Exploring Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative And 2 Other Undiscovered Gems With Strong Fundamentals

Reviewed by Simply Wall St

The French market has shown resilience, with the CAC 40 Index gaining 1.54% recently, buoyed by an interest rate cut from the European Central Bank amid signs of weakening economic growth and slowing inflation in the eurozone. In this environment, investors are increasingly looking for stocks with strong fundamentals that can weather economic uncertainties. A good stock in such a climate typically exhibits solid financial health, consistent earnings growth, and a competitive edge in its sector. In this article, we explore Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative and two other undiscovered gems with these attributes.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| VIEL & Cie société anonyme | 72.14% | 5.72% | 19.86% | ★★★★★☆ |

| Exacompta Clairefontaine | 30.44% | 6.92% | 31.73% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| CFM Indosuez Wealth Management | 239.60% | 10.01% | 13.52% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse client groups in France, including individuals, professionals, farmers, businesses, and public sector clients, with a market cap of €929.31 million.

Operations: The company generates revenue through a diverse range of banking products and services targeted at various client groups in France. With a market cap of €929.31 million, the financial performance is driven by its core banking activities, including loans and deposits.

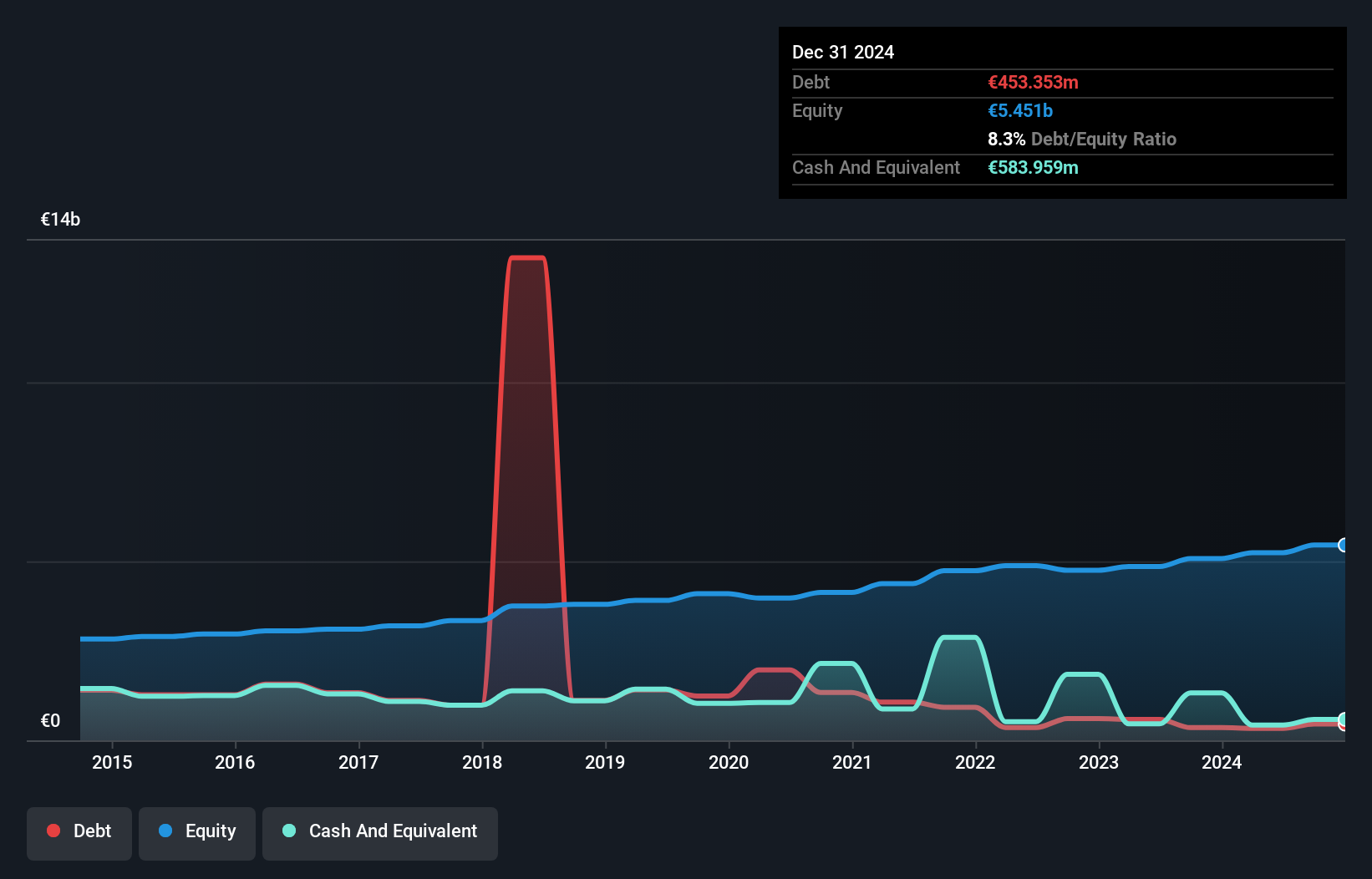

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative, with total assets of €35.3B and equity of €5.2B, has seen earnings growth of 1.3% over the past year, outperforming the Banks industry average of -4.9%. Total deposits stand at €28.2B while loans are at €29.0B, supported by primarily low-risk funding sources (94%). The bank also maintains an appropriate level of bad loans (1.4%) and a sufficient allowance for these loans (133%).

Linedata Services (ENXTPA:LIN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Linedata Services S.A. develops, publishes, and distributes financial software across Southern Europe, Northern Europe, North America, and Asia with a market cap of €396.67 million.

Operations: Linedata Services generates revenue primarily through the development, publication, and distribution of financial software across various regions. The company operates with a market cap of €396.67 million.

