- Germany

- /

- Diversified Financial

- /

- XTRA:HYQ

Top Growth Companies With Insider Stakes January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, driven by cooling inflation and strong bank earnings in the U.S., investors are keenly observing growth companies with substantial insider ownership. In this context, stocks with high insider stakes can often signal confidence from those closest to the company's operations, potentially offering unique opportunities amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 35.8% | 112.9% |

Let's uncover some gems from our specialized screener.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★★☆

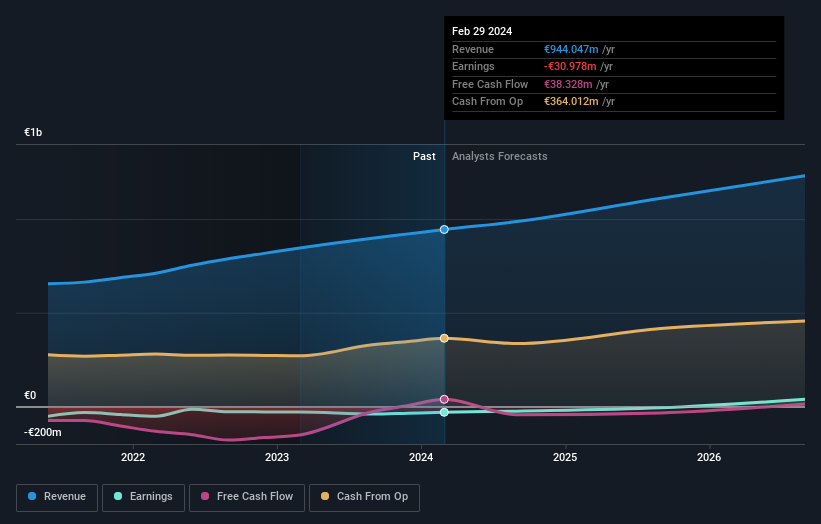

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market capitalization of approximately €1.59 billion.

Operations: The company's revenue segments include Public Cloud at €182.82 million, Private Cloud at €623.53 million, and Web Cloud & Other at €186.71 million.

Insider Ownership: 10.1%

OVH Groupe, with significant insider ownership, is positioned for substantial growth. The company reconfirmed its fiscal 2025 revenue guidance of 9% to 11%, aligning with its forecasted annual profit growth above the market average. Recent product launches, like the third-generation game servers and managed MongoDB services, enhance its cloud offerings and support future expansion. Despite a net loss reduction to €10.3 million in 2024, OVH trades at a notable discount to estimated fair value.

- Get an in-depth perspective on OVH Groupe's performance by reading our analyst estimates report here.

- Our valuation report here indicates OVH Groupe may be undervalued.

International Games SystemLtd (TPEX:3293)

