As global markets navigate a landscape of mixed economic signals and geopolitical developments, major U.S. indices have shown divergent performances, with growth stocks significantly outpacing their value counterparts. In this context of market volatility and sector dispersion, dividend stocks can offer investors a measure of stability and income potential, making them an attractive consideration for those seeking to balance growth with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.13% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

Click here to see the full list of 1927 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

CIE Automotive (BME:CIE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CIE Automotive, S.A. is a company that designs, manufactures, and sells automotive components and sub-assemblies globally, with a market cap of €3.10 billion.

Operations: CIE Automotive's revenue primarily comes from the design, manufacturing, and sale of automotive components and sub-assemblies on a global scale.

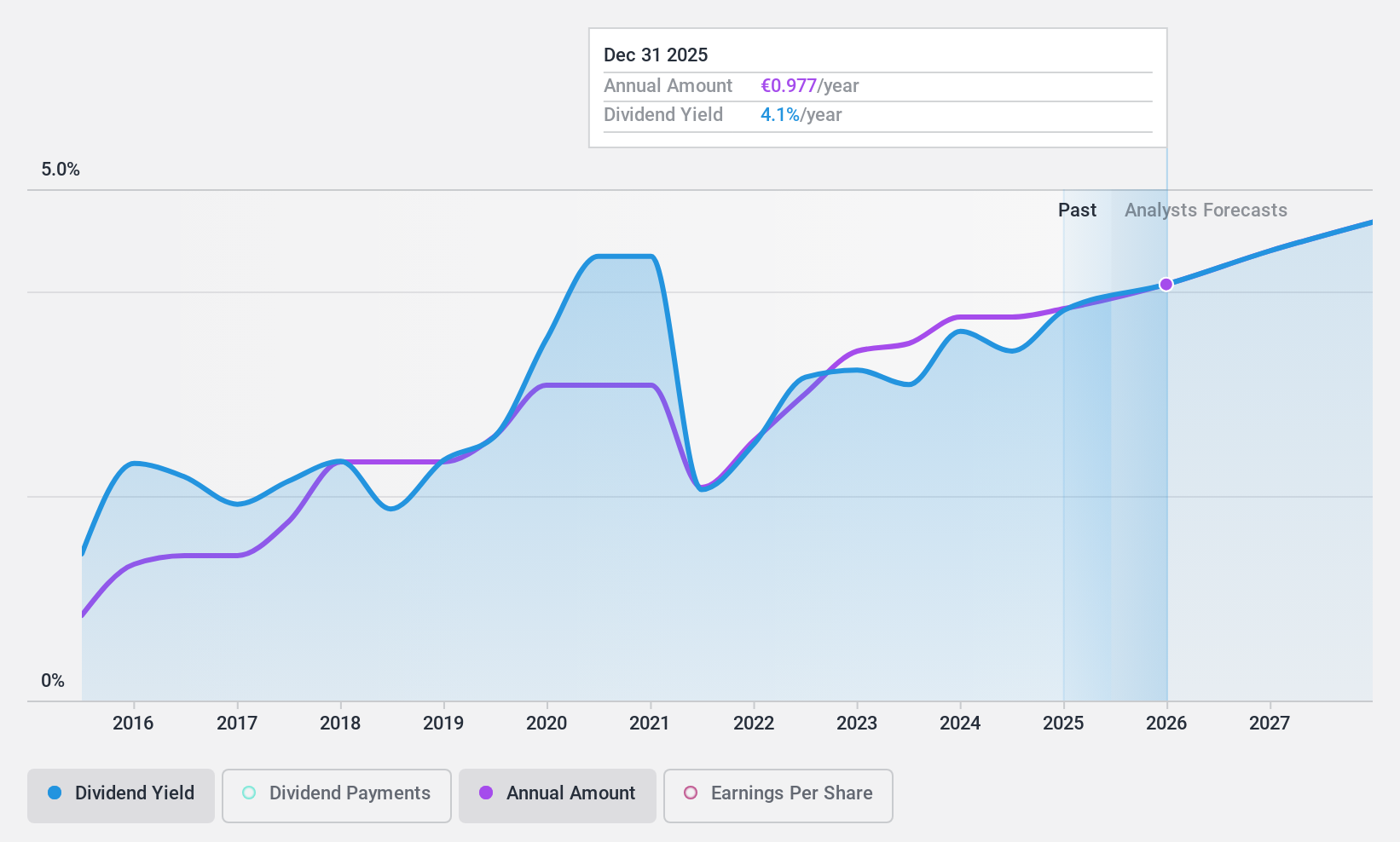

Dividend Yield: 3.5%

CIE Automotive's dividend payments are well-covered by earnings, with a low payout ratio of 17.3%, and cash flows, reflected in a cash payout ratio of 39.8%. However, the company's dividend yield is relatively low at 3.48% compared to top-tier Spanish market payers. Despite an increase over the past decade, dividends have been volatile and unreliable. The stock trades significantly below its estimated fair value but profit margins have decreased notably from last year.

