As global markets experience a boost from easing core U.S. inflation and robust bank earnings, major indices like the S&P 500 and Dow Jones Industrial Average have recorded significant gains, signaling a positive shift in investor sentiment. In this environment of optimism, identifying high growth tech stocks becomes crucial as these companies often thrive on innovation and adaptability to changing economic conditions, making them potential standouts amidst broader market trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.43% | 56.40% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 30.02% | 61.89% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture sectors across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market capitalization of €978.38 million.

Operations: The company generates revenue from its industrial intelligence solutions primarily in the Americas (€172.19 million) and Asia-Pacific (€124.33 million) regions.

Despite a challenging year with a 10.8% dip in earnings, Lectra's strategic focus on innovation and market adaptation is evident from its R&D commitment, aligning with industry demands for advanced software solutions. The company's recent financial performance reveals resilience; although net income slightly decreased to €22.77 million from €25.87 million year-over-year, Lectra maintains a positive trajectory in revenue growth at 5.6% annually, outpacing the French market average of 5.5%. This growth is underpinned by significant investments in technology development, crucial for sustaining long-term competitiveness in the swiftly evolving tech landscape. Moreover, the firm's robust earnings forecast suggests an anticipated annual profit surge of 25.6%, promising for future prospects amidst global tech intensification.

- Get an in-depth perspective on Lectra's performance by reading our health report here.

Examine Lectra's past performance report to understand how it has performed in the past.

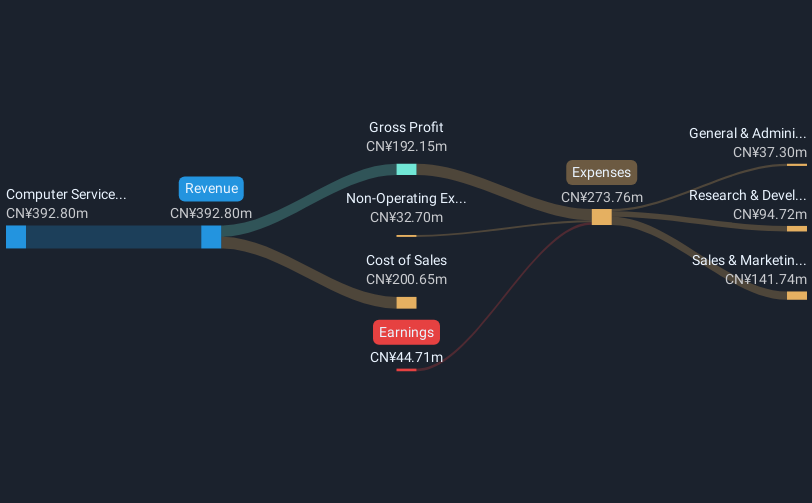

Primeton Information Technologies (SHSE:688118)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Primeton Information Technologies, Inc. specializes in offering professional software foundation platforms and technical services within China, with a market capitalization of approximately CN¥2.04 billion.

Operations: The company generates revenue primarily from its Computer Services segment, amounting to CN¥392.80 million.

Primeton Information Technologies has demonstrated a robust annual revenue growth rate of 24.5%, significantly outpacing the Chinese market average of 13.4%. Despite recent challenges, including a net loss reported at CNY 68.68 million for the nine months ending September 2024, the firm is positioned for an impressive turnaround with earnings expected to grow by 112.17% annually over the next three years. This potential shift towards profitability, coupled with its strategic commitment to innovation—evidenced by substantial R&D investments—positions Primeton as a dynamic player in the tech sector, ready to leverage emerging opportunities despite current volatility in its share price.

