Despite the downward trend in earnings at Lectra (EPA:LSS) the stock grows 4.5%, bringing five-year gains to 78%

Stock pickers are generally looking for stocks that will outperform the broader market. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, long term Lectra SA (EPA:LSS) shareholders have enjoyed a 64% share price rise over the last half decade, well in excess of the market return of around 47% (not including dividends).

The past week has proven to be lucrative for Lectra investors, so let's see if fundamentals drove the company's five-year performance.

See our latest analysis for Lectra

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

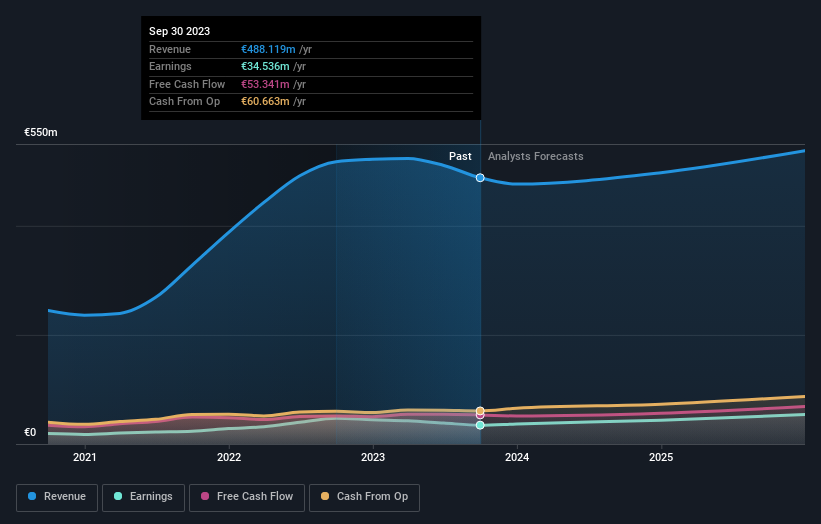

Lectra's earnings per share are down 0.3% per year, despite strong share price performance over five years.

So it's hard to argue that the earnings per share are the best metric to judge the company, as it may not be optimized for profits at this point. Therefore, it's worth taking a look at other metrics to try to understand the share price movements.

We doubt the modest 1.7% dividend yield is attracting many buyers to the stock. In contrast revenue growth of 17% per year is probably viewed as evidence that Lectra is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Lectra stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Lectra the TSR over the last 5 years was 78%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 13% in the last year, Lectra shareholders lost 17% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 12%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Is Lectra cheap compared to other companies? These 3 valuation measures might help you decide.

We will like Lectra better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:LSS

Lectra

Provides industrial intelligence solutions for fashion, automotive, furniture markets, and other industries in Europe, the Americas, the Asia Pacific, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives