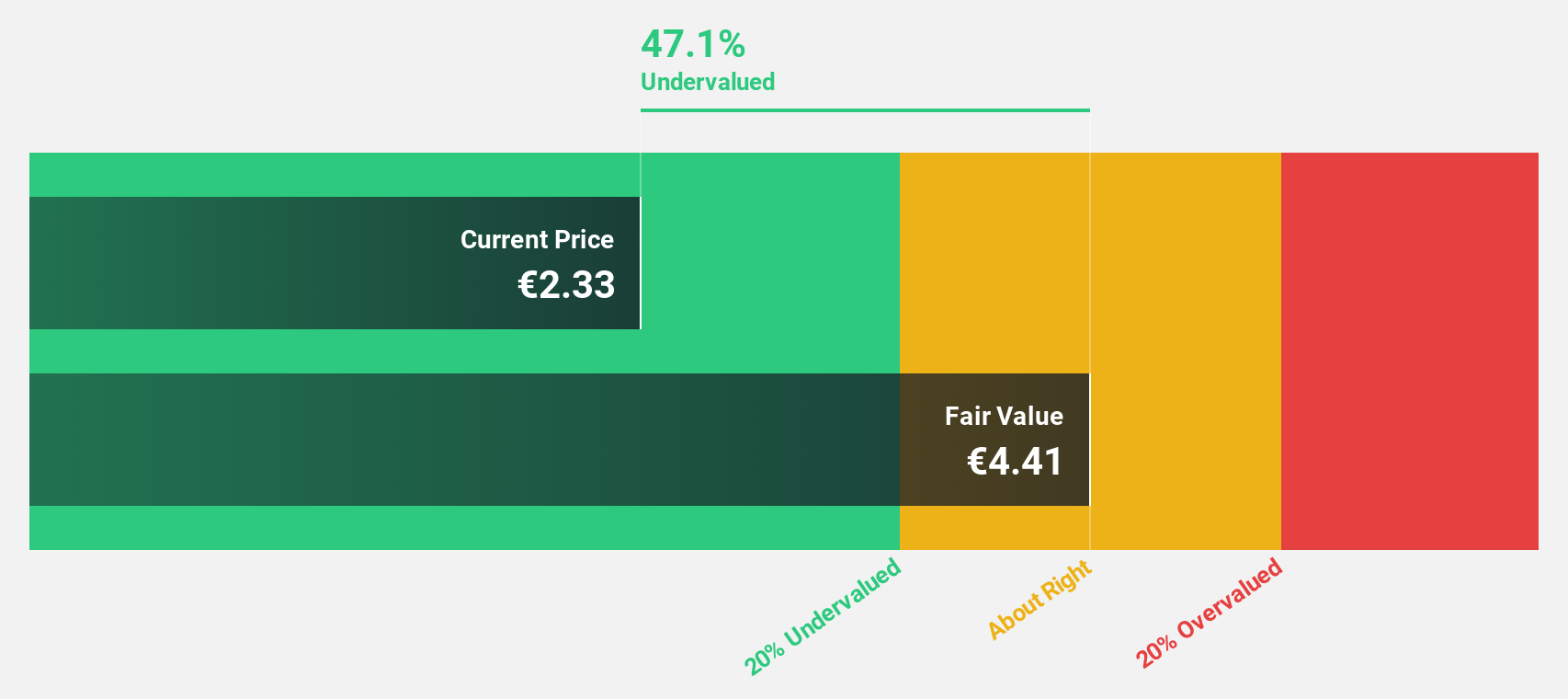

doValue (BIT:DOV)

Overview: doValue S.p.A. specializes in managing non-performing loans, unlikely to pay, early arrears, and performing loans for banks and investors across Italy, Spain, Greece, and Cyprus with a market cap of €548.47 million.

Operations: The company's revenue is derived from managing non-performing loans, unlikely to pay accounts, early arrears, and performing loans for financial institutions and investors in Italy, Spain, Greece, and Cyprus.

Estimated Discount To Fair Value: 45.3%

doValue, trading at €2.89, is significantly undervalued against its estimated fair value of €5.29, presenting a potential opportunity based on discounted cash flow analysis. Despite recent volatility and substantial shareholder dilution, the company is expected to achieve profitability within three years with earnings growth forecasted at 88.39% annually. However, interest payments remain poorly covered by earnings and recent financials showed a net loss of €4.05 million for H1 2025 despite increased revenue to €281.67 million from the previous year.

- According our earnings growth report, there's an indication that doValue might be ready to expand.

- Take a closer look at doValue's balance sheet health here in our report.

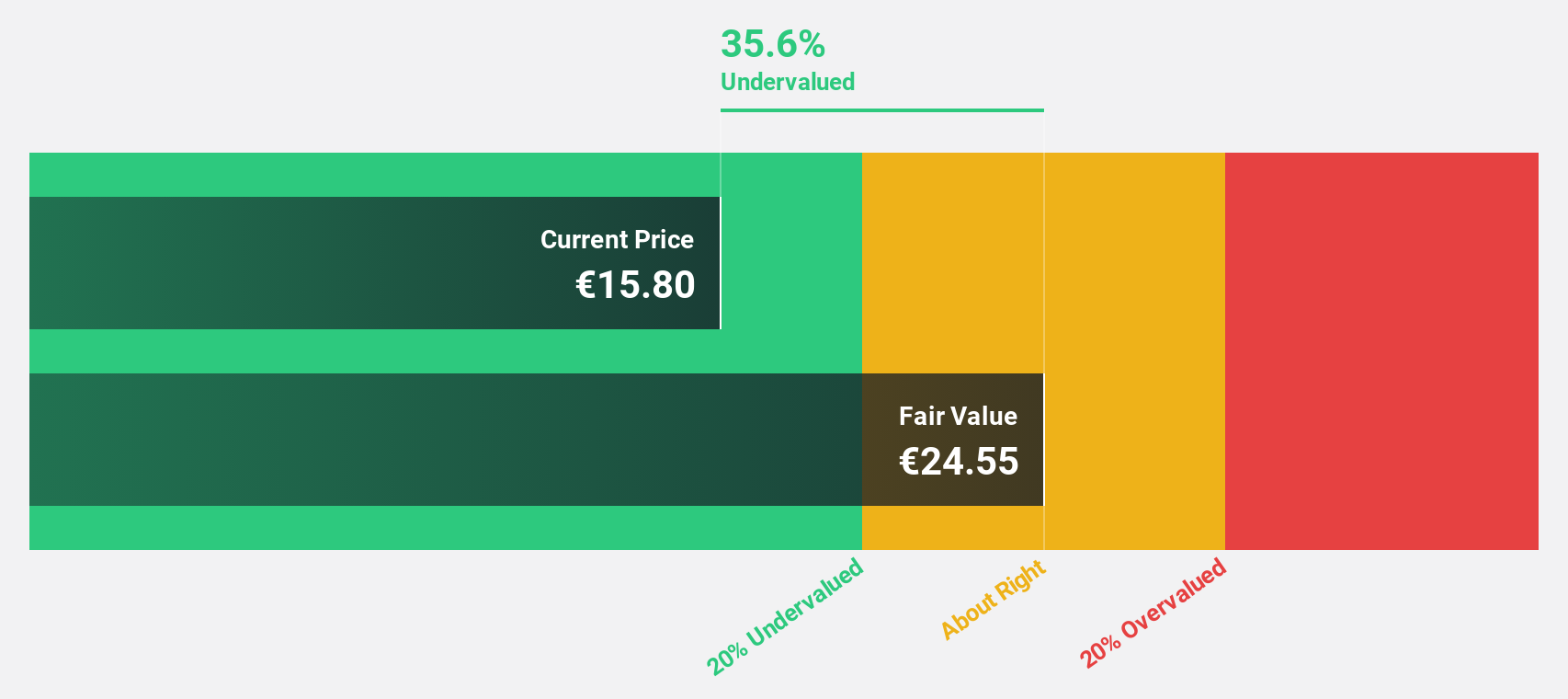

Lumibird (ENXTPA:LBIRD)

Overview: Lumibird SA designs, manufactures, and sells a range of lasers for scientific, industrial, and medical applications with a market cap of €380.76 million.

Operations: The company's revenue is primarily derived from its Medical segment, generating €107.75 million, and its Photonic segment, contributing €99.37 million.

Estimated Discount To Fair Value: 35%

Lumibird, trading at €17.3, is significantly undervalued compared to its estimated fair value of €26.61, suggesting potential based on discounted cash flow analysis. Earnings are forecast to grow 38.2% annually, outpacing the French market's growth rate of 12.1%. However, revenue growth is slower at 7.4% per year and large one-off items have impacted financial results recently. Despite these challenges, Lumibird remains a compelling option for investors seeking undervalued opportunities in Europe.

- Our comprehensive growth report raises the possibility that Lumibird is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Lumibird stock in this financial health report.

