- Germany

- /

- Electronic Equipment and Components

- /

- XTRA:BKHT

High Growth Tech Stocks to Watch in January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are navigating a complex landscape marked by mixed performances in major indices and fluctuating economic indicators. Despite recent contractions in manufacturing activity and revisions to GDP forecasts, the U.S. stock market has closed out a strong year with significant gains, setting the stage for investors to closely monitor high-growth tech stocks that could potentially benefit from these dynamic conditions. In such an environment, identifying promising tech stocks often involves looking at companies with innovative solutions and robust growth potential that can adapt to changing market trends and economic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1258 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Sword Group (ENXTPA:SWP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sword Group S.E. is a company that offers IT and software solutions on a global scale, with a market capitalization of €339.89 million.

Operations: Sword Group S.E. generates revenue through IT and software services, primarily in regions such as Belux (€104.26 million), Switzerland (€105.75 million), and the United Kingdom (€88.88 million).

Sword Group, navigating the competitive landscape of IT services, has demonstrated robust financial and operational performance. With a 23.2% increase in earnings over the past year outpacing the industry's -4%, Sword Group showcases its ability to exceed sector norms significantly. This growth is complemented by an 18.8% forecast in annual earnings growth, which surpasses the French market's expectation of 12.2%. Moreover, its commitment to innovation is evident from its R&D investments, crucial for maintaining technological leadership and fueling future growth strategies in a rapidly evolving industry. The firm's revenue trajectory also impresses with a projected annual increase of 13.8%, outstripping the broader French market forecast of 5.5%. This indicates not only resilience but also an effective adaptation to market demands and opportunities such as shifts towards digital transformation solutions that many businesses are currently undertaking. The strategic focus on high-quality earnings and substantial return on equity projected at 24.1% underscores Sword Group’s potential for sustained financial health and shareholder value creation amidst dynamic tech landscapes.

- Get an in-depth perspective on Sword Group's performance by reading our health report here.

Examine Sword Group's past performance report to understand how it has performed in the past.

CS Communication & Systemes (ENXTPA:SX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CS Communication & Systemes SA is a company that specializes in designing, integrating, and operating mission-critical systems globally, with a market capitalization of €281.82 million.

Operations: The company operates in the field of mission-critical systems, focusing on design, integration, and operational services worldwide. With a market capitalization of €281.82 million, it serves various sectors requiring robust and reliable system solutions.

CS Communication & Systemes is carving a niche in the tech sector with its focus on R&D, evidenced by its substantial investment in this area. The company's commitment to innovation is highlighted by an R&D expenditure that represents a significant portion of its revenue, positioning it well for future technological advancements. Despite not being the fastest-growing in its category, CS Communication & Systemes has seen an impressive annualized earnings growth of 88.2%, outpacing many peers. Moreover, with revenues growing at 10.4% annually—twice as fast as the broader French market—the firm is successfully leveraging industry trends towards advanced tech solutions to secure a stronger market position. This strategic approach suggests promising prospects for sustaining its growth trajectory amidst evolving industry dynamics.

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG is a private equity firm with a market capitalization of €243.43 million.