Simply Wall St Growth Rating: ★★★★★☆

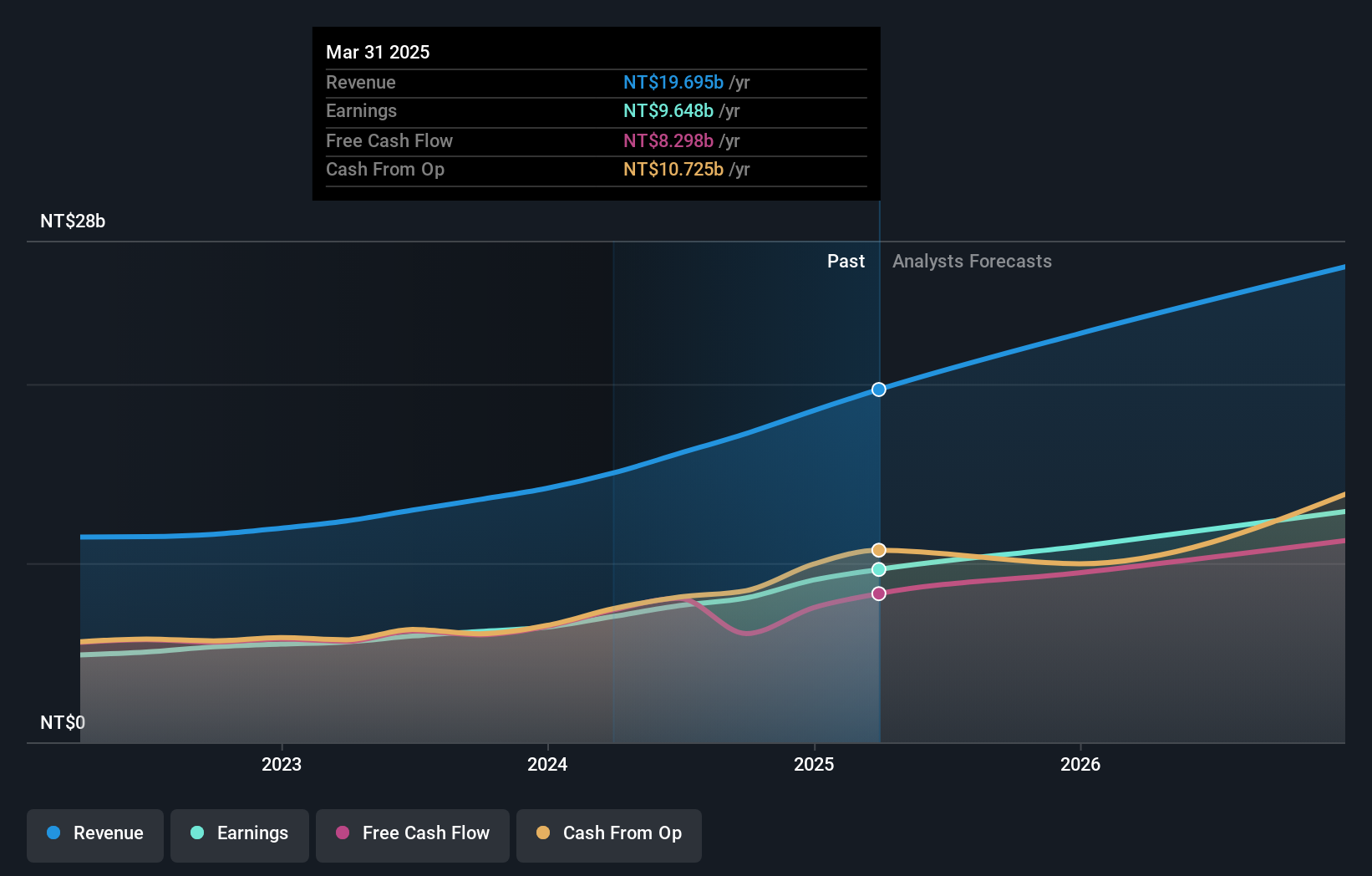

Overview: International Games System Co., Ltd. is involved in the planning, design, research, development, manufacturing, marketing, servicing, and licensing of arcade, online, and mobile games primarily in Taiwan, the United Kingdom, and China with a market cap of NT$267.71 billion.

Operations: The company's revenue segments include NT$10.11 billion from the Online Games Division and NT$7.13 billion from the Business Game Division.

Insider Ownership: 11.3%

International Games System Ltd. demonstrates strong growth potential, with earnings expected to grow significantly over the next three years, outpacing the Taiwan market. Recent results show robust performance, with third-quarter sales rising to TWD 4.70 billion and net income increasing to TWD 2.17 billion year-on-year. Despite high non-cash earnings, insider ownership remains a key factor in its growth strategy, supported by reliable dividend payments of 1.84%.

- Click to explore a detailed breakdown of our findings in International Games SystemLtd's earnings growth report.

- Our valuation report here indicates International Games SystemLtd may be overvalued.

Hypoport (XTRA:HYQ)

