3 Stocks That May Be Priced Below Estimated Value In January 2025

Reviewed by Simply Wall St

As we enter 2025, global markets reflect a mix of cautious optimism and economic uncertainty, with U.S. indices closing out a strong year despite recent volatility and mixed signals from manufacturing data. In this environment, identifying stocks that may be priced below their estimated value can present opportunities for investors seeking to navigate the complexities of market fluctuations. Understanding what constitutes a potentially undervalued stock involves assessing factors such as earnings potential, industry position, and broader economic trends highlighted in recent market updates.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Camden National (NasdaqGS:CAC) | US$42.01 | US$83.84 | 49.9% |

| Brickability Group (AIM:BRCK) | £0.626 | £1.25 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$6.00 | CA$11.94 | 49.8% |

| Brunel International (ENXTAM:BRNL) | €9.84 | €19.64 | 49.9% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.73 | €5.44 | 49.8% |

| EnomotoLtd (TSE:6928) | ¥1452.00 | ¥2887.72 | 49.7% |

| Zhende Medical (SHSE:603301) | CN¥20.99 | CN¥41.91 | 49.9% |

| ReadyTech Holdings (ASX:RDY) | A$3.14 | A$6.25 | 49.8% |

| Neosperience (BIT:NSP) | €0.572 | €1.14 | 49.8% |

| Vogo (ENXTPA:ALVGO) | €2.92 | €5.81 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

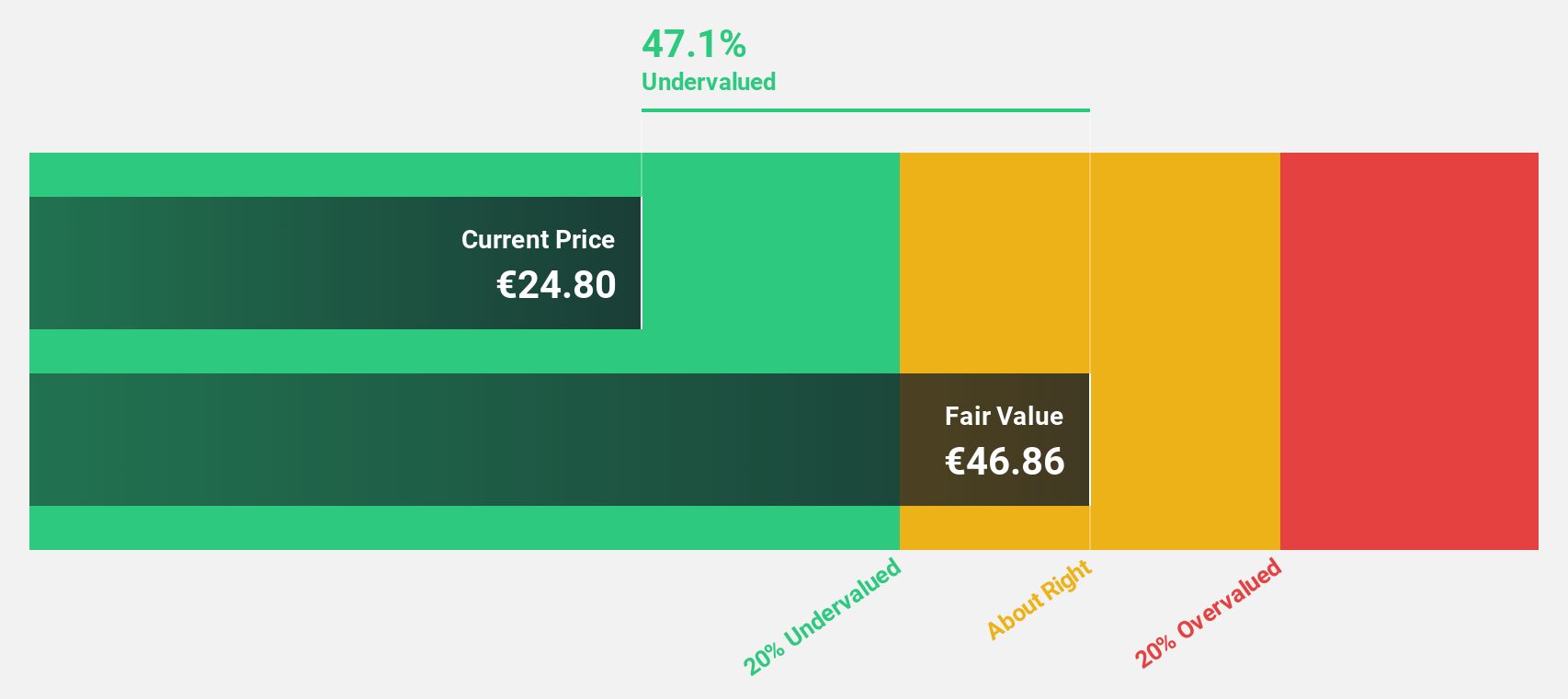

Lectra (ENXTPA:LSS)

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €1.02 billion.

Operations: Revenue segments for Lectra include €172.19 million from the Americas and €124.33 million from the Asia-Pacific region.

Estimated Discount To Fair Value: 33.7%

Lectra is trading at €26.85, significantly below its estimated fair value of €40.53, presenting a potential opportunity based on cash flow valuation. Despite a decline in net income to €22.77 million for the first nine months of 2024, earnings are forecast to grow by over 25% annually, outpacing the French market's growth rate. However, revenue growth is moderate at 5.6%, and return on equity is expected to remain low at 12.1%.

- Our comprehensive growth report raises the possibility that Lectra is poised for substantial financial growth.

- Take a closer look at Lectra's balance sheet health here in our report.

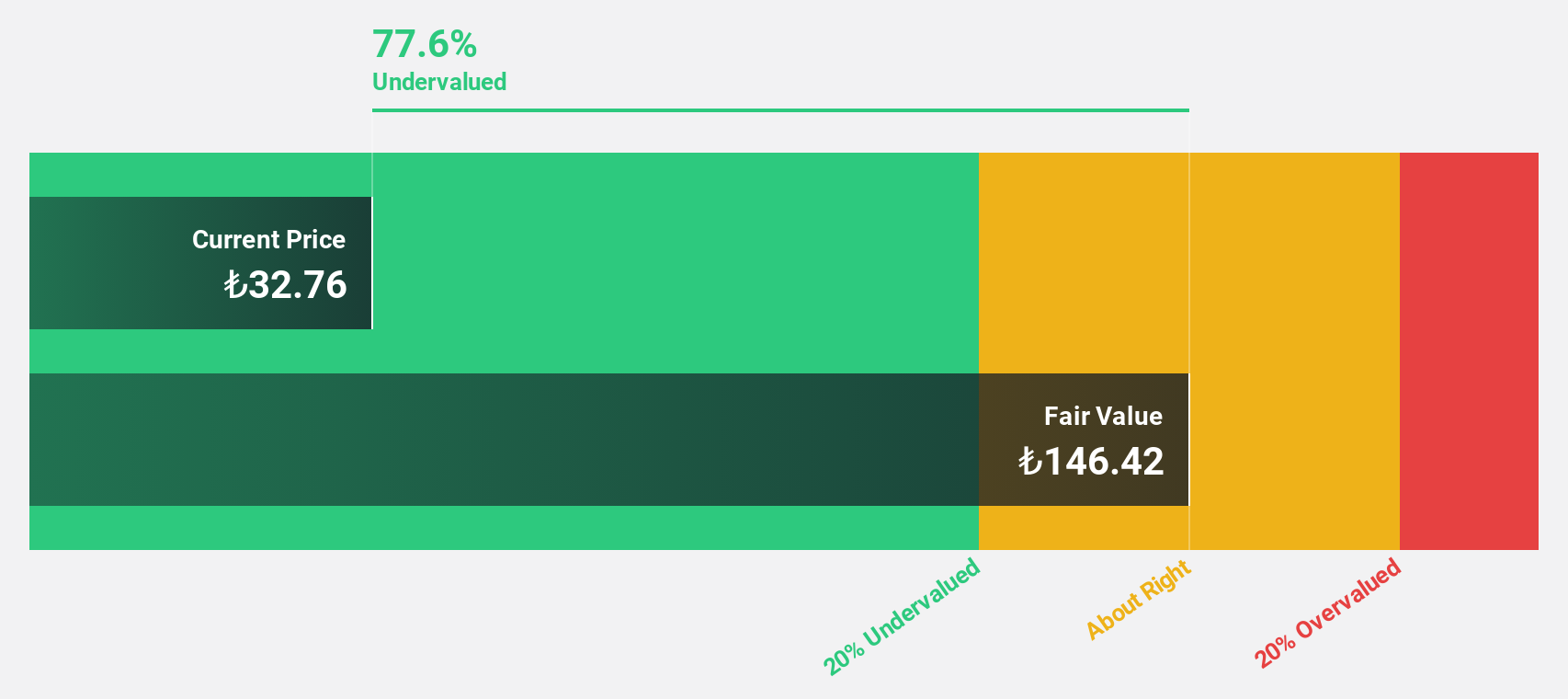

Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE)

Overview: Türkiye Sise Ve Cam Fabrikalari A.S. is a company that manufactures and sells glass products across Turkey, the United States, Russia, Ukraine, Georgia, Europe, and other international markets with a market cap of TRY128.29 billion.

Operations: The company's revenue segments include Energy (TRY17.19 billion), Chemicals (TRY32.58 billion), Glass Packaging (TRY26.02 billion), Industrial Glasses (TRY14.38 billion), Architectural Glasses (TRY30.33 billion), and Glass Household Goods (TRY15.95 billion).

Estimated Discount To Fair Value: 48.1%

Türkiye Sise Ve Cam Fabrikalari is trading at TRY41.88, significantly below its estimated fair value of TRY80.64, highlighting potential undervaluation based on cash flow analysis. Despite a decline in sales for the third quarter of 2024 to TRY42.87 billion from TRY46.19 billion a year ago, earnings are expected to grow by over 40% annually, surpassing the Turkish market's growth rate. However, return on equity is projected to remain low at 9.1%.