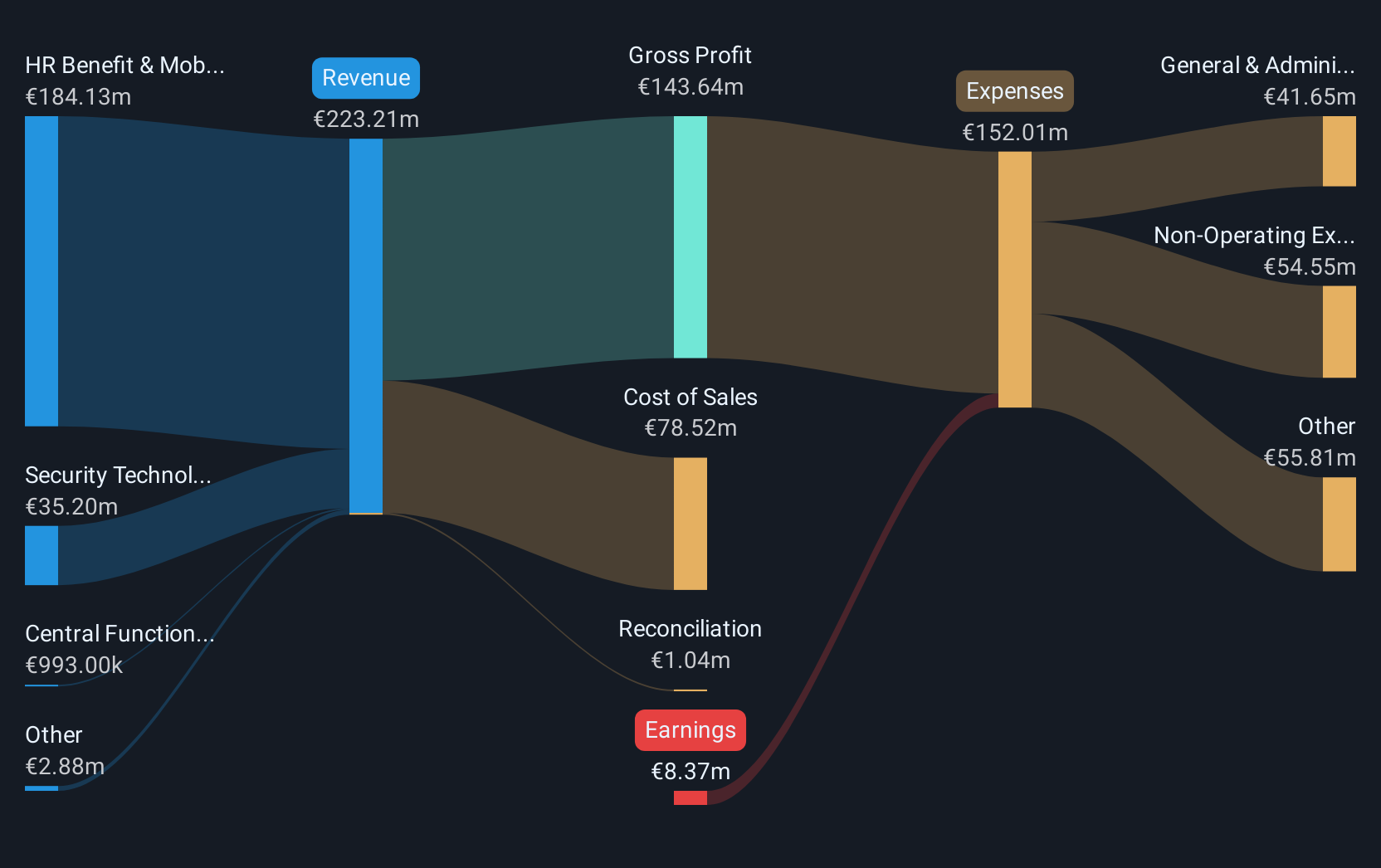

Operations: Brockhaus Technologies AG generates revenue primarily through its HR Benefit & Mobility Platform, contributing €184.13 million, and its Security Technologies segment, adding €35.20 million. The company incurs costs for Central Functions amounting to €0.99 million.

Brockhaus Technologies is navigating the high-tech landscape with a focus on turning around its financials, as evidenced by its forecasted shift from unprofitability to profitability within three years. This transition is underpinned by an impressive projected annual earnings growth of 114.4%, significantly outpacing the broader market expectations. Despite current challenges, such as a net loss reported in the recent earnings for the nine months ending September 2024, Brockhaus maintains a robust R&D commitment which not only reflects in its substantial revenue growth rate of 12.6% but also positions it well amidst evolving tech dynamics. The company's strategic emphasis on innovation and development is poised to harness future industry shifts, enhancing its long-term prospects in an increasingly competitive sector.

Turning Ideas Into Actions

- Access the full spectrum of 1258 High Growth Tech and AI Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Brockhaus Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Brockhaus Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BKHT

Excellent balance sheet and good value.