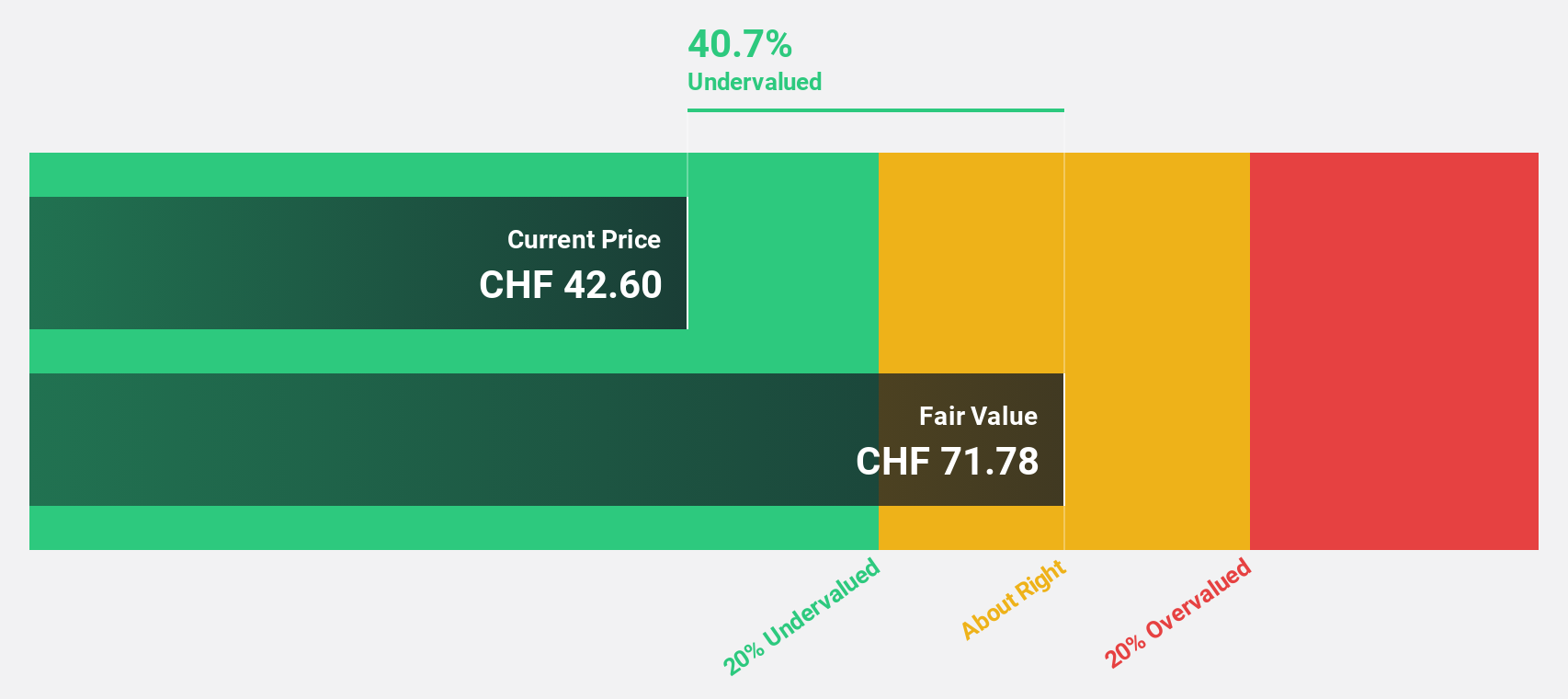

Avolta (SWX:AVOL)

Overview: Avolta AG is a travel retailer company with a market capitalization of CHF6.52 billion.

Operations: The company generates revenue from several regions, with CHF4.21 billion from North America, CHF725 million from Asia Pacific (APAC), CHF1.61 billion from Latin America (LATAM), and CHF7.35 billion from Europe, Middle East and Africa (EMEA).

Estimated Discount To Fair Value: 37.7%

Avolta, priced at CHF44.9, is undervalued compared to its estimated fair value of CHF72.06, presenting potential based on discounted cash flow analysis. Earnings are projected to grow 23.91% annually, surpassing the Swiss market's growth rate of 11.2%. Recent expansions in key airports like Atlanta and San Jose enhance Avolta's retail footprint and revenue prospects, though interest payments remain inadequately covered by earnings and dividend sustainability is a concern with current coverage levels.

- Our growth report here indicates Avolta may be poised for an improving outlook.

- Click here to discover the nuances of Avolta with our detailed financial health report.

Summing It All Up

- Explore the 210 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:DOV

doValue

Engages in the management of non-performing loans (NLP), unlikely to pay (UTP), early arrears, and performing loans for banks and investors in Italy, Spain, Greece, and Cyprus.

High growth potential and fair value.

Market Insights

Community Narratives