- France

- /

- Diversified Financial

- /

- ENXTPA:ALHYP

What Can We Conclude About HiPay Group's (EPA:HIPAY) CEO Pay?

Grégoire Bourdin became the CEO of HiPay Group SA (EPA:HIPAY) in 2016, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for HiPay Group

Comparing HiPay Group SA's CEO Compensation With the industry

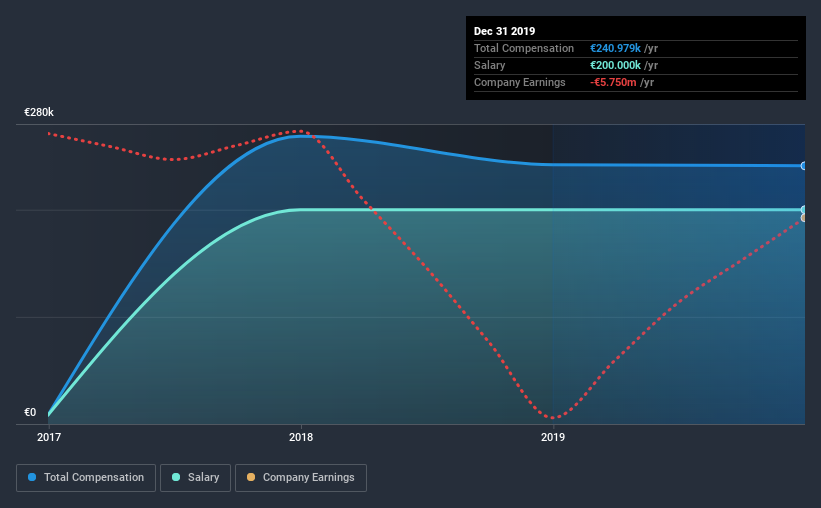

At the time of writing, our data shows that HiPay Group SA has a market capitalization of €69m, and reported total annual CEO compensation of €241k for the year to December 2019. This means that the compensation hasn't changed much from last year. Notably, the salary which is €200.0k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below €164m, reported a median total CEO compensation of €260k. From this we gather that Grégoire Bourdin is paid around the median for CEOs in the industry.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | €200k | €200k | 83% |

| Other | €41k | €42k | 17% |

| Total Compensation | €241k | €242k | 100% |

Speaking on an industry level, nearly 64% of total compensation represents salary, while the remainder of 36% is other remuneration. HiPay Group is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at HiPay Group SA's Growth Numbers

HiPay Group SA has reduced its earnings per share by 14% a year over the last three years. It achieved revenue growth of 21% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has HiPay Group SA Been A Good Investment?

Given the total shareholder loss of 1.9% over three years, many shareholders in HiPay Group SA are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As we noted earlier, HiPay Group pays its CEO in line with similar-sized companies belonging to the same industry. However, revenues have increased over the past year, a positive sign for the company. Contrarily, shareholder returns are in the red over the same stretch. EPS growth is also negative, adding insult to injury. Overall, we wouldn't say CEO is highly paid, but shareholders might not go for a raise before business metrics start to improve precipitously.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 4 warning signs (and 1 which is a bit unpleasant) in HiPay Group we think you should know about.

Switching gears from HiPay Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading HiPay Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HiPay Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALHYP

HiPay Group

Provides augmented payment solutions in France and rest of Europe.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)