- Germany

- /

- Food and Staples Retail

- /

- XTRA:RDC

3 European Growth Companies With Insider Ownership Up To 24%

Reviewed by Simply Wall St

As the European market navigates through geopolitical tensions and economic uncertainties, reflected by the recent declines in major indices like the STOXX Europe 600, investors are increasingly seeking stability and growth potential. In this environment, companies with high insider ownership can be particularly appealing as they often indicate management's confidence in their business prospects.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| Redelfi (BIT:RDF) | 12.1% | 37.3% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 130.8% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| Diamyd Medical (OM:DMYD B) | 11.9% | 93% |

| CTT Systems (OM:CTT) | 17.5% | 34.2% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 58.6% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

We'll examine a selection from our screener results.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, furniture markets, and other industries globally, with a market cap of €940.56 million.

Operations: The company's revenue is segmented as follows: €176.26 million from the Americas, €134.84 million from Asia-Pacific, and €220.46 million from EMEA (Europe, Middle East and Africa).

Insider Ownership: 12.7%

Lectra's recent expansion of its Valia Fashion platform into new markets like Mexico and Brazil underscores its growth strategy in the fashion industry's shift to Industry 4.0. Despite a modest revenue growth forecast of 5.9% annually, Lectra's earnings are expected to grow significantly at 21.42% per year, outpacing the French market average. The company is exploring M&A opportunities to strengthen its position further while trading below estimated fair value, indicating potential for future appreciation.

- Delve into the full analysis future growth report here for a deeper understanding of Lectra.

- Our comprehensive valuation report raises the possibility that Lectra is priced lower than what may be justified by its financials.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE is a digital media company that provides ad-software solutions in North America and Europe, with a market cap of €528.13 million.

Operations: The company's revenue is derived from two main segments: Demand Side Platforms (DSP), generating €117.61 million, and Supply Side Platforms (SSP), contributing €401.53 million.

Insider Ownership: 24.5%

Verve Group SE's recent financial activities, including a SEK 360.024 million follow-on equity offering and board changes, highlight its dynamic growth strategy. Despite a drop in net income to €0.186 million for Q1 2025, revenue increased to €114.91 million compared to the previous year. The company anticipates annual revenues between €530 million and €565 million for 2025, with substantial insider buying indicating confidence in its growth potential despite volatile share prices and lower profit margins than last year.

- Take a closer look at Verve Group's potential here in our earnings growth report.

- According our valuation report, there's an indication that Verve Group's share price might be on the cheaper side.

Redcare Pharmacy (XTRA:RDC)

Simply Wall St Growth Rating: ★★★★☆☆

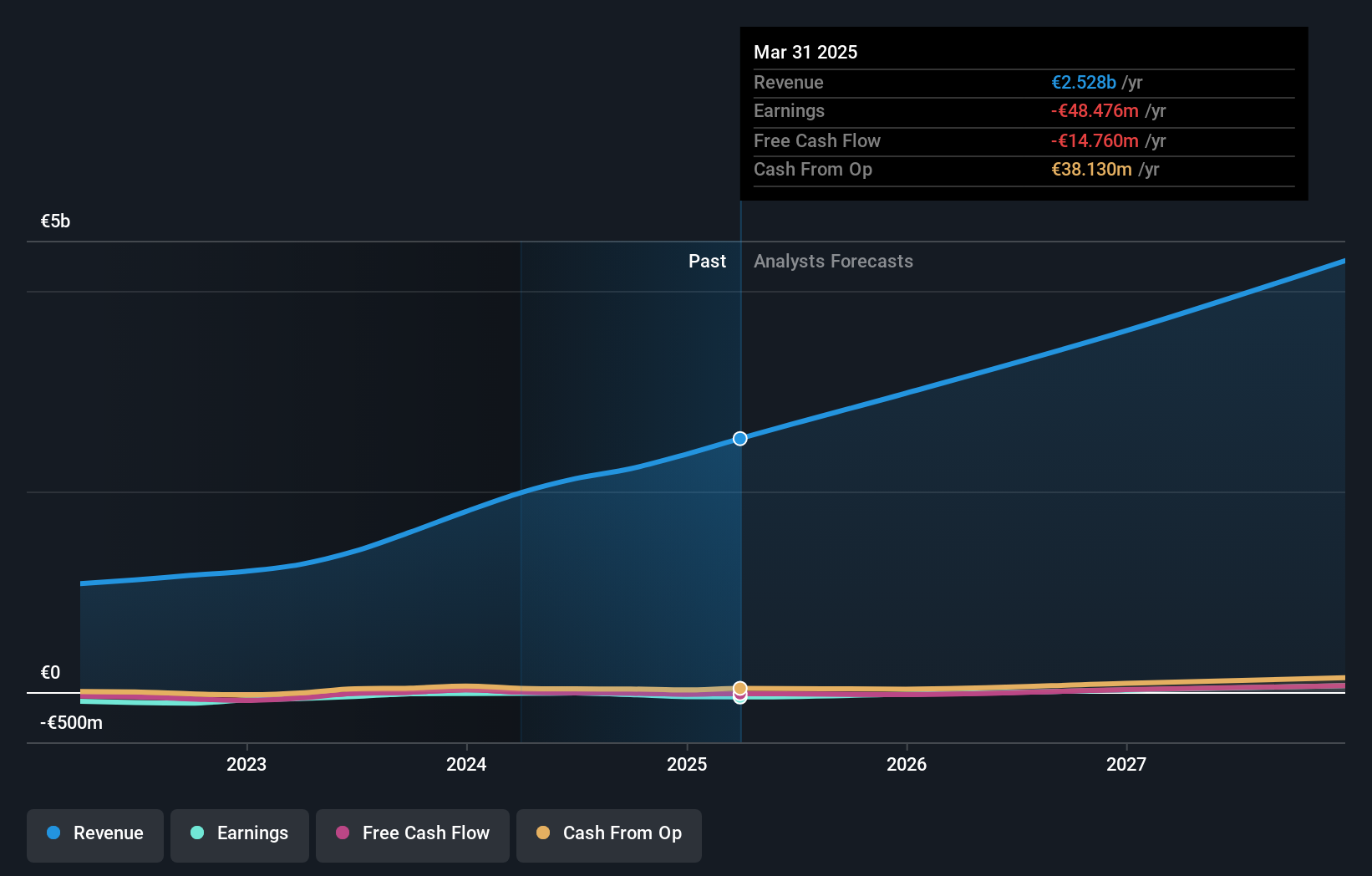

Overview: Redcare Pharmacy NV operates an online pharmacy business across the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market cap of €1.99 billion.

Operations: The company's revenue is divided into two main segments: DACH, generating €2.06 billion, and International, contributing €464.53 million.

Insider Ownership: 13.4%

Redcare Pharmacy's growth potential is underscored by substantial insider buying, indicating confidence despite a volatile share price. The company reported Q1 2025 sales of €717.29 million, up from €560.22 million the previous year, though it incurred a net loss of €10.82 million. With revenue forecasted to grow at 16% annually and expected profitability within three years, Redcare remains undervalued at 69% below its estimated fair value amid recent board changes enhancing strategic oversight.

- Click here to discover the nuances of Redcare Pharmacy with our detailed analytical future growth report.

- The analysis detailed in our Redcare Pharmacy valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Unlock more gems! Our Fast Growing European Companies With High Insider Ownership screener has unearthed 187 more companies for you to explore.Click here to unveil our expertly curated list of 190 Fast Growing European Companies With High Insider Ownership.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RDC

Redcare Pharmacy

Operates in online pharmacy business in the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives