- France

- /

- Electrical

- /

- ENXTPA:MRN

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets continue to react to the latest policy shifts and economic indicators, U.S. stocks are reaching new heights fueled by optimism around trade policies and advancements in artificial intelligence. In this dynamic environment, dividend stocks can offer a compelling blend of income and potential growth, providing investors with a measure of stability amid market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.91% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

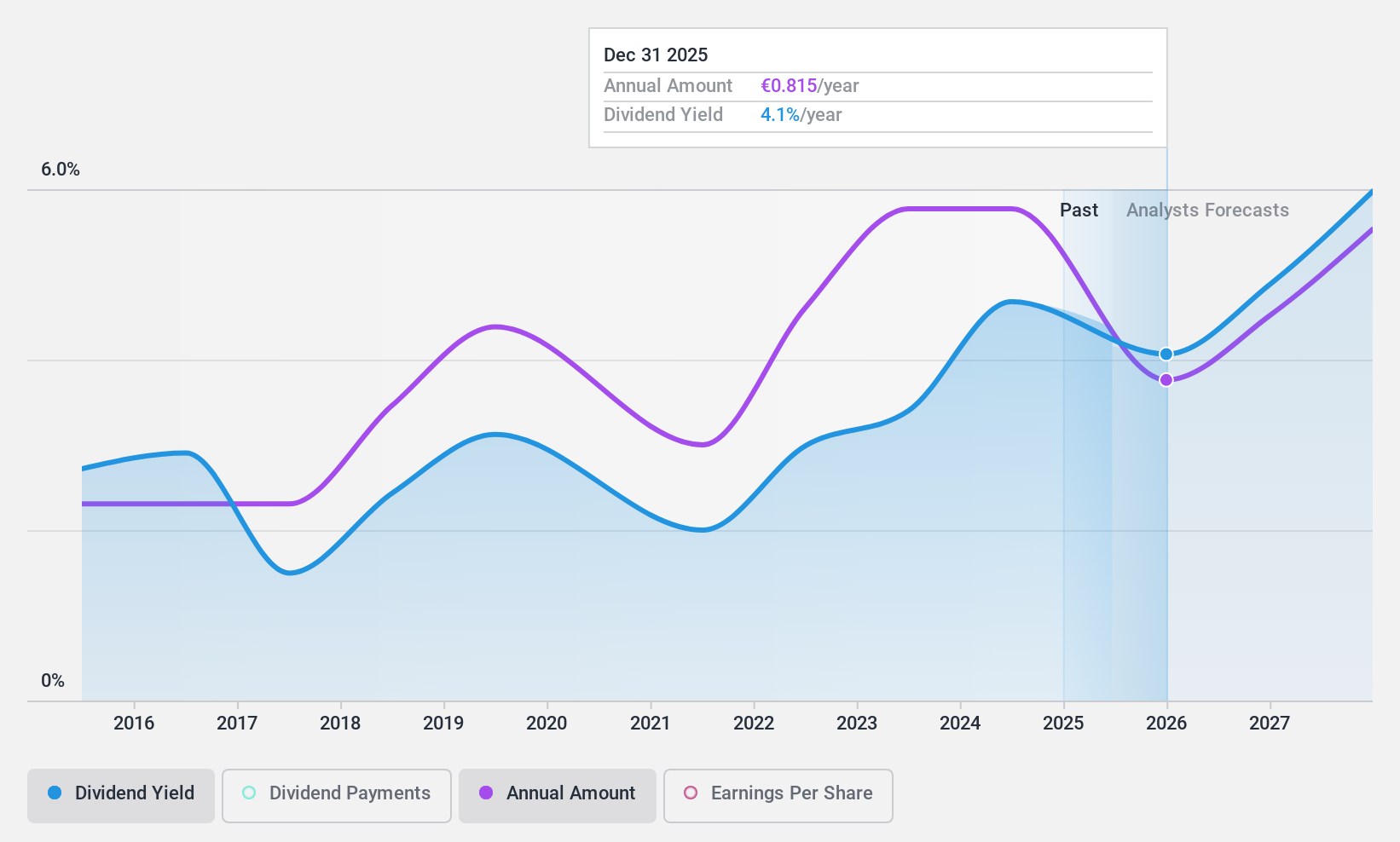

Infotel (ENXTPA:INF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Infotel SA is a global company that designs, develops, markets, and maintains software solutions focused on security, performance, and management with a market cap of €251.59 million.