- Click here and access our complete dividend analysis report to understand the dynamics of CIE Automotive.

- Our comprehensive valuation report raises the possibility that CIE Automotive is priced lower than what may be justified by its financials.

Infotel (ENXTPA:INF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Infotel SA is a global company that designs, develops, markets, and maintains software solutions focused on security, performance, and management with a market cap of €280.70 million.

Operations: Infotel SA generates revenue through its Services segment, which accounts for €286.69 million, and its Software segment, contributing €11.53 million.

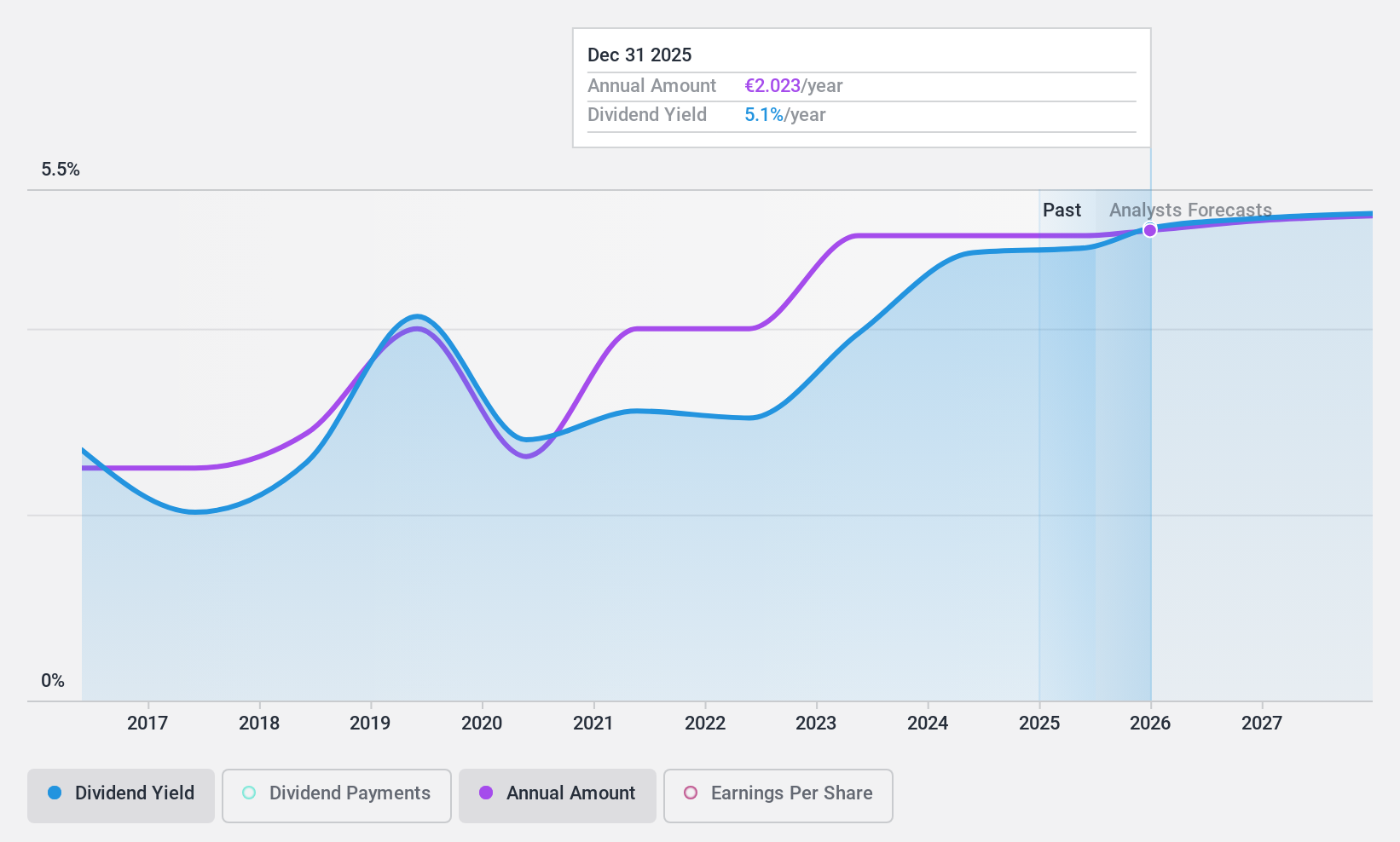

Dividend Yield: 4.9%

Infotel's dividend payments are well-covered by earnings and cash flows, with payout ratios of 83.3% and 40.6%, respectively, but have been volatile over the past decade. The current yield of 4.94% is lower than the top quartile in France. Despite trading at a good value, below estimated fair value by 14.8%, recent earnings show a decline with net income at €7.97 million for H1 2024 compared to €9.46 million last year.

- Navigate through the intricacies of Infotel with our comprehensive dividend report here.

- Our valuation report unveils the possibility Infotel's shares may be trading at a discount.