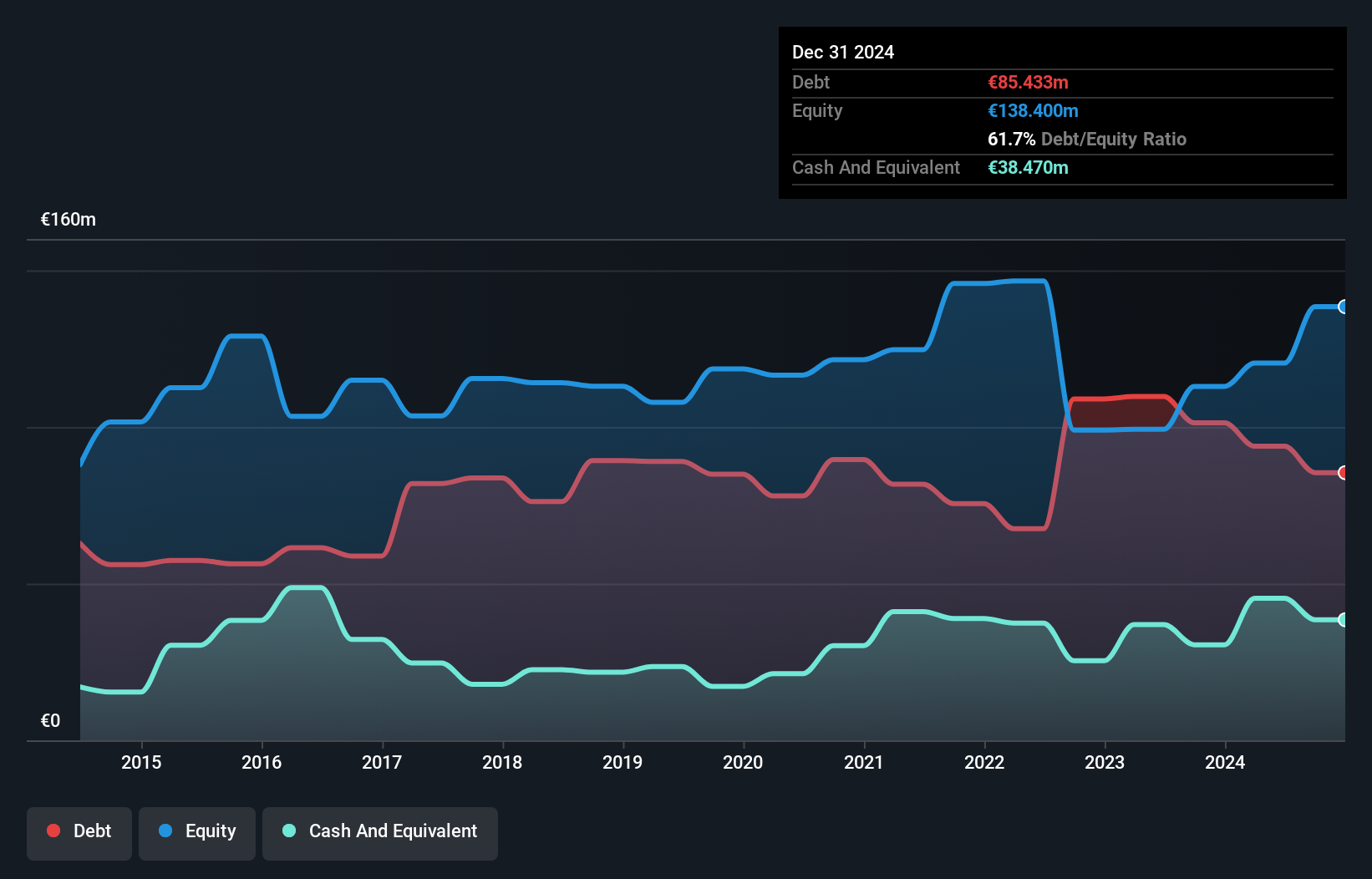

Linedata Services, a small-cap software firm, reported half-year sales of €89.69 million, up from €87.47 million last year. Net income rose to €10.55 million from €8.48 million, with basic earnings per share increasing to €2.13 from €1.71. Over the past five years, its debt-to-equity ratio improved from 82% to 78%. Earnings grew 22% last year and outpaced the industry’s growth rate of 10%. Trading at a discount of 30% below estimated fair value suggests potential upside for investors.

- Navigate through the intricacies of Linedata Services with our comprehensive health report here.

Explore historical data to track Linedata Services' performance over time in our Past section.

Altamir (ENXTPA:LTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Altamir SCA, formerly known as Altamir Amboise, is a private equity investment arm of Amboise SAS specializing in both direct and fund of fund investments in small and mid-cap companies, with a market cap of €864.61 million.