- Upon reviewing our latest growth report, Türkiye Sise Ve Cam Fabrikalari's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Türkiye Sise Ve Cam Fabrikalari with our detailed financial health report.

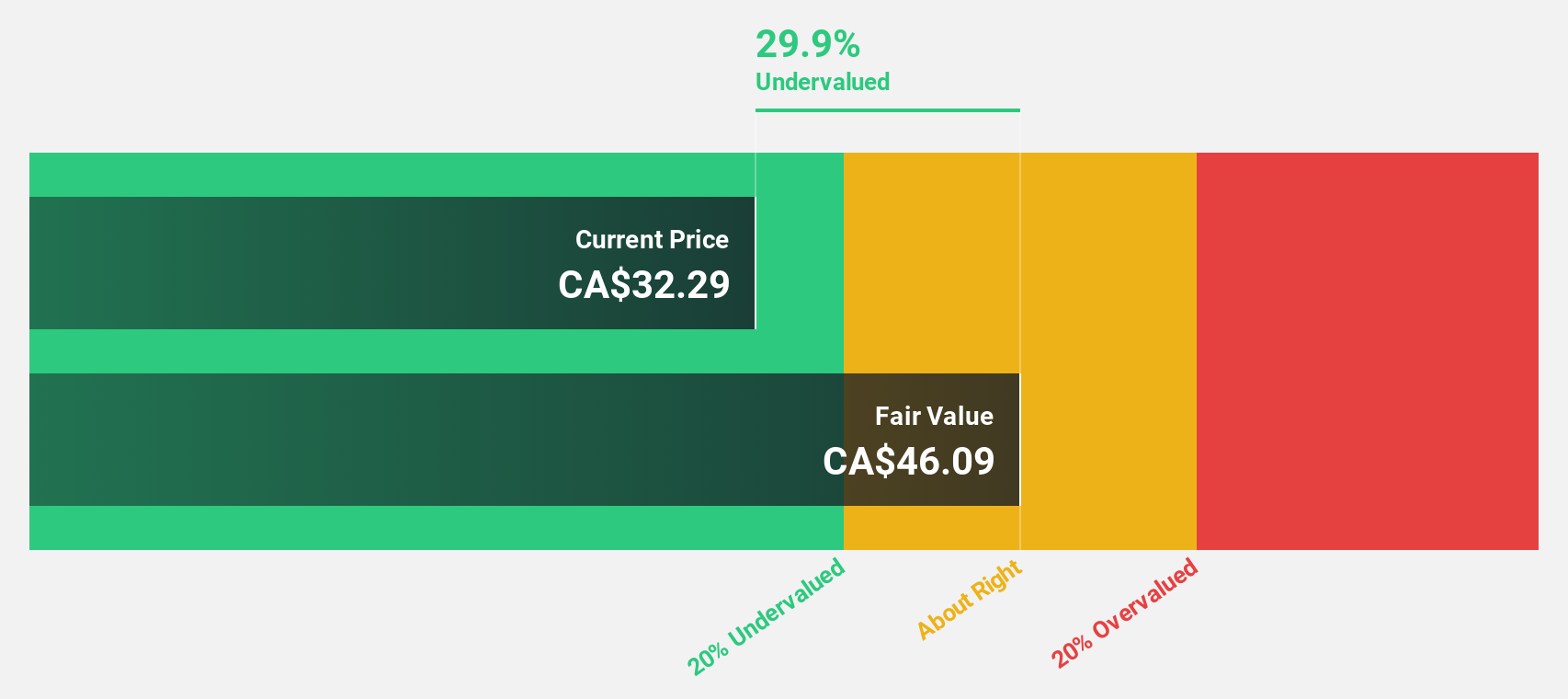

Triple Flag Precious Metals (TSX:TFPM)

Overview: Triple Flag Precious Metals Corp. is a streaming and royalty company focused on acquiring and managing precious metals interests across various countries, with a market cap of CA$4.40 billion.

Operations: The company generates revenue of $246.52 million from its operations in acquiring and managing high-quality streams and royalties related to precious metals.

Estimated Discount To Fair Value: 38.9%

Triple Flag Precious Metals is trading at CA$21.92, well below its estimated fair value of CA$35.86, suggesting undervaluation based on cash flows. Despite significant insider selling recently, the company forecasts strong revenue growth of 12.1% annually and expects profitability within three years. Recent earnings show improvement with a net income of US$29.65 million in Q3 2024 compared to a loss last year, alongside an active share buyback program enhancing shareholder value.

- The analysis detailed in our Triple Flag Precious Metals growth report hints at robust future financial performance.

- Dive into the specifics of Triple Flag Precious Metals here with our thorough financial health report.

Where To Now?

- Dive into all 890 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LSS

Lectra

Provides industrial intelligence solutions for fashion, automotive, and furniture markets in Northern Europe, Southern Europe, the Americas, and the Asia Pacific.

Good value with reasonable growth potential.