Simply Wall St Growth Rating: ★★★★☆☆

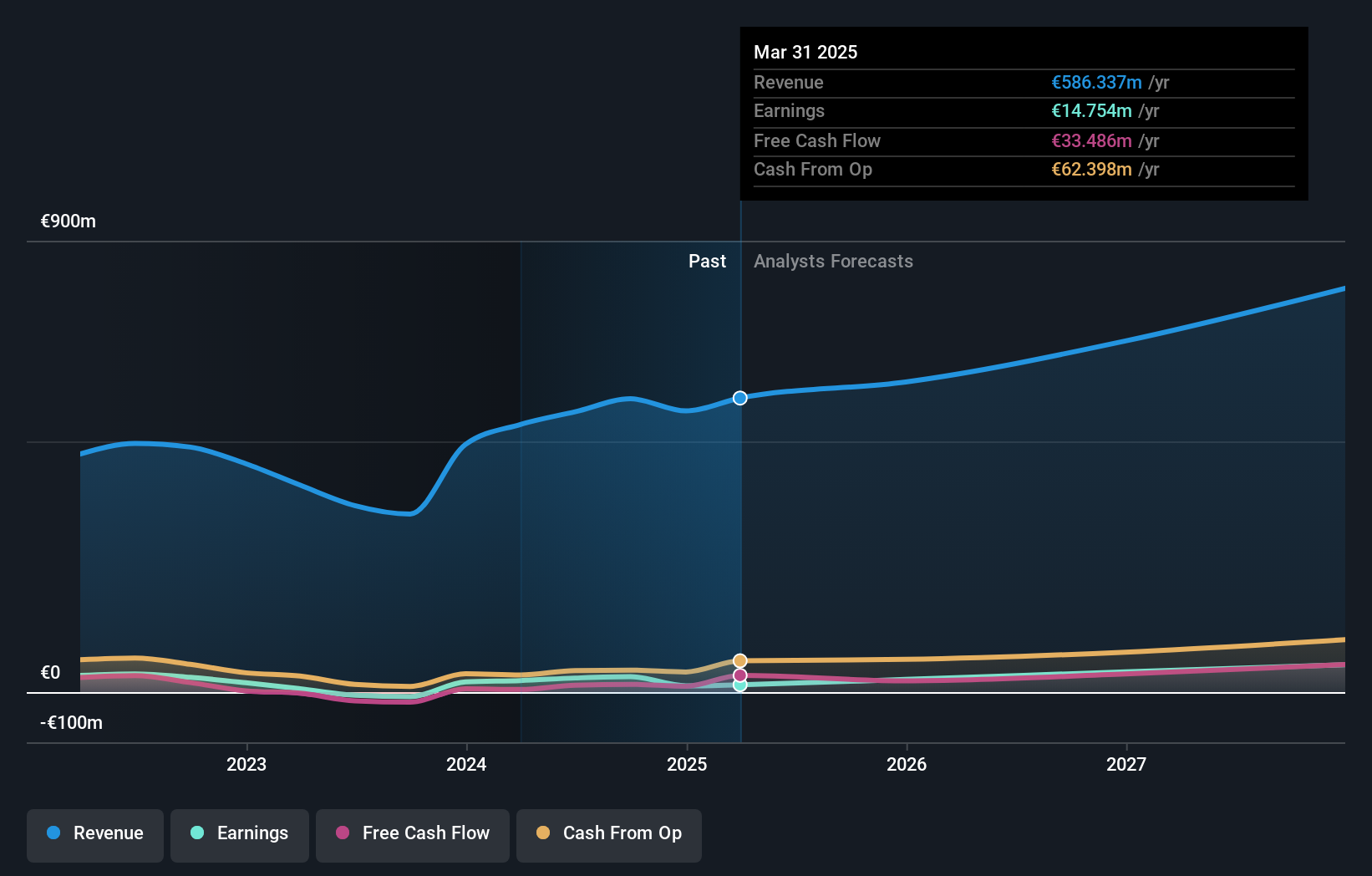

Overview: Hypoport SE is a company that develops and markets technology platforms for the financial services, property, and insurance industries in Germany, with a market cap of approximately €1.34 billion.

Operations: The company's revenue segments include €27.44 million from Holding, €66.60 million from Insurance Platform, and a Segment Adjustment of €359.92 million.

Insider Ownership: 33.5%

Hypoport SE has shown substantial growth, becoming profitable this year with third-quarter sales rising to €113.86 million and net income reaching €1.81 million. Revenue is forecast to grow 11% annually, surpassing the German market's 5.6%. Earnings are expected to increase significantly at nearly 28% per year over the next three years, despite low forecasted return on equity of 11.1%. Insider ownership remains influential in its strategic direction without recent insider trading activity noted.

- Click here to discover the nuances of Hypoport with our detailed analytical future growth report.

- The analysis detailed in our Hypoport valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Embark on your investment journey to our 1471 Fast Growing Companies With High Insider Ownership selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hypoport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HYQ

Hypoport

Develops and markets technology platforms for the financial services, property, and insurance industries in Germany.

Reasonable growth potential with adequate balance sheet.