Operations: Altamir SCA generates revenue primarily through its investments in small and mid-cap companies. The company has a market cap of €864.61 million.

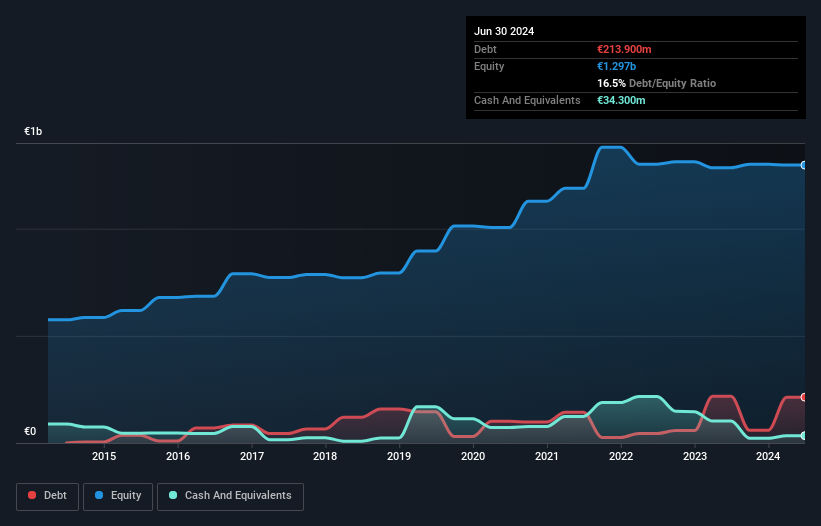

Altamir, a smaller player in the French market, reported revenue of €66 million and net income of €35.5 million for the first half of 2024. Over the past year, earnings surged by 135.1%, far outpacing the Capital Markets industry’s growth rate of 36.3%. The company has no debt now compared to a debt-to-equity ratio of 16.3% five years ago and trades at a price-to-earnings ratio of 16.6x, below the industry average of 19.3x.

- Click here and access our complete health analysis report to understand the dynamics of Altamir.

Examine Altamir's past performance report to understand how it has performed in the past.

Taking Advantage

- Discover the full array of 33 Euronext Paris Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LIN

Linedata Services

Develops, publishes, and distributes financial software in Southern Europe, Northern Europe, North America, and Asia.

Outstanding track record, undervalued and pays a dividend.