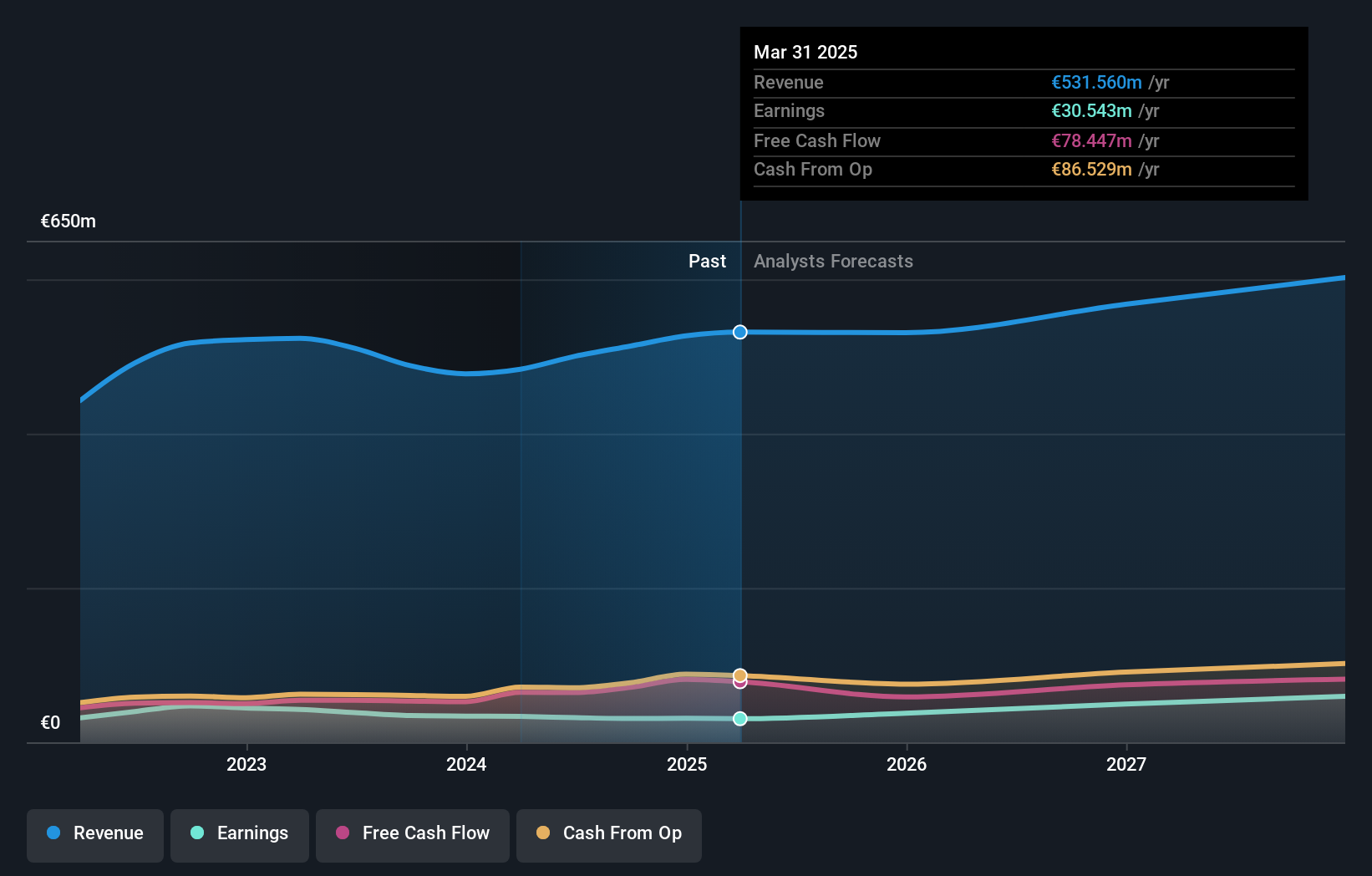

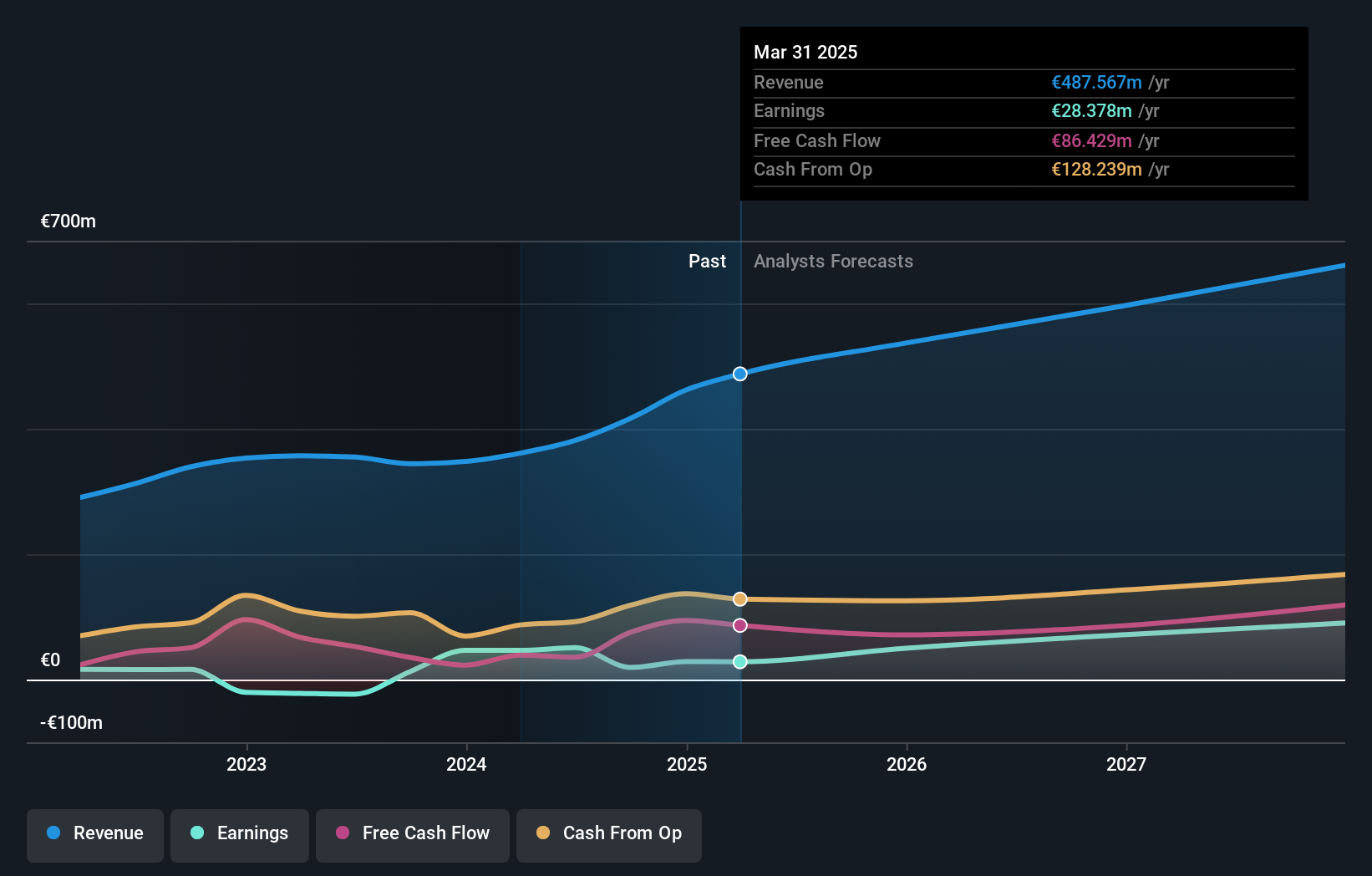

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform facilitating the automated buying and selling of digital advertising space across North America and Europe, with a market capitalization of €552.97 million.

Operations: The company generates revenue primarily through its Supply Side Platforms (SSP) and Demand Side Platforms (DSP), with SSP contributing €367.48 million and DSP €73.36 million.

Verve Group SE's recent financial performance underscores its resilience and adaptability in the tech sector, with a notable increase in sales to EUR 311.88 million from EUR 243.24 million year-over-year, reflecting a robust growth trajectory. Despite a dip in net income to EUR 14.49 million from EUR 41.83 million, the company's strategic initiatives are poised to bolster future profitability, evidenced by an expected earnings growth of 44.4% annually. The appointment of Christian Duus as CFO could further enhance financial strategies given his extensive background in ad-tech and corporate finance, positioning Verve Group well amidst market volatilities and ongoing innovations within the tech landscape.

- Unlock comprehensive insights into our analysis of Verve Group stock in this health report.

Evaluate Verve Group's historical performance by accessing our past performance report.

Key Takeaways

- Discover the full array of 1225 High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:M8G

Verve Group

Operates a software platform for the automated buying and selling of digital advertising space in North America and Europe.

Good value with reasonable growth potential.