- Italy

- /

- Electric Utilities

- /

- BIT:EVISO

3 European Stocks That Investors Might Be Undervaluing By Up To 48.8%

Reviewed by Simply Wall St

Amid renewed uncertainty surrounding U.S. trade policy and escalating geopolitical tensions in the Middle East, European markets have experienced a downturn, with major indices like Germany's DAX and Italy's FTSE MIB seeing significant declines. In this environment of volatility, identifying undervalued stocks can be crucial for investors looking to capitalize on potential opportunities; understanding intrinsic value relative to current market conditions might reveal stocks that are priced below their true worth.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VIGO Photonics (WSE:VGO) | PLN518.00 | PLN1019.78 | 49.2% |

| TTS (Transport Trade Services) (BVB:TTS) | RON4.31 | RON8.45 | 49% |

| Sparebank 68° Nord (OB:SB68) | NOK180.00 | NOK358.42 | 49.8% |

| Qt Group Oyj (HLSE:QTCOM) | €54.60 | €108.05 | 49.5% |

| Lectra (ENXTPA:LSS) | €23.90 | €46.66 | 48.8% |

| Koskisen Oyj (HLSE:KOSKI) | €8.80 | €17.34 | 49.2% |

| I.CO.P.. Società Benefit (BIT:ICOP) | €13.00 | €25.66 | 49.3% |

| doValue (BIT:DOV) | €2.22 | €4.43 | 49.9% |

| CTT Systems (OM:CTT) | SEK208.50 | SEK407.80 | 48.9% |

| Boreo Oyj (HLSE:BOREO) | €14.85 | €29.48 | 49.6% |

Let's review some notable picks from our screened stocks.

eVISO (BIT:EVISO)

Overview: eVISO S.p.A. operates a platform utilizing artificial intelligence for the commodities market, primarily in Italy, with a market cap of €230.88 million.

Operations: eVISO S.p.A.'s revenue segments are not specified in the provided text.

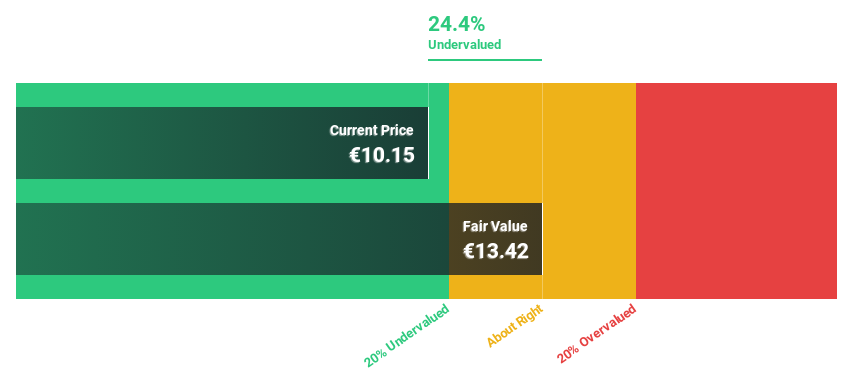

Estimated Discount To Fair Value: 15.8%

eVISO S.p.A. is trading at €10.38, below its estimated fair value of €12.33, indicating potential undervaluation based on cash flows. Recent earnings reports show an increase in net income to €3.51 million from €2.41 million a year ago, with sales rising to €170 million from €109.39 million last year. The company's earnings are forecasted to grow significantly at 32% annually, outpacing the Italian market's growth rate of 7.4%.

- The analysis detailed in our eVISO growth report hints at robust future financial performance.

- Take a closer look at eVISO's balance sheet health here in our report.

Lectra (ENXTPA:LSS)

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, furniture markets, and other industries globally, with a market cap of €908.26 million.

Operations: The company's revenue is segmented as follows: €176.26 million from the Americas, €134.84 million from the Asia-Pacific region, and €220.46 million from EMEA (Europe, Middle East and Africa).