Keepers Holdings (PSE:KEEPR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Keepers Holdings, Inc. is an investment holding company involved in the distribution of liquor, wine, and specialty beverages in the Philippines with a market cap of ₱30.90 billion.

Operations: The Keepers Holdings, Inc. generates revenue of ₱17.80 billion from the sale of spirits, wines, and specialty beverages in the Philippines.

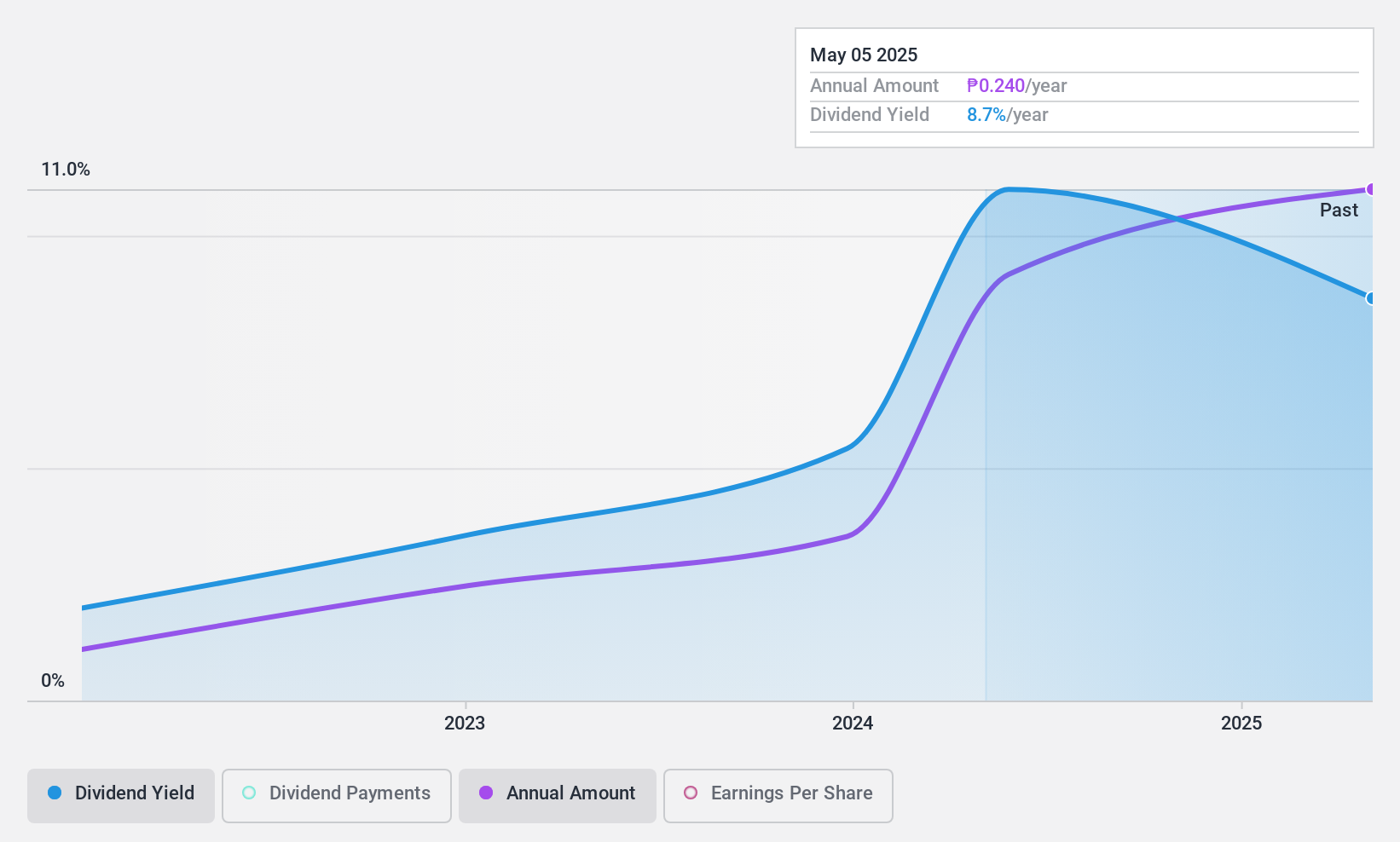

Dividend Yield: 9.4%

Keepers Holdings' dividend is well-supported by earnings and cash flows, with payout ratios of 78.3% and 71.3%, respectively. Although dividends have been stable, they have only been paid for three years. The yield is competitive at 9.39%, placing it in the top quartile of the Philippine market. Recent earnings growth reflects a net income increase to PHP 2.17 billion for the first nine months of 2024, supporting future dividend sustainability amidst potential acquisition activities.

- Unlock comprehensive insights into our analysis of Keepers Holdings stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Keepers Holdings shares in the market.

Turning Ideas Into Actions

- Dive into all 1927 of the Top Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:INF

Infotel

Designs, develops, markets, and maintains software solutions in the areas of security, performance, and management worldwide.

Very undervalued with excellent balance sheet and pays a dividend.