Operations: Infotel SA generates revenue primarily from its Services segment, which accounts for €286.69 million, and its Software segment, contributing €11.53 million.

Dividend Yield: 5.3%

Infotel's dividend payments have been volatile over the past decade, with a payout ratio of 83.3% indicating coverage by earnings, while a cash payout ratio of 40.6% suggests strong cash flow support. Despite being below top-tier yields in France, its dividends have grown over ten years. Trading at good value compared to peers and analysts expect price appreciation. Recent share buyback authorization for up to 10% of shares may enhance shareholder value through improved liquidity and potential capital returns.

- Get an in-depth perspective on Infotel's performance by reading our dividend report here.

- According our valuation report, there's an indication that Infotel's share price might be on the cheaper side.

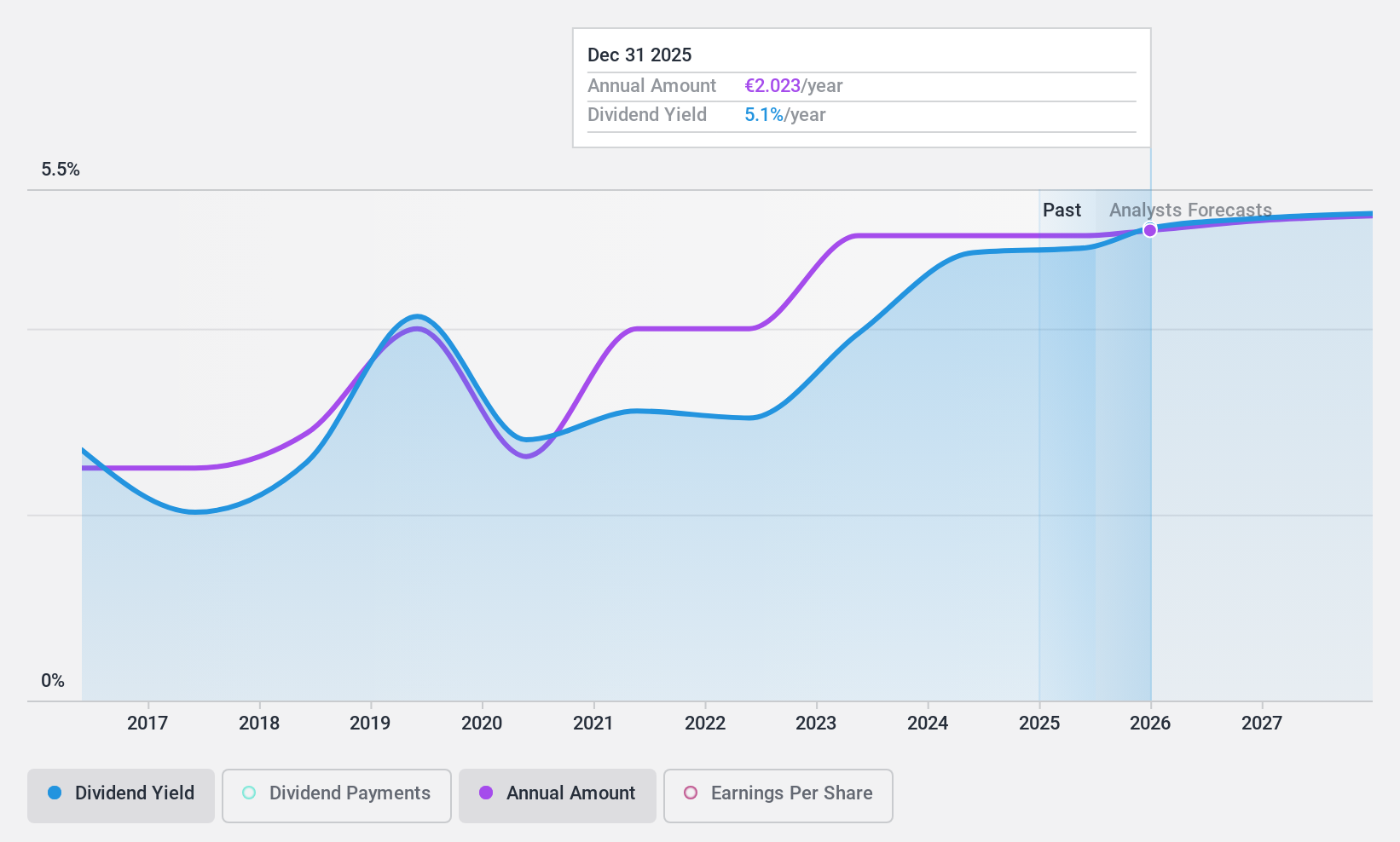

Mersen (ENXTPA:MRN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mersen S.A. manufactures and sells electrical power products and advanced materials across various regions including France, North America, Europe, the Asia-Pacific, and internationally, with a market cap of €548.09 million.

Operations: Mersen S.A.'s revenue is derived from two main segments: Electrical Power, which contributes €545.50 million, and Advanced Materials, which accounts for €681.70 million.

Dividend Yield: 5.7%

Mersen's dividend, yielding 5.72%, ranks among the top 25% in France but lacks free cash flow coverage, raising sustainability concerns despite a modest payout ratio of 39.5%. The dividend has been volatile over the past decade, yet it has grown during this period. Trading significantly below its estimated fair value and offering good relative value against peers, Mersen's earnings are projected to grow by 7.45% annually, potentially supporting future dividends.