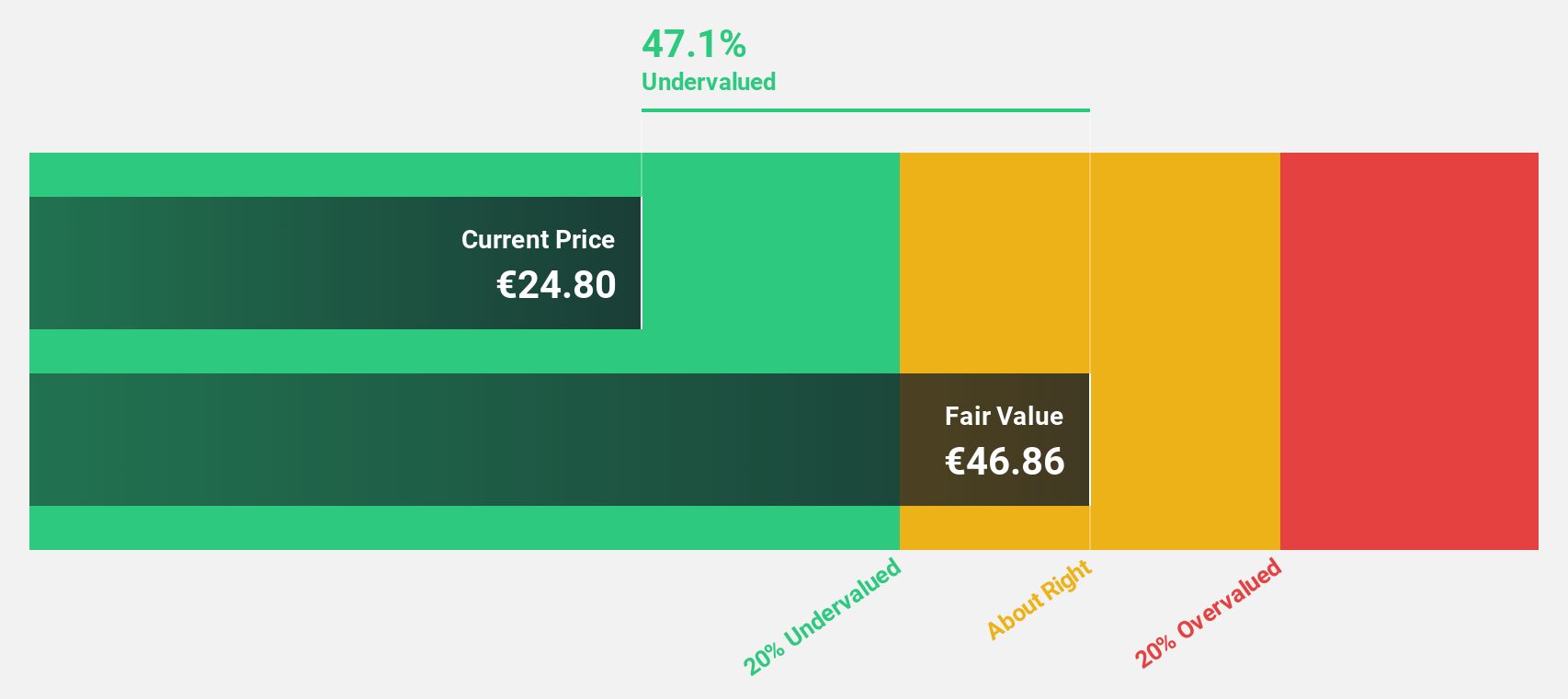

Estimated Discount To Fair Value: 48.8%

Lectra is trading at €23.9, significantly below its estimated fair value of €46.66, highlighting potential undervaluation based on cash flows. The company's earnings are forecast to grow by 21.4% annually, outpacing the French market's growth rate of 12.1%. Recent expansions of the Valia Fashion platform into new markets like Mexico and Brazil aim to enhance global operations and efficiency, potentially boosting Lectra's revenue streams and supporting its growth trajectory amidst favorable M&A opportunities.

- Our expertly prepared growth report on Lectra implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Lectra with our comprehensive financial health report here.

Dino Polska (WSE:DNP)

Overview: Dino Polska S.A., along with its subsidiaries, operates a network of mid-sized grocery supermarkets under the Dino brand in Poland, with a market cap of PLN49.80 billion.

Operations: The company's revenue primarily comes from sales in its retail network and online sales, totaling PLN29.72 billion.

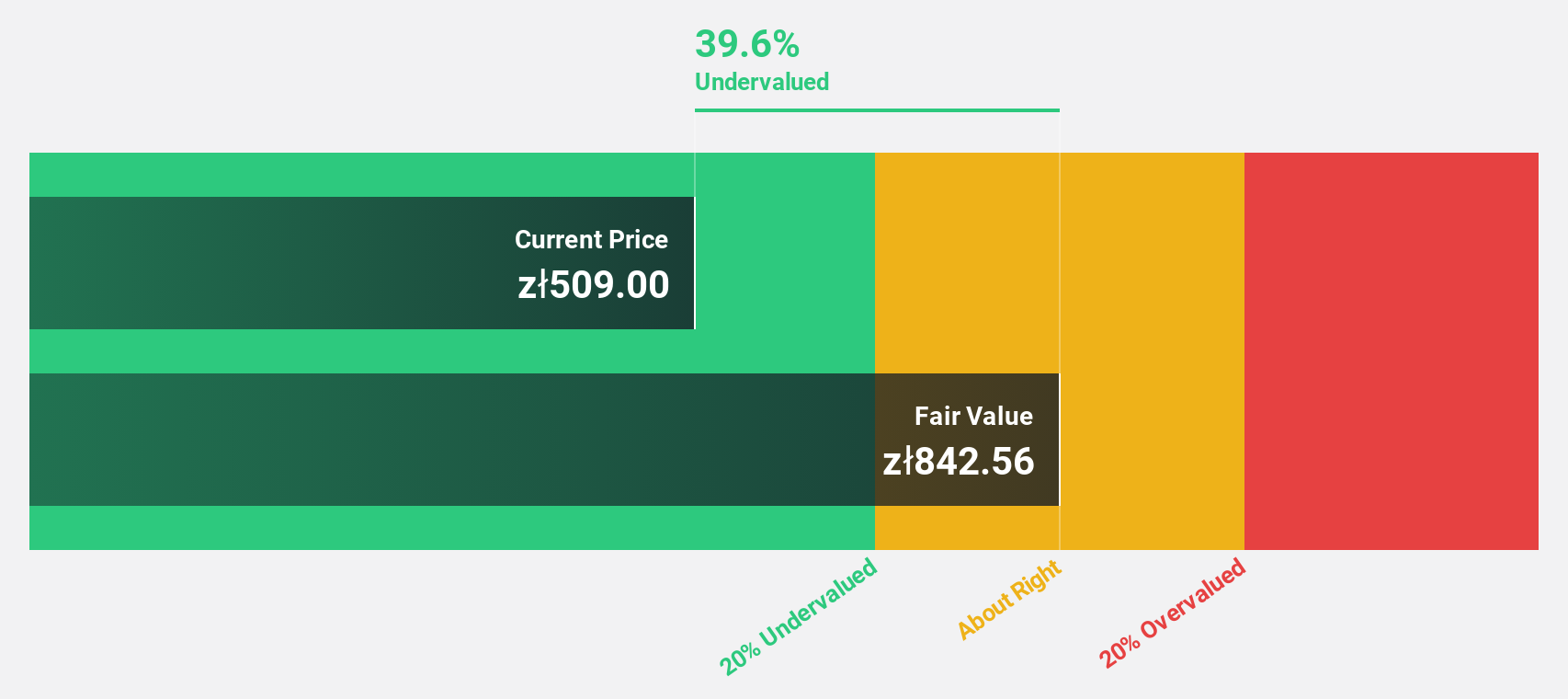

Estimated Discount To Fair Value: 32.1%

Dino Polska is trading at PLN 508, significantly below its estimated fair value of PLN 748.13, suggesting potential undervaluation based on cash flows. The company's earnings are forecast to grow by 18.1% annually, outpacing the Polish market's growth rate of 14.5%. Recent first-quarter results showed increased sales and net income compared to the previous year, supporting its growth trajectory amidst robust revenue forecasts that exceed broader market expectations in Poland.

- According our earnings growth report, there's an indication that Dino Polska might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Dino Polska.

Summing It All Up

- Unlock our comprehensive list of 179 Undervalued European Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:EVISO

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026