- Take a closer look at Mersen's potential here in our dividend report.

- Upon reviewing our latest valuation report, Mersen's share price might be too pessimistic.

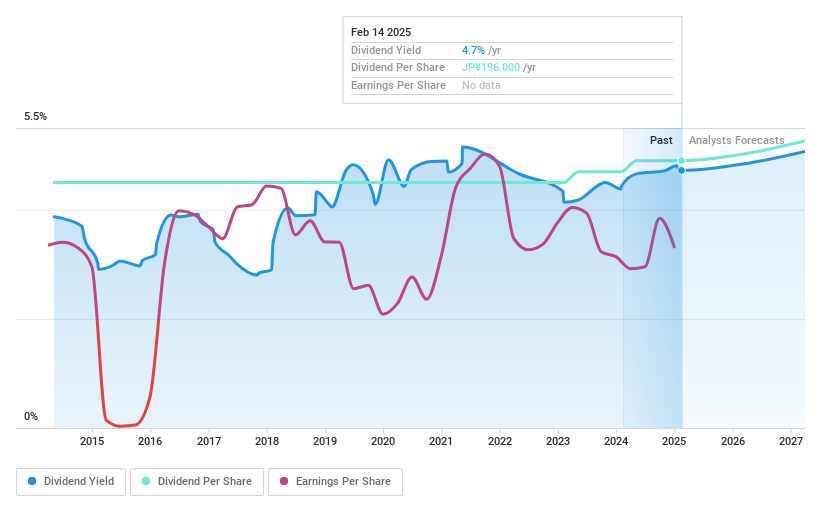

Takeda Pharmaceutical (TSE:4502)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Takeda Pharmaceutical Company Limited is involved in the research, development, manufacture, marketing, and out-licensing of pharmaceutical products both in Japan and internationally, with a market cap of ¥6.67 trillion.

Operations: Takeda Pharmaceutical's revenue is primarily derived from its pharmaceutical products, which are developed, manufactured, and marketed across Japan and international markets.

Dividend Yield: 4.7%

Takeda Pharmaceutical's dividend yield is attractive at 4.66%, ranking in the top 25% of Japanese dividend payers. The company's dividends are well-supported by earnings and cash flows, with a payout ratio of 71.2% and a cash payout ratio of 39.1%. Despite high debt levels, Takeda's dividends have been stable and reliable over the past decade, showing consistent growth. Recent share buyback plans aim to enhance shareholder returns further.

- Delve into the full analysis dividend report here for a deeper understanding of Takeda Pharmaceutical.

- Our expertly prepared valuation report Takeda Pharmaceutical implies its share price may be lower than expected.

Seize The Opportunity

- Embark on your investment journey to our 1938 Top Dividend Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MRN

Mersen

Manufactures and sells electrical power products and advanced materials in France, North America, rest of Europe, the Asia-Pacific, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)